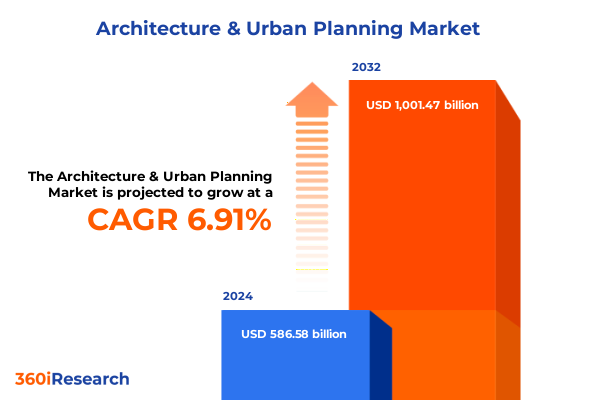

The Architecture & Urban Planning Market size was estimated at USD 626.06 billion in 2025 and expected to reach USD 668.63 billion in 2026, at a CAGR of 6.94% to reach USD 1,001.47 billion by 2032.

An integrative introduction that situates contemporary architecture and urban planning within converging technological, environmental, and stakeholder-driven dynamics

The architecture and urban planning arena is undergoing profound reframing as technological, environmental, and socioeconomic vectors converge to reshape professional practice and built outcomes. Practitioners now navigate an environment where digital modeling, integrated sustainability criteria, and stakeholder-centric planning coexist with legacy procurement systems and complex regulatory landscapes. As a result, firms and public agencies must reconcile design ambition with lifecycle performance, community expectations, and cost-efficiency imperatives.

This introduction frames the core themes explored in the report: the interplay between services and software platforms, the resurgence of distinct design languages, evolving material and construction choices, and the strategic responses required across project scales and building types. It establishes the analytical lens of the brief: to combine qualitative practitioner insight and cross-disciplinary synthesis in order to surface decisions that meaningfully influence project resilience and long-term value creation. The narrative sets expectations for readers seeking practical guidance, outlining how subsequent sections link market dynamics to operational levers and strategic interventions.

Throughout this summary, an emphasis on actionable clarity remains central. The introduction anchors the reader in the critical trade-offs and opportunities that define contemporary architecture and urban planning, and it prepares decision-makers to evaluate segmentation nuances, regional differences, and policy-driven disruptions with a pragmatic, evidence-based mindset.

A concise exposition of the transformative shifts reshaping architectural and urban practice driven by digital integration, sustainability, and collaborative delivery models

The landscape of architecture and urban planning has shifted from incremental adaptation to transformative reorientation as a result of simultaneous advances in digital capability, material science, and policy ambition. Digital tools have evolved beyond drafting aids to become platforms for holistic project orchestration, enabling real-time collaboration across disciplines and informing design decisions with simulation-driven evidence. Concurrently, heightened sustainability expectations are reframing programmatic priorities; environmental performance now factors into early-stage feasibility assessments and long-term asset management alike.

These shifts also alter the nature of client relationships and delivery models. Cross-sector collaborations are now commonplace, with public agencies, private developers, and community stakeholders engaging through more structured, data-informed processes. As a result, design firms and technology vendors face pressure to offer integrated solutions that bridge conceptual design and operational performance. The rise of modular construction and digital twin platforms exemplifies a move toward repeatable, efficiency-driven approaches while preserving opportunities for contextual design and civic innovation.

In practical terms, this transformational moment calls for organizations to recalibrate capabilities around interdisciplinary workflows, invest in skills that translate simulation outputs into policy-ready recommendations, and reconfigure contracting models to reward outcomes rather than outputs. The net effect is a more dynamic ecosystem in which agility, evidence-based decision-making, and a clear sustainability narrative become core competitive differentiators.

A focused analysis of how recent tariff changes have altered procurement strategies, material selection, and supply chain resilience in built environment projects

The introduction of expanded tariff measures has reverberated through procurement chains, design specifications, and supply-side strategies across built-environment projects. Tariff pressures have incentivized both immediate sourcing adjustments and longer-term supply chain reconfiguration, prompting designers and developers to reassess material selection, fabrication strategies, and vendor relationships. For example, higher import costs for specific metals and engineered components have accelerated the search for alternative materials, local supply partnerships, and pre-fabrication approaches that reduce exposure to international price volatility.

At the same time, tariffs have influenced specification practices; procurement teams increasingly require lifecycle cost disclosures and supply chain provenance to mitigate risk. This trend has encouraged closer collaboration between architects, contractors, and suppliers early in the design phase so that substitution strategies remain aligned with aesthetic and performance objectives. In addition, the tariffs have highlighted the strategic value of modular construction and digital fabrication, which allow for controlled production environments and often enable sourcing of inputs with less exposure to cross-border duties.

Moving forward, organizational resilience will hinge on flexible procurement frameworks, robust supplier diversification, and strengthened technical partnerships that support the testing and validation of alternative materials and assembly methods. By aligning specification standards with supply-chain contingencies, project teams can preserve design intent while protecting budgets and delivery timelines against policy-driven disruptions.

An in-depth segmentation analysis that maps offerings, design languages, materials, construction methods, scales, building types, and end-users into actionable strategic priorities

Understanding the market through a segmentation lens reveals where strategic priorities and capability gaps intersect, and it clarifies where investment will deliver disproportionate value. Based on Offering, the landscape divides into Services and Software / Tools: Services encompass architectural design, master planning, project feasibility and management, sustainability and environmental consulting, and urban planning; Software and Tools include building information modeling, computer-aided design, digital twin platforms, geographic information systems, and urban simulation, each enabling distinct efficiencies in delivery and decision-making. This offering-based split indicates that successful firms will blend consultative services with platform-enabled workflows to close the loop between concept and operations.

Design Styles present another axis of differentiation, spanning classical design, futuristic architecture, minimalist design, and vernacular architecture; within classical approaches, baroque and gothic styles continue to inform conservation and heritage projects. Such stylistic variety affects client expectations, regulatory negotiations, and material choices, creating niches where specialist expertise commands strategic advantage. Material selection forms its own partition: concrete, glass, steel, and wood lead prevalent choices, while wood subcategories such as bamboo and timber gain traction where sustainability or regional identity shapes procurement.

Construction Technique further segments activity between modular construction and traditional on-site methods, with modular approaches offering repeatability and schedule certainty and on-site techniques retaining value for bespoke, context-responsive projects. Project Scale distinguishes large-scale developments from mid- and small-scale work, which influences financing structures, stakeholder complexity, and delivery cadence. Building Type categorization-commercial, industrial, institutional, and residential-adds another layer of granularity; commercial work often concentrates on office spaces and retail buildings, industrial projects on manufacturing plants and warehouses, institutional efforts on educational facilities and hospitals, and residential development on multifamily housing and single-family homes. Finally, End User segmentation across private and public sectors, with private clients encompassing corporate, individual, and real estate developer profiles and public clients including government agencies, municipalities, and public institutions, frames procurement cycles, risk appetites, and performance requirements. Together, these segmentation dimensions offer a multidimensional map for prioritizing capability investments, aligning service portfolios with client needs, and targeting technology deployments that support differentiated value propositions.

This comprehensive research report categorizes the Architecture & Urban Planning market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Construction Type

- Design Styles

- Building Material

- Project Scale

- Building Type

- End User

Comprehensive regional insights revealing how varied regulatory, economic, and cultural drivers shape design priorities, technology adoption, and procurement strategies across global markets

Regional dynamics materially influence design practice, regulatory engagement, technology adoption, and supply chain strategy, producing distinct priorities for stakeholders across the globe. In the Americas, projects often emphasize adaptive reuse, mixed-use urban intensification, and resilient infrastructure investments, with private developers and municipal authorities driving demand for solutions that reconcile density with quality of life. This region tends to adopt digital design tools rapidly while balancing cost pressures and regulatory variability across federal, state, and municipal jurisdictions.

In Europe, Middle East & Africa, the environment is heterogeneous: Western European markets foreground sustainability certification, heritage conservation, and progressive urban governance models that shape project approval and financing; the Middle East emphasizes large-scale, landmark developments and integrated master planning; and parts of Africa prioritize affordable housing, infrastructure modernization, and capacity building, often under constrained procurement and financing environments. Technology adoption follows divergent paths, with regional hubs leading in smart city pilots and others focusing on pragmatic, low-cost construction innovations.

The Asia-Pacific region continues to combine rapid urbanization with aggressive infrastructure rollout and strong interest in modular and prefabricated construction methods that accelerate delivery. Governments and developers in this region frequently pair large-scale urban ambitions with policy incentives for green building and digital platforms. Across all regions, the interaction between regulatory frameworks, local supply chains, and client priorities dictates which business models and technologies gain traction, underscoring the need for regionally tailored strategies rather than uniform, global approaches.

This comprehensive research report examines key regions that drive the evolution of the Architecture & Urban Planning market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key corporate and institutional insights revealing how design firms, technology vendors, contractors, suppliers, and financiers are restructuring to capture opportunity and mitigate risk

Corporate players and institutional actors occupy differentiated roles across the architecture and urban planning ecosystem, and their strategies reveal important signals about capability, scale, and innovation pathways. Leading design firms increasingly pair deep sectoral expertise with platform partnerships to offer outcome-oriented services, integrating simulation, sustainability consulting, and project management into bundled offerings that appeal to complex clients. Technology vendors position themselves as enablers of productivity gains, with BIM and digital twin providers focusing on interoperability, data governance, and lifecycle integration.

Contractors and fabricators are responding to shifting material mixes and modular demand by investing in controlled-environment manufacturing capabilities and in-house logistics competencies, while suppliers diversify sourcing and increase transparency to mitigate tariff and trade risks. Public-sector institutions and large developers set procurement norms through specification standards and pilot programs, thereby shaping adoption curves for emerging materials and construction techniques. Financial stakeholders, including institutional investors and specialized lenders, play a pivotal role in underwriting innovation by incentivizing performance-based contracting and green capital allocation.

Collectively, these company-level dynamics highlight the importance of cross-sector collaboration and the emergence of consortium models that align design intent, fabrication capacity, and financing structures. Firms that excel in integrating interdisciplinary teams with robust digital platforms and resilient supply networks will be best positioned to capture opportunities in the evolving landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Architecture & Urban Planning market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AECOM

- Aedas

- Autodesk, Inc.

- Bentley Systems, Incorporated

- CityCAD Technologies Limited

- DLR Group

- Foster + Partners

- Gensler

- Google LLC by Alphabet Inc.

- HDR, Inc.

- Hexagon AB

- HKS Inc.

- HOCHTIEF Aktiengesellschaft by ACS Group

- HOK Group, Inc.

- IBI Group Inc. by Arcadis NV

- Jacobs Engineering Group Inc. by WorleyParsons Ltd.

- Kohn Pedersen Fox

- NBBJ

- Nikken Sekkei Ltd.

- PCL Constructors Inc.

- Perkins Eastman

- Perkins&Will

- Populous Holdings, Inc.

- SAP SE

- Skidmore, Owings & Merrill LLP

- SmithGroup

- Stantec Inc.

- TestFit, Inc.

- Trimble Inc.

- ZGF Architects LLP

Actionable recommendations for industry leaders to strengthen resilience, accelerate innovation, and embed outcome-focused procurement and delivery practices

To translate insight into strategic action, industry leaders must prioritize interventions that strengthen resilience, accelerate innovation, and preserve design quality in the face of complexity. Organizations should embed integrated procurement and specification practices that bring architects, engineers, contractors, and suppliers into early-stage decision-making, thereby reducing the risk of costly redesigns and enabling more effective material substitution when policy or market disruptions arise. Investing in interoperable digital platforms and in the data literacy of project teams will improve coordination and allow performance metrics to inform trade-offs between cost, speed, and sustainability.

Leaders should also cultivate modular and off‑site capabilities where project typologies and scale justify repeatable production, while maintaining on-site expertise for context-sensitive work. Strategic partnerships between design firms, fabricators, and technology providers can accelerate time-to-market for innovative assemblies and enable pilots that demonstrate performance under real-world conditions. At the organizational level, upskilling initiatives and targeted recruitment will be essential to bridge gaps in simulation, sustainability assessment, and supply chain management expertise. Finally, engagement with policymakers and municipal stakeholders through evidence-based advocacy will help shape procurement frameworks and incentive structures that reward lifecycle performance and circularity.

A rigorous mixed-methods research methodology combining practitioner interviews, case synthesis, scenario analysis, and capability mapping to ensure robust and actionable findings

The research methodology underpinning this analysis combines qualitative and quantitative techniques to ensure robust, multi-perspective findings that are relevant to practitioners and decision-makers. Primary inputs include structured interviews with senior practitioners across design firms, developers, contractors, technology providers, and public-sector clients, complemented by case-based analyses of exemplar projects that illustrate how segmentation, regional context, and procurement choices interact in practice. Secondary research synthesizes policy documents, technical standards, and peer-reviewed literature to validate trends and identify emergent best practices.

Analytical approaches employed in the study include comparative case synthesis, scenario analysis to explore supply-chain sensitivities, and capability mapping to identify strategic gaps across organizations. Triangulation across data sources mitigates bias and strengthens the credibility of conclusions. Transparency in methodology is maintained through explicit documentation of interview protocols, inclusion criteria for case selection, and a clear exposition of the assumptions that guide scenario frameworks. Where appropriate, sensitivity checks explore alternative interpretations to ensure recommendations remain robust under varying conditions.

This mixed-methods approach produces insights that are both grounded in practitioner experience and tested against broader evidence, enabling stakeholders to apply findings with confidence while adapting them to their specific organizational contexts.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Architecture & Urban Planning market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Architecture & Urban Planning Market, by Offering

- Architecture & Urban Planning Market, by Construction Type

- Architecture & Urban Planning Market, by Design Styles

- Architecture & Urban Planning Market, by Building Material

- Architecture & Urban Planning Market, by Project Scale

- Architecture & Urban Planning Market, by Building Type

- Architecture & Urban Planning Market, by End User

- Architecture & Urban Planning Market, by Region

- Architecture & Urban Planning Market, by Group

- Architecture & Urban Planning Market, by Country

- United States Architecture & Urban Planning Market

- China Architecture & Urban Planning Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2862 ]

A compelling conclusion synthesizing themes of digital integration, sustainability, supply-chain resilience, and the imperative for regionally tailored strategic responses

The conclusion synthesizes the dominant themes that emerged across segmentation, regional dynamics, corporate strategies, and policy influences. The built-environment sector stands at an inflection point in which digital integration, sustainability imperatives, and supply-chain considerations collectively raise the bar for multidisciplinary collaboration and adaptive procurement. Decision-makers who integrate platform-enabled workflows, prioritize lifecycle performance in specifications, and invest in supply-chain resilience will be better equipped to deliver projects that meet contemporary expectations for quality, cost-effectiveness, and environmental stewardship.

Equally important is the recognition that one-size-fits-all strategies will fail in a context defined by regional diversity and project-specific constraints. Rather, leaders should adopt modular playbooks that allow them to scale repeatable practices for suitable project types while retaining bespoke capabilities for culturally and ecologically sensitive work. By aligning organizational structures, partnerships, and technology investments with the segmentation and regional priorities outlined in this summary, firms and public agencies can translate insight into sustainable outcomes.

Ultimately, the pathway forward requires coordinated action: stronger integration across the value chain, evidence-based policy engagement, and disciplined investments in the people and tools that convert ambition into measurable performance.

Secure immediate access to a comprehensive market research report and tailored executive briefings to translate strategic insights into actionable decisions

For immediate access to the full market research report and to receive tailored briefings that align with your strategic priorities, please contact Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. The report provides the comprehensive context, segmented analysis, regional insights, corporate benchmarking, and actionable recommendations necessary to inform capital allocation, partnership decisions, design direction, and procurement strategies across both public and private sector stakeholders.

Engage with Ketan to schedule a customized walkthrough of the report where findings can be mapped to your organization’s project pipeline, technology roadmap, and sustainability commitments. During a briefing, core themes can be emphasized, including offering-level implications for services and software, the interaction between design styles and material choices, the operational implications of evolving tariffs, and priority interventions for modular versus on-site construction approaches.

Requesting the report directly enables access to methodological annexes and data appendices that underpin the analysis, as well as follow-up support for stakeholder workshops, procurement tendering, and pilot program design. Reach out to secure the report and to start a collaborative discussion about how the insights can be translated into measurable initiatives for design excellence, operational resilience, and policy engagement.

- How big is the Architecture & Urban Planning Market?

- What is the Architecture & Urban Planning Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?