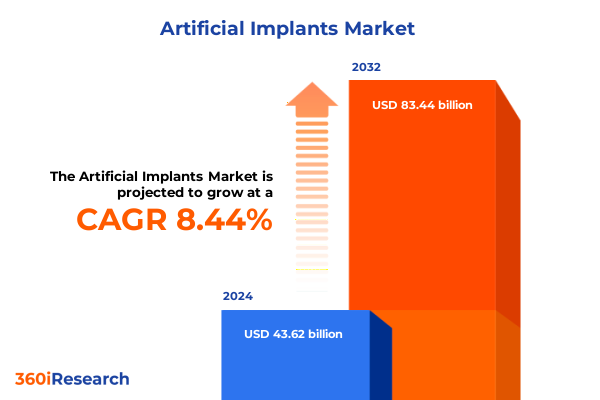

The Artificial Implants Market size was estimated at USD 47.24 billion in 2025 and expected to reach USD 51.16 billion in 2026, at a CAGR of 8.46% to reach USD 83.44 billion by 2032.

Revolutionary Technological Breakthroughs and Market Forces Driving Artificial Implant Innovation Across Cardiovascular and Orthopedic Specialties

The artificial implant sector stands at a pivotal juncture, driven by the convergence of groundbreaking medical technologies and evolving patient needs. Over recent years, rapid advancements in materials science, engineering, and digital health integration have catalyzed a transformation across multiple therapeutic areas. Implantable devices-from cardiovascular stents and orthopedic joint replacements to neural stimulators and cochlear systems-are being reimagined with enhanced biocompatibility, durability, and functional intelligence. This progress is not solely technological; collaborative partnerships among academic institutions, industry leaders, and regulatory agencies have fostered an ecosystem where innovation thrives. As a result, implantable solutions are extending beyond mere biomechanical support to deliver active physiological monitoring, targeted drug delivery, and adaptive therapeutic interventions.

Simultaneously, several macro forces are reshaping demand dynamics and market structures. A globally aging population is driving chronic disease prevalence, while healthcare systems are emphasizing value-based care models focused on long-term outcomes. Regulatory frameworks are evolving to fast-track high-impact devices, yet they maintain rigorous safety and efficacy standards. Moreover, healthcare providers are increasingly adopting minimally invasive techniques, supported by advanced imaging and robotic-assisted platforms. These complementary trends underscore a transition from reactive, one-size-fits-all treatments toward personalized, precision-based implant strategies that promise improved patient outcomes and system-level efficiencies

Emerging Paradigm Shifts in Artificial Implant Technologies Revolutionizing Patient Outcomes and Clinical Practices Worldwide

A profound paradigm shift is emerging within the artificial implant landscape, fueled by the integration of cutting-edge technologies that challenge conventional design and delivery paradigms. Additive manufacturing, notably 3D printing, now enables the fabrication of implants with intricate internal architectures that closely mimic natural bone structures, optimizing load distribution and accelerating osseointegration. Concurrently, the adoption of smart implant technologies-incorporating wireless sensors, AI-driven analytics, and closed-loop drug-eluting mechanisms-is redefining the role of devices from passive tissue supports to active therapeutic agents that continuously adapt in real time to physiological changes. These advances are shortening development lifecycles and generating novel value propositions for patients and providers alike.

In parallel, bioactive surface treatments such as antimicrobial and osteoinductive coatings are deepening device functionality. These biofunctional coatings enhance biocompatibility, reduce infection risks, and promote faster tissue integration. Regulatory agencies are responding with tailored pathways that balance expeditious market entry and post-market surveillance to ensure safety. Additionally, minimally invasive implantation modalities-supported by robotics and advanced imaging-are driving broader procedure adoption in outpatient settings. Collectively, these technological and procedural innovations are carving a new era in which implants are holistically integrated into the continuum of care, enabling personalized treatment regimens and elevating long-term clinical success

Complex Interplay of 2025 U.S. Tariff Policies Unveiling Significant Supply Chain Disruptions and Cost Pressures on Artificial Implant Manufacturers

The reimposition of Section 301 tariffs on medical devices in 2025 has introduced unprecedented supply chain complexities for implant manufacturers. Targeted duties affecting Class I and II devices-including critical components sourced from China and other key markets-have elevated raw material costs and production overheads. Industry analysts warn that these headwinds are straining established globalization strategies, prompting leading manufacturers to reconsider sourcing, nearshoring, and tariff mitigation tactics. As U.S. Trade Representative policies intensify, device makers face difficult choices in balancing cost, quality, and regulatory compliance within a highly integrated global ecosystem.

The cascading impact is evident across procurement lead times, inventory management, and contract negotiations with healthcare providers. Hospitals and surgical centers report elongated delivery schedules and elevated device pricing, pressuring operational budgets and, in some cases, patient out-of-pocket costs. Smaller enterprises are disproportionately affected due to limited supply chain flexibility, while established players leverage diversified manufacturing footprints and seek tariff exemptions for essential implant components. In response, some healthcare systems are intensifying cost-tracking measures and exploring standardized Bill-Only processes to monitor price fluctuations in real time. Overall, the 2025 tariff landscape underscores the critical need for agile supply chain strategies and proactive stakeholder collaboration to safeguard patient access and clinical continuity

Comprehensive Multidimensional Segmentation Uncovering Diverse Implant Types, End Users, Material Categories, and Cutting-Edge Technological Modalities

Segmentation by implant type reveals a multifaceted environment encompassing cardiovascular devices-such as heart valves, pacemakers, stents, and vascular grafts-alongside cochlear, cosmetic, dental, neurostimulator, orthopedic, retinal, and urological implants. Within cardiovascular prosthetics, heart valve replacements bifurcate into bioprosthetic and mechanical categories, while stents subdivide into coronary and peripheral applications. Orthopedic systems also exhibit granularity: bone plates and screws, joint replacements across hip, knee, and shoulder, as well as spinal fusion and trauma fixation constructs. These delineations enable companies to tailor product development to specific anatomical and functional requirements, fostering innovation in material science and engineering for each distinct subsegment.

End users span ambulatory surgical centers, specialty and multispecialty clinics, home care networks, and hospitals. Ambulatory centers are expanding their procedural capabilities as minimally invasive implants migrate away from inpatient settings, supported by regulatory shifts and streamlined reimbursement. Clinics deliver specialized treatments, often in collaborative networks that integrate surgical, medical, and rehabilitative services. Home care models are increasingly incorporating remote monitoring implants and telehealth-enabled devices, empowering patients to receive ongoing support outside traditional settings. Hospitals continue to serve as primary adopters for complex device implantations, leveraging consolidated purchasing power and integrated clinical teams to manage high-acuity interventions.

Material type segmentation underscores the importance of alloys, biodegradable polymers, advanced ceramics, and titanium in meeting diverse biocompatibility, mechanical, and longevity criteria. Parallel segmentation by technology highlights the ascendancy of 3D printing for patient-specific designs, bioactive coatings that prevent infection and promote tissue integration, drug-eluting platforms for localized therapy, minimally invasive implant delivery systems, and smart implants equipped with sensing and wireless communication capabilities. This multidimensional segmentation framework guides targeted R&D investments, enabling stakeholders to prioritize high-value areas and align product pipelines with evolving clinical demands.

This comprehensive research report categorizes the Artificial Implants market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Implant Type

- Technology

- Material Type

- End User

Strategic Regional Perspectives Highlighting Growth Drivers and Unique Opportunities Across Americas, Europe Middle East Africa, and Asia-Pacific Territories

In the Americas, robust healthcare infrastructure and high per capita healthcare spending continue to drive adoption of advanced implantable devices. North America remains a global innovation hub, hosting leading manufacturers, research institutions, and clinical trial networks. U.S. regulatory pathways facilitate expedited approval of breakthrough devices, while private and public reimbursement policies support broad utilization across cardiovascular, orthopedic, and neurotechnology segments. Meanwhile, Latin American markets present emerging opportunities, with expanding middle-class populations and growing healthcare investments spurring interest in minimally invasive procedural adoption and digital health integration. This regional outlook underscores the Americas’ central role in shaping global implant innovation and commercialization strategies.

Europe, the Middle East, and Africa navigate a complex landscape marked by stringent regulatory frameworks under the EU Medical Device Regulation and varied reimbursement environments. Western European nations lead in neuromodulation and smart implant R&D, benefiting from coordinated funding mechanisms and sophisticated clinical infrastructure. In Eastern Europe and parts of the Middle East and Africa, infrastructure limitations and cost sensitivities temper market evolution but open avenues for value-oriented solutions and public–private partnerships. Harmonization initiatives and post-market surveillance requirements via EUDAMED are gradually leveling the playing field, promoting enhanced patient safety and device traceability across the EMEA region.

Asia-Pacific is characterized by dynamic growth driven by demographic shifts, rising healthcare access, and government initiatives to localize medical device manufacturing. Japan, China, and South Korea are investing heavily in advanced implant technologies-particularly in 3D printing and smart neurodevices-while Southeast Asian and Oceania markets register increased demand for cost-effective yet clinically robust solutions. Collaborative ventures with multinational corporations and regional innovation clusters are accelerating technology transfers and creating new market entry pathways. Overall, Asia-Pacific’s confluence of demand potential and manufacturing maturation positions it as a strategic growth corridor for artificial implant stakeholders

This comprehensive research report examines key regions that drive the evolution of the Artificial Implants market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading Industry Players Leveraging Innovation, Strategic Partnerships, and Supply Chain Resilience to Dominate the Artificial Implant Landscape

Global leaders in artificial implants are distinguishing themselves through bold innovation, strategic collaborations, and supply chain agility that enhance resilience amid evolving trade dynamics. Medtronic is pioneering titanium 3D printing applications-including its TiONIC spinal fusion implants-while partnering with academic institutions to develop patient-specific cardiovascular models. Johnson & Johnson’s MedTech division is navigating a $400 million tariff headwind with ongoing investment in domestic manufacturing and tax policy advocacy to bolster U.S. production. Stryker and Zimmer Biomet are investing in nearshore facilities and supplier diversification to mitigate tariff exposure and sustain clinical supply continuity. These industry behemoths leverage scale, integrated R&D, and adaptive manufacturing footprints to maintain market leadership and introduce next-generation therapy platforms.

Meanwhile, emerging players are carving niches by focusing on specialized segments. Arthrex and Globus Medical, for instance, are capitalizing on low-tariff nearshore facilities in Mexico and Costa Rica to supply orthopedic implants with minimized lead times. Boston Scientific is amplifying its minimally invasive cardiovascular device portfolio with AI-driven sensor integration for real-time patient monitoring. Specialty implant innovators are forging alliances-such as Medtronic’s multi-parameter wearable partnership in Western Europe-to enhance post-implant care through remote monitoring and data analytics. Collectively, this ecosystem underscores the importance of convergent strategies that blend technological differentiation, regulatory acumen, and supply chain dexterity to succeed in a fast-moving market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Artificial Implants market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Advanced Bionics Corporation by Sonova Holding AG

- Aesculap Implant Systems by B. Braun Medical, Inc.

- Bicon, LLC

- Boston Scientific Corporation

- Cochlear Limited

- DENTSPLY SIRONA Inc.

- DIOPTEX GmbH

- Exactech Inc.

- EyeYon

- FCI Ophthalmics, Inc.

- GS Solutions, Inc.

- Johnson & Johnson

- KeraMed, Inc.

- Medical Device Business Services, Inc. by Johnson & Johnson

- Medtronic plc

- Nobel Biocare Services AG

- NuVasive, Inc.

- Smith & Nephew Plc

- Straumann Holding AG

- Stryker Corporation

- Terumo Corporation

- TTK Healthcare Limited

- Zimmer Biomet Holdings, Inc.

Targeted Strategic Initiatives for Industry Stakeholders to Enhance Innovation, Optimize Supply Chains, and Navigate Regulatory Challenges Effectively

Industry leaders must adopt proactive supply chain diversification strategies to mitigate the financial and operational impacts of trade policy fluctuations. Nearshoring critical component production and expanding manufacturing capacity in low-tariff regions can safeguard device availability and cost competitiveness. For smaller enterprises, collaborative procurement alliances and co-manufacturing arrangements offer scalable access to resilient supply networks.

Accelerating R&D investment in advanced materials-such as biodegradable polymers and bioactive nanocoatings-and digital integration is essential for sustaining clinical differentiation. Organizations should prioritize partnerships with academic centers and tech innovators to co-create patient-specific solutions that align with precision medicine paradigms. At the same time, engagement with regulatory bodies and participation in expedited approval programs can streamline market entry for transformative devices.

Finally, aligning segmentation strategies with regional market dynamics is critical. Tailored product portfolios that address specific end-user needs, from ambulatory surgical centers in the U.S. to cost-sensitive EMAR markets and digitally enabled Asia-Pacific ecosystems, will maximize adoption potential. Incorporating robust post-market surveillance and outcome analytics will not only meet evolving safety requirements but also strengthen stakeholder trust and drive long-term value creation.

Comprehensive Research Framework Combining Rigorous Primary and Secondary Methods to Deliver Actionable Insights Across the Artificial Implant Ecosystem

This research integrates a mixed-methods approach, combining rigorous primary and secondary methodologies to ensure comprehensive coverage and analytical depth. Primary research involved structured interviews with C-suite executives, supply chain directors, and key opinion leaders across major implant segments to validate market drivers and strategic priorities. Secondary research leveraged peer-reviewed journals, regulatory filings, and proprietary databases to map emerging technologies, tariff impacts, and regional dynamics.

Quantitative data were triangulated across multiple sources-including FDA device approvals, EU EUDAMED registries, and global customs statistics-to quantify trade flow disruptions and segmentation performance. A detailed supply chain assessment framework evaluated tariff exposures, manufacturing footprints, and logistics resilience. Finally, scenario analysis was employed to project potential regulatory and trade policy evolutions, providing actionable foresights under varying macroeconomic conditions. This methodological rigor underpins the insights and recommendations presented herein, offering stakeholders a robust foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Artificial Implants market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Artificial Implants Market, by Implant Type

- Artificial Implants Market, by Technology

- Artificial Implants Market, by Material Type

- Artificial Implants Market, by End User

- Artificial Implants Market, by Region

- Artificial Implants Market, by Group

- Artificial Implants Market, by Country

- United States Artificial Implants Market

- China Artificial Implants Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Synthesis of Key Findings and Strategic Imperatives Guiding Stakeholders Through the Evolving Artificial Implant Market Landscape

The artificial implant market is undergoing a transformative evolution marked by converging technological breakthroughs, reshaped trade policies, and dynamically shifting regional landscapes. Segmentation across device types, end-user channels, materials, and advanced technologies reveals diverse growth pathways and clinical imperatives. While leading players harness scale, R&D prowess, and supply chain dexterity to navigate 2025 tariff headwinds, emerging innovators are leveraging specialized niches and collaborative ecosystems to introduce disruptive solutions. Regionally, the Americas remain an innovation stronghold, EMEA balances regulatory rigor with funding initiatives, and Asia-Pacific emerges as a critical growth frontier underpinned by demographic and manufacturing shifts.

To thrive in this complex environment, stakeholders must embrace supply chain resilience, invest in next-generation materials and digital integration, and align product strategies with regional and end-user requirements. Robust regulatory engagement and outcome-driven post-market surveillance will further reinforce trust and accelerate adoption. Ultimately, a strategic, multidimensional approach-blending operational agility, technological leadership, and market-focused segmentation-will be key to unlocking sustained competitive advantage in the rapidly evolving artificial implant landscape.

Connect with Ketan Rohom to Unlock Comprehensive Market Intelligence and Elevate Your Strategic Decisions in the Artificial Implant Sector Today

Don’t miss the opportunity to leverage deep industry expertise and proprietary data tailored to your strategic needs. Reach out directly to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, to explore customized solutions and secure your comprehensive market report on artificial implants.

- How big is the Artificial Implants Market?

- What is the Artificial Implants Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?