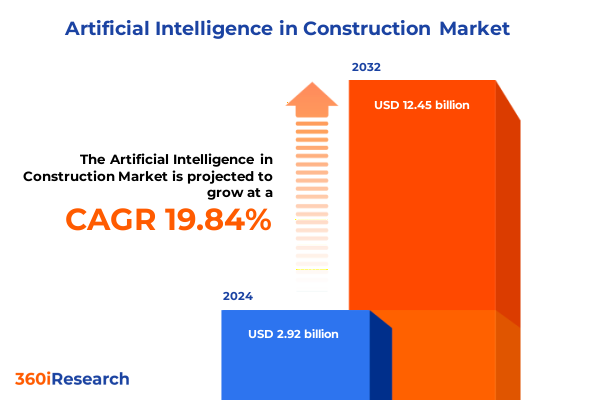

The Artificial Intelligence in Construction Market size was estimated at USD 3.47 billion in 2025 and expected to reach USD 4.12 billion in 2026, at a CAGR of 20.01% to reach USD 12.45 billion by 2032.

Pioneering the Integration of Artificial Intelligence to Revolutionize Construction Processes and Deliver Unparalleled Efficiency Across the Industry

In the face of growing project complexity and cost pressures, construction firms are increasingly turning to artificial intelligence to drive efficiency and innovation. Artificial intelligence now underpins predictive analytics that forecast potential schedule delays and resource constraints, enabling project teams to take decisive action before minor setbacks escalate into major disruptions. Parallel to this shift, generative design tools are automating routine tasks-such as structural optimization and energy efficiency analysis-freeing engineers and architects to focus on high-value strategic decisions and creative problem solving.

Furthermore, the synergy between AI and cloud-based Building Information Modeling platforms has redefined collaboration across geographically dispersed teams. These systems synchronize design iterations in real time, ensuring that every stakeholder-from subcontractor to owner-accesses the latest project data. As a result, cost overruns caused by miscommunication and version control errors have declined significantly, driving quicker turnaround times and improved project outcomes.

Lastly, advanced reality capture through drone-based LiDAR surveys and 3D laser scanning is feeding detailed, up-to-date site models directly into AI-powered workflows. By automating topographic and as-built data collection, firms are reducing site survey times from days to hours while improving the accuracy of digital twins. This convergence of AI, cloud, and reality capture is laying the foundation for a new era of data-driven construction management and operational excellence.

Unprecedented Shifts Shaping Construction Through Cutting-Edge Digital Technologies and Evolving Industry Strategies to Meet Modern Project Demands

The past several years have witnessed a fundamental transformation in construction technology, driven by the emergence of AI-enabled autonomous machinery and data-driven decision making. Robotics equipment is now executing repetitive tasks-such as bricklaying and concrete pouring-with precision and consistency, mitigating labor shortages and reducing rework. Alongside automation, computer vision systems are continuously monitoring jobsite conditions, identifying safety hazards in real time, and issuing proactive alerts that have demonstrably lowered incident rates.

Concurrently, machine learning algorithms are being integrated with project management platforms to deliver predictive maintenance insights. By analyzing IoT sensor data embedded in heavy machinery and critical equipment, AI models can anticipate component failures before they occur, thereby minimizing unexpected downtime and costly schedule disruptions. This proactive maintenance paradigm is rapidly becoming best practice for contractors seeking to maximize asset utilization and extend equipment lifecycles.

Moreover, the convergence of digital twin technology with real-time operational intelligence is enabling stakeholders to simulate project scenarios, test design variants, and optimize resource allocations before ground is ever broken. This holistic approach to project delivery is reshaping stakeholder expectations, elevating the role of data analytics from a supporting function to a strategic differentiator in high-stakes construction environments.

Assessing the Compound Effects of 2025 United States Tariff Policies on Construction Material Costs Supply Chains and Project Viability Nationwide

In early June 2025, a presidential proclamation increased tariffs on imported steel and aluminum to 50 percent ad valorem, directly impacting the cost structure of U.S. construction projects and heightening concerns around budget overruns and supply chain disruptions. Prior to this escalation, builders were already facing material cost inflation of up to 20 percent owing to earlier 25 percent levies, with ripple effects evident across everything from structural steel framing to specialized robotics components sourced overseas.

These tariff measures have not only inflated direct material expenses but have also triggered secondary surcharges across a wide array of construction machinery and components. Manufacturers and suppliers have responded by imposing additional fees-often in the range of 3 to 5 percent-to offset elevated import duties. Such surcharges have compounded the total cost of ownership for advanced AI-enabled equipment, prompting firms to reevaluate procurement strategies and, in some cases, delay planned technology upgrades.

Moreover, the broader trade policy uncertainty has driven contractors to diversify their sourcing strategies, balancing domestic procurement with alternative international partnerships to secure critical supplies. While this adaptive approach has alleviated some short-term cash flow pressures, it has introduced new logistical complexities and elongated lead times by up to 30 percent, thereby challenging contractors to optimize inventory forecasts and schedule buffers with unprecedented precision.

Illuminating the Diverse Market Segments Driving Artificial Intelligence Adoption Along Component Application End User Technology and Deployment Dimensions

The artificial intelligence in construction market can be dissected along multiple dimensions, each revealing unique pathways to innovation. From a component perspective, hardware encompasses drones, IoT devices, robotics equipment, and sensors, forming the physical scaffolding upon which data-driven decision making rests. Meanwhile, services-ranging from integration consulting to support maintenance and specialized workforce training-play a pivotal role in ensuring that organizations harness the full potential of their AI investments. Complementing these layers, software solutions span AI software platforms, analytics tools, and BIM software, delivering the computational intelligence that powers everything from predictive insights to automated design generation.

Application segmentation surfaces how AI technologies are reshaping every phase of construction. AI-driven design modeling accelerates concept validation, whereas predictive analytics for equipment maintenance enhances uptime. Project management platforms now embed collaboration and scheduling tools to orchestrate complex workflows, and quality control systems leverage defect detection and inspection modules to uphold construction standards. In the safety domain, predictive monitoring and video analytics proactively identify site hazards, safeguarding labor forces and reinforcing compliance protocols.

Market dynamics further evolve based on end user profiles, with civil and structural engineers leveraging AI for precision design, contractors deploying autonomous machinery for on-site execution, infrastructure owners monitoring asset health through digital twins, and real estate developers integrating predictive analytics to optimize capital allocation. Each of these distinct end user segments underscores the tailored value proposition that AI solutions deliver across the construction ecosystem.

This comprehensive research report categorizes the Artificial Intelligence in Construction market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology Type

- Deployment Mode

- Project Type

- Application

- End User

Unveiling Regional Variances in AI Implementation Across the Americas EMEA and Asia-Pacific to Highlight Growth Drivers and Unique Market Dynamics

Across the Americas, advanced economies in North America are spearheading the adoption of AI-enabled construction technologies, driven by supportive regulatory frameworks, extensive infrastructure renewal programs, and widespread integration of cloud-based collaboration platforms. Latin American markets, while nascent in their digital transformation journeys, are beginning to pilot IoT-driven monitoring solutions to enhance project transparency and accelerate payment cycles under public-private partnership models.

In Europe, Middle East, and Africa, mature markets in Western Europe are leveraging stringent sustainability mandates to deploy AI-powered energy management systems and digital twin simulations that optimize building performance throughout the asset lifecycle. Simultaneously, mega-infrastructure projects across the Gulf Cooperation Council are embracing robotics and modular construction to achieve rapid execution timelines, while sub-Saharan regions focus on low-cost AI applications such as remote condition monitoring to extend the service life of critical utilities.

Asia-Pacific represents the most dynamic frontier, with government-led smart city initiatives in China and South Korea fueling large-scale trials of autonomous cranes, 3D printing technologies, and machine learning-based resource planning. Australia’s robust BIM adoption and Japan’s focus on construction robotics both underscore a region characterized by ambitious innovation pipelines, heightening competitive pressure for solution providers and project stakeholders alike.

This comprehensive research report examines key regions that drive the evolution of the Artificial Intelligence in Construction market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining the Strategic Moves and Technological Alliances of Leading Enterprises Shaping the AI-Driven Construction Ecosystem Globally

Leading technology vendors are actively forging strategic alliances to consolidate their foothold in the AI in construction landscape. Global software providers have integrated machine learning modules directly into their BIM and project management suites, creating unified platforms that traverse the design and build continuum. Collaboration between legacy equipment manufacturers and AI startups has also produced retrofit sensor kits that convert conventional machinery into smart assets capable of self-diagnosing maintenance needs and transmitting performance data in real time.

At the same time, cloud infrastructure specialists are partnering with edge computing innovators to reduce latency in mission-critical AI applications, such as live safety analytics and autonomous vehicle navigation on active job sites. This ecosystem of partnerships underscores the sector’s recognition that no single entity can address the breadth of data collection, algorithm development, and field deployment requirements in isolation.

Furthermore, several market leaders are making targeted investments in specialized training academies and certification programs to build a workforce capable of bridging the gap between construction domain expertise and advanced data science skills. These initiatives reflect an emerging industry consensus: long-term success hinges not only on technological prowess but also on the human capital needed to operationalize and scale AI solutions across complex construction portfolios.

This comprehensive research report delivers an in-depth overview of the principal market players in the Artificial Intelligence in Construction market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adobe Inc.

- Advanced Micro Devices, Inc.

- Amazon Web Services, Inc.

- Autodesk, Inc.

- Basler AG

- Bentley Systems, Incorporated

- Clarifai, Inc.

- Cognex Corporation

- Fujitsu Limited

- Google LLC by Alphabet Inc.

- Hailo Technologies Ltd.

- Hexagon AB

- Honeywell International Inc.

- Infosys Limited

- Intel Corporation

- International Business Machines Corporation

- Meta Platforms, Inc.

- Microsoft Corporation

- NetApp, Inc.

- Nvidia Corporation

- Oracle Corporation

- Procore Technologies, Inc.

- SAP SE

- Trimble Inc.

Empowering Construction Stakeholders with Tactical AI Adoption Roadmaps Operational Guidelines and Strategic Partnerships to Drive Competitive Advantage

Industry leaders should initiate small-scale pilot programs that integrate AI-driven predictive maintenance tools with existing asset management workflows, enabling teams to validate performance improvements and calculate return-on-investment metrics before broader deployment. By coupling these pilots with targeted training sessions and cross-functional workshops, organizations can cultivate internal expertise and build stakeholder confidence in data-driven decision making.

Moreover, construction firms are advised to develop strategic partnerships with specialized AI vendors that can offer modular integration services, thereby avoiding costly rip-and-replace scenarios. Such alliances should be governed by joint innovation roadmaps that align technology roadmaps with project timelines, ensuring that AI implementations dovetail with planned capital expenditures and site readiness schedules.

Finally, establishing a centralized data governance framework is essential for maximizing AI efficacy and compliance. This framework must define clear protocols for data ingestion, quality assurance, security controls, and privacy safeguards. In doing so, firms will not only enhance algorithmic accuracy but also meet evolving regulatory requirements, thereby fostering a scalable environment for ongoing AI innovation.

Detailing the Rigorous Research Framework Data Collection and Analytical Techniques Underpinning the AI in Construction Market Insights and Observations

This research initiative employed a multi-tiered methodology combining extensive primary interviews with C-level executives, project managers, and technology specialists across the construction value chain. These qualitative insights were complemented by systematic secondary research, which encompassed the analysis of industry white papers, regulatory filings, technical journals, and reputable trade publications.

Data triangulation was achieved by cross-referencing third-party vendor disclosures, case study performance metrics, and anonymous benchmarking surveys to validate anecdotal findings and ensure consistency across distinct data sets. The analytical framework included scenario modeling and stress-testing of key variables-such as tariff fluctuations and equipment utilization rates-to assess the robustness of strategic recommendations under varying market conditions.

Finally, all findings were subjected to peer review by an advisory panel composed of leading industry practitioners and academic experts in construction management and data science. Their critical feedback refined the final deliverables, enhancing the report’s credibility and ensuring that the insights remain actionable for decision makers at every level.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Artificial Intelligence in Construction market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Artificial Intelligence in Construction Market, by Component

- Artificial Intelligence in Construction Market, by Technology Type

- Artificial Intelligence in Construction Market, by Deployment Mode

- Artificial Intelligence in Construction Market, by Project Type

- Artificial Intelligence in Construction Market, by Application

- Artificial Intelligence in Construction Market, by End User

- Artificial Intelligence in Construction Market, by Region

- Artificial Intelligence in Construction Market, by Group

- Artificial Intelligence in Construction Market, by Country

- United States Artificial Intelligence in Construction Market

- China Artificial Intelligence in Construction Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3657 ]

Synthesizing Key Learnings and Future Outlook for Artificial Intelligence in Construction to Guide Informed Decision Making and Strategic Planning

In synthesizing the key themes from this executive summary, it is evident that artificial intelligence is poised to redefine every facet of construction, from conceptual design through to facility management. The convergence of machine learning, robotics, and digital twin technologies offers a powerful toolkit for mitigating longstanding industry challenges-such as labor shortages, schedule overruns, and safety risks-while unlocking new pathways for sustainable and efficient project delivery.

Moreover, the shifting trade policy landscape and associated tariff implications underscore the necessity for agile sourcing strategies and robust risk management frameworks. As firms navigate evolving cost structures and supply chain complexities, the ability to seamlessly integrate AI tools will become a critical differentiator in project execution and long-term asset performance.

Looking ahead, the successful organizations will be those that balance technological ambition with organizational preparedness-cultivating the data governance, talent pipeline, and partnership ecosystems required to sustain continuous innovation. In this way, artificial intelligence will not merely enhance existing practices but will catalyze a fundamental transformation in how the built environment is conceived, constructed, and managed.

Engage with Ketan Rohom to Unlock Comprehensive AI in Construction Market Intelligence and Propel Your Strategic Initiatives Forward

To explore the full breadth of our in-depth market research on artificial intelligence applications in the construction industry and gain immediate access to proprietary strategic insights, please contact Ketan Rohom, Associate Director of Sales & Marketing. His deep understanding of market dynamics and technology adoption can guide your organization in harnessing AI-driven efficiencies and competitive differentiation. Engage with Ketan to secure your copy of the comprehensive report and position your projects for success in today’s rapidly evolving construction landscape.

- How big is the Artificial Intelligence in Construction Market?

- What is the Artificial Intelligence in Construction Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?