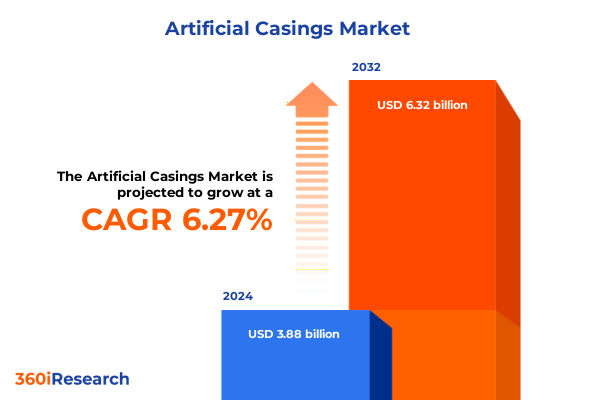

The Artificial Casings Market size was estimated at USD 4.13 billion in 2025 and expected to reach USD 4.41 billion in 2026, at a CAGR of 6.25% to reach USD 6.32 billion by 2032.

Unveiling the Comprehensive Scope and Strategic Significance of Artificial Casings to Illuminate Current Market Dynamics and Industry Drivers

Artificial casings play a vital role in the processed meat industry, providing consistent shape, size, and quality across a wide range of products such as sausages, hot dogs, and smoked meats. These synthetic and bio-based alternatives to natural casings have evolved in response to increasing consumer demand for food safety, product uniformity, and production efficiency. In recent years, advancements in materials science and manufacturing technologies have enabled producers to offer casings that meet stringent performance criteria while also addressing regulatory and environmental considerations.

This executive summary provides a concise yet comprehensive overview of the current artificial casings landscape. It outlines transformative market shifts, examines the impact of the 2025 United States tariffs, and presents key segmentation, regional, and competitive insights. By synthesizing these findings, this document aims to equip decision-makers with actionable knowledge to navigate emerging challenges and capitalize on growth opportunities in the global artificial casings market.

Highlighting the Key Transformative Shifts and Technological Disruptions Redefining Competitive Strategies in the Artificial Casings Market Landscape

The artificial casings industry has undergone a remarkable transformation driven by technological innovation and evolving consumer preferences. Novel biopolymer developments now enable casing manufacturers to deliver enhanced barrier properties that extend product shelf life while reducing environmental impact. At the same time, next-generation extrusion and filament winding techniques have improved consistency in casing thickness, tensile strength, and porosity, meeting the exacting standards of large-scale meat processors. Moreover, digitalization of manufacturing processes-through advanced process control and real-time quality monitoring-has elevated production efficiency and minimized waste.

In addition to material and process innovations, sustainability and regulatory compliance have become pivotal drivers of change. Companies are investing in eco-friendly raw materials, exploring bioresorbable and compostable casing options that align with circular economy principles. Regulatory shifts toward stricter hygiene and food contact requirements have prompted collaborative research efforts to validate new materials. Collectively, these developments are reshaping competitive dynamics, compelling established producers and new entrants alike to adopt agile strategies in order to thrive in a rapidly evolving market.

Assessing the Cumulative Effects of 2025 United States Tariffs on Production Costs Supply Chains and Market Competitiveness in Artificial Casings

The implementation of United States tariffs in early 2025 has exerted substantial cumulative effects on the artificial casings market. Tariffs imposed on key imported materials-including collagen derivatives sourced from major European and Asian suppliers, high-performance plastic polymers, and specialized fibrous substrates-have increased input costs for casing manufacturers. As a result, many producers have faced compressed margins and heightened pressure to optimize procurement strategies. In turn, some organizations have pursued alternative sourcing arrangements and diversified supplier bases to mitigate cost escalation.

Beyond raw material expenses, the tariff structure has influenced supply chain configurations and trade flows. Companies have recalibrated distribution networks, shifting certain production volumes to regions outside the United States in order to circumvent elevated duties. This realignment has prompted both domestic and international manufacturers to reevaluate their logistics, warehousing, and inventory management practices. Ultimately, these cumulative tariff impacts underscore the importance of resilient sourcing strategies and agile operational frameworks in maintaining competitiveness.

Uncovering Actionable Segmentation Insights Across Materials Applications End Uses and Distribution Channels Shaping Artificial Casings Demand

An in-depth examination of market segmentation reveals distinct growth drivers and competitive levers across materials, applications, end uses, and distribution channels. Considering materials such as cellulose, collagen, fibrous, and plastic, the market demonstrates a balance between traditional and innovative casing solutions. Each material class offers unique performance attributes that cater to specific processing requirements, from high-temperature resistance to enhanced barrier functionality.

Applications further delineate the market landscape through sub-categories including cooked sausages like bologna and mortadella, fresh sausages such as bratwurst and breakfast sausage, hot dogs comprising beef and poultry variants, and smoked sausages like kielbasa and pepperoni. Each application imposes distinct technical and sensory demands on casing materials. End use segmentation underscores the roles of food service channels-encompassing caterers and restaurants-alongside meat processors ranging from artisanal butchers to large-scale operators, and diverse retail outlets including convenience stores and supermarkets. Finally, distribution dynamics span offline networks such as direct sales and wholesale distributors, as well as online platforms including manufacturers’ websites and third-party e-commerce portals, each influencing go-to-market strategies and customer engagement models.

This comprehensive research report categorizes the Artificial Casings market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Diameter

- Application

- End Use

- Distribution Channel

Mapping Regional Variations and Growth Drivers Across the Americas Europe Middle East & Africa and Asia Pacific Artificial Casings Production and Consumption

Regional analysis highlights distinct patterns of production, consumption, and innovation across three primary geographies. In the Americas, robust demand is fueled by a well-established meat processing industry, coupled with rising consumer interest in convenient and high-quality protein products. North America’s regulatory emphasis on food safety further drives adoption of advanced casing technologies, while Latin American markets display growing potential based on expanding urban populations and modernizing cold-chain infrastructure.

In Europe, the Middle East & Africa region, regulatory frameworks around hygiene and packaging sustainability are key drivers of market evolution. Western European manufacturers lead in material innovation, whereas emerging economies in the Middle East and Africa present nascent opportunities as local meat processing capabilities expand. Asia Pacific exhibits the fastest growth trajectory, driven by surging consumption in populous nations, government initiatives to enhance food production efficiency, and increasing investments in meat processing capacity. Together, these regional insights inform tailored market entry and expansion strategies for stakeholders.

This comprehensive research report examines key regions that drive the evolution of the Artificial Casings market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating the Strategic Initiatives and Competitive Positioning of Leading Manufacturers in the Artificial Casings Industry Ecosystem

Leading companies within the artificial casings sector have demonstrated diverse strategic approaches to capitalize on market opportunities. Vertically integrated manufacturers have invested heavily in research to develop proprietary materials and processing technologies that deliver superior barrier performance and operational efficiency. Others have pursued collaborative partnerships with ingredient suppliers and equipment providers to accelerate product innovation and expand application portfolios.

Mergers and acquisitions remain a key avenue for competitive positioning, enabling companies to augment geographic reach and consolidate capabilities. At the same time, investment in sustainability initiatives-from sourcing renewable raw materials to reducing manufacturing waste-has become integral to corporate strategies. By balancing product innovation, operational excellence, and environmental stewardship, these leading players are shaping the competitive landscape and setting benchmarks for industry standards.

This comprehensive research report delivers an in-depth overview of the principal market players in the Artificial Casings market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Biostar Group

- Crown Soya Protein Group Co., Ltd.

- DAT-Schaub Group

- Devro plc

- Fabryka Osłonek Białkowych FABIOS Sp. z o.o.

- Fibran S.A.

- Foodchem International Corporation

- Kalle GmbH

- LEM Products, Inc.

- Nippi Collagen NA, Inc.

- Nitta Gelatin, Inc.

- Oversea Casing Co., Ltd.

- Qingdao Artificial Casing Co., Ltd.

- Selo B.V.

- Shandong Haiaos Biotechnology Co., Ltd.

- Shenguan Holdings (Group) Limited

- Viscofan, S.A.

- Viskase Companies, Inc.

- ViskoTeepak Holding B.V.

- Weschenfelder Direct Ltd.

Presenting Strategic Actionable Recommendations for Industry Leaders to Optimize Supply Chains Innovate Products and Navigate Regulatory and Trade Challenges

Industry leaders seeking sustainable growth in the artificial casings market should prioritize strategic actions across multiple fronts. First, optimizing supply chain resilience through diversified sourcing and inventory management can mitigate tariff-related cost pressures and logistical disruptions. By establishing secondary supplier relationships and exploring near-shore manufacturing options, companies can reduce dependency on singular procurement channels.

Second, investment in material research and development-targeting advanced biopolymer formulations and ecofriendly substrates-will foster product differentiation and align with consumer preferences for sustainable solutions. Third, companies should leverage digital platforms and data analytics to gain real-time visibility into production performance and market demand patterns. Finally, proactive engagement with regulatory bodies and trade associations is essential to anticipate policy changes and influence standards, ensuring compliance while maintaining agility in strategic planning.

Detailing the Robust Multi-Method Research Methodology Employed to Ensure Data Integrity Triangulation and Comprehensive Market Analysis for Artificial Casings

This research employs a multi-method approach designed to ensure data integrity, comprehensiveness, and analytical rigor. Primary data collection involved in-depth interviews with industry experts, C-level executives of casing manufacturers, procurement specialists at meat processors, and distribution channel partners. Secondary research encompassed a thorough review of trade journals, regulatory filings, technical standards, and corporate disclosures.

Quantitative data points were triangulated across multiple sources to validate key trends and verify inconsistencies. Stressed scenario analyses and sensitivity testing provided insights into tariff impacts and supply chain disruptions. Segmentation frameworks were defined based on material type, application, end use, and distribution channels, ensuring detailed breakdowns of market dynamics. Finally, expert validation workshops were conducted to refine findings and confirm the strategic relevance of actionable recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Artificial Casings market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Artificial Casings Market, by Material Type

- Artificial Casings Market, by Diameter

- Artificial Casings Market, by Application

- Artificial Casings Market, by End Use

- Artificial Casings Market, by Distribution Channel

- Artificial Casings Market, by Region

- Artificial Casings Market, by Group

- Artificial Casings Market, by Country

- United States Artificial Casings Market

- China Artificial Casings Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesizing Core Findings and Forward-Looking Perspectives to Provide a Cohesive Conclusion on Market Evolution and Strategic Imperatives for Artificial Casings

This executive summary synthesizes the converging forces shaping the artificial casings market, including rapid technological advancements, evolving sustainability mandates, and trade policy shifts. The cumulative impact of US tariffs underscores the need for resilient sourcing strategies, while segmentation, regional, and competitive analyses reveal nuanced growth paths across materials, applications, geographies, and corporate models.

Moving forward, stakeholders must embrace a holistic strategic outlook-leveraging innovation, operational agility, and regulatory foresight-to navigate an increasingly complex landscape. By integrating the insights and recommendations outlined herein, organizations can position themselves to capture emerging opportunities, mitigate risks, and drive long-term value creation in the dynamic artificial casings sector.

Engaging with Associate Director Ketan Rohom to Secure the Definitive Artificial Casings Market Research Report and Unlock Competitive Business Advantages

We invite industry stakeholders and strategic decision-makers to engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to secure the definitive artificial casings market research report. This comprehensive study synthesizes transformative trends, tariff impacts, segmentation insights, and competitive strategies, offering an indispensable resource for companies seeking to optimize operations, innovate product portfolios, and gain a competitive edge in a dynamic global environment.

To acquire the full report and unlock tailored guidance on navigating cost pressures, regulatory changes, and regional growth opportunities, please connect with Ketan Rohom. His expertise in market intelligence and client support ensures that organizations receive the insights and actionable recommendations necessary to drive success in the artificial casings sector.

- How big is the Artificial Casings Market?

- What is the Artificial Casings Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?