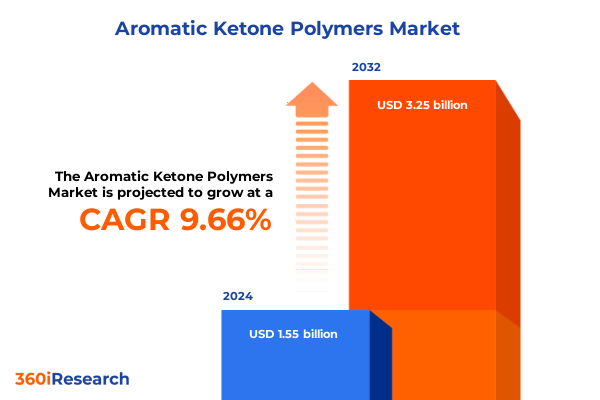

The Aromatic Ketone Polymers Market size was estimated at USD 1.70 billion in 2025 and expected to reach USD 1.87 billion in 2026, at a CAGR of 9.67% to reach USD 3.25 billion by 2032.

A Comprehensive Overview of Aromatic Ketone Polymers Highlighting Their Unique Properties and Strategic Importance Across High-Performance Applications

Aromatic ketone polymers represent a class of high-performance thermoplastic materials characterized by exceptional mechanical strength, thermal stability, and chemical resistance. These polymers, including polyether ether ketone, polyether ketone, and polyether ketone ketone, are synthesized through precise polymerization techniques that yield materials capable of operating in extreme environments. Their unique backbone structures provide rigidity while maintaining processability, making them indispensable in critical applications where conventional plastics fall short. Furthermore, the ability to engineer these polymers in various forms such as films, pellets, and powders expands their utility across diverse manufacturing processes.

The strategic importance of aromatic ketone polymers extends beyond performance metrics; they are catalysts for innovation in sectors demanding reliability and longevity. From aerospace components enduring high thermal cycles to medical implants requiring biocompatibility and sterilization resilience, these materials are at the forefront of design evolution. In addition, regulatory pressures and sustainability goals are driving manufacturers to adopt next-generation polymers that deliver lifecycle advantages. Consequently, an in-depth understanding of market dynamics and stakeholder needs is essential for organizations aiming to leverage aromatic ketone polymers as a competitive differentiator.

Emerging Innovations and Market Disruptions Reshaping the Aromatic Ketone Polymer Landscape with Breakthroughs in Materials Science and Engineering Excellence

Recent developments in material science and processing technologies have initiated transformative shifts across the aromatic ketone polymer sector. Breakthroughs in polymerization catalysts and reactor design have significantly enhanced reaction kinetics, enabling higher molecular weight polymers without sacrificing throughput. As a result, manufacturers can now tailor polymer grades more precisely, aligning material properties with application-specific requirements. Moreover, investment in continuous manufacturing processes has reduced cycle times and operational costs, fostering agility in meeting dynamic market demands.

In parallel, sustainability considerations have begun to reshape research priorities. Innovations aimed at recycling and chemical recovery are emerging as viable pathways to address end-of-life challenges, thereby reinforcing the circular economy for high-performance polymers. Additionally, advancements in additive manufacturing are unlocking new design possibilities, allowing complex geometries that optimize weight and performance while utilizing minimal material. Consequently, companies adopting digital tools for simulation and process monitoring are gaining a strategic edge by accelerating time-to-market and reducing production variance.

Evaluating the Far-Reaching Effects of 2025 United States Tariff Policies on Supply Chains Costs and Competitiveness of Aromatic Ketone Polymers Industry

The introduction of targeted tariff measures by the United States in early 2025 has exerted significant pressure on the import-dependent segments of the aromatic ketone polymer supply chain. Increased duties on foreign-sourced monomers and intermediate resins have translated into elevated input costs for downstream converters and original equipment manufacturers. As a result, manufacturers have been compelled to reassess supplier portfolios and explore near-shoring opportunities to buffer against price volatility. In doing so, several industry participants have accelerated investments in domestic production capacity and local partnerships to secure feedstock availability under more predictable cost structures.

Conversely, these tariffs have catalyzed innovation and strategic realignment within the industry. Domestic polymer producers are capitalizing on reshored demand to justify expansions and modernize process technologies. Meanwhile, end users are advancing design optimization to mitigate material cost increases, often by integrating aromatic ketone polymers more selectively within multi-material assemblies. Although short-term price pressures have constrained profit margins for certain stakeholders, the resulting supply chain diversification and renewed focus on operational resilience are expected to yield long-term benefits in terms of security and competitive positioning.

Deep Dive into Product Types Forms Processes Applications and Industries Revealing Critical Trends and Opportunities in the Aromatic Ketone Polymer Market Segments

Insights gleaned from segmentation analysis reveal that performance requirements and processing considerations are driving differentiation across multiple axes. When examining product types, polyether ether ketone grades continue to dominate due to their proven balance of thermal stability and mechanical properties, while polyether ketone variants gain traction where cost optimization and moderate performance suffice. In certain specialist applications, the elevated heat resistance of polyether ketone ketone is being leveraged to meet extreme service conditions, underscoring the importance of material selection aligned with functional imperatives.

Beyond chemistry, form factor plays a pivotal role in downstream manufacturing. Film architectures provide engineers with thin, conformable substrates for precision components, whereas pelletized feedstocks facilitate high-speed extrusion and injection molding operations. Powder grades, in turn, enable advanced consolidation techniques and custom molding processes that cater to complex part geometries. Equally important is the manufacturing route: bulk polymerization remains a workhorse for high-throughput production, although solution and suspension polymerization methods are gaining preference to achieve tighter molecular weight control and specialized polymer distributions.

Applications such as compression and injection molding continue to capture the bulk of demand, yet extrusion processes are increasingly adopted for continuous part fabrication, and precision machining delivers bespoke tolerances for mission-critical components. Finally, the array of end-use industries spans aerospace and defense programs that demand uncompromising reliability, automotive initiatives focused on weight reduction and efficiency, electrical and electronics markets requiring dielectric performance, medical fields prioritizing biocompatibility, and oil and gas operations where chemical resistance and durability are paramount. Collectively, these segmentation insights provide a nuanced understanding of market drivers and highlight opportunities for targeted innovation.

This comprehensive research report categorizes the Aromatic Ketone Polymers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Manufacturing Process

- Application

- End-Use Industry

Regional Dynamics and Growth Drivers Across Americas Europe Middle East Africa and Asia-Pacific Shaping the Global Aromatic Ketone Polymer Landscape

Regional dynamics in the aromatic ketone polymer market display marked contrasts in adoption rates, investment focus, and regulatory influences. In the Americas, established aerospace and automotive hubs have long anchored demand, with manufacturers in the United States and Canada seeking materials that balance performance and cost. Brazil’s growing industrial base is intensifying interest in high-performance polymers to support local manufacturing ecosystems, prompting strategic collaborations aimed at technology transfer and capacity development. Cross-border trade agreements and federal incentives continue to shape procurement strategies, reinforcing North America’s role as both major consumer and innovation center.

Europe, Middle East, and Africa present a diverse tapestry of market conditions. Western Europe remains at the forefront of polymer R&D, underpinned by stringent environmental regulations that accelerate the adoption of sustainable material solutions. In contrast, Middle Eastern economies capitalize on petrochemical feedstock availability to explore integrated production models, while African markets focus on infrastructure development and industrialization themes that increasingly demand high-performance materials. Regulatory harmonization across the European Union and targeted national policies further stimulate investment in domestic polymer manufacturing and recycling technologies.

Asia-Pacific exhibits the most rapid expansion as regional players in China, Japan, and South Korea ramp up capacity to meet burgeoning demand across automotive electrification, consumer electronics miniaturization, and renewable energy applications. India and Southeast Asia are emerging as alternative hubs, where government-backed initiatives and joint ventures are establishing polymer processing clusters. Moreover, digitalization and smart factory deployments are gaining traction in the region, elevating production efficiency and supporting quality consistency in high-specification polymer grades.

This comprehensive research report examines key regions that drive the evolution of the Aromatic Ketone Polymers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Positioning and Competitive Analysis of Leading Players Driving Innovation Partnerships and Market Penetration in the Aromatic Ketone Polymer Sector

A competitive landscape characterized by innovation, strategic partnerships, and capacity investments underscores the trajectories of leading players. Industry pioneers with integrated production capabilities have leveraged scale advantages to maintain cost leadership, while niche specialists focus on custom polymer grades to address differentiated performance requirements. Collaborations between material producers and equipment OEMs are accelerating the development of tailored solutions that optimize processing and end-use functionality, reflecting a trend toward closer alignment between polymer chemistry and application engineering.

Mergers and acquisitions have further reshaped market positioning, enabling companies to expand their geographic footprints and broaden product portfolios. Joint ventures targeting high-growth regions are unlocking localized expertise, and technology licensing agreements are disseminating advanced polymerization techniques across the value chain. Concurrently, research and development investments are being prioritized to advance sustainable feedstock alternatives, enhance polymer recyclability, and develop additive manufacturing formulations that push the boundaries of design freedom. Collectively, these strategic maneuvers define a dynamic competitive environment where innovation agility and global reach are critical determinants of success.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aromatic Ketone Polymers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AMERICHEM POLYMERS INDIA PRIVATE LIMITED

- Arkema S.A.

- DIC CORPORATION

- Drake Plastics Ltd. Co

- Ensinger GmbH

- Evonik Industries AG

- Fengchen Group Co.,Ltd

- Kalpsutra Chemicals Pvt. Ltd

- KR Chemicals Pvt Ltd

- KRATON CORPORATION.

- LyondellBasell Industries Holdings B.V.,

- Merck KGaA

- Quadrant Engineering Plastic Products AG

- RTP Company

- Saudi Basic Industries Corporation

- Shell plc

- Solvay S.A.

- SPECIALCHEM INDIA PRIVATE LIMITED

- Sumitomo Chemical Company, Ltd.

- Toray Industries, Inc.

- Univar Solutions Inc

- Victrex plc

Targeted Strategic Initiatives and Operational Excellence Measures to Strengthen Market Presence Enhance Innovation and Mitigate Risks in Aromatic Ketone Polymers

To navigate the evolving market landscape, industry leaders should consider targeted investments in capacity augmentation complemented by modernization of existing facilities. Upgrading plant infrastructure to enable continuous polymerization will enhance operational flexibility and reduce cost per unit. In parallel, pursuing strategic alliances with feedstock suppliers and tool OEMs can secure preferential access to advanced monomers and proprietary processing equipment, thereby fostering integrated value chain control.

Moreover, embedding sustainability criteria into R&D roadmaps will not only address regulatory imperatives but also create differentiation through recycled and bio-based polymer grades. Companies should pilot closed-loop recycling initiatives to validate performance retention and economic viability, setting the stage for broader circular economy adoption. Additionally, leveraging digital platforms for end-to-end supply chain visibility will mitigate disruption risks and enable real-time inventory optimization. Finally, advanced customer engagement models-such as technical service partnerships and co-development programs-will deepen relationships and accelerate application-specific innovation, driving long-term revenue growth and brand loyalty.

Rigorous Research Framework Integrating Primary Qualitative Expert Interviews Secondary Data Triangulation and Analytical Modeling to Ensure Robust Market Insights

The research methodology underpinning this analysis integrates both primary and secondary data sources to ensure comprehensive coverage and analytical rigor. Primary insights were obtained through structured interviews with key stakeholders across polymer producers, converters, equipment manufacturers, and end users, providing firsthand perspectives on market drivers, challenges, and emerging trends. In parallel, secondary research drew upon peer-reviewed publications, patent databases, industry whitepapers, and regulatory filings to triangulate quantitative and qualitative findings.

Advanced analytical frameworks, including scenario modeling and trend extrapolation, were applied to validate observations and identify potential inflection points. Data integrity was maintained through cross-verification of corroborative sources, while expert panel reviews facilitated iterative refinement of market interpretations. This multilayered approach ensures that the conclusions derived herein reflect both current realities and forward-looking implications, equipping stakeholders with actionable intelligence anchored in methodological transparency.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aromatic Ketone Polymers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aromatic Ketone Polymers Market, by Product Type

- Aromatic Ketone Polymers Market, by Form

- Aromatic Ketone Polymers Market, by Manufacturing Process

- Aromatic Ketone Polymers Market, by Application

- Aromatic Ketone Polymers Market, by End-Use Industry

- Aromatic Ketone Polymers Market, by Region

- Aromatic Ketone Polymers Market, by Group

- Aromatic Ketone Polymers Market, by Country

- United States Aromatic Ketone Polymers Market

- China Aromatic Ketone Polymers Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Conclusive Reflections on Key Findings Strategic Imperatives and Future Outlook Guiding Stakeholders Toward Sustainable Growth in the Aromatic Ketone Polymer Market

In summary, the aromatic ketone polymer market stands at an inflection point where performance imperatives intersect with strategic imperatives around sustainability and supply chain resilience. Key findings underscore the critical role of polyether ether ketone in established applications, the ascent of alternative chemistries for specialized needs, and the diverse adoption patterns across regional markets. Furthermore, tariff interventions and technology innovations are reshaping competitive dynamics, prompting stakeholders to recalibrate investments and operational strategies.

Looking ahead, companies that combine robust R&D trajectories with agile production models and sustainability commitments will be best positioned to capitalize on growth opportunities. By embracing integrated partnerships, leveraging digitalization, and optimizing material selection, stakeholders can deliver differentiated solutions that address the evolving demands of aerospace, automotive, electronics, medical, and energy sectors. Ultimately, a proactive stance grounded in market intelligence will be essential for driving sustainable value creation and maintaining leadership in this high-performance polymer arena.

Connect Directly with Ketan Rohom Associate Director Sales and Marketing to Secure the Complete Aromatic Ketone Polymer Market Report and Drive Informed Strategic Decisions

To explore the comprehensive findings and nuanced insights within this market research report, engage directly with Ketan Rohom Associate Director Sales and Marketing. Ketan Rohom can guide you through tailored service offerings, clarify analytical methodologies, and demonstrate how the data can be applied to your organization’s strategic roadmap. By partnering with him, you will gain privileged access to proprietary analysis, scenario planning tools, and exclusive executive briefings that will empower your team to capitalize on emerging opportunities in the aromatic ketone polymer market. Reach out today to secure your copy of the report and embark on a journey toward data-driven decision making that drives growth and competitive advantage.

- How big is the Aromatic Ketone Polymers Market?

- What is the Aromatic Ketone Polymers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?