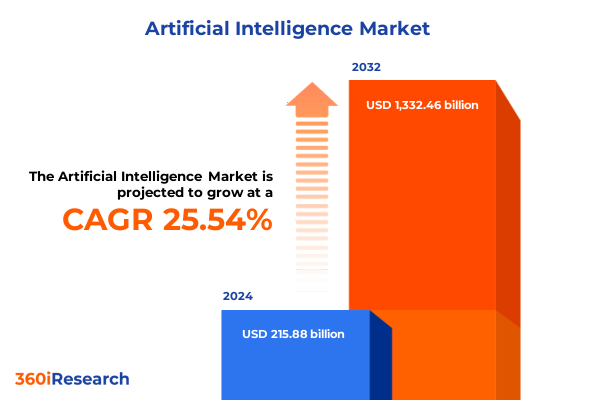

The Artificial Intelligence Market size was estimated at USD 268.15 billion in 2025 and expected to reach USD 333.98 billion in 2026, at a CAGR of 25.73% to reach USD 1,332.46 billion by 2032.

Establishing the Context for Artificial Intelligence Adoption by Highlighting Emerging Trends, Strategic Drivers, and Market Dynamics Fueling Innovation

Artificial intelligence has evolved from a theoretical concept to a transformative force reshaping industries at an unprecedented pace. As organizations across technology, finance, healthcare, manufacturing, and retail integrate AI capabilities into their core operations, understanding the underlying market dynamics becomes essential. This report embarks on a comprehensive exploration of the AI ecosystem by examining the convergence of technological innovations, competitive forces, and regulatory environments that collectively define the current landscape.

The introduction sets the stage by articulating the strategic importance of AI investments, illustrating how advancements in machine learning algorithms, edge computing, and software platforms are fueling new applications. By establishing the context for adoption, decision-makers gain clarity on the interdependencies between components such as specialized hardware accelerators, consulting-driven integration services, and robust software tools. This foundational overview underscores the report’s objective: to equip industry leaders with the insights necessary to navigate complexity, identify high-impact opportunities, and craft informed strategies that align technical capabilities with business goals.

Uncovering the Transformative Shifts in AI Ecosystem That Redefine Competitive Landscapes, Drive Investment Priorities, and Accelerate Technological Advancements

In recent years, the AI ecosystem has undergone seismic shifts driven by breakthroughs in deep learning architectures, widespread availability of high-performance hardware, and the democratization of development frameworks. Enhanced GPU and specialized integrated circuit designs have accelerated processing speeds, enabling real-time analytics and complex model training that were once the purview of large research labs. Concurrently, the proliferation of edge devices has decentralized intelligence, empowering applications from autonomous vehicles to industrial IoT with localized decision-making.

This transformation extends to services and software, where consulting firms are forging strategic partnerships to guide enterprise deployments while integration specialists streamline the adoption of AI platforms. Meanwhile, a surge in open-source machine learning libraries and natural language processing frameworks has lowered barriers to entry, allowing small and medium enterprises to harness advanced capabilities. These shifts collectively redefine competitive dynamics by shifting the focus from proof-of-concept experiments to scalable, operationalized AI solutions that deliver measurable business value.

Analyzing the Cumulative Effects of 2025 United States Tariff Policies on Global AI Supply Chains, Cost Structures, and Innovation Trajectories

The introduction of new tariff measures by the United States in early 2025 has had profound implications for the global AI supply chain, particularly affecting the import of semiconductors, application-specific integrated circuits, and GPU hardware. By imposing higher duties on certain foreign-manufactured components, the policy has increased procurement costs for domestic AI hardware producers, prompting critical reassessments of supplier diversification strategies and inventory management practices.

While the tariffs have catalyzed near-term cost pressures, they have also initiated a wave of innovation in local manufacturing and design optimization. Hardware vendors are exploring closer partnerships with domestic foundries and investing in R&D to reduce reliance on higher-tariff imports. At the same time, global AI software providers are adjusting pricing models to mitigate margin compression, accelerating transitions to cloud-based delivery models that bypass hardware constraints. These adaptations highlight the resilience of the AI ecosystem, showcasing how industry participants recalibrate operational frameworks to sustain innovation despite shifting trade policies.

Deriving Strategic Insights from Component, Technology, End-Use, Deployment Model, and Organization Size Segmentation to Inform Tailored Market Engagement

Component segmentation reveals a fragmented landscape where hardware, services, and software each play pivotal roles in driving AI adoption. Within hardware, the rapid evolution of application-specific integrated circuits, central processing units, edge devices, and graphics processing units underpins performance improvements across a range of use cases. Meanwhile, consulting, system integration, and support & maintenance services are emerging as differentiators, ensuring that complex AI initiatives are not only deployed but also continuously optimized.

In the software domain, AI platforms and specialized software tools serve as the connective tissue that links data ingestion, model development, and deployment workflows. Technology segmentation provides further granularity by tracking advancements in computer vision applications such as facial recognition, image recognition, and video analytics alongside the maturation of deep learning frameworks including convolutional neural networks, generative adversarial networks, and recurrent neural networks. Machine learning subdivisions spanning reinforcement learning, supervised learning, and unsupervised learning demonstrate how varied algorithmic approaches address unique problem sets. Natural language processing breakthroughs in conversational AI, speech recognition, and text analytics illustrate growing sophistication in human-machine interactions.

End-use segmentation illuminates sector-specific AI adoption pathways, from precision agriculture applications such as crop monitoring to automotive innovations in driver assistance systems, predictive maintenance, and vehicle analytics. The financial services sector leverages algorithmic trading, credit scoring, and risk management models, while energy and utilities companies integrate AI for energy forecasting and smart grid management. Government and defense agencies prioritize cybersecurity and surveillance, while healthcare organizations deploy AI for drug discovery, hospital management systems, medical imaging, and telemedicine. Manufacturing environments rely on predictive maintenance and quality control systems, and retail enterprises optimize customer personalization, fraud detection, and inventory management.

Deployment model segmentation contrasts cloud-based and on-premise solutions, highlighting the trade-offs between scalability, security, and latency. Organizations find that cloud architectures accelerate time to market and lower upfront investment, whereas on-premise deployments offer tighter control over sensitive data and predictable operational costs. Organization size segmentation differentiates the needs of large enterprises from those of small and medium enterprises, noting that larger corporations often invest in bespoke, end-to-end AI ecosystems while smaller organizations prefer modular, turnkey offerings that deliver rapid proof of value.

This comprehensive research report categorizes the Artificial Intelligence market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology

- End-Use

- Deployment Model

- Organization Size

Revealing Regional Nuances and Strategic Imperatives Across the Americas, Europe Middle East & Africa, and Asia Pacific to Guide Targeted Expansion

Regional dynamics present unique considerations, beginning with the Americas where robust venture capital activity, mature technology infrastructures, and a supportive regulatory environment foster rapid AI commercialization. North American enterprises lead in investment while Latin American markets show rising interest in AI-driven agriculture and financial inclusion initiatives. Transitioning to Europe, the Middle East & Africa region, stringent data protection regulations and evolving digital sovereignty frameworks shape enterprise strategies, prompting investments in privacy-enhanced computing and localized data centers.

Within EMEA, adoption rates vary significantly, with Western Europe accelerating digital transformation projects and the Middle East prioritizing smart city deployments. Africa is characterized by burgeoning innovation hubs solving hyperlocal challenges. Finally, Asia-Pacific stands out as a high-growth frontier where government-backed AI programs, large consumer markets, and advanced manufacturing ecosystems converge. China’s emphasis on AI self-sufficiency, Japan’s focus on robotics, and India’s thriving software services sector collectively underscore the region’s strategic importance. These regional insights inform differentiated market entry strategies, tailored solution portfolios, and localized partnership frameworks.

This comprehensive research report examines key regions that drive the evolution of the Artificial Intelligence market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Artificial Intelligence Ecosystem Participants to Illuminate Competitive Strengths, Partnership Strategies, and Innovation Roadmaps

The competitive landscape is defined by a diverse range of players, from hardware titans driving chip innovation to agile software developers crafting turnkey AI platforms. Leading semiconductor firms are investing in next-generation process nodes and heterogeneous computing architectures to deliver specialized accelerators for deep learning workloads. Meanwhile, software vendors differentiate through preconfigured AI modules, industry-specific templates, and managed services that support cloud and hybrid deployment strategies.

Consulting and integration specialists are forging ecosystem partnerships, combining domain expertise with technical proficiency to streamline end-to-end solution delivery. At the same time, emerging disruptors harness open-source communities and data-centric AI approaches to develop novel applications that address niche business challenges. Collaboration between established and emerging participants manifests in joint development initiatives, technology licensing agreements, and shared venture capital funding vehicles. Altogether, these dynamics highlight an ecosystem that is simultaneously competitive and collaborative, accelerating overall market momentum.

This comprehensive research report delivers an in-depth overview of the principal market players in the Artificial Intelligence market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture PLC

- Adobe Inc.

- Alibaba Group Holding Limited

- Altron Limited

- Amazon Web Services, Inc.

- Autodesk, Inc.

- Baidu, Inc.

- Business Connexion (Pty) Ltd. by Telkom Group

- C3.ai, Inc.

- CLEVVA Pty. Ltd.

- Cortex Logic

- Databricks, Inc.

- DataProphet Proprietary Limited

- Dimension Data Holdings PLC by NTT DATA Corporation

- General Electric Company

- Google LLC by Alphabet Inc.

- H2O.ai, Inc.

- Infosys Limited

- Intel Corporation

- International Business Machines Corporation

- Microsoft Corporation

- NVIDIA Corporation

- OpenAI OpCo, LLC

- Oracle Corporation

- Palantir Technologies Inc.

- Qualcomm Inc.

- Robert Bosch GmbH

- Salesforce Inc.

- SAP SE

- SAS Institute Inc.

- ServiceNow, Inc.

- Splunk Inc. by Cisco Systems Inc.

- Tencent Holdings Ltd.

- UiPath, Inc.

Recommending Actionable Strategic Imperatives for Industry Leaders to Capitalize on AI Momentum, Mitigate Risks, and Foster Sustainable Competitive Advantage

Industry leaders seeking to convert AI potentials into tangible outcomes should prioritize establishing clear governance frameworks that align data stewardship with strategic objectives. By defining roles, responsibilities, and performance metrics early in the journey, organizations create a foundation for ethical, scalable AI deployments. In parallel, developing an upskilling agenda that cultivates both data science expertise and domain-specific knowledge will accelerate adoption while mitigating talent shortages.

Furthermore, executives should evaluate hybrid infrastructure architectures that balance the agility of cloud-native services with the security benefits of on-premise deployments. Strategic procurement processes that incorporate total cost of ownership analyses and tariff impact scenarios will safeguard budgets against geopolitical disruptions. To unlock new value pools, cross-industry partnerships and consortium models offer routes to share data assets and co-develop innovative solutions. Finally, iterative pilot programs with embedded feedback loops enable rapid prototyping, risk containment, and course correction, ensuring that AI initiatives deliver measurable business impact.

Detailing Robust Research Methodologies Employed to Ensure Data Integrity, Analytical Rigor, and Comprehensive Coverage of the Artificial Intelligence Landscape

This analysis leveraged a multi-tiered methodology combining primary and secondary research to ensure robustness and validity. Primary research encompassed in-depth interviews with C-level executives, data scientists, and technology integrators, providing qualitative insights into adoption challenges and success factors. Secondary research involved comprehensive reviews of financial reports, regulatory documents, patent filings, and industry publications to map technological trajectories and competitive positioning.

Quantitative data was triangulated through proprietary databases, corroborated by global trade statistics, government policy announcements, and vendor disclosures. Segmentation frameworks were rigorously tested against real-world case studies to ensure their applicability across diverse market scenarios. Analytical tools such as SWOT and Porter’s Five Forces analyses facilitated deeper understanding of competitive pressures and strategic opportunities. Throughout, a peer-review process involving subject matter experts validated findings and refined conclusions to deliver accurate, actionable intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Artificial Intelligence market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Artificial Intelligence Market, by Component

- Artificial Intelligence Market, by Technology

- Artificial Intelligence Market, by End-Use

- Artificial Intelligence Market, by Deployment Model

- Artificial Intelligence Market, by Organization Size

- Artificial Intelligence Market, by Region

- Artificial Intelligence Market, by Group

- Artificial Intelligence Market, by Country

- United States Artificial Intelligence Market

- China Artificial Intelligence Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3339 ]

Synthesizing Key Takeaways and Strategic Considerations to Solidify Understanding of Market Dynamics and Inform Critical Decision Pathways

Across technology components, services, and software, the AI market demonstrates enduring strength driven by continuous innovation and strategic alignment with business priorities. Tariff-induced supply chain recalibrations underscore the importance of adaptive procurement and localized manufacturing capabilities. Segmentation insights reveal that no single solution fits all needs; rather, success hinges on customizing platforms and services to specific technology, deployment, and organizational profiles.

Regionally, the Americas maintain leadership in venture-backed innovation, while EMEA emphasizes regulatory compliance and localized infrastructure. Asia-Pacific emerges as an indispensable growth engine, propelled by government support and massive digital transformation programs. Competitive dynamics highlight a balanced ecosystem where large incumbents and nimble challengers co-innovate, creating a virtuous cycle of technology advancement and market expansion. These key takeaways inform strategic imperatives that will guide industry stakeholders as they navigate evolving market conditions and harness AI to drive sustained competitive advantage.

Driving Engagement with Ketan Rohom to Secure Comprehensive Market Intelligence and Empower Strategic Growth Through Tailored AI Research Offerings

Engaging with Ketan Rohom as your primary point of contact streamlines access to a wealth of AI market research expertise and ensures that your organization receives tailored insights aligned with its unique strategic objectives. By leveraging direct collaboration, you unlock a consultative approach that enables customization of analytical frameworks, integration of proprietary data sets, and continuous alignment with evolving business priorities. This partnership model enhances decision-making agility by providing timely updates on emerging technologies, regulatory shifts, and competitive dynamics that influence long-term growth pathways.

Initiating a conversation with the Associate Director of Sales & Marketing positions your team to benefit from hands-on guidance in selecting the most relevant research deliverables, whether a focused deep-dive into hardware supply chain resilience or a comprehensive exploration of AI adoption patterns across end-use segments. Ketan Rohom’s proven track record in advancing complex technology engagements means your organization will receive not just a report, but a strategic asset that integrates actionable recommendations, risk assessments, and opportunity maps. This collaboration unlocks a customized roadmap for leveraging AI to strengthen core capabilities, optimize operational efficiency, and accelerate time to value.

To take the next step, simply reach out to coordinate a discovery call that aligns your requirements with the ideal research scope. By choosing to partner with Ketan Rohom today, you demonstrate a commitment to data-driven decision-making and position your organization at the forefront of AI-enabled innovation. Secure your competitive advantage now by accessing the insights that will shape tomorrow’s market leaders

- How big is the Artificial Intelligence Market?

- What is the Artificial Intelligence Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?