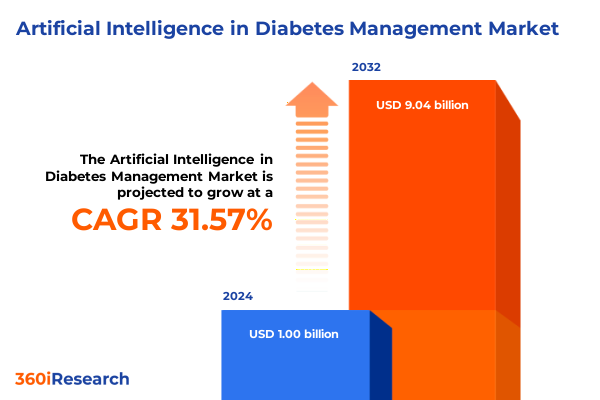

The Artificial Intelligence in Diabetes Management Market size was estimated at USD 1.31 billion in 2025 and expected to reach USD 1.72 billion in 2026, at a CAGR of 31.66% to reach USD 9.04 billion by 2032.

Exploring the Revolutionary Role of Artificial Intelligence in Transforming Diabetes Care Through Predictive Insights and Personalized Treatment Strategies

Diabetes continues to exert a profound impact on global health, with recent data indicating that approximately 38.4 million individuals in the United States live with this chronic condition, representing 11.6% of the total population as of 2020. Early detection and effective management of blood glucose levels remain critical to preventing long-term complications and reducing economic burdens on healthcare systems. Against this backdrop, artificial intelligence has emerged as a transformative force, offering the potential to refine diagnostic precision and optimize therapy decisions for millions of people affected by diabetes.

The complexity of diabetes management presents significant challenges for patients and providers alike, as individuals must navigate an average of 180 daily therapy decisions to maintain glycemic balance. Traditional care models often rely on reactive interventions after glycemic excursions occur, exposing patients to preventable episodes of hypo- and hyperglycemia. With the advent of AI-trained algorithms, real-time predictive insights can now anticipate glucose trends and recommend proactive adjustments in insulin dosing to avert adverse glycemic events before they arise.

Recent advancements in continuous glucose monitoring and decision support tools illustrate AI’s capacity to enhance clinical outcomes and patient quality of life. Mobile applications equipped with machine learning algorithms analyze individual user data to deliver personalized coaching and dose recommendations, fostering greater adherence to treatment regimens and lifestyle modifications. By integrating predictive analytics into the care continuum, clinicians can make data-driven decisions that reduce acute complications and hospital admissions while empowering patients to engage more confidently in self-management.

As these innovations gain traction, the regulatory landscape and reimbursement frameworks have also begun to adapt, reflecting a growing recognition of AI’s role in chronic disease management. From algorithm validation to device clearance, stakeholders across industry, academia, and healthcare systems are collaborating to establish robust evidence and standardized pathways for AI-enabled diabetes solutions. This introduction sets the stage for a comprehensive examination of the dynamic forces shaping the future of diabetes care through artificial intelligence.

Unleashing Predictive Precision and Automation in Diabetes Management As AI-fueled Devices and Analytics Replace Reactive Treatment Paradigms

Over the past decade, the field of diabetes management has evolved from reactive, episodic care to a data-rich ecosystem where artificial intelligence serves as the cornerstone of proactive treatment. This shift has been fueled by innovations in sensor technology, algorithm development, and digital connectivity, allowing care teams and patients to anticipate and address glycemic fluctuations before they escalate into medical emergencies. The transformation reflects a broader trend toward precision medicine, wherein individualized insights drive clinical decision-making with greater accuracy and timeliness.

Examining How the 2025 US Import Tariffs on Medical Devices and Technology Components Are Reshaping Costs and Accessibility of AI-driven Diabetes Management

In 2025, the United States introduced sweeping import tariffs designed to recalibrate global trade dynamics, but the healthcare sector, especially medical device manufacturers, has felt the repercussions acutely. By April, a 10% baseline import tax on most goods took effect, supplemented by higher duties on key trading partners, affecting everything from glucose sensors to cloud infrastructure components that underpin AI analytics platforms. Earlier in March, derivative tariffs on steel and aluminum-containing products rose to 25%, further inflating production costs for devices incorporating metal components, including sensor housings and infusion pump casings.

Medical device companies such as pacemaker and insulin pump manufacturers have warned that these levies threaten to raise end-user prices and constrain supply chain flexibility. Analysts project that without mitigation, hospitals and clinics could face double-digit increases in procurement expenses, prompting budgetary reallocations that may deprioritize advanced AI features in favor of essential equipment. Some firms are exploring alternative sourcing strategies, but these often involve lengthy qualification processes and regulatory reviews, introducing potential delays in product rollout.

Abbott Laboratories, a leading player in continuous glucose monitoring, has specifically cited annual tariff costs in the hundreds of millions of dollars, spurring plans to expand domestic manufacturing capacity with new facilities in Georgia, Illinois, and Texas. These initiatives aim to insulate against future duty hikes and ensure consistent supply, but they require significant capital investment and multiyear lead times. Similarly, the American Hospital Association has urged tariff exemptions for critical medical supplies, warning that sustained cost pressures could exacerbate financial headwinds already faced by providers, potentially limiting access to AI-driven diabetes care tools among vulnerable populations.

Collectively, the cumulative effect of 2025 tariffs threatens to temper the rapid adoption of AI-enabled diabetes management solutions, shifting the industry’s strategic focus toward supply chain resilience and domestic manufacturing. As stakeholders navigate this complex policy environment, balancing cost containment with innovation imperatives will be paramount to sustaining progress in patient-centered diabetes care.

Uncovering Segmentation Insights on How Device Types Technologies End Users Deployment Modes and Components Shape AI-driven Diabetes Care Strategies

The landscape of AI-driven diabetes management is defined by a multidimensional segmentation framework that informs product development and market strategies. From a device perspective, the market spans four principal categories, each subdivided into specialized subtypes. Blood glucose meters, including noninvasive and self-monitored variants, coexist alongside closed loop systems, which range from fully automated to hybrid platforms. Continuous glucose monitors offer both intermittent and real-time scanning capabilities, while insulin pumps cater to users through patch and tubed configurations, enabling highly personalized therapy regimens.

Technological segmentation reveals the diverse AI and digital tools powering these devices. Cloud computing infrastructure, delivered through private and public architectures, underpins large-scale data analytics, whereas decision support systems generate critical alerts and dosage recommendations. Machine learning techniques, from reinforcement to supervised and unsupervised models, continuously refine algorithms based on user feedback and clinical outcomes. Mobile applications tailored for Android and iOS platforms extend AI-driven guidance beyond the clinic, complemented by predictive analytics engines specializing in glucose trend and risk forecasting.

End-user distinctions capture unique deployment contexts across clinical, home care, hospital, and research environments. Specialized diabetes centers and general clinics integrate AI tools for patient monitoring, while remote and self-monitoring scenarios enhance home-based care. Hospitals leverage both inpatient and outpatient solutions, and academic and private research institutes fuel ongoing innovation through collaborative studies. Deployment modalities span cloud-based and on-premise configurations, with hybrid cloud and public cloud models addressing scalability requirements, and edge computing alongside server-based setups securing data integrity.

Further classification by diabetes type addresses gestational, type 1, and type 2 cohorts. Each segment branches into finer clinical categories, from trimester-specific gestational care to adult and juvenile onset of type 1, and insulin dependent or independent subpopulations within type 2. Component-level segmentation delineates hardware elements-such as pumps, sensors, and wearable devices-from software assets, including algorithm suites, data management frameworks, and user interfaces. This comprehensive segmentation insight forms the backbone of strategic decisions for stakeholders seeking to align product offerings with precise market needs.

This comprehensive research report categorizes the Artificial Intelligence in Diabetes Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Device Type

- Technology

- Component

- Deployment Mode

- End User

Revealing Regional Dynamics Highlighting How the Americas EMEA and Asia-Pacific Markets Are Pioneering Distinct AI-driven Approaches to Diabetes Management

Regional dynamics in the AI-driven diabetes management sector reflect distinct healthcare infrastructures, regulatory environments, and patient needs. In the Americas, particularly the United States, robust healthcare systems and broad insurance coverage for continuous glucose monitoring and remote patient monitoring have propelled early adoption of AI tools. Regulatory bodies like the FDA have cleared over 40 AI-enabled diabetes management devices, while telehealth reimbursement parity across many states has facilitated remote care expansion. Together, these factors have established North America as a global leader in leveraging AI to enhance patient outcomes and operational efficiency.

In the Europe, Middle East & Africa region, established healthcare frameworks and sustained government investment in digital health have underpinned the growth of AI-infused diabetes solutions. European Union initiatives such as fast-track digital therapeutics reimbursement and stringent data protection standards have fostered patient trust and market stability. Countries like the UK, Germany, and France champion AI-driven diagnostic tools and predictive analytics, improving early detection rates and reducing hospital admissions through proactive intervention strategies.

Asia-Pacific stands out for its high diabetes prevalence, rapid digital transformation, and supportive public health policies. Nations including China, India, and Japan have made significant infrastructure investments, from 5G network rollouts to domestic cloud platforms, accelerating AI integration in both urban and rural healthcare settings. Mobile health applications and noninvasive monitoring technologies are gaining traction, driven by economies of scale and government-sponsored e-health missions designed to expand access and reduce clinical burdens. These regional insights highlight the varied pathways through which AI is reshaping diabetes management on a global scale.

This comprehensive research report examines key regions that drive the evolution of the Artificial Intelligence in Diabetes Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators Driving AI-powered Breakthroughs in Diabetes Management Across Continuous Monitoring and Automated Insulin Delivery Technologies

Industry leaders are at the forefront of AI-driven advancements in diabetes management, each with uniquely positioned innovations. Roche recently secured CE mark approval for its Accu-Chek SmartGuide continuous glucose monitoring solution, which integrates AI-trained predictive algorithms to forecast hypoglycemia risk, estimate nocturnal events, and enable proactive intervention for patients on flexible insulin therapy. The SmartGuide system, comprising a wearable sensor and companion applications, exemplifies the seamless convergence of hardware and software in personalized diabetes care.

Dexcom has differentiated itself through the launch of its proprietary Generative AI platform, marking the first integration of GenAI into glucose biosensing technology. Built on Google Cloud’s Vertex AI and Gemini models, this platform enhances the Stelo over-the-counter CGM by delivering personalized weekly insights and recommendations based on lifestyle variables such as diet, activity, and sleep patterns. Dexcom’s approach underscores the strategic partnership between AI and cloud infrastructure in real-world metabolic health applications.

Tandem Diabetes Care has advanced the closed loop technology space with its t:slim X2 insulin pump featuring Control-IQ functionality, which employs machine learning to automatically adjust basal insulin rates. Complementing hardware innovations, decision support tools like DreaMed Advisor offer real-time insulin dose recommendations, reducing manual errors and improving glycemic stability through data-driven guidance.

Insulet Corporation’s Omnipod 5 Automated Insulin Delivery System, now fully commercialized in select European markets, leverages algorithmic refinements to optimize insulin delivery without requiring multiple daily injections. This patch pump platform demonstrates how software intelligence and user-centric design drive adherence and clinical efficacy in diabetes therapy.

Abbott Laboratories has sustained its leadership in continuous glucose monitoring with products like FreeStyle Libre and Lingo. Despite facing tariff-related cost pressures, the company reported a 21.4% year-over-year CGM sales increase, reflecting strong market demand for minimally invasive, AI-enabled glucose tracking solutions that streamline patient self-management.

This comprehensive research report delivers an in-depth overview of the principal market players in the Artificial Intelligence in Diabetes Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Apple Inc.

- Bigfoot Biomedical, Inc.

- Dexcom, Inc.

- Diabeloop SA

- Eyenuk, Inc.

- F. Hoffmann-La Roche Ltd

- Glooko Inc.

- Google LLC by Alphabet Inc.

- Insulet Corporation

- International Business Machines Corporation

- Livongo Health, Inc.

- Medtronic plc

- Omada Health, Inc.

- Tandem Diabetes Care, Inc.

- Teladoc Health, Inc.

- Tidepool Inc.

- Virta Health Corp.

- Wellthy Therapeutics Pvt. Ltd.

Strategic Actionable Recommendations for Industry Leaders to Accelerate Adoption and Impact of AI-driven Solutions in Diabetes Care Delivery

To sustain competitive advantage, industry leaders must prioritize strategic investments in algorithm development and validation. Cultivating partnerships with academic and healthcare institutions can accelerate clinical trials and real-world evidence generation, ensuring that AI models achieve high accuracy across diverse patient populations. It is critical that developers allocate dedicated resources to rigorous testing protocols and collaborate closely with regulatory agencies to streamline approval pathways without compromising patient safety.

Building resilient supply chains should accompany technology strategies, particularly in light of recent tariff fluctuations. Manufacturers should diversify component sourcing and establish contingency plans, including domestic production capabilities, to mitigate exposure to import duties and logistical disruptions. Enhancing vertical integration may also provide greater cost predictability and ensure uninterrupted access to essential hardware for AI-enabled devices.

Patient-centric design principles must guide product roadmaps to drive adoption and adherence. Solving usability challenges through intuitive interfaces, seamless device integration, and multilingual support will broaden market reach. Industry participants should invest in human-centered design research to uncover unmet needs and iterate on solutions that minimize user burden and maximize clinical benefit.

Finally, stakeholders should champion interoperability standards and data governance frameworks that facilitate secure information exchange across platforms. Enabling seamless integration with electronic health records, telehealth services, and third-party applications will empower care teams with comprehensive insights. By adhering to robust privacy and security protocols, organizations can foster trust among patients, providers, and payers while unlocking the full potential of integrated AI ecosystems in chronic disease management.

Unveiling the Rigorous Research Methodology Employing Robust Primary Secondary Data Collection and Analysis Techniques to Ensure Insights Validity

This study follows a multifaceted research methodology that begins with an extensive secondary data review, encompassing scientific literature, regulatory filings, and industry publications. Each source is critically evaluated for relevance and credibility, ensuring that the evolving landscape of AI in diabetes management is accurately captured. Key insights from peer-reviewed journals and official agency reports form the foundation for developing the conceptual framework.

Primary research complements secondary findings through structured interviews and surveys with leading endocrinologists, device manufacturers, technology providers, and health system executives. These engagements provide firsthand perspectives on market trends, adoption drivers, and implementation challenges. Data triangulation is employed to reconcile any discrepancies between qualitative feedback and quantitative data, strengthening the overall validity of conclusions.

The segmentation model used in this report is constructed based on product typologies, technological categories, end-user profiles, deployment modes, diabetes types, and system components. This granular segmentation ensures that supply chain considerations, regulatory pathways, and clinical workflows are integrated into the analysis. Expert validation rounds with industry veterans further refine the segmentation logic and confirm alignment with real-world market dynamics.

Finally, quantitative modeling techniques are applied to historical data and current indicators to identify emerging patterns without projecting specific market sizes. Sensitivity analyses stress-test key assumptions related to regulatory milestones, tariff impacts, and technological breakthroughs. Throughout the process, adherence to ethical research standards and data privacy regulations underpins all activities, safeguarding the integrity of insights delivered to stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Artificial Intelligence in Diabetes Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Artificial Intelligence in Diabetes Management Market, by Device Type

- Artificial Intelligence in Diabetes Management Market, by Technology

- Artificial Intelligence in Diabetes Management Market, by Component

- Artificial Intelligence in Diabetes Management Market, by Deployment Mode

- Artificial Intelligence in Diabetes Management Market, by End User

- Artificial Intelligence in Diabetes Management Market, by Region

- Artificial Intelligence in Diabetes Management Market, by Group

- Artificial Intelligence in Diabetes Management Market, by Country

- United States Artificial Intelligence in Diabetes Management Market

- China Artificial Intelligence in Diabetes Management Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3180 ]

Concluding Perspectives on How Artificial Intelligence Is Shaping Personalized Diabetes Management Through Precision Monitoring and Predictive Intervention

Artificial intelligence has indelibly reshaped the management of diabetes by ushering in an era of precision monitoring and predictive intervention. The confluence of advanced sensors, machine learning algorithms, and scalable computing platforms has elevated care delivery from a reactive model to one that anticipates and averts complications before they arise. Such capabilities not only alleviate individual patient burdens but also promise systemic efficiencies by reducing emergency visits and hospitalizations.

The integration of AI into insulin delivery systems, decision support tools, and digital therapeutics underscores the importance of a holistic ecosystem approach. As industry leaders continue to innovate, collaboration across sectors-from device manufacturers to cloud infrastructure providers-will be essential to surmount technical, regulatory, and economic challenges. Harmonizing data standards and fostering open APIs will enable seamless workflows and comprehensive patient management.

Looking ahead, the trajectory of AI in diabetes management hinges upon sustained investment in R&D, supply chain resilience, and user-centric design. Equally important is the cultivation of trust through transparent algorithm validation and adherence to robust data governance. By prioritizing these imperatives, stakeholders can unlock the full potential of AI to deliver safer, more personalized, and cost-effective diabetes care solutions.

Seize Your Opportunity to Unlock In-depth Market Insights on AI-driven Diabetes Management by Connecting with Ketan Rohom Today

I invite you to discover the full depth of this market research report by connecting with Ketan Rohom, Associate Director of Sales & Marketing, to gain exclusive access to detailed analyses, rich datasets, and actionable insights tailored to your organizational needs. Engage directly to explore customized packages that align with your strategic priorities, whether you require an executive briefing, a comprehensive data license, or bespoke consulting support. By partnering with Ketan Rohom, you will leverage a wealth of industry knowledge and take advantage of an opportunity to transform your diabetes management strategies with cutting-edge intelligence. Reach out today to arrange a personalized consultation and unlock the competitive advantage offered by this forward-looking study on artificial intelligence in diabetes care

- How big is the Artificial Intelligence in Diabetes Management Market?

- What is the Artificial Intelligence in Diabetes Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?