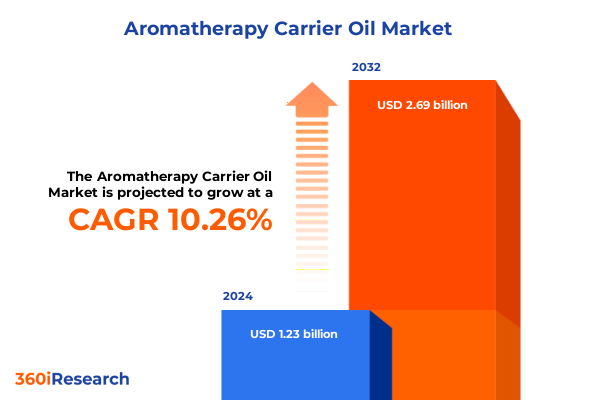

The Aromatherapy Carrier Oil Market size was estimated at USD 1.35 billion in 2025 and expected to reach USD 1.50 billion in 2026, at a CAGR of 10.26% to reach USD 2.69 billion by 2032.

Positioning the Aromatherapy Carrier Oil Sector in a Dynamic Landscape of Consumer Preferences, Supply Chain Shifts, and Sustainable Innovation Pathways

The aromatherapy carrier oil sector has evolved into a dynamic arena shaped by shifting consumer preferences and rapid innovation in sustainability practices. As wellness and natural health trends continue to rise, carriers such as coconut, grapeseed, jojoba, and sweet almond oils have gained prominence for their dual role in therapeutic efficacy and beauty applications. These oils serve as foundational elements in aromatherapy formulations, enhancing the performance and safety of essential oils while catering to an increasingly discerning consumer base prioritizing transparency, traceability, and eco-friendly credentials.

Market participants are navigating a landscape characterized by an expanding array of product options-from organic and cold-pressed variants to fractionated and solvent-extracted alternatives. Concurrently, technological advancements in extraction and packaging processes have introduced new quality assurance measures, enabling producers to maintain bioactive profiles and extend shelf life without compromising purity. Importantly, this surge in innovation aligns with regulatory developments demanding greater compliance and certification, signaling that companies must integrate robust traceability systems to meet emerging standards.

In this context, stakeholders are investing in strategic partnerships across supply chains to secure raw material provenance and optimize cost structures. From small-scale cooperatives to global distributors, collaboration is emerging as a cornerstone for resilience amid fluctuating raw material availability and evolving trade environments. As we embark on this comprehensive executive summary, these foundational trends set the stage for a deeper exploration of transformative shifts, tariff impacts, segmentation insights, and actionable strategies shaping the future of aromatherapy carrier oils.

Navigating Pivotal Transformations Redefining Consumer Demand, Technological Integration, and Sustainability Criteria Within the Carrier Oil Value Chain

Over the past several years, the aromatherapy carrier oil landscape has undergone significant transformation driven by changing consumer behaviors, advancements in extraction technology, and mounting sustainability demands. Consumers today are more knowledgeable and selective, seeking oils certified under rigorous eco-friendly and organic standards, and expecting full transparency regarding sourcing and production methods. This shift has encouraged producers to adopt blockchain and digital traceability platforms, ensuring product integrity from seed to shelf and building trust among end users.

Simultaneously, innovations in cold-pressed and steam-distillation techniques have improved yield efficiency while preserving the delicate phytochemical profiles critical to therapeutic efficacy. Processing improvements, such as hydraulic pressing and fractionation, have expanded the range of available carrier oil types, enabling formulators to fine-tune viscosity, absorption rates, and stability for diverse applications. Moreover, the push toward cruelty-free and non-GMO verified certifications reflects a broader commitment to ethical production, resonating strongly with both individual users and commercial partners operating in spas and wellness centers.

Additionally, integration of data analytics and IoT monitoring across production lines has optimized operational performance and quality control, reducing waste and energy consumption. As the industry continues to prioritize circular economy principles, companies are exploring bulk and reusable packaging solutions to minimize environmental footprint. Together, these transformative shifts outline a renewed and resilient carrier oil landscape-one that balances consumer-driven sustainability expectations with technological progress, ultimately redefining the value chain.

Assessing the Far-Reaching Effects of Recent United States Tariff Adjustments on Aromatherapy Carrier Oil Imports, Pricing Structures, and Strategic Sourcing Decisions

In 2025, the United States implemented a series of tariff adjustments targeting imported carrier oils, reflecting broader trade policy objectives and responses to global market volatility. These tariff changes have altered landed costs for key varieties such as coconut and sweet almond oils, prompting importers to reassess vendor relationships and adjust pricing models. As a result, downstream formulators in cosmetics, food and beverages, and pharmaceutical applications have encountered margin pressures, driving a strategic shift toward local sourcing and domestic production.

Concurrently, the tariffs have incentivized new investments in regional extraction facilities and processing centers across North America. Domestic producers are capitalizing on this momentum by expanding capacity for organic blends and refining processes for solvent-extracted variants, thereby mitigating exposure to import duties. Industry alliances have emerged to advocate for tariff realignments and negotiate quota increases, revealing a collaborative response to policy-driven cost fluctuations.

Beyond cost implications, the tariff landscape is also influencing procurement strategies. Forward-looking companies are incorporating hedging mechanisms and multi-sourcing frameworks to balance supply security with price stability. This has underscored the importance of agile supply chain management and risk mitigation, as market participants seek to navigate the complexities of evolving trade regulations. Looking ahead, tariff dynamics will continue to shape strategic sourcing and partnerships, setting the tone for competitive positioning in the U.S. aromatherapy carrier oil market.

Uncovering Profound Insights Across Carrier Oils by Product Type, Application, Distribution Channels, Consumer Profiles, and Extraction Criteria in Market Segmentation

When examining market segmentation by product type, blended oils encompass both organic blends and synthetic blends, offering formulators the flexibility to balance cost and natural claims, while single oils include organic singles and synthetic singles that deliver consistent purity and bioactive profiles. In terms of application, cosmetic and personal care users rely on carrier oils for face serums, hair care, lip balms, and moisturizers, whereas the food and beverage industry leverages these oils for baking, beverage flavors, and condiments, and the pharmaceutical and therapeutic segment employs them in massage and relaxation formulations as well as sleep improvement aids.

Evaluating distribution channels reveals that offline stores, including beauty and personal care specialty outlets, health and wellness centers, and pharmacies, remain pivotal for consumer engagement and product education, while online stores such as direct selling platforms and e-commerce websites drive convenience and broader geographic reach. From an end-user perspective, commercial segments like spas, wellness centers, therapists, and practitioners prioritize bulk and turnkey solutions, whereas individual aromatherapy enthusiasts and home users favor smaller, ready-to-use packaging with clear certification claims.

Further analysis by carrier oil type highlights the prevalence of coconut oil-available as refined or unrefined virgin varieties-alongside grapeseed oil in expeller-pressed or solvent-extracted formats, jojoba oil processed via cold-pressed or fractionated methods, and sweet almond oil offered as cold-pressed or expressed. Extraction methods range from hydraulic and mechanical pressing for cold-pressed oils to chemical extraction and steam distillation for solvent-extracted products. Packaging options span glass or plastic bottles for consumer-ready units and barrels or drums for commercial volumes. Certification criteria encompass eco-friendly designations like BPA-free and cruelty-free accreditation, as well as organic certifications such as non-GMO verification and USDA organic.

This comprehensive research report categorizes the Aromatherapy Carrier Oil market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Carrier Oil Type

- Extraction Method

- Packaging Type

- Application

- End User

- Sales Channel

Revealing Regional Market Dynamics Spanning the Americas, Europe Middle East & Africa, and Asia Pacific to Illuminate Growth Opportunities and Competitive Challenges

In the Americas, market dynamics are characterized by mature consumer awareness and high demand for certified organic and eco-friendly carrier oils, spurring innovation in domestic extraction technologies and sustainable packaging solutions. Regulatory frameworks across the United States, Canada, and Brazil emphasize stringent quality and safety standards, compelling suppliers to maintain robust compliance measures and invest in traceability systems.

Across Europe, the Middle East, and Africa, diverse market maturity levels present a mosaic of opportunities and challenges. Western European countries exhibit strong consumer preference for cold-pressed and non-GMO verified oils, whereas markets in the Middle East and North Africa are witnessing rapid growth driven by rising disposable incomes and an increasing emphasis on natural health remedies. Cross-border trade corridors and varying export regulations necessitate agile distribution strategies to navigate tariff differentials and logistical complexities.

In Asia-Pacific, the proliferation of domestic oilseed production in India and Southeast Asia is reshaping supply chains, with local suppliers expanding capacity to serve burgeoning cosmetic and therapeutic markets. Concurrently, sophisticated e-commerce ecosystems in China, Japan, and Australia are driving digital-first distribution models, encouraging global players to establish omnichannel approaches. Emerging economies within the region remain attractive for contract manufacturing partnerships, presenting avenues for scaling production while meeting diverse regional certification requirements.

This comprehensive research report examines key regions that drive the evolution of the Aromatherapy Carrier Oil market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Strategies and Innovations from Leading Carrier Oil Manufacturers Driving Quality, Sustainability, and Market Differentiation Across Global Operations

Industry leaders in the aromatherapy carrier oil sector have adopted differentiated strategies to secure competitive advantage through quality, sustainability, and innovation. Major producers are reinforcing upstream collaborations with growers to ensure consistent supply of organic and non-GMO raw materials, leveraging vertical integration to optimize cost structures and guarantee traceability. Simultaneously, strategic alliances with technology providers have enabled the deployment of advanced extraction platforms-such as steam distillation units equipped with real-time analytics-to enhance bioactive retention and operational efficiency.

Leading companies are also expanding their portfolios with value-added services, offering customized blends and private-label solutions to meet the nuanced needs of cosmetics brands, spa chains, and therapeutic practitioners. Investment in R&D has fueled the development of fractionated oils and specialized carrier formulations designed for targeted skin delivery and improved aroma profiles. Moreover, a growing number of manufacturers are embedding sustainability across their operations through renewable energy integration, zero-waste processing initiatives, and eco-friendly packaging innovations.

In the realm of distribution, top competitors are strengthening direct-to-consumer channels by optimizing digital platforms with subscription models and interactive educational content that highlights product provenance and usage guidance. Collaborative marketing agreements with wellness influencers and clinical practitioners have further amplified brand credibility and consumer trust. As the competitive landscape intensifies, companies that blend operational excellence with purposeful sustainability commitments are best positioned to lead the global carrier oil market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aromatherapy Carrier Oil market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aethon International LLP

- AOS Products Pvt. Ltd.

- Aromantic Ltd.

- ConnOils LLC

- dōTERRA International, LLC

- Edens Garden Essentials Corporation

- Esperis S.p.a.

- Falcon Essential Oils

- Flavex Naturextrakte GmbH

- FLORIHANA

- G. Baldwin & Co.

- India Aroma Oils and Company

- La Tourangelle

- Mountain Rose Herbs

- NOW Health Group, Inc.

- Plant Therapy

- Rocky Mountain Oils, LLC

- Silverline Chemicals

- Sva Naturals

- THANN-ORYZA CO., LTD.

- The Essential Oil Company

- Wild As The Wind

- Young Living Essential Oils LC

Delivering Actionable Strategies for Industry Leaders to Capitalize on Emerging Trends, Enhance Operational Efficiency, and Foster Sustainable Growth Trajectories

Industry stakeholders must prioritize strategic initiatives that align with evolving consumer expectations and operational imperatives. First, investing in transparency mechanisms-from blockchain-based traceability to comprehensive third-party certifications-will reinforce brand authenticity and foster consumer loyalty. Equally important is the expansion of domestic processing capacities to mitigate tariff exposure and reduce lead times, ensuring supply resilience in the face of trade uncertainties.

Moreover, companies should intensify collaboration with research institutions and innovation labs to accelerate development of sustainable extraction methods that minimize environmental footprint while maximizing yields. Embracing a circular economy mindset, leaders can explore reusable and bulk packaging solutions that cater to commercial end users while reducing overall plastic waste. This approach not only addresses environmental concerns but also differentiates brands committed to holistic sustainability.

Finally, adopting data-driven demand forecasting and agile supply chain management systems will enable real-time visibility across operations, empowering organizations to swiftly adapt sourcing strategies and optimize inventory. By leveraging predictive analytics and scenario planning, businesses can anticipate market shifts, align production with consumer trends, and maintain competitive advantage. These recommendations, when executed cohesively, will facilitate sustainable growth and operational excellence.

Outlining a Robust Research Methodology Combining Primary Interviews, Secondary Data Synthesis, and Advanced Analytical Techniques to Ensure Data Integrity

This analysis is underpinned by a rigorous research methodology that integrates both primary and secondary data to ensure comprehensive market coverage and data integrity. The primary research component comprises structured interviews with key stakeholders-including oilseed growers, extraction facility managers, product formulators, retail buyers, and regulatory experts-to capture firsthand insights into supply chain dynamics, quality challenges, and evolving demand drivers. Each interview is conducted using standardized protocols to guarantee consistency and depth across regional and functional perspectives.

Secondary research sources consist of an extensive review of government trade databases, industry association reports, and academic publications to validate primary findings and provide historical context. Data from import-export registries and tariff schedules were analyzed to assess the implications of trade policy adjustments on cost structures and sourcing strategies. Additionally, specialized literature on extraction technologies and certification frameworks informed the evaluation of quality benchmarks and sustainability criteria.

Analytical techniques such as cross-tabulation, SWOT analysis, and trend extrapolation were employed to synthesize data into actionable insights, while validation workshops with industry practitioners were conducted to refine conclusions and recommendations. This multi-layered approach ensures that the insights presented are robust, reliable, and reflective of the complex forces shaping the aromatherapy carrier oil market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aromatherapy Carrier Oil market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aromatherapy Carrier Oil Market, by Carrier Oil Type

- Aromatherapy Carrier Oil Market, by Extraction Method

- Aromatherapy Carrier Oil Market, by Packaging Type

- Aromatherapy Carrier Oil Market, by Application

- Aromatherapy Carrier Oil Market, by End User

- Aromatherapy Carrier Oil Market, by Sales Channel

- Aromatherapy Carrier Oil Market, by Region

- Aromatherapy Carrier Oil Market, by Group

- Aromatherapy Carrier Oil Market, by Country

- United States Aromatherapy Carrier Oil Market

- China Aromatherapy Carrier Oil Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2385 ]

Synthesizing Key Findings to Provide a Cohesive Conclusion That Underscores Strategic Priorities and Long-Term Prospects within the Carrier Oil Landscape

The convergence of shifting consumer values, technological advancements, and regulatory developments has redefined the aromatherapy carrier oil landscape, underscoring the importance of transparency, sustainability, and supply chain resilience. Strategic segmentation by product type, application, channel, and region reveals nuanced growth avenues, while the impact of recent U.S. tariffs highlights the need for agile sourcing and domestic capacity expansion.

As competitive pressures intensify, industry players that embrace collaborative innovation, invest in cutting-edge extraction processes, and embed eco-friendly practices across their operations will set new benchmarks for quality and brand trust. Meanwhile, targeted regional approaches-spanning mature markets in the Americas to emerging opportunities in Asia-Pacific-will enable companies to optimize distribution strategies and capitalize on diverse consumer preferences.

Looking forward, the interplay between policy shifts, consumer-driven sustainability mandates, and digital transformation will continue to shape strategic priorities. By grounding decisions in rigorous data analysis and adopting a forward-looking mindset, stakeholders can navigate uncertainties and capture value across the aromatherapy carrier oil value chain. This cohesive conclusion provides a strategic compass for organizations aiming to secure long-term success.

Engage with Ketan Rohom to Secure Comprehensive Aromatherapy Carrier Oil Market Insights and Empower Your Organization with Strategic Research Advantage

Unlock exclusive access to a comprehensive aromatherapy carrier oil market report by connecting with Ketan Rohom, who can guide your organization toward strategic growth. With personalized consultation and detailed insights, Ketan Rohom will collaborate with you to understand specific business needs and deliver tailored research that addresses your critical questions. This partnership ensures your team is equipped with rigorous data, market intelligence, and practical recommendations to make informed decisions.

By engaging directly with Ketan Rohom, you tap into an extensive network of industry experts and benefit from strategic support on implementing findings across R&D, procurement, marketing, and sales functions. His expertise in translating complex market dynamics into actionable plans will empower your organization to anticipate challenges and capitalize on key opportunities. Don’t miss the chance to elevate your market positioning with expert-driven insights and drive sustainable success.

- How big is the Aromatherapy Carrier Oil Market?

- What is the Aromatherapy Carrier Oil Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?