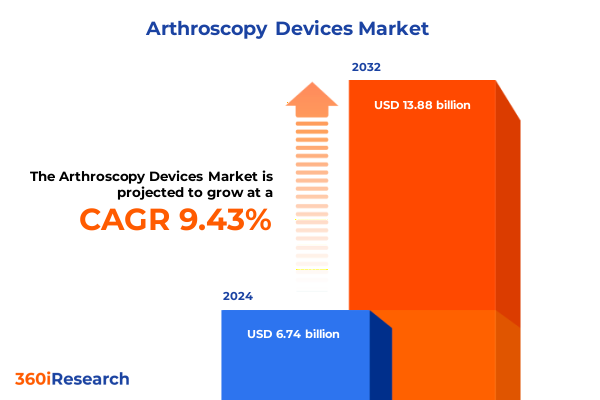

The Arthroscopy Devices Market size was estimated at USD 7.30 billion in 2025 and expected to reach USD 7.91 billion in 2026, at a CAGR of 9.60% to reach USD 13.88 billion by 2032.

Unveiling the Rising Importance of Arthroscopy Devices as Minimally Invasive Procedures Revolutionize Joint Care and Surgeons’ Treatment Paradigms

The field of arthroscopic surgery has undergone profound transformation as minimally invasive procedures have become the standard for diagnosing and treating joint ailments. With nearly one in five U.S. adults living with diagnosed arthritis, the demand for precise, low-impact surgical interventions continues to rise. Recent data indicate that in excess of 3.19 million arthroscopy procedures were performed in the United States in 2022, underscoring the critical role these devices play in orthopedic care.

Concurrently, technological advancements are redefining what surgeons can achieve in the operating room. Integration of augmented reality, machine learning, and artificial intelligence tools is empowering clinicians with real-time guidance, enhancing diagnostic accuracy, and optimizing decision-making during complex arthroscopic interventions. As the landscape evolves, stakeholders must understand both the clinical imperatives and the underlying forces driving the adoption of next-generation arthroscopy platforms.

Defining the Major Technological and Clinical Breakthroughs Reshaping Arthroscopy Device Usage Across Surgical Practices Worldwide

Clinical practice is shifting rapidly toward disposable and single-use arthroscopy instruments that streamline workflows and mitigate infection risks. Enhanced regulatory focus on patient safety has accelerated the development and adoption of high-quality disposable arthroscopes and associated instrumentation. This paradigm shift not only simplifies sterilization protocols but also supports the migration of procedures into outpatient and ambulatory surgical center settings where operational efficiency and patient throughput are paramount.

At the same time, the emergence of wireless, portable visualization systems and the integration of robotic-assisted platforms are elevating the precision and accessibility of arthroscopic surgery. Wireless camera technologies eliminate cumbersome cabling, reducing setup times and enhancing intraoperative mobility. Moreover, robotic assistance and augmented reality overlays are providing unprecedented dexterity and real-time anatomical visualization, reshaping the surgeon’s capabilities and broadening the scope of procedures that can be performed minimally invasively.

Assessing the Comprehensive Impact of the U.S. 2025 Tariff Measures on Arthroscopy Device Supply Chains and Industry Cost Structures

In April 2025, the U.S. government implemented a sweeping tariff framework that introduced a universal 10% duty on all medical device imports, reciprocal measures of 20% on EU products, 24% on Japanese exports, a punitive 54% on Chinese goods, and 25% on imports from Canada and Mexico, with no carve-out for surgical instruments and equipment. This unprecedented scope of duties has disrupted established supply chains, compelled many manufacturers to reconsider sourcing strategies, and placed upward pressure on costs throughout the arthroscopy ecosystem.

Moreover, the reinstatement of Section 301 tariffs on select medical consumables-including rubber gloves at a 50% levy beginning January 1, 2025, and disposable facemasks at 25%-exacerbates cost inflation for operating rooms and may erode hospital budgets over time. Early indicators suggest that healthcare providers could face price hikes of 15% or more for imported arthroscopic components if these duties persist, underscoring the imperative for industry participants to reevaluate production footprints and inventory planning.

Unlocking Precision Market Intelligence Through Detailed Arthroscopy Device Segmentation Spanning Product Types, Visualization, Applications, End Users, and Sales Channels

The market for graspers, punches, retractors, scissors, and shavers has seen a surge in demand for multifunctional platforms that accommodate single-use protocols while maintaining the surgical performance of reusable instruments. Manufacturers are prioritizing ergonomic refinements and modular designs to address diverse procedural requirements, enabling surgeons to transition seamlessly across various interventions without compromising precision or safety.

Parallel innovation in visualization systems-spanning cameras, light sources, monitors, and scopes-has led to enhanced image resolution, improved tissue differentiation, and seamless integration with digital operating platforms. Artificial intelligence is playing an increasingly prominent role, automating image recognition, highlighting anatomical landmarks, and offering intraoperative decision support to minimize the risk of human error during delicate joint procedures.

Different anatomical applications are advancing at variable paces: knee arthroscopy remains the most extensive segment due to the high incidence of osteoarthritis and sports-related injuries, while hip, shoulder, and wrist interventions are emerging as fast-growing niches driven by procedural refinements and expanding surgeon expertise. The growing utilization of ambulatory surgical centers and dedicated orthopedic clinics has heightened the demand for compact, user-friendly platforms, prompting a reorientation of end-user strategies toward tighter integration of direct sales models alongside distributor partnerships. Simultaneously, online sales channels have gained traction, enabling manufacturers to streamline procurement processes, reduce lead times, and deliver enhanced service levels to customers across diverse care settings.

This comprehensive research report categorizes the Arthroscopy Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Visualization Systems

- Application

- End User

- Sales Channel

Geospatial Perspectives on Arthroscopy Devices Highlighting Differing Adoption Patterns, Infrastructure Strengths, and Growth Drivers Across Key Global Regions

The Americas region, led by the United States and Canada, commands leadership in arthroscopy device adoption, buoyed by robust healthcare investment, favorable reimbursement structures, and a mature network of ambulatory and outpatient surgical facilities. High procedural volumes and a strong emphasis on R&D continue to reinforce North America’s dominant position, as evidenced by widespread deployment of advanced platforms and a growing pipeline of next-generation devices.

In Europe, a rapidly aging population-projected to include nearly 130 million individuals aged 65 and older by 2050-has intensified the need for minimally invasive joint care and spurred significant demand for knee and shoulder arthroscopy. Concurrently, high sports participation rates and evolving regulatory frameworks have fostered technological inspections and clinical trials, enabling regional manufacturers to introduce absorbable polymer implants and image-guided navigation systems with strong uptake in key Western European markets.

Asia-Pacific is emerging as the fastest-growing market, driven by escalating incidences of musculoskeletal disorders, increased healthcare infrastructure investment, and rising geriatric populations. Market participants are capitalizing on the shift toward minimally invasive surgery by introducing low-cost, high-quality arthroscopy instruments and leveraging telehealth and remote training initiatives to expand penetration into tier 2 and 3 cities across China, India, and Southeast Asia.

This comprehensive research report examines key regions that drive the evolution of the Arthroscopy Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Innovations and Competitive Positioning of Leading Arthroscopy Device Manufacturers Driving the Industry Forward Through Breakthrough Developments

Leading market participants have consistently introduced breakthrough offerings to reinforce their competitive positioning. In March 2025, Smith + Nephew launched its Werewolf Fastseal 6.0 Hemostasis Wand, a device engineered to streamline soft tissue management and bleeding control during shoulder and knee arthroscopies. Earlier in January 2025, Arthrex introduced the NanoNeedle Scope System, a needle-sized diagnostic platform enabling in-office joint assessments and reducing reliance on traditional operating room workflows.

In late 2024, Stryker showcased its advanced 1688 AIM 4K Platform with SPY fluorescence imaging, enhancing intraoperative visualization and real-time perfusion mapping during joint surgeries. CONMED solidified its leadership with the September 2024 release of the Argo Knotless Suture Anchor System, which improves soft tissue fixation and streamlines operative workflows in shoulder and knee repair procedures. These strategic product introductions underscore the intensity of R&D activity and the race to deliver differentiated solutions that address both clinical needs and economic pressures.

This comprehensive research report delivers an in-depth overview of the principal market players in the Arthroscopy Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arthrex, Inc.

- B. Braun Melsungen AG

- Bioventus LLC

- Cannuflow, Inc.

- CONMED Corporation

- DJO Global, Inc.

- EndoMed Systems GmbH

- GPC Medical Ltd.

- Henke Sass Wolf GmbH

- Henke‑Sass, Wolf GmbH

- Hoya Corporation

- Johnson & Johnson

- JOIMAX GmbH

- Karl Storz SE & Co. KG

- MEDICON eG

- Medicon Health Care Private Limited

- MedShape, Inc.

- Richard Wolf GmbH

- Richard Wolf GmbH

- Shenzhen Mindray Bio‑Medical Electronics Co., Ltd.

- Sklar Surgical Instruments

- Smith & Nephew plc

- Stryker Corporation

- Wright Medical Group N.V.

- Zimmer Biomet Holdings, Inc.

Actionable Strategic Imperatives for Arthroscopy Device Industry Leaders to Navigate Market Disruptions, Harness Technological Advances, and Optimize Supply Chains

To mitigate the repercussions of escalating tariffs and supply chain disruptions, industry leaders should accelerate investments in nearshore manufacturing and forge partnerships with domestic suppliers, replicating the successful strategies of firms that have diversified production into Mexico and Central America. In parallel, adopting hybrid sales models that integrate field and remote engagement will be essential to meet evolving customer preferences and reduce the total cost to serve, as demonstrated by leading medtech organizations that have harnessed digital and remote-sales capabilities to unlock new growth avenues.

Furthermore, organizations must expand their single-use platforms and streamline distribution through online channels to enhance product availability and responsiveness in ambulatory and outpatient settings. Embracing data-driven decision support, leveraging artificial intelligence for demand forecasting, and implementing advanced inventory-management systems will help companies preserve margin and maintain service levels in volatile trading environments. By prioritizing supply chain resilience, technology integration, and omnichannel engagement, stakeholders can secure sustainable growth and maintain operational agility.

Comprehensive Research Methodology Combining Rigorous Primary Engagement, In-Depth Secondary Analysis, and Structured Data Triangulation for Robust Market Insights

This analysis draws upon a structured research framework combining extensive primary and secondary data collection. Primary insights were gathered through in-depth interviews with leading orthopedic surgeons, supply chain executives, and healthcare procurement specialists, ensuring firsthand perspectives on clinical requirements and market dynamics.

Secondary research encompassed rigorous review of peer-reviewed journals, regulatory filings, trade association publications, and industry white papers. Data triangulation techniques were applied to reconcile divergent sources, while continuous expert validation sessions guaranteed the accuracy and relevance of findings. Collectively, these methodologies underpin a robust, transparent approach to delivering actionable market intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Arthroscopy Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Arthroscopy Devices Market, by Product Type

- Arthroscopy Devices Market, by Visualization Systems

- Arthroscopy Devices Market, by Application

- Arthroscopy Devices Market, by End User

- Arthroscopy Devices Market, by Sales Channel

- Arthroscopy Devices Market, by Region

- Arthroscopy Devices Market, by Group

- Arthroscopy Devices Market, by Country

- United States Arthroscopy Devices Market

- China Arthroscopy Devices Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Insights on Arthroscopy Devices to Emphasize Market Opportunities, Operational Resilience, and Future Directions for Sustainable Industry Advancement

The convergence of advanced digital imaging, robotic assistance, and single-use instrumentation is redefining best practices in arthroscopy, setting new benchmarks for precision, safety, and efficiency. Simultaneously, geopolitical factors such as the 2025 U.S. tariff revisions have prompted a reexamination of global supply chain strategies, compelling manufacturers to seek greater regional self-reliance and operational resilience.

Against this backdrop, a nuanced understanding of device segmentation, end-user preferences, and regional market dynamics is essential for stakeholders aiming to capitalize on expansion opportunities. As the landscape continues to evolve, organizations that proactively embrace technological differentiation, hybrid go-to-market models, and supply chain diversification will be best positioned to deliver superior clinical outcomes and sustained competitive advantage.

Secure your competitive edge today by engaging with Ketan Rohom for exclusive access to the definitive arthroscopy device market research report

For tailored guidance on leveraging the latest insights in the global arthroscopy devices market, engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to secure exclusive access to the comprehensive market research report available for purchase. Reach out today to ensure your organization remains at the forefront of industry developments and capitalizes on critical opportunities for growth and innovation.

- How big is the Arthroscopy Devices Market?

- What is the Arthroscopy Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?