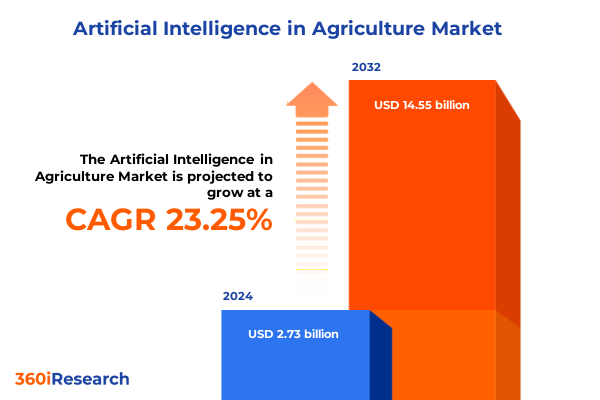

The Artificial Intelligence in Agriculture Market size was estimated at USD 1.94 billion in 2025 and expected to reach USD 2.17 billion in 2026, at a CAGR of 13.60% to reach USD 4.75 billion by 2032.

Unveiling how artificial intelligence is reshaping traditional farming paradigms and driving a wave of data-driven innovation across agricultural operations globally

The agricultural sector is undergoing a fundamental transformation as artificial intelligence (AI) integrates across every facet of farm operations and food supply chains. Advances in data processing, sensor technology, and machine learning algorithms are converging to enable real-time decision-making, predictive maintenance, and resource optimization at scales previously unattainable. These developments are redefining the roles of agronomists and farm managers, empowering them with precise insights into crop health, soil conditions, and livestock welfare.

Building on decades of incremental digitization, modern farmers now harness AI-driven platforms to translate terabytes of environmental and operational data into actionable strategies. From drone-based imaging that identifies pest outbreaks to predictive analytics forecasting harvest times, the sector has moved from reactive to proactive management. As a result, both established agribusinesses and innovative startups are coalescing around new business models that emphasize outcome-based services and recurring revenue from data subscriptions.

Looking ahead, AI’s evolving capabilities will extend beyond efficiency gains to address broader sustainability goals. By optimizing water usage, reducing chemical inputs, and minimizing waste, intelligent agriculture solutions will play a pivotal role in meeting global food demand under the pressures of climate change and resource scarcity. This report delves into these dynamics, setting the stage for deeper insights into the forces reshaping agriculture today.

Exploring the dramatic evolution from manual agriculture to autonomous operations fueled by cloud-native services collaborative networks and edge computing capabilities

Over the last decade, the agricultural landscape has shifted from manual field inspections and post-harvest analysis toward real-time monitoring and predictive modeling enabled by AI advances. Autonomous drones and ground-based robots have supplanted labor-intensive tasks, while machine vision systems now detect nutrient deficiencies and disease more accurately than human scouts ever could. These transformations are underscored by a growing ecosystem of cloud-native platforms where stakeholders share and refine models, driving collective learning across geographies and crops.

Simultaneously, farm input providers and technology vendors have migrated from one-off hardware sales to integrated service offerings. Clients now subscribe to full-stack solutions encompassing sensors, analytics engines, and expert support, unlocking continuous performance improvements through iterative software updates. This servitization echoes broader industrial trends and reflects the rising customer demand for turnkey solutions that provide clear return-on-investment metrics and seamless integration with existing operations.

Moreover, cross-industry collaborations between agriculture, telecommunications, and energy sectors have spurred the adoption of low-power wide-area networks and edge computing, enabling pervasive connectivity even in remote areas. By shifting processing closer to the source of data, latency is reduced and data privacy is preserved, fostering scalability. Together, these shifts herald an era where precision agriculture is fully automated, distributed, and intelligence-driven, redefining stakeholder expectations and market dynamics.

Analyzing how recent United States tariff measures on high-tech agricultural components are reshaping supply chains fueling domestic innovation and impacting adoption costs

In 2025, United States tariff adjustments targeting high-tech imports have introduced a layer of complexity for agriculture technology providers and end users alike. By imposing increased duties on drone components, advanced sensors, and specialized imaging hardware, policymakers aimed to protect domestic manufacturing while maintaining market access for critical technologies. These measures have elevated input costs for hardware-dependent solutions, prompting a reevaluation of procurement strategies across the value chain.

As a consequence, some service providers have accelerated the localization of their supply chains, forging partnerships with North American electronics manufacturers to mitigate tariff impacts. Simultaneously, software-centric firms have emphasized subscription models and cloud-based analytics to offset upfront hardware price increases and realign their revenue streams. Farm operators have responded by prioritizing modular systems that allow incremental upgrades, thus preserving capital budgets and maintaining operational continuity.

Despite short-term cost pressures, the tariff-driven pivot to domestic sourcing has catalyzed innovation within local industry clusters. Research institutions and start-ups have collaborated to develop next-generation sensors and imaging modules designed for manufacturability within US facilities. Over time, these developments promise to strengthen North American leadership in precision agriculture hardware, reduce dependency on imports, and curtail exposure to future trade policy volatility.

Synthesizing a comprehensive segmentation framework that interlinks offerings applications technologies deployment modes and endusers shaping AI agriculture pathways

A holistic view of the agriculture AI market reveals diverse revenue streams across hardware, services, and software. Within hardware, cameras, drone platforms, and a spectrum of sensor technologies form the foundation of data acquisition strategies. Meanwhile, services encompass advisory consulting, system implementation, and ongoing technical support, each offering distinct value propositions that guide technology integration and user adoption. Complementing these elements, software platforms provide analytics engines for data interpretation, decision support systems for operational guidance, and farm management suites that integrate multiple workflows into unified dashboards.

The intended applications of these solutions span crop monitoring, livestock management, soil health assessment, supply chain optimization, and yield forecasting. In crop environments, subdomains such as disease detection, irrigation scheduling, and nutrient analysis leverage advanced computer vision and predictive modeling to enhance field-level performance. Livestock operations benefit from feed optimization algorithms and health monitoring sensors that detect stress indicators. Soil scientists rely on in situ analysis and moisture tracking to refine amending strategies, while supply chain stakeholders adopt logistics optimization and traceability solutions to streamline distribution. Yield prediction marries meteorological data with crop growth simulations to generate actionable forecasts for harvest planning.

Underpinning this landscape are enabling technologies such as fixed-wing and rotary-wing drones, optical and thermal imaging systems, AI algorithms, machine learning frameworks, automated harvesting robots, and autonomous tractors. Deployment models vary from cloud-native analytics platforms to hybrid solutions that combine edge computing with centralized data repositories, and fully on-premise systems for users prioritizing data sovereignty. Across these configurations, end users-including agrochemical firms, large-scale commercial growers, research institutes, and small to medium-sized farms-tailor technology choices to their unique operational needs and capital structures.

This comprehensive research report categorizes the Artificial Intelligence in Agriculture market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Deployment Mode

- Technology

- Application

- End User

Uncovering dynamic regional drivers across Americas EMEA and AsiaPacific that influence adoption rates investment priorities and technology strategies

From the Americas through the Asia-Pacific region, geography plays a pivotal role in the pace of AI agriculture adoption and the competitive landscape of providers. In North America and Latin America, expansive arable lands and established value chains have fostered rapid uptake of precision technologies, driven by leading agribusinesses and government incentive programs. Across South America, governments and cooperatives have partnered with technology vendors to pilot soil moisture networks and drone monitoring systems, laying the groundwork for broader commercialization.

In Europe, the Middle East, and Africa, regulatory frameworks emphasizing sustainability and food safety have propelled investments in traceability solutions and resource-efficient farming practices. The European Union’s Green Deal initiatives, for instance, have accelerated the use of analytics platforms to track input usage and environmental impacts. Meanwhile, in the Middle East and North Africa, water scarcity challenges have catalyzed remote sensing and irrigation automation projects. Sub-Saharan Africa has witnessed collaborative efforts between research organizations and NGOs to deploy low-cost sensors and mobile-enabled decision support systems for smallholder farmers.

Asian-Pacific markets showcase a spectrum of maturity, from high-tech deployments in Australia and New Zealand to emerging implementations in South and Southeast Asia. China and India, with their vast agricultural outputs, are investing heavily in AI-driven yield enhancement and supply chain digitization. In Southeast Asia, public-private partnerships are advancing integrated platforms that combine weather forecasting with crop modeling to bolster resilience against climate volatility. Collectively, these regional dynamics underscore the necessity of localized strategies that reflect regulatory environments, infrastructure capabilities, and end-user requirements.

This comprehensive research report examines key regions that drive the evolution of the Artificial Intelligence in Agriculture market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Interpreting competitive positioning as hardware innovators service specialists and software disruptors converge around open platforms and strategic alliances

Leading players in the agriculture AI ecosystem span established technology titans, specialized equipment manufacturers, and nimble software innovators. Hardware vendors are enhancing their imaging and sensing portfolios through partnerships with semiconductor companies and academic labs, infusing next-generation optics and signal processing into their products. Services specialists, ranging from global consultancy firms to regional system integrators, differentiate themselves by offering tailored deployment roadmaps, ROI assessments, and training programs designed for diverse farm sizes.

On the software front, platform providers are in a race to enrich their analytics capabilities with cross-crop modeling, real-time anomaly detection, and seamless integration with third-party data sources such as satellite imagery and local weather feeds. Start-ups are also disrupting traditional value chains by offering niche modules optimized for specific crop types, soil conditions, or livestock breeds, leveraging agile development cycles to incorporate user feedback rapidly. Simultaneously, research institutes continue to spin off commercial ventures, translating breakthroughs in machine learning and robotics into market-ready solutions.

Collectively, these companies are forging strategic alliances and consortiums to accelerate interoperability, reduce barriers to entry, and drive standardization across data formats and communication protocols. As a result, the ecosystem is converging toward open architectures that empower end users to mix and match hardware, software, and services from multiple providers, ensuring flexibility and future-proofing investments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Artificial Intelligence in Agriculture market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGCO Corporation

- BASF SE

- Bayer AG

- CNH Industrial N.V.

- Corteva, Inc.

- Deere & Company

- Farmers Edge Limited

- FarmWise Labs, Inc.

- Google LLC

- International Business Machines Corporation

- Microsoft Corporation

- Oracle Corporation

- Syngenta AG

- Taranis Inc.

- Trimble Inc.

- Valmont Industries, Inc.

- Wipro Limited

- Yara International ASA

Crafting strategic roadmaps that integrate open architectures ethical AI practices and localized solutions to drive adoption and recurring revenue growth

Industry leaders should prioritize building scalable ecosystems that integrate hardware, software, and advisory services into cohesive, outcome-driven offerings. By adopting modular architectures and open APIs, providers can enable seamless interoperability, reducing integration costs for end users and accelerating time to value. Collaborating with research institutions and participating in industry consortia will ensure access to the latest breakthroughs in computer vision, robotics, and AI algorithms while fostering standards that enhance market transparency.

Furthermore, service differentiation through value-added consulting, proactive support models, and performance-based contracting will strengthen customer retention and generate recurring revenue streams. Developers should invest in user education programs and customizable training modules that translate technical capabilities into clear operational benefits. Equally important is the pursuit of responsible AI practices, incorporating ethical data governance frameworks and robust cybersecurity measures to build trust among stakeholders and comply with evolving regulatory standards.

Finally, expanding localization strategies-whether by onshoring manufacturing of critical components or adapting software interfaces to local languages and agronomic practices-will mitigate trade policy risks and amplify global market reach. By aligning innovation roadmaps with regional sustainability targets and subsidy programs, companies can position themselves as strategic partners in the agricultural transformation journey and capture long-term growth opportunities.

Detailing a rigorous multi-method research protocol integrating stakeholder dialogues literature analysis and proprietary data verification procedures

This research employed a multi-method approach combining primary stakeholder interviews, secondary literature review, and proprietary data synthesis. Key insights were gathered through structured conversations with farm operators, agronomists, equipment manufacturers, and technology providers across major agricultural regions. These dialogues provided qualitative perspectives on adoption challenges, performance expectations, and evolving partnership models.

Complementing the interview data, an exhaustive review of peer-reviewed publications, patent filings, government policy documents, and technology vendor collateral was conducted to identify technological milestones and regulatory catalysts. A proprietary taxonomy grounded in industry-standard segmentation frameworks was used to categorize offerings, applications, technologies, deployment modes, and end-user profiles, ensuring consistency and comparability across geographies and market segments.

Quantitative data were triangulated from publicly available trade statistics, academic research databases, and selected corporate financial disclosures, allowing for the validation of emerging trends and cross-region comparisons. Finally, internal experts synthesized these inputs into an integrated narrative, subjecting assumptions to rigorous validation sessions and peer reviews to maintain objectivity and analytical rigor.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Artificial Intelligence in Agriculture market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Artificial Intelligence in Agriculture Market, by Offering

- Artificial Intelligence in Agriculture Market, by Deployment Mode

- Artificial Intelligence in Agriculture Market, by Technology

- Artificial Intelligence in Agriculture Market, by Application

- Artificial Intelligence in Agriculture Market, by End User

- Artificial Intelligence in Agriculture Market, by Region

- Artificial Intelligence in Agriculture Market, by Group

- Artificial Intelligence in Agriculture Market, by Country

- United States Artificial Intelligence in Agriculture Market

- China Artificial Intelligence in Agriculture Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2862 ]

Synthesizing the transformative power of AI agriculture solutions underscoring segmentation synergies regional nuances and paths to sustained growth

The convergence of AI, robotics, and data analytics marks a paradigm shift in agriculture, with transformative implications for productivity, sustainability, and supply chain resilience. Advances in sensor-based monitoring, machine vision, and predictive modeling are redefining farm management practices, while service-based business models and open architecture platforms are democratizing access to cutting-edge solutions.

Although recent tariff measures have introduced short-term cost challenges, they have simultaneously spurred domestic innovation and supply chain localization, laying the groundwork for strengthened regional capabilities. A clear segmentation framework highlights the interdependencies between hardware, software, and services, revealing how tailored solutions across applications and deployment modes cater to diverse end-user needs. Regional insights underscore the importance of contextual strategies, reflecting differences in regulatory environments, infrastructure maturity, and agronomic priorities.

Looking forward, industry leaders who embrace modular design, ethical AI governance, and collaborative ecosystems will be best positioned to navigate trade uncertainties and sustain growth. The insights presented in this executive summary provide a strategic foundation for stakeholders seeking to harness the full potential of artificial intelligence in agriculture and to contribute to a more productive and sustainable global food system.

Elevate your strategic positioning in agriculture technology by securing authoritative market intelligence directly through Ketan Rohom Associate Director Sales & Marketing

We invite you to partner with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to access our comprehensive exploration of artificial intelligence in agriculture. By engaging with Ketan, you will receive tailored insights that align with your strategic priorities and operational requirements. Our market intelligence provides the analysis and clarity you need to make informed investment decisions, identify partnership opportunities, and optimize technology adoption across your agricultural value chain.

To secure a copy of the full market research report, please reach out to Ketan Rohom. He will guide you through the report’s detailed findings, help you explore custom data solutions, and facilitate your acquisition of the information that will empower your organization to lead in the evolving landscape of AI-driven agriculture. Take the next step toward strategic advantage by connecting with Ketan today to obtain your report and unlock actionable intelligence.

- How big is the Artificial Intelligence in Agriculture Market?

- What is the Artificial Intelligence in Agriculture Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?