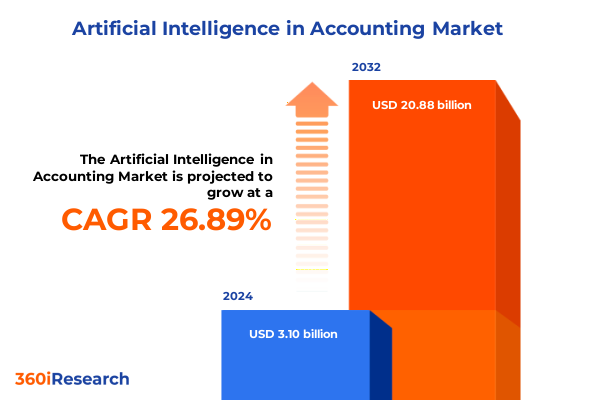

The Artificial Intelligence in Accounting Market size was estimated at USD 3.88 billion in 2025 and expected to reach USD 4.87 billion in 2026, at a CAGR of 27.17% to reach USD 20.88 billion by 2032.

Understanding the Convergence of Artificial Intelligence and Accounting to Propel Innovation and Operational Excellence Across Financial Functions

Artificial intelligence has emerged as a cornerstone for redefining the contours of modern accounting, driving efficiency gains and reshaping traditional financial processes. As organizations grapple with exploding data volumes, heightened regulatory scrutiny, and the demand for real-time insights, AI-powered tools have become indispensable. By automating regression analyses, anomaly detection, and routine reconciliations, accounting teams can elevate their strategic focus and reduce operational costs. In addition, intelligent workflows now support continuous auditing and predictive forecasting, delivering a level of precision and speed that was previously unattainable.

Furthermore, the confluence of cloud computing and advanced analytics is unlocking new paradigms for data collaboration and transparency across finance functions. Companies are adopting scalable architectures that facilitate seamless integration of machine-learning models, natural language processing frameworks, and robotic process automation engines. This integration is not merely an incremental upgrade; it represents a paradigm shift toward proactive decision-making and risk management. Consequently, finance leaders are recalibrating resource allocations to sponsor AI initiatives, while control functions are embedding intelligent monitoring in governance protocols.

Looking ahead, the growth trajectory for AI in accounting will be shaped by evolving regulations, emerging standards for algorithmic transparency, and the imperative to secure sensitive financial data. This executive summary unpacks the transformative forces at play, assesses the impact of recent policy developments, explores segment-level insights, and outlines strategic recommendations. By grounding this analysis in robust research methodology, the following sections offer a comprehensive roadmap for decision-makers intent on harnessing the full potential of artificial intelligence within their accounting ecosystem.

Revolutionary Technological Advances Reshaping Accounting Processes with Intelligent Automation and Machine-Learning Driven Decision-Making

The accounting industry is currently experiencing a wave of transformation driven by the rapid maturation of machine-learning algorithms and intelligent automation platforms. Organizations are no longer confined to batch-run financial processes; instead, they are embracing continuous analytics and cognitive tools that can interpret unstructured data from invoices, contracts, and emails. As a result, manual transaction coding and ledger reconciliation are giving way to self-learning systems that adapt to new data patterns and enforce compliance automatically.

In parallel, natural language processing has enabled AI agents to comprehend regulatory texts and generate draft disclosures or audit reports, significantly reducing the time spent on research and ensuring greater consistency. This shift toward AI-augmented decision-making is further accelerated by the deployment of robotic process automation across repetitive accounting workflows, including accounts payable, expense management, and payroll processing. Consequently, finance teams are refocusing on higher-value tasks such as financial strategy, risk assessment, and stakeholder engagement.

Moreover, the proliferation of cloud-native architectures has facilitated the rapid rollout of AI modules by decoupling development cycles from legacy infrastructure constraints. This agility has fostered experimentation and innovation, allowing firms to pilot new use cases for tax compliance and financial forecasting at scale. The cumulative effect of these technological advances is a reshaping of organizational mindsets, with cross-functional teams collaborating to harness data-driven insights and drive continuous improvement.

Assessing the Cumulative Impact of New United States Trade Tariffs on Accounting Technologies and Cross-Border Financial Workflows in 2025

Recent policy shifts in the United States, particularly the implementation of targeted trade tariffs in early 2025, have introduced new cost considerations for accounting technology providers and end-users alike. These measures, which impose additional duties on imported software components and specialized hardware used in AI deployments, have reverberated across the value chain. Consequently, solution architects and procurement teams are recalibrating total cost of ownership analyses to account for elevated import expenses and potential delays in equipment availability.

In addition, the increased cost of certain semiconductor and server imports has prompted a reevaluation of on-premise versus cloud-based infrastructure strategies. Many enterprises are now accelerating their migration to public and private cloud environments to mitigate capital expenditures, while negotiating service packages that incorporate hardware leasing or local data center provisioning. Small and medium-sized firms, in particular, are seeking managed service offerings that provide bundled support and maintenance, thereby preserving budget predictability.

However, the tariffs have also spurred innovation among domestic service providers and system integrators. Local firms are expanding consulting and integration services to fill gaps in the supply chain, while software developers are optimizing applications to run efficiently on cost-effective microservers and edge-computing platforms. As a result, end-users are increasingly presented with hybrid deployment models that blend on-premise security with cloud scalability, ensuring that AI-driven accounting functions remain resilient amidst shifting trade policies.

Uncovering Critical Insights Through Component, Technology, Deployment, Organization Size, Application, and End-User Segmentation Dynamics

Insights derived from component-level analysis reveal distinct dynamics between services and software offerings. While consulting and integration services continue to underpin large-scale digital transformations, support and maintenance engagements are capturing elevated demand as organizations seek to maximize uptime of mission-critical AI platforms. On the software side, cloud-based solutions have gained traction for their flexibility and rapid deployment cycles, whereas on-premise installations remain prevalent in sectors with stringent data sovereignty requirements.

Technological segmentation underscores the diverse applications of AI methodologies. Deep learning models are central to advanced financial forecasting, enabling budgeting teams to incorporate non-linear risk assessments. Natural language processing drives tax management and audit automation, extracting insights from voluminous regulatory texts and unstructured financial documents. Robotic process automation, in turn, powers routine ledger operations and expense reporting, delivering predictable outcomes with minimal human intervention.

Organizational size influences adoption patterns and vendor engagement strategies. Large enterprises are forging strategic alliances with global solution providers, investing in hybrid cloud infrastructures that balance resilience and scalability. In contrast, small and medium-sized businesses favor cloud-native platforms with straightforward subscription models and embedded support services that mitigate internal IT overhead.

Deployment preferences further differentiate the market landscape. Public cloud environments enable rapid experimentation and elastic capacity, while private and hybrid clouds address compliance imperatives and latency concerns. Within these paradigms, hybrid cloud architectures are emerging as the optimal compromise, delivering both security controls and development agility.

Application segmentation highlights specific functional domains where AI delivers the greatest impact. External and internal audit automation reduces cycle times and enhances anomaly detection, while expense reporting and reimbursement processing streamline employee workflows. Budgeting and risk assessment modules elevate financial forecasting accuracy, and compensation management tools optimize payroll operations. Tax compliance engines expedite filing processes, ensuring adherence to evolving regulations.

Finally, end-user perspectives reveal nuanced requirements across different buyer categories. Accounting firms leverage AI to augment advisory services and improve client deliverables. Corporate enterprises integrate intelligent systems within centralized finance functions to enable global consolidation. Research institutions and universities utilize AI to advance accounting scholarship and pedagogical frameworks. Government agencies and non-profit organizations adopt AI modules to enhance transparency and regulatory compliance, demonstrating the technology’s broad applicability.

This comprehensive research report categorizes the Artificial Intelligence in Accounting market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology

- Organization Size

- Deployment

- Application

- End-User

Evaluating Regional Variations in Artificial Intelligence Adoption for Accounting Across the Americas, Europe Middle East & Africa, and Asia-Pacific

Regional analysis demonstrates that the Americas maintain a leadership position in AI-powered accounting adoption, driven by a robust ecosystem of software vendors, cloud service providers, and innovative startups. The United States, in particular, benefits from a favorable regulatory framework that encourages data center expansion and incentivizes research and development. Canada and Latin American economies are gradually following suit, leveraging partnerships with global providers to introduce AI applications tailored to local compliance requirements.

Meanwhile, Europe, the Middle East, and Africa present a mosaic of regulatory landscapes and digital maturity levels. In Western Europe, stringent data privacy regulations have fostered the rise of private and hybrid cloud deployments, with finance teams prioritizing on-premise encryption and AI-driven compliance monitoring. Central and Eastern European markets are witnessing increased interest in audit automation, while Middle East governments are investing in national AI strategies that emphasize public sector modernization. Across Africa, a growing number of non-profit organizations and small enterprises are piloting expense management and payroll automation solutions to streamline financial operations despite constrained budgets.

Asia-Pacific emerges as the fastest-growing region for AI in accounting, propelled by government-backed digital transformation initiatives and a vibrant technology services sector. China leads with state-sponsored pilot programs in tax management automation, while Japan and South Korea emphasize integration of AI into established enterprise resource planning systems. Southeast Asian economies, including India and Australia, are expanding cloud infrastructure and enabling localized AI applications that address multilingual regulatory challenges. This convergence of policy support, infrastructure investment, and cross-border collaboration underscores the region’s pivotal role in shaping the future of intelligent accounting solutions.

This comprehensive research report examines key regions that drive the evolution of the Artificial Intelligence in Accounting market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing the Strategies, Innovations, and Partnerships Driving Progress and Competition Among Leading Artificial Intelligence in Accounting Solution Providers

Leading solution providers are pursuing differentiated strategies that combine platform innovation, strategic alliances, and targeted acquisitions. Enterprise software vendors have integrated AI modules into their core financial suites, enabling seamless deployment of intelligent forecasting, compliance monitoring, and continuous auditing across global client bases. Their emphasis on open APIs and partner ecosystems supports customization and fosters an expanding network of value-added resellers.

Conversely, specialized fintech firms are carving out niches by offering purpose-built AI applications, such as advanced natural language processing engines for regulatory interpretation and robotic process automation platforms optimized for transactional efficiency. These providers often collaborate with system integrators to deliver end-to-end implementations, coupling domain expertise with technical capabilities. Recent partnerships between leading SaaS vendors and managed service providers highlight a trend toward bundled offerings, which combine software licensing, cloud hosting, and ongoing support into unified contracts.

Start-ups are also playing a critical role in driving innovation, focusing on emerging technologies such as generative AI for financial statement narrative generation and edge computing for decentralized ledger reconciliation. Venture-backed entrants leverage agile development methodologies to release frequent updates, while larger incumbents are responding with accelerated investment in research and development. Ultimately, the competitive landscape is defined by a balance between the breadth of integrated platforms and the depth of specialized solutions, offering clients the flexibility to pursue bespoke AI strategies aligned with their organizational objectives.

This comprehensive research report delivers an in-depth overview of the principal market players in the Artificial Intelligence in Accounting market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amazon.com, Inc.

- AppZen Inc.

- Bill.com, Inc.

- Botkeeper, Inc.

- Deloitte Touche Tohmatsu Limited

- Docyt Inc.

- Ernst & Young LLP

- International Business Machines Corporation

- Intuit Inc.

- Kore.ai, Inc.

- KPMG International Limited

- Microsoft Corporation

- MindBridge Analytics Inc.

- Ocrolus Inc.

- OneUp

- OSP Labs, Inc.

- PricewaterhouseCoopers LLP

- Sage Group PLC

- SMACC GmbH

- Truewind

- Trullion Inc.

- UiPath, Inc.

- Vic.ai

- Xero Limited

- Zeni Inc.

- Zoho Corporation Pvt. Ltd.

Actionable Strategic Recommendations for Industry Leaders to Harness Artificial Intelligence for Enhanced Accounting Efficiency and Risk Mitigation

Industry leaders should establish a clear strategic vision for artificial intelligence integration, beginning with the identification of high-value use cases that address key pain points such as audit cycle inefficiencies and manual data extraction. Business executives must collaborate with IT stakeholders to define success metrics, create a centralized data governance framework, and prioritize investments in scalable cloud or hybrid infrastructures. By aligning technology roadmaps with organizational objectives, companies can reduce implementation risk and accelerate time to value.

Moreover, forging partnerships with technology specialists and academic institutions can enhance internal capabilities in machine learning and natural language processing. Leaders should negotiate flexible service agreements that include regular software updates, expert support, and performance-based incentives. Simultaneously, upskilling programs for finance professionals are essential to ensure user adoption and foster a culture of innovation. Clear communication strategies, combined with iterative pilot programs, will build confidence and demonstrate tangible returns.

To mitigate regulatory and operational risks, organizations should adopt explainable AI frameworks that provide audit trails and transparent decision-making pathways. Engaging with industry consortia and regulatory working groups can influence emerging standards and ensure compliance. Finally, establishing feedback loops with end-users and continuous monitoring mechanisms will enable proactive optimization, ensuring that AI systems evolve in tandem with shifting business requirements and market dynamics.

Robust Research Methodology Combining Secondary Data Analysis Expert Interviews and Data Triangulation to Ensure Accuracy and Depth

This analysis is underpinned by a rigorous research framework that integrates multiple data sources and methodologies. The secondary research phase encompassed reviews of corporate annual reports, regulatory filings, white papers, and academic publications to establish a comprehensive understanding of technology trends and policy developments. In parallel, proprietary databases and open-source repositories were examined to identify active patents, strategic alliances, and emerging solution providers.

Primary research was conducted through in-depth interviews with senior finance and IT executives, system integrators, AI technology architects, and academic subject-matter experts. These conversations illuminated real-world adoption challenges, success factors, and innovation roadmaps. Insights were validated through a multi-stage data triangulation process, which juxtaposed supply-side intelligence from vendor disclosures against demand-side feedback from end-users.

Quantitative analyses employed descriptive statistical techniques to map deployment preferences, technological maturity levels, and segmentation dynamics. Qualitative findings were enriched by thematic coding of interview transcripts, enabling the identification of common patterns and divergent strategies. Throughout the research cycle, an external advisory panel provided peer review to ensure methodological rigor, accuracy, and unbiased interpretation of results.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Artificial Intelligence in Accounting market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Artificial Intelligence in Accounting Market, by Component

- Artificial Intelligence in Accounting Market, by Technology

- Artificial Intelligence in Accounting Market, by Organization Size

- Artificial Intelligence in Accounting Market, by Deployment

- Artificial Intelligence in Accounting Market, by Application

- Artificial Intelligence in Accounting Market, by End-User

- Artificial Intelligence in Accounting Market, by Region

- Artificial Intelligence in Accounting Market, by Group

- Artificial Intelligence in Accounting Market, by Country

- United States Artificial Intelligence in Accounting Market

- China Artificial Intelligence in Accounting Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2385 ]

Concluding Insights Highlighting the Future Trajectory of Artificial Intelligence in Accounting and Its Implications for Stakeholders and Decision-Makers

As artificial intelligence continues its ascent in accounting, stakeholder readiness and strategic alignment will determine which organizations emerge at the forefront of this evolution. The confluence of advanced technologies, shifting policy frameworks, and changing buyer preferences underscores the importance of a holistic approach that balances innovation with governance. By leveraging the insights presented in this summary, finance and technology leaders can chart a course toward more intelligent, resilient, and adaptive accounting operations.

Ultimately, the journey toward AI-enabled accounting is iterative and requires sustained commitment to experimentation, capability development, and stakeholder engagement. Those who proactively integrate AI into their core financial processes stand to realize substantial gains in efficiency, accuracy, and strategic influence. Conversely, delaying adoption may result in increasing competitive pressure and missed opportunities for operational excellence. This analysis offers a roadmap to navigate the complexities and capitalize on the transformative potential of artificial intelligence in accounting.

Engaging with Ketan Rohom to Secure Your Artificial Intelligence in Accounting Market Research Report Today and Gain Competitive Advantage

Engaging with Ketan Rohom offers direct access to tailored insights and premium advisory support for organizations seeking to leverage advanced artificial intelligence solutions within their accounting operations. His strategic guidance will enable your team to navigate complex regulatory environments, optimize implementation roadmaps, and prioritize high-impact use cases that drive immediate value. By securing the report, stakeholders gain a competitive edge through granular analysis, expert-validated methodologies, and actionable data that can accelerate decision-making and foster sustained innovation. This partnership opportunity is designed to empower executive leadership and finance teams with the clarity and confidence needed to transform accounting functions through intelligent technologies. Reach out today to initiate a dialogue and obtain the comprehensive artificial intelligence in accounting market research report that will underpin your strategic initiatives and support your journey toward operational excellence

- How big is the Artificial Intelligence in Accounting Market?

- What is the Artificial Intelligence in Accounting Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?