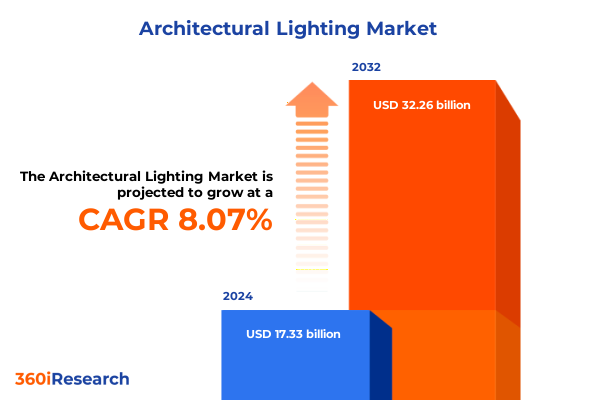

The Architectural Lighting Market size was estimated at USD 18.58 billion in 2025 and expected to reach USD 19.93 billion in 2026, at a CAGR of 8.19% to reach USD 32.26 billion by 2032.

Illuminating the Path Ahead: A Compelling Overview Framing the Architectural Lighting Market’s Evolution and Strategic Imperatives

The architectural lighting sector stands at a pivotal juncture where aesthetic aspirations converge with technological innovation and sustainability imperatives. Over the past decade, traditional illumination methods have ceded ground to advanced LED and smart lighting systems that promise energy savings, design flexibility, and enhanced occupant well-being. This confluence of driving forces has elevated architectural lighting from a purely functional component to a strategic design element with the power to transform built environments and user experiences. As stakeholders navigate this multifaceted landscape, a clear understanding of current dynamics and emergent opportunities becomes indispensable.

At the core of this evolution lies the widespread adoption of energy-efficient LED technologies coupled with intelligent control systems that integrate seamlessly into building management platforms. The industry’s orientation toward human-centric lighting-tunable systems that mimic natural daylight cycles to promote health and productivity-illustrates the way innovation is responding to growing demands for occupant-focused design solutions. Concurrently, advancements in miniaturization, flexible LED strips and micro-LED arrays are enabling designers to apply light in novel and unexpected ways, blurring the lines between illumination and architectural form.

As market participants recalibrate their strategies, heightened emphasis on sustainable and circular design principles is reshaping how luminaires are conceived, manufactured and deployed. Incorporating recycled materials, lowering carbon footprints and extending product lifecycles are becoming non-negotiable criteria for specifiers and end users alike. Against this backdrop, this executive summary offers a succinct yet comprehensive exploration of transformative trends, policy influences, and competitive maneuvers that will define the architectural lighting space in 2025 and beyond.

Revolutionary Technological, Design, and Sustainability Shifts Redefining the Architecture Lighting Landscape for Modern Built Environments

The architectural lighting landscape is undergoing a profound metamorphosis driven by leaps in LED performance and material innovation. Ultra-miniaturized micro-LEDs and emissive OLED panels are redefining fixture form factors, enabling entirely new applications where light emerges from seemingly impossible apertures. These ultra-thin, energy-efficient solutions allow surfaces to glow uniformly, creating immersive environments that respond dynamically to user needs and aesthetic imperatives. Simultaneously, human-centric lighting (HCL) systems that offer tunable white and full-spectrum controls are gaining rapid traction in sectors ranging from healthcare to corporate offices, where evidence continues to demonstrate measurable gains in mood, productivity and recovery outcomes.

Parallel to hardware advances, smart integration and the Internet of Things (IoT) are reshaping user experiences and operational efficiencies. Lighting systems no longer function in isolation; they act as intelligent nodes within building ecosystems, collecting usage and environmental data to optimize energy consumption and maintenance schedules. These interconnected solutions enable facility managers to automate scene settings, respond to occupancy patterns, and integrate with security, HVAC and other building controls. As remote monitoring platforms mature, the capacity to glean actionable insights from light fixtures will be a key differentiator for manufacturers and service providers alike.

Sustainability remains a unifying theme across all transformative shifts. The emergence of “greenovation”-where ecological stewardship intersects with technological creativity-reflects an industry-wide commitment to reducing carbon footprints and enhancing circular economy practices. Regulatory frameworks such as the European Union’s energy labelling and Ecodesign directives are catalyzing the adoption of more efficient fixtures, while leading manufacturers are pioneering biodegradable materials, recyclable housing designs and zero-waste production techniques. As specification criteria increasingly incorporate lifecycle assessments, lighting players must integrate sustainable principles into both product roadmaps and corporate strategies to remain relevant.

Assessing the Broad Reach and Economic Implications of 2025 United States Tariff Policies on Architectural Lighting Imports

In 2025, United States trade policies have imposed a layered structure of tariffs that directly impact architectural lighting imports and component sourcing. At the forefront are global steel and aluminum levies of 25 percent established in early 2025, which affect critical fixture housings, heat sinks and support structures. A baseline 10 percent duty on general lighting imports from a broad range of trading partners is also in effect, while Chinese-origin products bear supplemental surcharges that can exceed 25 percent, cumulatively reaching punitive rates for certain items. This constellation of trade measures has substantially altered cost structures, supply chain planning and procurement strategies across the industry.

As a tangible example, leading smart-lighting manufacturer Philips Hue announced price increases of roughly 10 percent on select products in July 2025, directly attributing the adjustment to the new tariff regime. Concurrently, interior design and construction firms have reported material cost escalations in high-end residential and commercial projects. Builders in the U.S. Northeast, for instance, have experienced up to a 10 percent rise in steel and aluminum expenditures attributable to the tariff landscape, prompting budget revisions and project timeline extensions.

In response to these cumulative pressures, manufacturers and distributors are pursuing strategic realignments. Some are migrating final assembly operations to regions such as India and Mexico to mitigate tariff exposure, while others are accelerating investments in domestic production capacity to stabilize supply chains. Major players are also negotiating longer-term contracts with alternative suppliers in Southeast Asia and Europe, broadening their sourcing ecosystems to avoid single-country concentration risks. These adaptive strategies underscore the industry’s resilience and the imperative to maintain agility in the face of evolving trade policies.

Comprehensive Insights into Architectural Lighting Market Segmentation Across Technology, Product, Installation, End User, and Distribution Channels in Unified Detail

The architectural lighting market encompasses a spectrum of solutions segmented by technology modalities, product configurations, installation methods, end-use applications, and distribution pathways. From the technology standpoint, legacy fluorescent systems-specifically T5 and T8 variants-continue to serve retrofit scenarios, while halogen and HID modules address niche high-intensity needs. Today, LEDs dominate new installations, with chip-on-board (COB) and surface-mounted device (SMD) formats offering superior efficacy and design flexibility. Examining product typologies reveals that downlights remain pervasive in commercial interiors, even as linear luminaires, robust outdoor fixtures, surface-mounted designs, and versatile track systems gain momentum among architects seeking both form and function. Installation preferences further differentiate market segments, as recessed applications deliver clean sightlines, surface-mounted fixtures offer rapid implementation, suspended solutions create focal design statements, and wall-mounted options complement ambient layering strategies.

End-use segmentation highlights the critical role of commercial environments-including healthcare facilities, hospitality venues, office campuses and retail spaces-in driving large-scale deployments, while government and institutional projects maintain steady demand for specification-grade luminaires. Industrial installations prioritize durability and compliance, whereas residential end users increasingly favor aesthetic appeal combined with energy efficiency. Distribution channels also exhibit bifurcated dynamics: established offline networks such as electrical wholesalers, mass merchants and specialty lighting showrooms continue to support project-based procurement, even as online platforms-from leading e-commerce marketplaces to manufacturer direct-to-customer websites-capture discrete renovation and value-engineering segments.

This comprehensive research report categorizes the Architectural Lighting market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Product Type

- Installation Type

- End User

- Distribution Channel

Regionally Distinct Dynamics Shaping Architectural Lighting Demand, Innovation, and Deployment Patterns Across Americas, EMEA, and Asia-Pacific

In the Americas, North America leads with an accelerated uptake of human-centric and IoT-enabled lighting solutions across commercial and institutional buildings, prompted by stringent energy codes and incentives for smart building certifications. Facilities managers are leveraging tunable white systems in healthcare and education settings to enhance occupant comfort, while office environments deploy dynamic lighting controls to optimize energy performance and support flexible workspace strategies. Latin American markets exhibit growing interest in cost-effective LED replacements for legacy systems, underpinned by electrification programs and urban renewal initiatives that emphasize energy affordability and infrastructure resilience.

Europe, the Middle East and Africa demonstrate diverse regional dynamics shaped by regulatory and cultural factors. The European Union’s Ecodesign and energy labelling directives have accelerated the phase-out of inefficient luminaires, driving innovations in recyclable materials and circular-economy manufacturing models. In the Middle East, iconic architectural lighting projects and large-scale urban developments underscore the region’s appetite for decorative façade illumination and performance-driven solutions, whereas African markets are characterized by incremental growth fueled by infrastructure modernization and solar-powered outdoor lighting deployments.

Asia-Pacific stands out as the fastest-growing regional segment, supported by rapid urbanization, smart city initiatives and proactive government incentives for LED adoption. Strategic programs such as India’s Smart Cities Mission and ASEAN digital infrastructure investments are propelling demand for advanced architectural lighting systems in public and private developments alike. Concurrently, China’s domestic manufacturing clusters are expanding production capacities for LED components, while advanced markets in Japan and South Korea focus on premium, precision-engineered solutions for compact and high-density architectural applications.

This comprehensive research report examines key regions that drive the evolution of the Architectural Lighting market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Responses and Operational Investments by Leading Architecture Lighting Manufacturers Amid Shifting Cost and Trade Environments

Signify, a global leader in smart lighting, has directly attributed its mid-year price adjustments in the U.S. market to the 2025 tariff regime, marking an approximate 10 percent increase on select Hue series fixtures. The company is actively realigning its operational footprint by exploring assembly shifts to India and Mexico, aiming to alleviate the effects of escalating import duties while maintaining its innovation pipeline.

Acuity Brands and RAB Lighting have responded to rising raw material costs by implementing targeted product price revisions across their portfolios. These adjustments reflect the broader context of duty-induced cost pressures and are part of a broader strategy to balance margin preservation with customer affordability in North American and international markets alike.

Investment in domestic manufacturing has become a strategic imperative for companies seeking supply chain resilience. Eaton has committed over $500 million to expand its North American fabrication capabilities, including enlargements of its Texas and Wisconsin facilities to support increased production of voltage regulators, busway systems and critical power distribution components. These expansions not only address congestion in global supply chains but also align with customer demand for locally sourced, high-quality solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Architectural Lighting market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acuity Brands, Inc.

- Alcon Lighting Inc.

- ams-OSRAM AG

- Artemide S.p.A.

- Cree Lighting

- Current Lighting Solutions, LLC

- Cyanlite Technology Co., Ltd.

- Delta Light N.V.

- Eaton Corporation plc

- EPISTAR Corporation

- Fagerhult Group AB

- Hubbell Incorporated

- Kichler Lighting LLC

- LED A Plus Co., Ltd.

- NICHIA CORPORATION

- Nora Lighting

- Nordeon USA

- RC Lighting Limited

- Signify Holding

- Technical Consumer Products, Inc.

- TRILUX GmbH & Co. KG

- WAC Lighting

- Zhongshan Laviki Lighting Co., Ltd.

- Zumtobel Group AG

Actionable Supply Chain, Sustainability, and Collaboration Strategies for Industry Leaders to Strengthen Positioning and Resilience

To navigate the intertwined pressures of technological innovation, sustainability mandates and trade policy fluctuations, industry leaders must prioritize a proactive diversification of supply chains. Identifying and qualifying alternative manufacturing hubs beyond traditional sourcing locales can mitigate the financial impact of tariffs while safeguarding continuity of supply. For instance, the shift of assembly operations to India and Mexico by major players offers a blueprint for balancing cost efficiency with regulatory compliance. At the same time, organizations should accelerate adoption of human-centric and IoT-enabled lighting systems, leveraging dynamic tunable controls and data analytics to deliver differentiated value propositions to clients across commercial and institutional segments.

Embedding sustainability as a core tenet of product design and corporate strategy will be critical to meet evolving regulatory and customer expectations. Manufacturers and specifiers alike should invest in circular design practices, selecting recyclable and biodegradable materials, and pursuing fixture designs that facilitate easy disassembly and component reuse. As evidenced by the rise of greenovation trends in the European market, aligning with energy labelling and Ecodesign standards yields competitive advantages and brand differentiation.

Finally, forging collaborative partnerships throughout the value chain-from raw material suppliers to architectural firms and end-users-can spur co-innovation and accelerate time-to-market for emerging solutions. Engaging in joint research initiatives, pilot programs and specification workshops enables stakeholders to co-create lighting strategies that resonate with performance, aesthetic and sustainability objectives. Concurrently, reinforcing domestic manufacturing footprints through strategic capital deployments, as demonstrated by recent investments in North American facilities, bolsters market responsiveness and long-term resilience against potential policy shifts.

Methodology Detailing Comprehensive Primary Interviews, Quantitative Surveys, and Secondary Data Triangulation for Robust Market Insight Generation

This analysis is grounded in a rigorous research methodology combining primary and secondary intelligence to ensure comprehensive coverage and validity. Primary research involved in-depth interviews with key stakeholders, including manufacturers, distributors, lighting designers and facility managers, to capture firsthand perspectives on emerging trends, cost dynamics and strategic priorities. These qualitative insights were complemented by quantitative surveys administered to end-users and consultants across commercial, industrial and residential segments, providing a balanced understanding of market requirements and adoption patterns.

Secondary research encompassed a thorough review of public policy documents, regulatory filings, trade databases, and reputable industry publications to contextualize the impact of tariff changes, regional incentives and technological advancements. Proprietary datasets on import-export flows and component sourcing patterns were integrated to quantify the influence of trade policies on material costs and supply chain configurations. Where possible, triangulation techniques were employed, correlating data points from multiple sources to validate findings and identify outliers.

The resulting synthesis offers a holistic perspective that aligns macroeconomic factors, such as trade policy shifts, with micro-level drivers, including product innovation cycles and specification trends. By combining strategic insights with empirical data, this report enables decision-makers to pinpoint opportunities, anticipate challenges and shape tactical roadmaps that resonate with evolving architectural lighting demands.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Architectural Lighting market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Architectural Lighting Market, by Technology

- Architectural Lighting Market, by Product Type

- Architectural Lighting Market, by Installation Type

- Architectural Lighting Market, by End User

- Architectural Lighting Market, by Distribution Channel

- Architectural Lighting Market, by Region

- Architectural Lighting Market, by Group

- Architectural Lighting Market, by Country

- United States Architectural Lighting Market

- China Architectural Lighting Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesis and Final Reflections on Navigating Technological Innovation, Sustainability Imperatives, and Policy Challenges in Architectural Lighting

The architectural lighting market’s trajectory is defined by a confluence of technological breakthroughs, evolving design paradigms and policy influences that collectively shape stakeholder decision-making. From the maturation of human-centric and smart lighting systems to the imperative of sustainable production and the ramifications of shifting trade policies, industry participants must remain vigilant and adaptable. By embracing diversified supply chain strategies, embedding circular design principles and fostering collaborative innovation, organizations can secure both short-term stability and long-term growth in this dynamic landscape.

The insights presented herein offer a strategic blueprint for navigating the complexities of 2025 and beyond. Whether specifiers seeking to integrate cutting-edge illumination techniques, manufacturers aiming to optimize operations, or distributors assessing channel expansion, the interplay of market segmentation, regional nuances and company initiatives offers a rich tapestry of considerations. Ultimately, success will hinge on the ability to translate multifaceted insights into targeted actions that drive operational excellence and deliver exceptional lighting experiences.

Secure Your Competitive Edge by Contacting Ketan Rohom to Obtain the Complete Architectural Lighting Market Research Report

To acquire the comprehensive architectural lighting market research report brimming with actionable intelligence, detailed regional breakdowns, and proprietary insights, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, who can provide guidance on securing the full suite of analysis and data necessary to inform your strategic decisions and maintain your competitive advantage.

- How big is the Architectural Lighting Market?

- What is the Architectural Lighting Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?