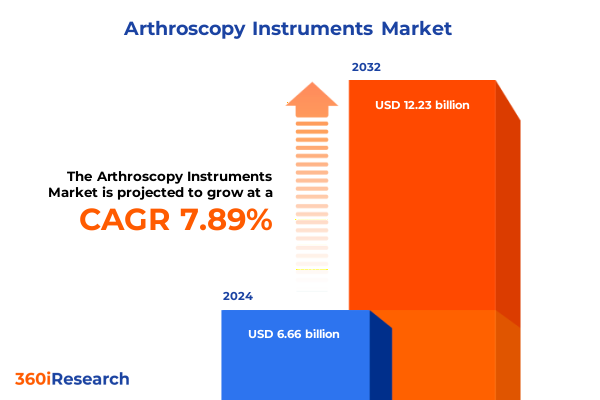

The Arthroscopy Instruments Market size was estimated at USD 7.17 billion in 2025 and expected to reach USD 7.74 billion in 2026, at a CAGR of 7.91% to reach USD 12.23 billion by 2032.

Exploring Fundamental Trends and Market Drivers Shaping the Adoption of Innovative Arthroscopy Instruments in Minimally Invasive Joint Procedures Worldwide

According to a study published in Lancet Rheumatology, the global prevalence of osteoarthritis surged by over 132% between 1990 and 2020, and nearly one billion individuals are projected to be affected by 2050 due to demographic shifts and rising obesity rates. In the United States, the Centers for Disease Control and Prevention reported that more than 53 million adults, or 21.2% of the population, had a diagnosis of arthritis during 2019–2021, with individuals aged 65 and older representing nearly 88.3% of all cases, highlighting the critical need for effective management of joint conditions.

In recent years, the incidence of sports-related orthopaedic injuries has risen significantly, particularly among aging yet active populations. Epidemiological data indicate that sports-related injuries in U.S. adults aged 65 and older increased from 78 per 100,000 individuals in 2012 to 91 per 100,000 in 2021, with projections suggesting a continued upward trajectory through 2040. This confluence of chronic degenerative conditions and acute trauma has driven widespread adoption of minimally invasive arthroscopic techniques, positioning arthroscopy instruments as essential components of modern joint surgery.

Unveiling the Next Generation of Arthroscopy: Digital Integration, Robotic Assistance, and Augmented Reality Transform Surgical Precision

Technological innovation is redefining the capabilities of arthroscopy systems, moving beyond traditional optics to integrated digital platforms. Recent advances in high-definition imaging have enabled 4K visualization across surgical towers, offering surgeons unprecedented clarity when navigating complex joint anatomy. This level of detail is further enhanced by programmable camera head controls and wireless connectivity, minimizing workflow disruptions and allowing real-time data integration into electronic medical records for post-procedural analysis. These visualization breakthroughs not only improve diagnostic precision but also enhance surgeon confidence in tissue assessment and repair.

Automation and robotic assistance are also gaining momentum in arthroscopic surgery, with autonomous systems demonstrating the ability to perform targeted procedures such as meniscoplasty with minimal human intervention. Researchers at UCSD and other institutions have developed robotic platforms for joint repairs that leverage motion‐capture teleoperation and force‐feedback control to supplement surgeon dexterity and endurance. Simultaneously, augmented reality integration is being explored to reconstruct intra-articular structures in 3D, providing real-time guidance overlays that facilitate accurate instrument placement and articular notch measurement. These converging trends are setting the stage for a new era of personalized, precision arthroscopy.

Analyzing the Far-Reaching Effects of Recent United States Trade Tariffs on the Cost Structures and Supply Chains of Arthroscopy Instruments

United States trade policies enacted in early 2025 imposed tariffs ranging from 10% to 54% on stainless steel imports and finished medical instruments, directly affecting arthroscopy instrument component costs. Many arthroscopy devices, including trocars, shaver blades, and camera components, rely on high-grade stainless steel and precision electronics sourced from Europe, Asia, and other regions now subject to increased duties. This escalation in input costs has narrowed manufacturer margins and introduced pricing pressures across the surgical instrument supply chain.

The tariff environment has prompted leading companies to reconfigure their supply networks through nearshoring initiatives and tariff exemption requests. Firms with manufacturing facilities in Mexico and other trade-partner countries have been able to partially mitigate cost increases by leveraging favorable trade agreements and shorter logistics routes. Nevertheless, smaller manufacturers and startups dependent on imported raw materials have faced significant challenges securing price-stable supply, leading to extended lead times and project delays. The cumulative effect underscores the importance of agile sourcing strategies and diversified production footprints in maintaining market resilience amid policy shifts.

Delineating Key Market Segmentation Pillars and Their Implications for Arthroscopy Instrument Development, Technology Adoption, and Distribution Strategies

A thorough examination of market segmentation reveals distinct demand drivers and adoption patterns across product categories, such as endoscopy cameras, fluid management platforms, hand instruments, power shaver systems, radiofrequency ablation devices, and trocar and cannula assemblies. Each primary product group encompasses specialized subsegments-ranging from automatic and manual fluid management systems to disposable and reusable shaver blades-catering to specific procedural requirements and surgeon preferences. These nuanced distinctions influence purchasing decisions and innovation priorities among OEMs seeking to address performance, sterilization, and cost objectives.

Technology segmentation further differentiates the market into disposable, manual, and powered instrument classes, with manual solutions subdivided into ergonomic and standard configurations and powered instruments available in electric or pneumatic variants. This tiered approach to tool classification underscores the importance of ergonomics and power options for improving procedural efficiency and user comfort. In parallel, end users such as ambulatory surgery centers, clinics, hospitals, and orthopedic specialty centers exhibit distinct procurement strategies and utilization rates, reflecting facility type, procedure volume, and resource allocation priorities. App-specific segmentation for ankle, elbow, hip, knee, and shoulder arthroscopy highlights the prevalence of knee ligament reconstruction and meniscal repair, as well as shoulder capsular release and rotator cuff repair procedures. Distribution channels-both offline and online-play complementary roles in reaching diverse customer segments and optimizing inventory management across global markets.

This comprehensive research report categorizes the Arthroscopy Instruments market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- End User

- Application

- Distribution Channel

Comparing Regional Dynamics in the Arthroscopy Instruments Market Across the Americas, Europe Middle East Africa, and Asia Pacific Health Care Landscapes

In the Americas region, robust healthcare infrastructure, high per capita healthcare expenditure, and a large patient pool with osteoarthritis and sports injuries drive the widespread adoption of advanced arthroscopy instruments. North America leads deployment of 4K visualization systems and robotic-assisted platforms, supported by substantial R&D investment and reimbursement frameworks conducive to minimally invasive procedures. Latin American markets, while more price-sensitive, are experiencing growing demand for single-use cannula systems and portable fluid management devices as outpatient surgery centers expand their procedural offerings.

Europe, the Middle East, and Africa face mounting cost-containment pressures within national health systems, prompting a focus on sustainable instrument design and comprehensive reprocessing programs. The NHS in the United Kingdom is targeting a significant increase in robot-assisted keyhole surgeries, with ambitions to perform half a million such operations by 2035, reflecting strategic investments in robotic infrastructure and surgeon training. In the Asia-Pacific, improving healthcare access, rising medical tourism, and supportive government policies are fueling rapid uptake of arthroscopic towers and endoscopic imaging solutions, with regions such as China and India emerging as high-growth markets due to expanding hospital networks and growing orthopedic procedure volumes.

This comprehensive research report examines key regions that drive the evolution of the Arthroscopy Instruments market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders in Arthroscopy Instrumentation: Strategic Moves, Partnerships, and Innovation Narratives Driving Market Competitiveness

Market leaders are strategically aligning their portfolios through technology innovation, supply chain optimization, and targeted acquisitions. Arthrex has prioritized nearshoring by expanding manufacturing capabilities in Mexico and leveraging free trade zones to minimize tariff exposure and logistics costs. Smith & Nephew’s launch of the LENS 4K Surgical Imaging System underscores its commitment to visualization excellence, integrating an autoclavable camera head and embedded light source with an intuitive workflow control app to streamline arthroscopic procedures.

Stryker’s acquisition of OrthoSensor has strengthened its digital ecosystem by incorporating intraoperative sensor technology and remote patient monitoring wearables, enhancing feedback-driven workflows and positioning its Mako SmartRobotics platform as a data-rich solution for joint balancing. Meanwhile, CONMED’s comprehensive portfolio-including powered resection instruments, fluid management systems, trocars, and electrosurgical devices-benefits from integrated research and development efforts and strategic alliances that support continuous product improvement and customer education.

This comprehensive research report delivers an in-depth overview of the principal market players in the Arthroscopy Instruments market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arthrex, Inc.

- B. Braun Melsungen AG

- BorgWarner Inc.

- CONMED Corporation

- Delphi Automotive

- Denso Corporation

- EndoMed Systems GmbH

- Hella GmbH & Co. KGaA

- Henke Sass Wolf GmbH

- Hitachi Automotive Systems

- Johnson & Johnson

- JOIMAX GmbH

- Karl Storz SE & Co. KG

- Lear Corporation

- Mando Corporation

- MEDICON eG

- NXP Semiconductors N.V.

- Panasonic Corporation

- Renesas Electronics Corporation

- Richard Wolf GmbH

- Smith & Nephew plc

- Stryker Corporation

- Texas Instruments Incorporated

- Toshiba Corporation

- Zimmer Biomet Holdings, Inc.

Actionable Strategic Recommendations for Health Care Executives to Navigate the Evolving Arthroscopy Instruments Market and Strengthen Competitive Positioning

To thrive amidst evolving market dynamics, industry executives should prioritize supply chain diversification by establishing production or assembly facilities in tariff-friendly jurisdictions and developing strategic partnerships with regional manufacturers. Investing in digital platforms that integrate imaging, fluid management, and workflow control can deliver differentiated value propositions and enhance procedural efficiency. Additionally, commercial teams must cultivate strong relationships with ambulatory surgery centers and specialty clinics by offering tailored product bundles, service agreements, and training programs that address unique procedural workflows.

A robust R&D roadmap should incorporate emerging technologies such as AI-driven visualization, haptic feedback enhancements, and modular robotic attachments to support a broad range of joint procedures. Companies can foster innovation through collaborations with academic robotics centers and participation in competitive challenges, ensuring access to cutting-edge research and early validation opportunities. Finally, proactive engagement with reimbursement stakeholders and health system procurement committees is essential to secure favorable payment pathways and support adoption of higher-value instrument solutions.

Comprehensive Research Methodology Overview: Integrating Secondary Analysis, Expert Consultations, and Data Triangulation to Deliver High-Fidelity Market Insights

This research integrates a dual-phase methodology combining comprehensive secondary data analysis and primary stakeholder engagement. Secondary research leveraged leading scientific journals, government publications, and industry reports to establish baseline prevalence and procedure trends. Subsequent primary research entailed interviews with orthopedic surgeons, hospital procurement officers, and device manufacturers to capture current purchasing criteria, unmet clinical needs, and emerging technology adoption rates.

Data triangulation was achieved by cross-validating interview insights with real-world trade data, regulatory filings, and company financial disclosures. Key segmentation parameters were defined through iterative workshops with subject-matter experts, ensuring alignment with clinical practice variations and facility capabilities. Regional and tariff impact assessments were informed by customs databases and policy documents, while methodological rigor was maintained through peer review and validation sessions with advisory board members.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Arthroscopy Instruments market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Arthroscopy Instruments Market, by Product Type

- Arthroscopy Instruments Market, by Technology

- Arthroscopy Instruments Market, by End User

- Arthroscopy Instruments Market, by Application

- Arthroscopy Instruments Market, by Distribution Channel

- Arthroscopy Instruments Market, by Region

- Arthroscopy Instruments Market, by Group

- Arthroscopy Instruments Market, by Country

- United States Arthroscopy Instruments Market

- China Arthroscopy Instruments Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Synthesizing Critical Insights and Forward-Looking Perspectives on Arthroscopy Instruments to Inform Strategic Decision Making and Future Research

The convergence of an aging population, rising sports injury incidence, and technological innovation is reshaping the arthroscopy instruments market into a dynamic landscape of personalized, minimally invasive solutions. Digital visualization, automation, and integrated workflow platforms are redefining surgical standards, while evolving trade policies underscore the need for agile supply chains and strategic manufacturing footprints. Distinct segmentation structures highlight diversified value pools and adoption pathways across product types, technologies, and facility settings.

Regional analysis reveals disparate growth drivers-from advanced infrastructure and reimbursement frameworks in North America to cost-containment initiatives in EMEA and emerging healthcare access in Asia-Pacific. Key players are differentiating through targeted acquisitions, nearshoring, and digital ecosystem expansion, signaling ongoing industry consolidation and innovation acceleration. Collectively, these insights underscore the imperative for proactive strategic alignment, technology investment, and stakeholder collaboration to capitalize on the next wave of arthroscopic procedure advancements.

Engage with Ketan Rohom to Access the Full Arthroscopy Instruments Market Report and Elevate Your Strategic Planning with In-Depth Analysis and Market Intelligence

If you are ready to gain a competitive edge with unparalleled insights into the arthroscopy instruments market, connect with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, who will guide you through the comprehensive report’s data-driven analysis and bespoke strategic recommendations. With direct access to detailed segmentation analyses, regional breakdowns, and company profiles, this executive summary is only the beginning. Secure your copy to unlock the full depth of research, including actionable intelligence on tariffs, emerging technologies, and competitive strategies tailored to your needs. Elevate your decision making today by reaching out to Ketan Rohom - take the next step toward informed market leadership and sustained growth in the evolving landscape of arthroscopy instruments

- How big is the Arthroscopy Instruments Market?

- What is the Arthroscopy Instruments Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?