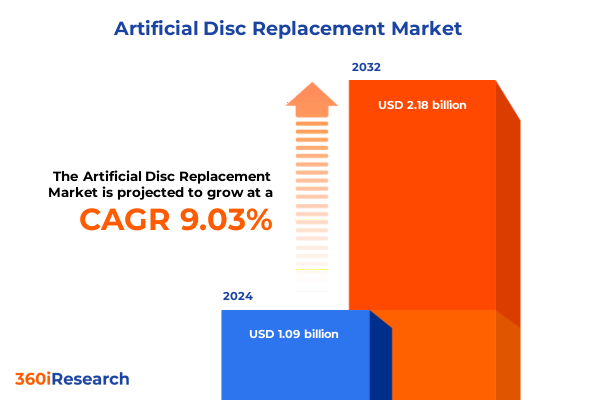

The Artificial Disc Replacement Market size was estimated at USD 1.18 billion in 2025 and expected to reach USD 1.28 billion in 2026, at a CAGR of 9.15% to reach USD 2.18 billion by 2032.

Comprehensive Overview Unveiling the Evolution and Clinical Significance of Artificial Disc Replacement Transforming Spinal Therapy Paradigms

As medical technology continues its rapid advance, artificial disc replacement has emerged as a transformative alternative to spinal fusion, offering renewed hope for patients suffering from degenerative disc disease. By substituting damaged intervertebral discs with biomechanically engineered prostheses, surgeons aim to preserve motion at the treated segment, thereby reducing adjacent-level degeneration and enhancing postoperative mobility. Clinical outcomes over the past decade have demonstrated the potential for improved pain relief, functional recovery, and patient satisfaction when compared with traditional fusion techniques. Refined surgical approaches and device designs have expanded the eligible patient population, bridging the gap between technological promise and real-world therapeutic impact.

The trajectory of disc replacement innovation reflects a confluence of material science, biomechanical engineering, and regulatory collaboration. Early generations of devices prioritized load-bearing capacity but encountered challenges in replicating natural kinematics. Recent refinements harness advanced polymers and metallurgical coatings to minimize wear, while modular geometries support multi-plane motion and disc height restoration. Concurrently, the global regulatory environment has adapted pathways for device approval, balancing safety rigor with expedited access for breakthrough implants. This introduction lays the groundwork for a deeper exploration of market drivers, emerging shifts, and strategic recommendations that will define the next chapter in spinal therapy evolution.

Emerging Technological and Regulatory Shifts Reshaping the Artificial Disc Replacement Market Dynamics and Driving Novel Patient Outcomes Across Regions

The artificial disc replacement sector is experiencing a critical inflection point driven by converging technological, clinical, and policy-level transformations. On the technological front, next-generation implants are integrating sensor-based feedback systems that monitor in vivo biomechanics, enabling real-time assessment of device performance and patient activity. These smart systems promise to elevate postoperative care by facilitating tailored rehabilitation protocols based on objective metrics. Moreover, novel surface textures and biologically active coatings are under investigation to encourage osseointegration and minimize inflammatory responses, thereby extending device longevity and reducing the incidence of revision surgeries.

Simultaneously, payer ecosystems are recalibrating reimbursement frameworks in recognition of the long-term value proposition offered by motion-preserving technologies. Several national health authorities and private insurers have introduced differentiated coverage criteria that consider functional outcomes and quality-of-life improvements rather than short-term cost comparisons with fusion. This shift has incentivized providers to adopt disc arthroplasty more readily, particularly for younger, working-age cohorts where sustained mobility and rapid return to duty hold significant socioeconomic importance. Looking ahead, strategic partnerships between device manufacturers, healthcare systems, and rehabilitation specialists will likely drive integrated care pathways, further consolidating disc replacement’s role as a mainstream spinal treatment modality.

Analyzing the Multifaceted Effects of 2025 United States Tariff Adjustments on Supply Chains, Cost Structures, and Competitive Strategies in Artificial Disc Replacement

In 2025, the United States implemented revised import tariffs targeting key materials and components used in artificial disc manufacturing, including specialized alloys and polymeric substrates. These levy changes were enacted to protect domestic producers and encourage onshore component fabrication, but they have produced a complex cost landscape for device makers. Manufacturers sourcing biomaterials from established foreign suppliers encountered increased input costs, compelling some to renegotiate contracts or absorb marginal price adjustments to maintain competitive pricing. As a knock-on effect, strategic sourcing teams accelerated searches for alternative domestic vendors, though capacity constraints have occasionally stretched lead times for critical raw materials.

Moreover, the tariff realignment has reverberated through global supply chains, prompting real-time adjustments in inventory management and logistics planning. Companies with vertically integrated production capabilities or pre-existing domestic partnerships have leveraged these structures to mitigate cost inflation and sustain margins. Conversely, industry players reliant on overseas assembly operations have re-evaluated geographic footprints, with some redirecting final assembly to North American facilities. Taken together, the 2025 tariff measures have reshaped competitive dynamics by rewarding domestically resilient supply models and catalyzing innovation in material sourcing strategies.

In-Depth Examination of Artificial Disc Replacement Market Through Application, Constraint, Material, and End User Perspectives Highlighting Strategic Opportunities

The artificial disc replacement market exhibits nuanced behavior when dissected by application, constraint type, material composition, and end user specialization. Through the lens of application, cervical and lumbar procedures each reveal distinct clinical imperatives; cervical interventions benefit from precision devices optimized for neck biomechanics, available in single-level and multi-level configurations, whereas lumbar replacements prioritize load-bearing capabilities and can accommodate both isolated and adjacent-segment treatments. In parallel, constraint-type classifications-ranging from rigid, semi-constrained, to unconstrained designs-address varying degrees of motion control, aligning device mechanics with patient-specific stability requirements.

Material innovation further subdivides the competitive landscape. Metal-on-metal articulations deliver robust durability, though they have prompted careful monitoring of ion release, whereas metal-on-polymer constructs balance longevity with lower friction coefficients. Finally, the end user environment, which encompasses ambulatory surgical centers, hospitals, and specialized spine centers, influences both device selection and procedural economics. High-volume specialized spine centers often adopt the latest advanced implants first, leveraging surgeon expertise and streamlined protocols, while ambulatory surgical centers emphasize cost efficiency and rapid turnover. This multifaceted segmentation underscores targeted opportunities for tailored product development and differentiated market entry approaches.

This comprehensive research report categorizes the Artificial Disc Replacement market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Constraint Type

- Material

- Application

- End User

Strategic Regional Analysis Revealing Growth Drivers and Market Characteristics Across the Americas, EMEA, and Asia-Pacific for Disc Replacement Solutions

Regional dynamics profoundly shape the trajectory of artificial disc replacement adoption, with each geography presenting unique regulatory, economic, and cultural variables. Within the Americas, market leaders in the United States and Canada benefit from established reimbursement pathways and a mature ecosystem of high-volume spinal surgery centers. Patient awareness campaigns and robust clinical advocacy have accelerated uptake in both urban and suburban markets, while investment in onshore manufacturing underpins supply security.

Europe, the Middle East, and Africa (EMEA) collectively face diverse adoption curves. Western European nations have incrementally integrated artificial disc solutions into national healthcare formularies, though budgetary constraints in some public systems temper rapid expansion. In contrast, select Gulf states are actively pursuing medical tourism strategies, investing in specialized spine centers that cater to regional demand. In several African nations, the focus remains on foundational access to advanced spinal care, with initial pilot programs under way.

In Asia-Pacific, dynamic growth is being propelled by rising healthcare expenditure, expanding private hospital networks, and proactive regulatory harmonization. Countries such as China, India, and Australia exhibit growing surgeon expertise and increasing patient willingness to consider alternative spinal therapies. Collaborative research initiatives between device makers and regional academic institutions are further catalyzing localized innovation and clinical validation.

This comprehensive research report examines key regions that drive the evolution of the Artificial Disc Replacement market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Critical Company Profiling Spotlighting Key Industry Players, Their Technological Innovations, and Competitive Positioning in Artificial Disc Replacement Arena

Leading manufacturers in the artificial disc replacement domain are differentiating through targeted innovation, strategic collaborations, and refined go-to-market approaches. Established global device firms continue to invest heavily in advanced implant designs that integrate real-time biomechanical monitoring, striving to offer comprehensive solutions encompassing hardware, software, and postoperative analytics. These integrated offerings are gaining traction among high-volume surgical centers seeking to enhance patient engagement and long-term outcome visibility.

Meanwhile, agile mid-size companies are carving specialized niches through material science breakthroughs, such as next-generation cobalt-chromium alloys with enhanced fatigue resistance or polymer blends engineered for superior wear characteristics. Partnerships with academic research hospitals are accelerating clinical evidence generation, with pilot studies testing bioactive coatings that promote bone integration. In addition, select startups are focusing on modular device architectures that support intraoperative customization, seeking to address diverse patient anatomies and reduce inventory complexity.

Competitive positioning also hinges on service models. Several leading players have expanded their commercial teams to include clinical education specialists, reinforcing best practices in surgical technique and perioperative care. By fostering collaborative surgeon networks and offering immersive training simulations, these companies aim to drive procedural standardization and ultimately boost device adoption.

This comprehensive research report delivers an in-depth overview of the principal market players in the Artificial Disc Replacement market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AxioMed LLC

- B. Braun Melsungen AG

- Centinel Spine, LLC

- Globus Medical, Inc.

- HIGHRIDGE MEDICAL

- Johnson & Johnson

- Medtronic plc

- NuVasive, Inc.

- Orthofix Medical Inc.

- Spinal Elements, Inc.

- Stryker Corporation

- SYNERGY SPINE SOLUTIONS INC.

- Zimmer Biomet Holdings, Inc.

Actionable Strategic Roadmap Guiding Industry Leaders Toward Sustainable Growth, Operational Excellence, and Collaborative Innovation in Disc Replacement

To secure leadership in an evolving artificial disc replacement market, companies must adopt a multifaceted strategic playbook. First, investing in vertically integrated supply chains will buffer against external tariff shocks and material shortages, ensuring continuity of product availability. Organizations should explore joint ventures with domestic alloy producers and polymer fabricators to co-develop bespoke biomaterials, thereby locking in preferential pricing and quality controls. Additionally, deploying agile manufacturing platforms that can pivot production volumes according to regional demand clustering will optimize asset utilization.

Second, advancing digital health integrations is critical. Firms should accelerate the deployment of sensor-embedded implants and cloud-based analytics portals that offer real-time insights into postoperative performance. By incentivizing surgeon adoption through outcome-linked reimbursement models, companies can differentiate offerings based on demonstrable clinical value. Complementary investment in tele-rehabilitation applications will further support patient engagement and adherence, enhancing long-term satisfaction metrics.

Finally, strategic market entry and expansion should be informed by focused clinical evidence generation. Prioritizing robust multicenter trials in emerging regions, and leveraging health economics studies to quantify lifetime cost benefits, will facilitate reimbursement approvals and payer buy-in. Collaborative consortium models-uniting device makers, payers, and independent research bodies-can streamline regulatory pathways and broaden the base of support for motion-preserving technologies.

Rigorous Research Methodology Outlining Data Collection, Validation Protocols, and Analytical Frameworks Ensuring Robustness of Artificial Disc Replacement Insights

This report’s analytical rigor is grounded in a robust, multi-layered research methodology. Primary data was collected through structured interviews with leading spine surgeons, payers, and device innovators, complemented by direct survey inputs from ambulatory and hospital administrators. Secondary sources comprised peer-reviewed clinical studies, regulatory filings, and policy white papers, ensuring a comprehensive understanding of both technical performance and market access landscapes.

Data validation was executed through cross-referencing third-party clinical registries and publicly available health system procedure volume data. Triangulation of findings across diverse stakeholder perspectives reduced bias and reinforced the reliability of market dynamics interpretation. Advanced statistical analysis, including cohort trend mapping and sensitivity testing, was applied to isolate the effects of tariff changes and segmentation variables on adoption trajectories.

The geographical scope spanned North America, EMEA, and Asia-Pacific, with careful consideration of regional regulatory heterogeneity and reimbursement frameworks. Analytical modeling employed scenario building to account for emerging technology adoption rates and policy shifts. Finally, all findings underwent peer review by an internal advisory panel of spinal health experts prior to publication, ensuring methodological transparency and actionable validity.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Artificial Disc Replacement market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Artificial Disc Replacement Market, by Constraint Type

- Artificial Disc Replacement Market, by Material

- Artificial Disc Replacement Market, by Application

- Artificial Disc Replacement Market, by End User

- Artificial Disc Replacement Market, by Region

- Artificial Disc Replacement Market, by Group

- Artificial Disc Replacement Market, by Country

- United States Artificial Disc Replacement Market

- China Artificial Disc Replacement Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Consolidated Conclusions Emphasizing Industry Evolution, Market Prospects, and Essential Considerations Driving Future Developments in Disc Replacement

The artificial disc replacement market stands at a pivotal juncture, driven by technological breakthroughs, evolving reimbursement paradigms, and strategic supply chain recalibrations. From the clinical promise of motion-preserving implants that emulate natural spinal kinematics to the operational resilience demanded by tariff-induced cost pressures, the industry’s evolution reflects a dynamic interplay of innovation and adaptation. Segments differentiated by application, constraint type, material, and end‐user context continue to reveal targeted pockets of opportunity, while regional analyses underscore the importance of tailoring market strategies to discrete healthcare environments.

Moving forward, companies that excel will be those that seamlessly integrate advanced device engineering with data-centric service models, forge resilient partnerships across the supply chain, and generate compelling clinical evidence to support value-based care frameworks. Embracing these imperatives will not only enhance patient outcomes but also fortify competitive positioning in an increasingly crowded marketplace. Ultimately, the convergence of digital health, material science, and collaborative ecosystems heralds a new era for artificial disc replacement, one defined by personalized therapies and sustained growth trajectories.

Exclusive Invitation to Engage with Associate Director Sales & Marketing for Tailored Insights and Comprehensive Market Intelligence on Artificial Disc Replacement

For decision-makers seeking to deepen their understanding of the artificial disc replacement landscape and leverage data-driven strategies, an opportunity awaits to connect directly with Ketan Rohom, Associate Director of Sales & Marketing. By engaging with Ketan, stakeholders can access a detailed, customized walkthrough of the comprehensive market research report, featuring insights tailored to unique organizational goals and competitive imperatives. This personalized session will illuminate actionable pathways for product development, market entry, and strategic partnerships, ensuring that every question is addressed with precision and industry expertise.

Securing this consultation not only unlocks deeper visibility into segment-specific dynamics and regional growth drivers but also provides clarity on tariff impacts and regulatory trends shaping 2025 and beyond. Engaging with Ketan enables companies to refine investment priorities, optimize supply chain resilience, and anticipate future shifts in technology adoption. To initiate this conversation and capitalize on the full breadth of analytical findings, reach out to schedule a dedicated briefing that will catalyze your firm’s position at the forefront of artificial disc replacement innovation.

- How big is the Artificial Disc Replacement Market?

- What is the Artificial Disc Replacement Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?