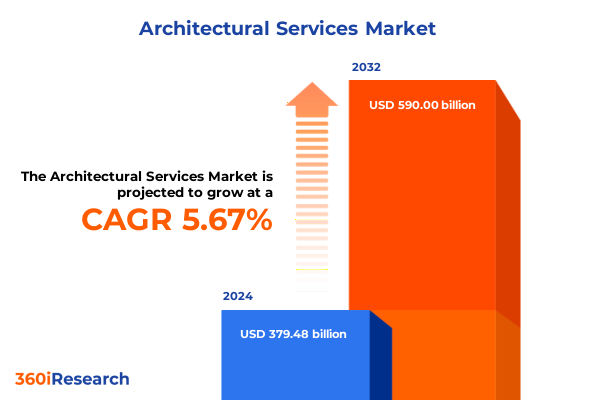

The Architectural Services Market size was estimated at USD 400.04 billion in 2025 and expected to reach USD 421.72 billion in 2026, at a CAGR of 5.70% to reach USD 590.00 billion by 2032.

Architectural Services are Navigating an Era of Unprecedented Innovation Coupled with Intensifying Regulatory Oversight and Market Dynamics

The architectural services landscape today is defined by a convergence of technological innovation, shifting regulatory frameworks, and heightened client expectations. In this era, firms are challenged to reconcile the creative aspiration of design with the pragmatic demands of compliance, environmental stewardship, and cost discipline. As sustainability imperatives deepen and digital tools reshape collaboration, practices must continuously adapt to maintain relevance and resilience. This dynamic environment underscores the need for a clear understanding of the forces that drive change across all facets of architectural services.

Against a backdrop of urbanization and globalization, firms of all sizes are striving to differentiate through value-added expertise, advanced workflows, and distinctive design language. The integration of virtual modeling platforms, data analytics, and automated systems is redefining traditional project lifecycles, from conceptualization to completion. Moving forward, success will hinge on the ability to anticipate evolving building codes, harness emerging technologies, and engage clients with solutions that balance aesthetic ambition and performance goals.

The Architecture Landscape is Transforming Through Digital Disruption Sustainability Imperatives and Evolving Client Expectations while Urbanization Trends Advance

The architecture sector is currently undergoing transformative shifts driven by digital disruption, sustainability mandates, and evolving client preferences. Over the past several years, the adoption of building information modeling platforms has transitioned from novelty to necessity, enabling integrated workflows that reduce design errors and accelerate delivery. Simultaneously, the rise of intelligent lighting systems and internet-enabled building controls is ushering in a new era of smart building technologies that optimize energy consumption and occupant experience. Consequently, firms that once relied on paper blueprints and siloed processes are now investing heavily in virtual reality integration, 4D simulations, and automated systems to deliver more resilient and responsive built environments.

Moreover, sustainability has moved to the forefront of design priorities, with passive solar strategies, green roofing, and energy-efficient solutions becoming critical differentiators. Clients are demanding demonstrable performance metrics, and regulations are steadily tightening to achieve carbon reduction targets. This convergence of digital capability and environmental responsibility is fundamentally altering how practices structure projects and allocate resources. Looking ahead, those who embrace these shifts will be best positioned to capture market opportunities while meeting increasingly rigorous industry standards.

United States Tariffs Implemented in 2025 are Reshaping Material Sourcing Construction Costs and Strategic Planning for Architectural Practices

The tariff measures implemented by the United States in 2025 are exerting a profound cumulative impact on material sourcing, procurement strategies, and project economics within architectural services. Tariffs on key inputs such as steel, aluminum, and solar panel components have led to a recalibration of supply chains as firms seek alternative suppliers domestically and abroad. Material cost inflation has prompted project teams to revisit design specifications, driving greater emphasis on modular systems and pre-fabricated components that can mitigate price volatility and logistical delays.

In response to these challenges, architecture firms are prioritizing strategic planning that encompasses scenario analysis, supply diversification, and long-term supplier partnerships. Some practices have turned to recycled and regionally sourced materials to reduce exposure to international trade disruptions. Additionally, the increased cost of metal frameworks and glazing has accelerated interest in advanced composite materials and high-performance insulation, which can offset initial investment through life-cycle energy savings. As these tariff pressures persist, firms that proactively adjust procurement strategies and integrate supply-chain resiliency into project roadmaps will maintain greater cost control and deliver more predictable outcomes for their clients.

Multidimensional Segmentation Reveals Critical Insights into Service Types Construction Modalities Technology Adoption Design Styles and End User Industries

A detailed examination of multiple segmentation frameworks reveals nuanced insights across service types, construction modalities, technology readiness, design aesthetics, and end-user industries. When services are categorized by type, we observe that compliance offerings-encompassing certification, code assessment, and inspection-are increasingly tied to regulatory complexity, driving demand for specialized expertise. Meanwhile, consulting engagements such as feasibility studies, remediation planning, and sustainability advisory are expanding as clients seek strategic guidance on risk management and environmental performance. Design services, from commercial schemes through interior and residential design, continue to form the creative core of many practices, while project management disciplines like construction oversight, site supervision, and schedule control ensure operational discipline and delivery precision.

Turning to construction type, private gardens, public parks, and urban open spaces highlight the growing appreciation for landscape architecture as a driver of well-being. New construction projects across high-rise, mid-rise, and low-rise buildings illustrate divergent needs in urban density and zoning, whereas adaptive reuse, exterior renovation, and interior remodeling underscore the importance of extending the life of existing assets. On the technology front, the blend of 3D modeling, 4D simulation, and virtual reality integration under building information modeling platforms is reshaping how projects unfold. Simultaneously, automated systems, intelligent lighting, and IoT integration within smart building technologies are enhancing operational efficiency. Sustainable architecture’s focus on energy-efficient solutions, green roofs, and passive solar design reflects an irreversible industry tilt toward ecological stewardship.

Exploring design style segmentation further, eclectic approaches such as art deco, bohemian themes, and industrial motifs are gaining traction among clients seeking unique brand identities, while modern design trends from brutalist geometry to minimalism appeal to those valuing clean lines and functionality. Traditional aesthetics rooted in colonial, Tudor, and Victorian influences remain relevant in heritage and high-end residential sectors. Finally, end-user industry segmentation spanning hospitality, offices, retail, manufacturing, educational, government, healthcare, multi-family apartments, and single-family homes underscores the breadth of specialization. Recognizing these distinct segments allows firms to align capabilities with client needs and to optimize service portfolios for maximum strategic impact.

This comprehensive research report categorizes the Architectural Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Construction Type

- Technology Adoption

- Design Style

- End-User Industry

Regional Dynamics in the Architectural Services Market Spotlight Diverging Growth Patterns Regulatory Environments and Investment Priorities Across Key Geographies

Geographical variation plays a pivotal role in shaping both demand and delivery dynamics for architectural services. In the Americas, established markets in North America continue to lead with robust investment in commercial projects, advanced construction techniques, and sustainable certifications. Meanwhile, Latin American nations are navigating infrastructure backlogs and rapid urbanization, creating opportunities for modular design and public-private partnerships. Regulatory regimes across the hemisphere vary significantly, requiring firms to maintain localized expertise in zoning ordinances, seismic codes, and sustainability incentives to ensure timely project approval and execution.

In the Europe, Middle East & Africa region, a diverse tapestry of regulatory frameworks and cultural heritage custodianship defines the agenda. European Union directives around carbon neutrality and building performance have accelerated retrofitting of institutional and residential structures, whereas Gulf Cooperation Council countries are investing heavily in mixed-use developments that blend traditional motifs with avant-garde forms. Africa presents both challenges and potential as many nations seek to address housing shortages and upgrade civic infrastructure, driving demand for cost-effective, context-sensitive design solutions.

Across Asia-Pacific, the rapid pace of urban expansion is most pronounced, with megacities in East and South Asia commissioning high-rise buildings and integrated smart districts at unprecedented scale. Governments are mandating green building certifications, and clients increasingly demand intelligent building management systems to optimize energy use. Southeast Asian markets are witnessing a balance of new construction and extensive renovations of colonial-era and mid-century structures. Regional talent pools are expanding, but competition for skilled labor remains intense, pushing firms to adopt automation and off-site prefabrication to meet tight timelines.

This comprehensive research report examines key regions that drive the evolution of the Architectural Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading Firms are Adapting to Industry Shifts by Embracing Advanced Technologies Strategic Partnerships and Innovative Sustainable Practice Models

Leading global practices have risen to these challenges by embedding innovation, partnerships, and sustainability into their growth strategies. Gensler has bolstered its technology practice by integrating digital twin capabilities and AI-driven analytics to support real-time performance monitoring. AECOM’s strategic alliances across engineering and construction divisions have enabled the delivery of turnkey solutions for large-scale infrastructure and urban revitalization programs. Perkins + Will has leveraged its deep research heritage to create knowledge platforms that inform biophilic and wellness-oriented design principles, setting a high bar for occupant health metrics.

Meanwhile, ARUP continues to push the envelope in structural engineering and climate-resilient frameworks, collaborating with local authorities to pilot resilient waterfront developments. HOK has distinguished itself through a matrixed service model that aligns project teams by market sector and innovation focus. These firms demonstrate the value of cultivating cross-disciplinary expertise, embracing emerging technologies such as generative design, and engaging in ongoing talent development. Their approaches underscore the importance of aligning internal capabilities with evolving client needs and broader societal objectives.

This comprehensive research report delivers an in-depth overview of the principal market players in the Architectural Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AECOM

- Aedas

- Arcadis N.V.

- Australian Design & Drafting Services company

- Bechtel Corporation

- BluEntCAD

- Cannon Design Inc.

- DP Architects Pte Ltd.

- Excel Project Solutions LLC

- Fluor Corporation

- Foster + Partners Group Limited

- Gensler. M. Arthur Gensler Jr. & Associates, Inc.

- Hardlines Design Company

- HDR, Inc.

- HKS Inc.

- HOK Group, Inc.

- Jacobs Solutions Inc.

- MBH Architects

- Mott MacDonald

- Nikken Sekkei Ltd.

- PCL Constructors Inc.

- Perkins and Will, Inc.

- Stantec Inc.

- Worley Limited

- WSP Global Inc.

Actionable Strategies Empowering Industry Leaders to Navigate Regulatory Challenges Drive Operational Efficiency and Foster Competitive Differentiation

To navigate the complexities of today’s architectural services environment, firms must prioritize strategic diversification and operational resilience. Investing in next-generation digital platforms, including integrated BIM and real-time data analytics, will accelerate decision-making and enhance collaboration across distributed teams. Furthermore, establishing flexible supply-chain arrangements and nurturing relationships with multiple material providers can mitigate the risks associated with tariff fluctuations and logistical disruptions.

In parallel, embedding sustainability as a core value proposition-through green certification expertise, performance benchmarking, and life-cycle cost analysis-can unlock new revenue streams and strengthen client trust. Talent acquisition and retention should focus on multi-disciplinary skill sets, blending creative design aptitude with technological proficiency. Engaging proactively with regulators and industry coalitions will ensure early visibility into code updates and incentive programs, while scenario-planning exercises will enable firms to anticipate market shocks. By operationalizing these strategies, industry leaders can reinforce their competitive differentiation and deliver resilient, high-performance built environments.

Rigorous Research Methodology Combines Primary Interviews Secondary Data Collection and Analytical Frameworks to Ensure Robust and Actionable Market Findings

This research combines primary and secondary sources to deliver an unbiased, rigorous view of the architectural services market. Primary data were gathered through in-depth interviews with senior executives at leading design firms, construction companies, and regulatory bodies. These conversations provided firsthand insights into emerging service models, technology adoption patterns, and strategic responses to tariff disruptions. Complementing this, a quantitative survey of project managers, compliance specialists, and sustainability consultants ensured a representative sample of perspectives across service lines and regions.

Secondary research drew on publicly available government documents, industry association publications, and peer-reviewed journals to validate and contextualize primary findings. Data triangulation techniques were applied to reconcile discrepancies and to enhance the reliability of segment-specific insights. The analytical framework integrates segmentation analysis, regional overlays, and scenario planning to identify high-impact trends and tactical imperatives. A continuous review process, including peer validation and external expert advisory sessions, reinforced objectivity and depth throughout the study.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Architectural Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Architectural Services Market, by Service Type

- Architectural Services Market, by Construction Type

- Architectural Services Market, by Technology Adoption

- Architectural Services Market, by Design Style

- Architectural Services Market, by End-User Industry

- Architectural Services Market, by Region

- Architectural Services Market, by Group

- Architectural Services Market, by Country

- United States Architectural Services Market

- China Architectural Services Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3657 ]

Comprehensive Conclusion Emphasizes the Strategic Imperatives for Architectural Firms Amid Rapid Market Evolution and Intensifying Competitive Pressures

The evolving architectural services market presents a mosaic of opportunities and challenges that demand a strategic response. Digital transformation, sustainability mandates, and tariff-driven cost pressures are reshaping client priorities and service delivery models. Firms that harness advanced technologies, adopt resilient procurement strategies, and cultivate specialized expertise across segmentation dimensions will be best positioned to thrive.

As regional dynamics continue to diverge, and as leading companies forge new paths through collaboration and innovation, the path ahead requires deliberate investment in talent, processes, and partnerships. By aligning strategic initiatives with the overarching imperatives of efficiency, resilience, and environmental stewardship, architectural practices can seize growth opportunities and sustain competitive advantage in an increasingly complex marketplace.

Seize the Opportunity to Access In-Depth Architectural Services Market Insights by Engaging Directly with Associate Director of Sales and Marketing

This research report is designed to empower decision-makers with a comprehensive understanding of the evolving architectural services environment. To explore the in-depth analysis of service type dynamics, regional variations, tariff impacts, and emerging technology trends, I encourage you to reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. Engaging with Ketan Rohom will provide you with tailored insights that address your specific strategic priorities and operational challenges.

By initiating a discussion, you can secure immediate access to supplementary data tables, executive presentations, and custom consulting opportunities. Connect with Ketan Rohom to arrange a personalized briefing and take the next step toward enhancing your firm’s competitive positioning through actionable market intelligence. We look forward to collaborating with you to unlock growth in the architectural services market.

- How big is the Architectural Services Market?

- What is the Architectural Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?