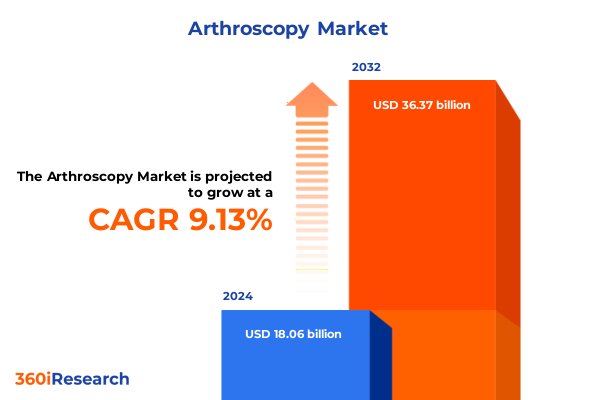

The Arthroscopy Market size was estimated at USD 6.65 billion in 2025 and expected to reach USD 6.98 billion in 2026, at a CAGR of 5.14% to reach USD 9.45 billion by 2032.

Emerging Dynamics and Strategic Imperatives Shaping the Global Arthroscopy Landscape Amid Accelerating Demand and Medical Innovation

Arthroscopy has emerged as a cornerstone of minimally invasive orthopedic practice, revolutionizing the way joint disorders are diagnosed and treated. By leveraging small incisions, high-definition imaging, and specialized instruments, surgeons have been able to offer patients reduced pain, shorter hospitalization, and faster return to function. These procedural advantages have accelerated adoption worldwide, reflecting a convergence of patient preferences, healthcare system efficiencies, and technological breakthroughs.

Underpinning these advancements is a demographic imperative: the global population is aging at an unprecedented rate, leading to a rising incidence of degenerative joint conditions. Patients and providers alike are seeking less invasive alternatives to traditional open surgeries, a trend that has driven investment in arthroscopic tools and training. In tandem, the prevalence of sports-related injuries among active populations has surged, further bolstering demand for diagnostic and therapeutic arthroscopy procedures. Collectively, these factors underscore the critical role of arthroscopy in meeting evolving clinical needs and improving patient outcomes.

Revolutionizing Arthroscopy with Nano-Scale Visualization, Robotics, and Decentralized Surgical Care Models Driving the Future of Minimally Invasive Joint Treatment

Technological innovation has redefined the arthroscopy landscape, enabling more precise interventions and expanding the scope of treatable conditions. The integration of nano-arthroscopy, characterized by needle-sized cameras for in-office assessments, has bridged the gap between diagnostic imaging and therapeutic intervention, offering unprecedented clarity and convenience for patients and clinicians alike. Meanwhile, 4K visualization platforms and wireless scope systems have enhanced surgical ergonomics and procedural efficiency, empowering specialists to navigate complex anatomy with remarkable accuracy.

The rise of robotic-assisted arthroscopy and AI-enabled navigation systems represents another paradigm shift, marrying human expertise with algorithm-driven precision. These platforms facilitate real-time decision support, minimize tissue trauma, and standardize workflows, thereby elevating clinical consistency and reducing revision rates. Concurrently, ambulatory surgical centers have become pivotal access points for arthroscopic care, driven by cost-containment strategies and patient preference for outpatient settings. As a result, the delivery model for arthroscopy is evolving toward decentralized, patient-centric environments that emphasize speed, safety, and satisfaction.

Navigating the Impact of Renewed Section 301 Tariffs on Orthopedic Instruments and Material Costs in Arthroscopic Supply Chains

Trade policy shifts have added a new layer of complexity to global arthroscopy supply chains. The U.S. Trade Representative’s reinstatement of Section 301 tariffs targets Class I and II medical devices, including a wide array of orthopedic instruments pivotal to arthroscopic procedures. These duties, set to take effect in early 2025, could impose additional levies of up to 25 percent on items such as shavers, radiofrequency probes, and fluid management components sourced from key manufacturing hubs in China. Beyond base rates, contingency measures could amplify cost pressures for devices reliant on intricate assemblies and regulated pathways for regulatory approval.

Moreover, broader tariff actions announced in late 2024 have seen rates on medical gloves rising to 50 percent, and duties on syringes and needles reaching 100 percent in specified categories by January 1, 2026. While not all materials align directly with arthroscopy applications, these escalations signal intensifying scrutiny on medical imports and underscore the need for strategic sourcing resilience. Industry leaders and trade associations have called for tariff exemptions and streamlined exclusion processes to safeguard patient access and mitigate undue cost transference to healthcare providers.

Unveiling Critical Insights Across Product, Patient, Application, and End User Segments to Guide Strategic Decisions in Arthroscopy

A nuanced segmentation framework informs the strategic outlook for arthroscopy stakeholders across multiple dimensions. When examining the product type landscape, implants remain at the core of reconstructive joint interventions, offering durability and biocompatibility, while instruments ranging from accessories and arthroscopes to pumps, radiofrequency probes, and shavers supply procedural versatility, and integrated systems-spanning fluid management, RF platforms, and advanced visualization-enable cohesive operating room workflows. Complementing this perspective is a patient type segmentation that distinguishes adult and pediatric cohorts, each presenting unique anatomical considerations and rehabilitation trajectories. The application segment highlights targeted interventions in ankle, elbow, hip, knee, shoulder, and wrist pathology, reflecting diverse clinical demands across orthopedic sub-specialties. Finally, end users divided between ambulatory surgery centers and hospitals & clinics reveal differentiated adoption pathways, reimbursement environments, and procedural volumes.

This comprehensive research report categorizes the Arthroscopy market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Patient Type

- Application

- End User

Decoding Regional Growth Patterns and Healthcare Ecosystem Nuances Across the Americas, EMEA, and Asia-Pacific Arthroscopy Markets

Regional dynamics shape the global arthroscopy narrative, with the Americas leveraging mature payor models and robust ambulatory care infrastructure to accelerate procedural throughput. In the United States, registries capturing millions of hip and knee joint replacements underscore a sustained shift toward less invasive modalities, and ASC utilization has grown by over 70 percent in recent years, highlighting efficiency imperatives in a value-based care landscape. Across Europe, Middle East & Africa, harmonized regulatory frameworks and public-private partnerships are fostering standardized training programs and cross-border collaboration, though variable reimbursement policies necessitate tailored market entry tactics and localized engagement strategies.

In the Asia-Pacific region, strategic healthcare investments and infrastructure expansion have positioned it as the fastest-growing regional market. Providers are rapidly adopting ambulatory surgical centers to meet surging demand for minimally invasive joint care, particularly in markets like China, Japan, and India, where enhanced government funding for orthopedic facilities and rising sports injury rates converge to drive procedure volumes.

This comprehensive research report examines key regions that drive the evolution of the Arthroscopy market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing How Market Leaders Are Driving Innovation, Portfolio Expansion, and Supply Chain Resilience in Arthroscopy

Leading medical technology firms are intensifying efforts to consolidate market positions and pioneer next-generation arthroscopy solutions. Arthrex has championed the miniaturization trend, launching patient-focused platforms to educate on nano-arthroscopy and expand office-based service offerings. Stryker continues to enhance its portfolio through targeted R&D in fluid management and integrated visualization, underscoring a commitment to end-to-end procedural ecosystems. Smith & Nephew’s recent product cadence-spanning advanced shoulder systems and AI-driven resection devices-demonstrates an accelerating cadence of launches, with over 60 percent of revenue growth in 2024 attributed to innovations introduced within the last five years. Meanwhile, Zimmer Biomet has signaled potential profit impacts of up to USD 80 million in 2025 due to tariff headwinds, prompting strategic supply chain diversification and reshoring evaluations to safeguard margins and maintain clinical access.

This comprehensive research report delivers an in-depth overview of the principal market players in the Arthroscopy market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arthrex Inc.

- Auxein Medical

- B. Braun Melsungen AG

- Baxter International Inc.

- Bioventus, LLC

- Boston Scientific Corporation

- CONMED Corporation

- Endoch Medical

- Endomed Systems GmbH

- Flexion Therapeutics Inc.

- GPC Medical Ltd.

- Hyalex Orthopaedics, Inc.

- Johnson & Johnson Services Inc.

- Karl Storz SE & Co. KG

- M J Surgical

- Medtronic plc

- Mercator Medical S.A.

- Norm Medical

- Olympus Corporation

- Richard Wolf GmbH

- Shagun Cares Inc.

- Sklar Surgical Instruments

- Smith & Nephew plc

- Stryker Corporation

- Visakha Healthcare India Pvt Ltd

- Zimmer Biomet Holdings, Inc.

Actionable Strategies for Stakeholder Alignment Across Sourcing, Technology Integration, and Policy Advocacy to Future-Proof Arthroscopy Operations

To thrive amid evolving clinical, technological, and regulatory landscapes, industry leaders should adopt a multifaceted strategic playbook. First, diversifying supplier networks and nearshoring key manufacturing processes can mitigate tariff exposure and reinforce delivery timelines. Second, investing in modular, interoperable systems that integrate fluid management, RF technology, and 4K visualization will differentiate service lines and enhance surgeon loyalty. Third, expanding ambulatory surgery center partnerships and training programs can capture the shift toward outpatient settings, maximize asset utilization, and streamline care pathways. Fourth, forging alliances with robotics and AI innovators will accelerate adoption curves for advanced navigation platforms, reducing operative variability and improving patient outcomes. Finally, active engagement with trade bodies and policy makers to pursue targeted tariff exemptions or expedited exclusion processes will help preserve affordability and ensure continuity of care.

Comprehensive Multi-Source Methodology Incorporating Clinical, Supply Chain, and Regulatory Perspectives to Authenticate Arthroscopy Market Insights

This study employed a rigorous, multi-tiered research methodology to ensure the integrity and relevance of insights. Secondary research encompassed regulatory filings, peer-reviewed clinical publications, industry press releases, and government trade notices to map policy shifts and technological benchmarks. Primary research involved structured interviews with orthopedic surgeons, procurement leaders, ASC administrators, and regulatory experts to validate supply chain challenges and adoption drivers. Quantitative data points were triangulated against publicly available procedural registries and health system utilization reports to corroborate modality trends across regions. Finally, findings underwent peer review by a cross-functional panel of medtech analysts, ensuring consistency, accuracy, and comprehensive perspective on segmentation frameworks and market dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Arthroscopy market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Arthroscopy Market, by Product Type

- Arthroscopy Market, by Patient Type

- Arthroscopy Market, by Application

- Arthroscopy Market, by End User

- Arthroscopy Market, by Region

- Arthroscopy Market, by Group

- Arthroscopy Market, by Country

- United States Arthroscopy Market

- China Arthroscopy Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesizing Technological, Policy, and Market Dynamics to Illuminate the Path Forward for Arthroscopy Innovation and Care Delivery

Arthroscopy stands at the confluence of demographic drivers, technological breakthroughs, and policy catalysts, positioning it as a critical pillar of minimally invasive orthopedic care. Advances in nano-scale visualization, robotics, and integrated systems are expanding therapeutic possibilities, while ambulatory care models are reshaping service delivery paradigms. Concurrently, renewed tariff measures underscore the imperative for resilient sourcing strategies and proactive policy engagement. As leading companies accelerate product innovation and pursue strategic partnerships, the market’s trajectory will hinge on the ability to harmonize cost management, clinical efficacy, and regulatory compliance.

Looking ahead, decision-makers who leverage nuanced segmentation insights, regional intelligence, and company best practices will be best equipped to navigate emerging opportunities and risks. Prioritizing interoperability, supply chain agility, and collaborative policy advocacy will be essential to sustaining momentum and delivering superior patient outcomes in the evolving arthroscopy ecosystem.

Seize Exclusive Arthroscopy Market Intelligence by Connecting with Our Associate Director for a Tailored Research Experience

Don’t miss the opportunity to gain a comprehensive understanding of the arthroscopy market and stay ahead in a rapidly evolving industry. Connect with Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the complete market research report and unlock the strategic insights you need to drive growth, innovation, and resilience throughout your organization.

- How big is the Arthroscopy Market?

- What is the Arthroscopy Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?