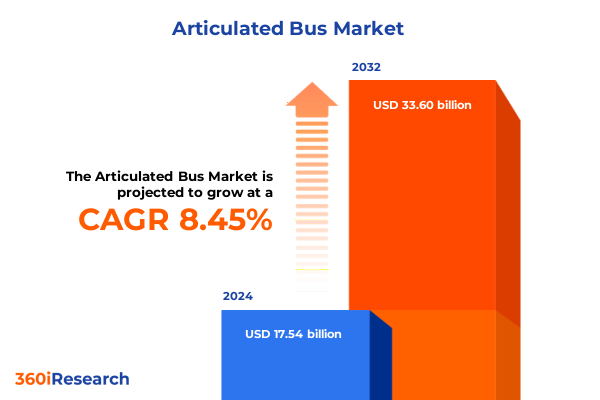

The Articulated Bus Market size was estimated at USD 19.02 billion in 2025 and expected to reach USD 20.62 billion in 2026, at a CAGR of 8.46% to reach USD 33.60 billion by 2032.

Navigating the Evolving Bus Industry Landscape: Key Drivers, Innovations, and Market Dynamics Shaping Growth and Opportunity

The global bus industry is undergoing an unprecedented phase of transformation, driven by converging forces of technological innovation, environmental policy mandates, and shifting customer expectations. Urban planners and transit authorities are increasingly prioritizing sustainable mobility solutions to address rising congestion, air quality challenges, and long-term carbon reduction targets. At the same time, operators are under mounting pressure to enhance service reliability and passenger comfort, while balancing operating costs and lifecycle efficiencies.

Against this backdrop, the market has witnessed accelerated adoption of advanced propulsion technologies, digital connectivity platforms, and data-driven fleet management tools that enable real-time monitoring and predictive maintenance. Parallel to these technological strides, regulatory landscapes are evolving to incentivize zero-emission bus deployment, compelling original equipment manufacturers and component suppliers to reimagine vehicle architectures and energy storage strategies. Moreover, a growing emphasis on public–private partnerships has fostered cross-sector collaboration, aligning transit investments with broader smart city initiatives.

This executive summary distills the critical insights and strategic imperatives essential for stakeholders seeking to navigate this dynamic terrain. By examining emerging trends, policy impacts, segmentation nuances, regional dynamics, and competitive landscapes, decision makers will gain a holistic understanding of the factors shaping growth and resilience in the bus market. Ultimately, this analysis sets the foundation for informed investment, product development, and operational excellence across the next five years and beyond.

Transformative Technological, Regulatory, and Societal Shifts Redefining Bus Mobility and Driving Industry Evolution Globally

The bus industry today is at the nexus of transformative shifts that extend far beyond incremental improvements. Electrification has emerged as the cornerstone of sustainable transit strategies, with battery electric and fuel cell vehicles redefining powertrain paradigms. Meanwhile, parallel and series hybrid configurations continue to bridge the gap for operators seeking lower emissions without full electrification, especially in regions where charging infrastructure remains nascent. These propulsion breakthroughs are complemented by digital solutions-telemetry, advanced analytics, and cloud-based fleet management-enabling operators to optimize routes, reduce downtime, and deliver superior passenger experiences.

Regulatory environments are equally dynamic, as government bodies implement stringent emissions targets and deploy low-emission zones in major metropolitan areas. Incentive structures, including grants, tax credits, and carbon credits, are reshaping procurement priorities and accelerating the retirement of legacy diesel fleets. Simultaneously, societal attitudes are driving demand for seamless, multi-modal journeys. Mobility-as-a-Service platforms are integrating bus transit with ride-hailing, cycling, and micro-mobility options, elevating the importance of digital ticketing and real-time journey planning.

Consequently, established manufacturers and emerging technology start-ups alike are forging strategic partnerships to co-create holistic mobility solutions. Supply chain diversification and near-shoring efforts are gaining traction to enhance resilience against geopolitical disruptions and trade policy fluctuations. In tandem, pilot deployments of autonomous and connected buses in controlled environments are laying the groundwork for future commercial rollouts, marking a paradigm shift in how transit networks will evolve over the coming decade.

Assessing the Cumulative Impact of 2025 United States Tariff Policies on Bus Manufacturers, Supply Chains, and Competitive Positioning

In 2025, the United States implemented a series of tariff escalations affecting key components and subassemblies integral to bus manufacturing, including electric powertrain modules, advanced battery cells, and specialized lightweight materials. These trade measures have introduced significant complexities for original equipment manufacturers, prompting a reassessment of global sourcing strategies. Suppliers in North America, Europe, and Asia-Pacific have had to navigate cost inflation for imported goods, while balancing contractual obligations and production schedules.

As a result, manufacturers have accelerated efforts to localize supply chains, forging new fabrication partnerships and investing in domestic battery cell production to mitigate tariff-induced cost pressures. Concurrently, component suppliers outside the U.S. have sought alternative distribution channels or established local operations to maintain market access, reshaping competitive dynamics across regions. Inflationary impacts have also cascaded through the value chain, leading to negotiated adjustments in procurement contracts and pilot programs to test tariff-resilient sourcing models.

Beyond immediate cost implications, the tariff landscape has driven a broader strategic realignment. Some global players have shifted assembly operations closer to key demand centers, while others have diversified into adjacent segments-such as intermodal logistics and charging infrastructure-where tariff exposure is lower. This recalibration underscores the imperative for agility and foresight as trade policies evolve, reinforcing the importance of continuous scenario analysis and proactive engagement with policy makers to safeguard supply chain continuity and competitive positioning.

Uncovering Critical Segmentation Insights Across Propulsion, Capacity, Application, Length, and Drive Orientation to Guide Strategic Decision Making

Insightful segmentation analysis reveals distinct preferences and performance dynamics across propulsion types, passenger capacities, applications, length categories, and drive orientations. When evaluating propulsion mix, compressed natural gas and diesel remain relevant in regions with established fueling networks, but electric powertrains-both battery electric and fuel cell electric-have gained momentum in low-emission zones. Hybrid solutions, spanning both parallel hybrid and series hybrid architectures, continue to find traction in markets transitioning toward full electrification, offering operators scalable emission reductions without extensive infrastructure upgrades.

Examining passenger capacity segmentation sheds light on operational strategies: buses accommodating fewer than eighty passengers are often deployed on feeder or first-mile routes characterized by variable demand, while eighty-to-one-twenty-seat vehicles comprise the backbone of standard urban and intercity services. Larger buses exceeding one-hundred-twenty seats are increasingly tailored for high-density corridors and Bus Rapid Transit systems, optimizing throughput on dedicated lanes.

Application-based segmentation further distinguishes market needs: BRT deployments prioritize high-capacity, low-floor buses with rapid boarding features, whereas intercity services require long-range propulsion systems and passenger comfort amenities. In contrast, urban transit routes demand agility, frequent stops, and robust telematics integration.

Length-category insights indicate a surge in demand for vehicles in the fifteen-to-eighteen-meter range, balancing maneuverability with seating capacity, while eighteen-to-twenty-meter buses serve as modular platforms for customizable interior layouts. Ultra-long buses over twenty meters are emerging in select megacities to alleviate congestion on peak routes.

Finally, drive orientation considerations-left hand drive versus right hand drive-dictate tailored cabin configurations, mirror placements, and regulatory compliance, influencing manufacturers’ global export strategies and aftermarket support frameworks.

This comprehensive research report categorizes the Articulated Bus market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Propulsion Type

- Passenger Capacity

- Length Category

- Drive Orientation

- Application

Examining Regional Dynamics and Growth Drivers in the Americas, Europe Middle East Africa, and Asia Pacific Bus Markets for Focused Opportunity Pursuit

Regional market dynamics underscore how localized policy frameworks, infrastructure maturity, and economic development influence bus deployment strategies. In the Americas, strong federal and state incentives in the United States have fueled electrification efforts, particularly in major metropolitan transit authorities. Canada’s provinces are likewise channeling investments into zero-emission bus initiatives, while Latin American markets maintain significant reliance on diesel and compressed natural gas fleets, with retrofit programs gaining momentum as governments strive for emission reductions.

The Europe, Middle East & Africa region exhibits diverse adoption curves. Western European countries have established stringent carbon emission targets and urban low-emission zones, prompting widespread procurement of battery electric and fuel cell buses. Conversely, several Eastern European and Middle Eastern markets still rely heavily on diesel propulsion, though pilot programs for hydrogen fuel cell systems are accelerating. In Africa, limited charging infrastructure has constrained full electrification, heightening interest in hybrid retrofits and robust diesel engines optimized for local operating conditions.

Asia-Pacific remains the largest and most fragmented region, with China leading global electric bus deployment through state-backed subsidies and domestic manufacturing capabilities. Japan is pioneering fuel cell electric buses for intercity routes, while India emphasizes cost-effective hybrid and CNG technologies to modernize its expansive public transit networks. Southeast Asian countries are at varying stages of infrastructure development, creating opportunities for regional players to introduce modular, scalable solutions that can adapt to evolving regulatory and economic environments.

This comprehensive research report examines key regions that drive the evolution of the Articulated Bus market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Bus Manufacturers, Component Suppliers, and Technology Innovators Driving Competitive Edge and Collaborative Ecosystem Development

The competitive landscape features established original equipment manufacturers alongside a new wave of specialized component and technology providers. Leading OEMs have leveraged decades of mass production expertise to scale up electric and hybrid bus lines, while also integrating advanced telematics and predictive maintenance services into their product portfolios. At the same time, emerging players focused exclusively on battery packs, electric drivetrains, or hydrogen fuel cells have carved out niches by optimizing energy density, charging speeds, and system reliability.

Component suppliers have similarly diversified, with electronics specialists delivering sophisticated battery management systems, power inverters, and energy recuperation technologies that enhance overall vehicle efficiency. Tier-two vendors are increasingly collaborating with software firms to embed over-the-air update capabilities and cybersecurity protocols, unlocking new revenue streams through connected services and aftermarket offerings. Partnerships and joint ventures between OEMs and technology start-ups have proliferated, reflecting a strategic shift toward co-development models that accelerate time-to-market for next-generation bus solutions.

Moreover, several key industry players are exploring vertical integration by investing in raw material sourcing and cell manufacturing to secure long-term supply of critical battery components. This move aims to reduce exposure to commodity price fluctuations and geopolitical risks, reinforcing resilience across the value chain. Collectively, these initiatives underscore how leading bus manufacturers and suppliers are redefining competitive advantage through innovation, strategic partnerships, and ecosystem development.

This comprehensive research report delivers an in-depth overview of the principal market players in the Articulated Bus market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AB Volvo

- Alexander Dennis Limited

- Anhui Ankai Automobile Co.,Ltd

- ATG AUTOTECHNIK GmbH

- Brisbane Bus Lines Pvt Ltd

- BYD Co., Ltd.

- Daimler Truck AG

- EBUSCO BV

- EvoBus GmbH

- HÜBNER GmbH & Co. KG

- IVECO S.p.A.

- Jebsen & Jessen Industrial Solutions GmbH

- MAN Truck & Bus SE

- New Flyer Industries Canada ULC

- NFI Group Inc

- OTOKAR Otomotiv ve Savunma Sanayi

- Proterra Inc.

- Scania Total Transport Solution

- Solaris Bus & Coach sp. z o.o.

- Tata Motors Limited

- Van Hool NV

- VDL GROEP BV

- Volvo Bus Corporation

- Zhongtong Bus Holdings Co., Ltd.

Delivering Actionable Strategic and Operational Recommendations for Industry Leaders to Capitalize on Emerging Bus Market Trends and Overcome Key Challenges

Industry leaders must adopt a proactive stance to seize emerging growth opportunities and mitigate market uncertainties. Companies should prioritize the expansion of localized manufacturing and assembly facilities in key demand centers to circumvent trade-related cost pressures and expedite delivery timelines. At the same time, forging strategic alliances with technology providers and energy infrastructure partners will enable more integrated solutions, spanning charging stations, telematics platforms, and digital maintenance ecosystems. These collaborations can also unlock novel financing models, such as subscription-based energy services and performance-based maintenance agreements, thereby reducing upfront capital requirements for transit operators.

From an operational perspective, standardizing modular vehicle architectures allows for rapid scalability and customization across different market segments and regulatory environments. Implementing robust data analytics frameworks will facilitate real-time performance monitoring, predictive diagnostics, and route optimization, ultimately lowering total cost of ownership and enhancing fleet utilization. Furthermore, actively engaging with policy makers and industry associations will help shape incentive structures, safety standards, and emissions regulations in a manner that supports sustainable growth objectives.

In the realm of talent development, companies should invest in upskilling programs focused on electric powertrain maintenance, software engineering, and advanced manufacturing techniques. Establishing innovation hubs and pilot testbeds with transit agencies can accelerate the validation of emerging technologies, while fostering a culture of continuous improvement. By combining these strategic and operational imperatives, industry stakeholders can strengthen resilience, capture new market share, and drive long-term value creation across the rapidly evolving bus sector.

Detailing a Robust Research Methodology Combining Primary and Secondary Sources to Ensure Credibility, Accuracy, and Actionable Insights Throughout the Study

This study employs a multi-layered research methodology combining extensive primary and secondary data collection to ensure a comprehensive and robust analysis. Primary research involved in-depth interviews with senior executives from bus original equipment manufacturers, component suppliers, and leading transit operators across multiple regions. These dialogues provided firsthand insights into strategic priorities, technology roadmaps, procurement challenges, and evolving policy impacts.

Secondary research encompassed a rigorous review of official government publications, industry association reports, academic journals, and reputable news outlets to validate market context and regulatory developments. Publicly available financial filings, investor presentations, and patent databases were analyzed to map competitive positioning and innovation trajectories across propulsion and digital technology segments. Data triangulation techniques were applied to reconcile discrepancies and enhance the credibility of qualitative observations.

Furthermore, the research incorporated scenario planning and sensitivity analysis to evaluate the potential effects of trade policy shifts, infrastructure deployments, and fuel price volatility. A structured validation process with external industry experts and regional stakeholders ensured the accuracy and relevance of key findings. Together, these methodological pillars underpin a data-driven assessment that delivers actionable insights tailored for decision makers navigating the complexities of the global bus market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Articulated Bus market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Articulated Bus Market, by Propulsion Type

- Articulated Bus Market, by Passenger Capacity

- Articulated Bus Market, by Length Category

- Articulated Bus Market, by Drive Orientation

- Articulated Bus Market, by Application

- Articulated Bus Market, by Region

- Articulated Bus Market, by Group

- Articulated Bus Market, by Country

- United States Articulated Bus Market

- China Articulated Bus Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Summarizing Key Findings, Strategic Implications, and Future Outlook in the Bus Industry to Inform Decision Makers and Stakeholders in a Dynamic Market

The global bus market is being reshaped by a confluence of decarbonization mandates, technology innovations, and evolving ridership demands. Electrification-both battery and fuel cell-has transitioned from pilot programs to mainstream fleet strategies, while hybrid solutions continue to provide transitional pathways in markets with nascent charging infrastructure. Simultaneously, digitalization is transforming fleet management through real-time analytics, predictive maintenance, and passenger engagement platforms that elevate service quality and operational efficiency.

Trade policies, notably the 2025 U.S. tariff adjustments, have highlighted the critical importance of supply chain resilience and localized production. Manufacturers and suppliers are recalibrating sourcing strategies and exploring vertical integration to mitigate cost impacts and maintain competitive pricing. Segmentation insights across propulsion types, passenger capacities, applications, length categories, and drive orientations have unveiled nuanced market dynamics, informing more targeted product development and deployment plans.

Regionally, the Americas, EMEA, and Asia-Pacific each exhibit unique adoption trajectories driven by regulatory incentives, infrastructure maturity, and economic considerations. Leading industry players are differentiating through strategic partnerships, innovation in energy storage, and modular vehicle platforms. To navigate this dynamic environment, stakeholders must balance strategic agility with disciplined execution, leveraging data-driven insights to capitalize on emerging trends and address key challenges. As the market continues to evolve, maintaining a forward-looking posture will be essential to unlocking sustainable growth and long-term value.

Take the Next Step to Empower Your Organization with Comprehensive Bus Market Insights and Drive Strategic Growth Through Expert Consultation

Unlock exclusive access to in-depth analysis, strategic frameworks, and competitive intelligence curated specifically for bus industry decision makers. Partner with Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch) to tailor insights around your operational priorities and growth objectives. Gain a decisive advantage with actionable recommendations, comprehensive segmentation deep dives, and regional dynamics assessments that inform your next product launches, partnerships, and investment strategies. Engage with our team for a personalized consultation and secure the essential market intelligence that will empower your organization to navigate challenges, capitalize on emerging trends, and drive sustained strategic growth across the global bus market. Reach out now to transform data-driven research into tangible business outcomes and ensure your leadership in a rapidly evolving mobility ecosystem.

- How big is the Articulated Bus Market?

- What is the Articulated Bus Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?