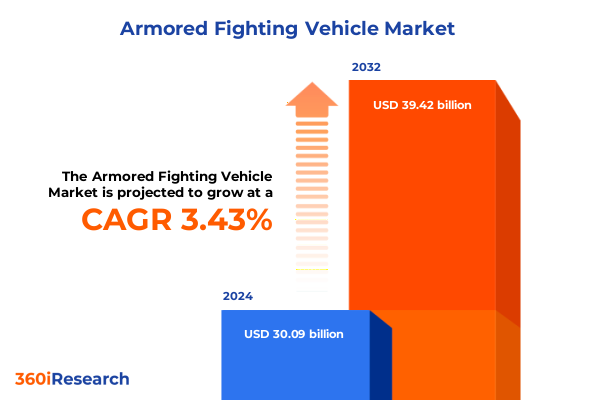

The Armored Fighting Vehicle Market size was estimated at USD 31.11 billion in 2025 and expected to reach USD 32.25 billion in 2026, at a CAGR of 3.43% to reach USD 39.42 billion by 2032.

Harnessing the Critical Role of Armored Fighting Vehicles to Enhance Force Projection and Protect Personnel in Contemporary Combat Scenarios

The introduction sets the stage by illustrating the critical importance of Armored Fighting Vehicles (AFVs) in modern defense architectures. In an era marked by rapidly shifting threat environments, these platforms serve as the backbone of mechanized forces, offering a blend of firepower, protection, and mobility that conventional systems cannot match. As defense ministries and military planners around the world prioritize force modernization, AFVs are at the forefront of capability development, driving investments in next-generation systems that can operate effectively in complex, multi-domain battlefields.

Transitioning from legacy fleets to advanced armored platforms demands a holistic understanding of evolving operational requirements, technological breakthroughs, and procurement strategies. This executive summary provides a concise yet thorough overview of the dynamic landscape, highlighting the key drivers, emerging trends, and strategic imperatives that define the AFV sector today. By contextualizing market shifts within broader geopolitical and technological frameworks, this introduction lays the groundwork for deeper analysis, ensuring that readers appreciate both the strategic rationale and the practical considerations that underpin AFV planning and acquisition.

Navigating the Transformative Technological Shifts Shaping the Future of Armored Fighting Vehicles Across Multifaceted Theaters of Operation

Over the past decade, Armored Fighting Vehicles have undergone transformative technological shifts that are reshaping battlefield operations. Automation and autonomous system integration now offer the promise of enhanced situational awareness while reducing crew workload and exposure to threat. Sensor fusion and network-centric capabilities enable AFVs to operate seamlessly within broader command, control, communications, computers, intelligence, surveillance, and reconnaissance (C4ISR) ecosystems. As a result, vehicles are becoming nodes in a highly connected battlespace rather than isolated platforms.

Concurrently, emerging materials science breakthroughs have produced advanced armor systems that increase protective performance without adding prohibitive weight. Composite and reactive armor technologies are now being combined with traditional steel armor to create hybrid solutions that strike an optimal balance between mobility and survivability. Equally important, advances in propulsion systems, including next-generation diesel engines and hybrid powertrains, are enhancing range, reducing logistical footprints, and supporting silent watch capabilities. These technological shifts, underpinned by investments in digital engineering and model-based systems design, are enabling defense manufacturers to accelerate the development cycle and field upgraded AFV variants more rapidly than ever before.

Assessing the Cumulative Impact of 2025 United States Tariffs on Armored Fighting Vehicle Supply Chains and Defense Procurement Strategies

In 2025, the United States implemented a series of tariffs targeting key inputs and components used in Armored Fighting Vehicle production. Steel and aluminum tariffs have increased raw material costs for domestic and allied producers, compelling manufacturers to seek alternative sourcing strategies and renegotiate supplier contracts. These cost pressures have reverberated across supply chains, prompting logistics realignments to mitigate delivery delays and maintain production schedules.

At the same time, targeted duties on specific defense electronics and advanced sensors have encouraged greater emphasis on indigenous development. Government incentives and offset agreements are guiding original equipment manufacturers toward investing in domestic research and development centers. While end customers face upward pricing pressure, mitigation measures-such as long-term procurement contracts and collaborative funding models-are helping to stabilize program budgets. As a result, defense stakeholders are balancing the short-term impacts of tariff-driven cost variability against long-term objectives of supply chain resilience and technological sovereignty.

Deriving Key Insights from Multidimensional Segmentation to Understand Market Dynamics Across Diverse Armored Fighting Vehicle Categories

A deep dive into segmentation reveals nuanced market dynamics across every analytical lens. Based on Vehicle Type, categories such as Armored Medical Evacuation Vehicle, Armored Personnel Carrier, Armored Reconnaissance Vehicle, Infantry Fighting Vehicle, Light Tank, Main Battle Tank, and Self-Propelled Artillery each address distinct mission profiles and battlefield roles, influencing procurement priorities. Based on Platform, the tracked versus wheeled dichotomy underscores trade-offs between off-road mobility and strategic deployability. Meanwhile, Propulsion systems vary from diesel engines to gas turbines and emerging hybrid configurations, each offering different performance characteristics and logistical footprints. Armor Type segmentation shows that composite armor, reactive armor, and steel armor deliver graduated protection levels, shaping vehicle weight and survivability trade-offs. Weapon System analysis distinguishes between primary armament options-ranging from 105 mm cannon to 120 mm and 125 mm cannon calibers-and secondary armament suites, which include automatic grenade launchers and machine guns to support close-in defense. Finally, Purchase Type segmentation differentiates between new platform procurement and retrofit and upgrade initiatives, reflecting the balance between greenfield acquisitions and life-extension programs. Together, these segmentation dimensions form an interconnected analytical framework that illuminates opportunities for targeted innovation, modular design strategies, and customer-driven customization.

This comprehensive research report categorizes the Armored Fighting Vehicle market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Vehicle Type

- Platform

- Propulsion

- Armor Type

- Weapon System

- Purchase Type

Uncovering the Regional Dynamics That Define Armored Fighting Vehicle Demand Across the Americas, Europe, the Middle East, Africa, and Asia-Pacific

Regional dynamics play a pivotal role in shaping the trajectory of armored combat vehicle development and acquisition. In the Americas, established defense budgets continue to support modernization of tracked and wheeled platforms, with prime contractors collaborating closely with government research laboratories to accelerate next-generation prototypes. Across Europe, the Middle East & Africa, interoperability and coalition operations drive standardization efforts, while regional tensions spur localized procurement of Main Battle Tanks and Infantry Fighting Vehicles optimized for varied terrain conditions. In the Asia-Pacific, expanding maritime and land-border security concerns are catalyzing investments in lighter, more mobile AFVs that can be rapidly deployed to remote theaters. Cross-regional partnerships, technology transfer agreements, and joint development programs are becoming increasingly common, as sovereign defense objectives align with industrial collaboration strategies. These regional insights underscore the importance of adaptable designs and flexible manufacturing footprints to address diverse strategic landscapes and operational imperatives.

This comprehensive research report examines key regions that drive the evolution of the Armored Fighting Vehicle market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Influential Industry Players Driving Innovation, Collaboration, and Competitive Edge in the Armored Fighting Vehicle Sector

Leading defense contractors and specialized OEMs are driving the current wave of AFV innovation through targeted research, strategic alliances, and ecosystem partnerships. Established players with decades of armored combat expertise are leveraging digital engineering platforms to streamline design iterations and reduce integration risks. Meanwhile, system integrators and electronics specialists are collaborating on advanced sensor suites, battlefield networking components, and active protection systems to enhance platform lethality and survivability. Joint ventures between domestic manufacturers and international technology firms are facilitating technology transfer while balancing sovereign capability development. Concurrently, emerging entrants are carving out niches in propulsion electrification, autonomous navigation, and lightweight armor composites, prompting incumbents to accelerate their innovation roadmaps. As companies navigate competitive pressures, strategic differentiation increasingly hinges on the ability to offer modular architectures, seamless upgrade paths, and comprehensive lifecycle support services that align with evolving user requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Armored Fighting Vehicle market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AM General LLC

- BAE Systems plc

- Elbit Systems Ltd

- FNSS Defense Systems AŞ

- General Dynamics Corporation

- Hanwha Defense

- Hyundai Rotem Company

- Iveco Defence Vehicles

- JSC Rosoboronexport Rostec State Corporation

- KNDS N.V.

- Krauss-Maffei Wegmann GmbH & Co KG

- Lockheed Martin Corporation

- Mahindra & Mahindra Limited

- Mitsubishi Heavy Industries Ltd

- Nexter Systems

- Northrop Grumman Corporation

- Oshkosh Corporation

- Otokar Otomotiv ve Savunma Sanayi AŞ

- Paramount Group

- Patria Group

- Rheinmetall AG

- ST Engineering

- Tata Advanced Systems Limited

- Textron Inc

Implementing Strategic Recommendations to Enhance Capabilities, Streamline Procurement and Optimize Lifecycle Management for Armored Fighting Vehicles

To sustain a competitive edge, industry leaders should prioritize a series of actionable strategies grounded in market realities. First, accelerating investment in hybrid propulsion research and development will yield platforms with enhanced range, reduced thermal signatures, and lower lifecycle costs. Equally important, strengthening domestic supply chains for critical armor materials and electronic components will mitigate tariff-induced cost volatility and logistical bottlenecks. Companies must also deepen collaboration with defense agencies to co-create digital twin models that inform predictive maintenance regimes and optimize readiness. Embracing open architecture frameworks will facilitate rapid integration of new weapon systems, sensors, and protection suites as threat landscapes evolve. Furthermore, expanding retrofit and upgrade offerings for legacy fleets can unlock additional revenue streams while extending platform service life. By implementing these recommendations, stakeholders can navigate the complex intersection of technological innovation, policy shifts, and end-user demands with confidence and agility.

Adopting a Robust Mixed-Method Research Methodology to Ensure Comprehensive Insights and Rigorous Validation for Armored Fighting Vehicle Analysis

This research employs a robust mixed-method approach to ensure comprehensive and validated insights. Secondary data sources include defense white papers, government procurement records, technical journals, and industry conference proceedings, forming a foundational knowledge base. Primary research encompasses in-depth interviews with defense program managers, military end users, and subject matter experts across design, procurement, and sustainment domains. Case study analyses of recent acquisition programs provide contextualized understanding of success factors and challenges. Quantitative triangulation involves cross-verifying techno-economic assumptions against multiple data points, while qualitative feedback loops with domain experts validate emerging hypotheses. This methodological rigor ensures that conclusions reflect real-world operational requirements and anticipate future market trajectories with a high degree of confidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Armored Fighting Vehicle market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Armored Fighting Vehicle Market, by Vehicle Type

- Armored Fighting Vehicle Market, by Platform

- Armored Fighting Vehicle Market, by Propulsion

- Armored Fighting Vehicle Market, by Armor Type

- Armored Fighting Vehicle Market, by Weapon System

- Armored Fighting Vehicle Market, by Purchase Type

- Armored Fighting Vehicle Market, by Region

- Armored Fighting Vehicle Market, by Group

- Armored Fighting Vehicle Market, by Country

- United States Armored Fighting Vehicle Market

- China Armored Fighting Vehicle Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Concluding Perspectives on the Strategic Imperatives Shaping the Evolution and Operational Effectiveness of Armored Fighting Vehicles Worldwide

In conclusion, the Armored Fighting Vehicle landscape is undergoing a period of rapid transformation driven by technological innovation, shifting geopolitical dynamics, and evolving procurement frameworks. Modernization imperatives are pushing defense stakeholders toward more connected, survivable, and adaptable platforms. As tariffs reshape supply chains and cost structures, manufacturers and buyers alike are emphasizing resilience through local sourcing and strategic partnerships. The multidimensional segmentation of vehicle types, platforms, propulsion systems, armor configurations, weapon suites, and purchase modes highlights the diverse requirements that must be addressed. Regional imperatives in the Americas, Europe, the Middle East & Africa, and the Asia-Pacific underscore the importance of flexibility in design and production. Ultimately, success in this sector will depend on a harmonious blend of strategic foresight, operational agility, and continuous innovation to meet the demands of twenty-first century conflict environments.

Driving Decisive Engagement Through Direct Collaboration with Associate Director Ketan Rohom to Secure In-Depth Armored Fighting Vehicle Market Research

To explore comprehensive insights into the rapidly evolving Armored Fighting Vehicle market and to secure a tailored research solution, please contact Ketan Rohom, Associate Director, Sales & Marketing, for a detailed discussion about report scope, customization options, and enterprise licensing. Engaging directly with Ketan Rohom will ensure you receive a personalized briefing on the competitive landscape, segmentation intelligence, and strategic recommendations that align with your organizational objectives. Reach out today to initiate your purchase process and gain immediate access to the definitive market research resource for armored combat platforms.

- How big is the Armored Fighting Vehicle Market?

- What is the Armored Fighting Vehicle Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?