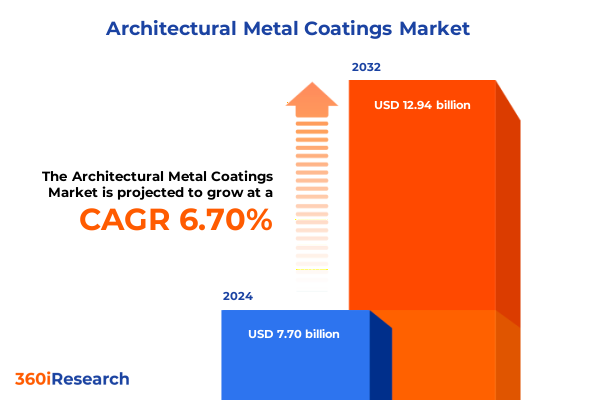

The Architectural Metal Coatings Market size was estimated at USD 8.21 billion in 2025 and expected to reach USD 8.75 billion in 2026, at a CAGR of 6.72% to reach USD 12.94 billion by 2032.

Setting the Stage for Next-Generation Architectural Metal Coatings that Drive Innovation, Sustainability, and Performance in Modern Building Environments

Architectural metal coatings have evolved from basic protective layers to sophisticated systems that enhance durability, aesthetics, and environmental performance. In recent years, the industry has witnessed a convergence of technological advancements, stringent regulatory requirements, and shifts in design trends that together are reshaping how coatings are formulated, applied, and specified. Sustainability imperatives now permeate every stage of product development, driving innovation in low-VOC, high-performance chemistries that meet both environmental standards and architecturally demanding specifications.

As the built environment becomes more complex, end users are demanding coatings that deliver superior weather resistance, color retention, and maintenance ease over multi-decade lifecycles. Whether coatings are applied on high-rise curtain walls, residential siding, or critical infrastructure components, the performance bar continues to rise. This executive summary introduces the critical themes that define the current state of the market, setting the stage for a deeper exploration of disruptive forces, regulatory impacts, and strategic imperatives that will guide industry leaders through 2025 and beyond.

How Environmental Regulations, Technological Evolution, and Design Preferences Are Redefining Architectural Metal Coating Applications Worldwide

The architectural metal coatings landscape is undergoing transformative shifts fueled by regulatory edicts, technological breakthroughs, and evolving design languages. Mandatory global regulations around volatile organic compound emissions have compelled formulators to innovate solvent-free systems and advanced powder coatings, yielding options that significantly reduce environmental impact without compromising performance. Concurrently, the rise of PVDF formulations with high-percent solids has redefined durability expectations, offering architects and fabricators long-lasting color vibrancy in exposed metal facades.

Alongside these chemical innovations, the advent of digital color management and automated application machinery is streamlining batch-to-batch consistency, minimizing waste, and accelerating project timelines. Hybrid approaches that marry coil coating with spray or roll technologies allow for unprecedented flexibility, supporting intricate geometries and custom finishes. As aesthetic preferences lean toward bold colors, metallic sheens, and textured surfaces, coatings must deliver both visual appeal and long-term resilience. These shifts collectively signal an era where material science, environmental stewardship, and design philosophy intersect to deliver next-generation coating solutions.

Assessing the Multifaceted Consequences of 2025 United States Tariffs on Raw Materials, Supply Chains, and Competitive Dynamics in Metal Coatings

The implementation of new United States tariffs in 2025 has introduced a complex set of challenges and opportunities across the architectural metal coatings value chain. Increased duties on key raw material imports, such as specialty pigments and polymer resins, have elevated input costs, prompting manufacturers to reevaluate sourcing strategies. In response, many players are accelerating domestic supplier development and forging strategic partnerships to mitigate exposure to tariff volatility.

At the same time, these tariff-driven cost pressures have stimulated localized R&D investments aimed at discovering alternative feedstocks and optimizing resin chemistries for cost efficiency. Although price competitiveness has tightened, the push toward vertical integration is enabling some leading firms to capture margin stability, while smaller formulators focus on niche applications where premium performance commands higher pricing flexibility. Ultimately, the cumulative impact of 2025 tariffs is driving a more resilient, domestically anchored supply chain, while catalyzing innovation in resin and pigment development to uphold market competitiveness.

Uncovering Strategic Market Dynamics Through Comprehensive Segmentation by Coating Type, Resin Composition, End Uses, Substrates, Application Methods, and Price Tiers

A nuanced understanding of market dynamics emerges when examining the interplay of coating type, resin composition, end use application, substrate compatibility, application methodology, and price tier. Liquid coatings, both solvent based and water based, continue to anchor versatility in field applications, while powder coatings-encompassing thermoplastic and thermoset variants-excel in coil coating lines where minimal waste and rapid throughput are critical. Meanwhile, PVDF coatings, differentiated by fifty and seventy percent solid content, have solidified their status as the gold standard for high-performance facades.

Resin selection further stratifies the market, with acrylics prized for color stability, epoxies delivering adhesion and chemical resistance, polyesters balancing durability and cost effectiveness, and polyurethanes offering enhanced flexibility and impact resistance. In terms of end use, the construction sector spans commercial high-rises to residential developments, each demanding unique aesthetic and compliance profiles. Industrial applications range from automotive chassis protectants to specialized manufacturing equipment finishes, while infrastructure coatings on bridges and tunnels must withstand extreme environmental stresses. Substrate preferences for aluminum and steel, including galvanized and stainless steel grades, dictate pretreatment protocols and primer chemistries. Application methods from coil coating to roll and spray technologies each contribute distinct efficiencies, while economic, standard, and premium price segments define competitive positioning. This comprehensive segmentation framework reveals not only where value is created, but how product portfolios can be optimized to address evolving market demands.

This comprehensive research report categorizes the Architectural Metal Coatings market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Coating Type

- Resin Type

- Substrate

- Application Method

- End Use

Evaluating Regional Market Behaviors and Growth Drivers Across the Americas, Europe Middle East & Africa, and the Asia-Pacific in the Metal Coatings Sector

Regional evaluations of the architectural metal coatings landscape reveal contrasting growth drivers and market maturities across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, robust investments in commercial redevelopment and infrastructure modernization have spurred demand for sustainable coating solutions that align with carbon reduction objectives. The emphasis on domestic manufacturing has further strengthened local capacity, enabling faster lead times and tighter quality control.

Across Europe Middle East & Africa, stringent environmental regulations and ambitious energy efficiency targets have elevated the adoption of high-solid and waterborne formulations. Public infrastructure projects, particularly in the Middle East’s emerging urban centers, are catalyzing demand for premium PVDF systems resistant to harsh climatic conditions. In Asia-Pacific, rapid urbanization, combined with growing consumer preference for smart building applications, drives heightened interest in multifunctional coatings that integrate self-cleaning, anti-corrosive, and thermal regulating properties. These region-specific insights underscore the necessity of tailored strategies that address local regulatory nuances, supply chain logistics, and end user priorities.

This comprehensive research report examines key regions that drive the evolution of the Architectural Metal Coatings market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players to Reveal Strategic Priorities, Innovation Pathways, and Collaborative Ventures Shaping the Metal Coatings Landscape

Leading players in the architectural metal coatings domain are distinguished by their commitment to sustainable innovation, extensive application expertise, and strategic partnerships that enhance market reach. Several top-tier manufacturers have recently expanded their product portfolios with next-generation PVDF offerings boasting enhanced UV resistance and customizable finishes. Parallel to this, others have invested in automated coil coating lines and digital color-matching technologies to minimize waste and accelerate project cycles.

Collaboration between coating formulators and equipment suppliers is increasingly prevalent, fueling solutions that optimize throughput and ensure consistent film thickness across diverse substrates. In addition, major companies are forging alliances with pigment producers to secure access to cutting-edge colorants that meet evolving design trends. Environmental stewardship also remains a differentiator, with leading firms publishing transparent sustainability reports and offering take-back or recycling programs for coating overspray and containers. These strategic moves not only elevate brand reputation but also fortify long-term resilience in an increasingly regulated global market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Architectural Metal Coatings market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- AGC Inc.

- Akzo Nobel N.V.

- Arkema S.A.

- Asian Paints Limited

- Axalta Coating Systems, LLC

- BASF SE

- Benjamin Moore

- Certified Enameling, Inc.

- Covestro AG

- Dow Inc.

- ESE Coatings North America.

- Fab-Tech Inc. by Exyte Group

- G.J. Nikolas & Co., Inc.

- Jotun Group

- Kansai Paint Co. Ltd.

- Metalier Coatings Limited.

- Nippon Paint Holdings Co., Ltd.

- PPG Industries, Inc.

- RPM International Inc.

- Sherwin-Williams Company

- Tiger Coatings

- Titan Coatings, Inc.

- Tnemec Company Inc.

- Vanda Coatings

Actionable Recommendations for Industry Leaders to Navigate Tariff Pressures, Sustainability Mandates, and Technological Adoption in Metal Coatings

Industry leaders should prioritize an integrated approach that balances sustainability, cost management, and technological advancement. Investing in next-generation powder and PVDF coating lines can significantly reduce waste and energy consumption, while enabling premium performance attributes demanded by architects and specifiers. Parallel efforts to diversify raw material sources-both domestically and from low-risk international partners-will mitigate tariff exposure and supply chain disruptions.

Furthermore, companies that embrace digital solutions for color management, application monitoring, and data analytics will gain a competitive edge by delivering consistent quality and faster turnarounds. Strategic alliances with upstream pigment and resin producers can secure preferential access to novel chemistries, supporting innovation pipelines. Lastly, embedding circular economy principles-such as container recycling and end-of-life coating reclamation-will not only meet emerging regulatory requirements but also strengthen brand loyalty among environmentally conscious stakeholders.

Robust Research Methodology Leveraging Multi-Source Data Triangulation, Expert Interviews, and Qualitative-Quantitative Integration for Market Analysis

This analysis synthesizes data from a robust combination of primary and secondary research methodologies. Initial insights were derived from in-depth interviews with industry executives, R&D leaders, and application specialists, capturing qualitative perspectives on emerging trends and strategic priorities. These insights were rigorously cross-validated with secondary sources, including trade publications, regulatory filings, and technical white papers, to ensure factual accuracy and comprehensive coverage.

Quantitative data points were obtained from anonymized shipment statistics, trade associations, and customs databases, allowing for triangulation of supplier performance and regional market activity. The research team employed a structured benchmarking framework to compare product attributes across coating chemistries, application methods, and end-use requirements. Throughout the process, continuous engagement with subject matter experts provided iterative validation, ensuring that the findings reflect the latest technological innovations, regulatory shifts, and market dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Architectural Metal Coatings market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Architectural Metal Coatings Market, by Coating Type

- Architectural Metal Coatings Market, by Resin Type

- Architectural Metal Coatings Market, by Substrate

- Architectural Metal Coatings Market, by Application Method

- Architectural Metal Coatings Market, by End Use

- Architectural Metal Coatings Market, by Region

- Architectural Metal Coatings Market, by Group

- Architectural Metal Coatings Market, by Country

- United States Architectural Metal Coatings Market

- China Architectural Metal Coatings Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Synthesis of Insights Highlighting Transformation Drivers, Risk Factors, and Strategic Imperatives for Financial and Operational Excellence

The architectural metal coatings sector stands at a pivotal juncture, driven by sustainability mandates, technological breakthroughs, and shifting geopolitical dynamics. Regulatory pressures are accelerating the transition to low-VOC, high-performance systems, while tariffs are reshaping supply chain strategies and product innovation. Segmentation analysis highlights the critical intersections of coating type, resin chemistry, substrate preference, application method, and price tier, illuminating pathways for portfolio optimization.

Regional insights reveal distinct market drivers, from infrastructure redevelopment in the Americas to regulatory rigor in Europe Middle East & Africa, and multifunctional product demand in Asia-Pacific. Leading companies are capitalizing on automation, strategic partnerships, and sustainability programs to secure competitive advantage. Collectively, these findings underscore the importance of adaptive business models, continuous R&D investment, and proactive regulatory compliance to navigate the complexities of the current landscape and achieve long-term growth.

Empower Your Organization with Customized Insights and Connect with Ketan Rohom to Unlock the Full Potential of This Metal Coatings Report

Ready to transform your organization’s strategic approach to architectural metal coatings, this report offers unparalleled depth and actionable insights to keep you ahead of market shifts and regulatory changes. With an emphasis on sustainable formulations, emerging application technologies, and region-specific trends, this study will empower your team to optimize product development, streamline supply chain operations, and refine go-to-market strategies. By engaging directly with the Associate Director of Sales & Marketing, Ketan Rohom, you can tailor the scope and depth of research to match your most pressing business objectives, ensuring you receive the precise intelligence you need to drive growth and innovation.

Don’t miss this opportunity to leverage comprehensive analysis, expert perspectives, and customized deliverables that will position your organization for success in the rapidly evolving architectural metal coatings sector. Reach out to Ketan Rohom today to secure your copy of the full market research report and begin capitalizing on the insights that will define competitive advantage in the years ahead.

- How big is the Architectural Metal Coatings Market?

- What is the Architectural Metal Coatings Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?