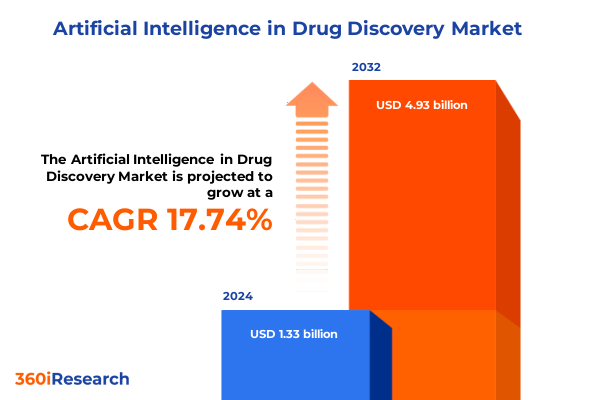

The Artificial Intelligence in Drug Discovery Market size was estimated at USD 1.55 billion in 2025 and expected to reach USD 1.81 billion in 2026, at a CAGR of 17.90% to reach USD 4.93 billion by 2032.

Groundbreaking Advances in Artificial Intelligence Are Revolutionizing Every Stage of Drug Discovery, Accelerating Target Identification and Clinical Development Timelines

Artificial intelligence has rapidly evolved from a theoretical concept into a cornerstone of modern drug discovery, reshaping how researchers identify, validate, and optimize therapeutic candidates. Advances in computational power, algorithmic sophistication, and data availability have converged to create an environment in which machine learning models can predict molecular properties, simulate biological interactions, and even design novel chemical entities with unprecedented precision. These capabilities are enabling pharmaceutical and biotechnology organizations to drastically shorten development timelines, reduce attrition rates, and allocate resources more effectively. As the industry pivots toward data-driven decision-making, AI tools are no longer peripheral, but rather central to every phase of the drug discovery and development continuum.

In this era of digital transformation, the integration of AI into laboratory workflows and clinical operations is delivering tangible benefits across diverse therapeutic areas. From leveraging deep neural networks to decode protein structures to applying natural language processing for mining biomedical literature, organizations are harnessing AI to gain critical insights that were previously unattainable. As the technology matures, partnerships between traditional life science companies, technology vendors, and academic institutions are driving collaborative innovation, further accelerating the pace of discovery. This introductory overview sets the stage for a deeper exploration of the key shifts, segmentation trends, regional dynamics, and strategic imperatives that define the current and future state of AI-driven drug discovery.

Disruptive Technological Shifts Are Reshaping the Drug Discovery Landscape with AI-Driven Innovations Transforming Research, Development, and Regulatory Pathways

The landscape of drug discovery is undergoing transformative shifts driven by algorithmic breakthroughs, expanding data ecosystems, and evolving computational architectures. Firstly, generative AI platforms have emerged as powerful engines for de novo drug design, enabling the creation of novel molecular scaffolds optimized for target affinity and ADMET properties. This shift is complemented by advances in molecular dynamics simulations and homology modeling, which provide high-resolution insights into protein folding and ligand interactions. As a result, research teams can iterate molecular designs in silico with greater confidence, reducing dependence on time-consuming and costly wet-lab experiments.

Secondly, deep learning–powered image analysis and computer vision techniques are transforming phenotypic screening and high-throughput assays. Automated microscopy coupled with convolutional neural networks can detect subtle cellular responses to candidate compounds, revealing off-target effects and toxicity signals at scale. Moreover, natural language processing tools are unlocking unstructured biomedical data, extracting actionable intelligence from clinical trial reports, patents, and scientific publications. By integrating these diverse data sources, companies are building comprehensive knowledge graphs that underpin predictive analytics and decision support systems.

Finally, the proliferation of cloud computing and hybrid deployment models is democratizing access to advanced AI capabilities. Smaller biotech firms and academic laboratories can now leverage scalable compute resources and preconfigured AI pipelines, leveling the playing field and fostering innovation outside traditional industry hubs. Collectively, these technological and operational shifts are redefining research paradigms, enabling faster, more accurate, and more cost-effective discovery processes.

Assessment of 2025 United States Tariff Adjustments Reveals Significant Implications for AI-Driven Drug Discovery Supply Chains and Research Collaborations

In 2025, the United States implemented revised tariff measures on imported computational hardware and specialized laboratory reagents, directly influencing the cost structure of AI-driven drug discovery operations. For organizations relying on foreign-manufactured GPUs, high-performance servers, and edge-computing devices, increased import duties have translated into heightened capital expenditures. These additional costs have compelled some research entities to reevaluate their procurement strategies, opting for domestic cloud services or shifting workloads to on-premises environments where possible to mitigate tariff impacts.

The ripple effects of these tariff adjustments extend beyond hardware procurement. Supply chain disruptions for reagent kits, custom oligonucleotides, and enzymatic assay components have introduced variability in experimental throughput. Companies with vertically integrated manufacturing capabilities have been better positioned to absorb these fluctuations, whereas early-stage biotech ventures and academic groups have faced supply lead times and cost pressures. To counteract these challenges, organizations are increasingly forging strategic partnerships with domestic suppliers, investing in inventory optimization algorithms, and leveraging AI-driven logistics platforms to maintain continuity of research operations.

Multidimensional Segmentation Analysis Reveals How Applications, Technologies, Therapeutic Areas, End Users, and Deployment Modes Shape AI-Driven Drug Discovery Dynamics

A granular analysis of market segmentation reveals the multifaceted nature of AI applications in drug discovery, each layer presenting unique opportunities and challenges. Within application categories, ADMET and toxicology prediction stands out for its ability to anticipate pharmacodynamic responses, pharmacokinetic profiles, and potential toxicity liabilities before in vivo testing. Meanwhile, clinical trial optimization leverages patient recruitment algorithms and trial design platforms to enhance protocol adherence and endpoint precision. The hit identification phase benefits from high-throughput screening methods, in silico target validation routines, and virtual screening campaigns that prioritize lead candidates with favorable binding affinities. In the realm of lead optimization, de novo drug design engines, quantitative structure-activity relationship models, and structure-based strategies converge to refine molecular potency and selectivity. Complementing these stages, protein structure prediction technologies-ranging from ab initio modeling to homology modeling and molecular dynamics simulations-provide structural blueprints essential for rational drug design.

Technological segmentation further underscores the critical roles of computer vision in phenotypic assays, deep learning in generative chemistry, machine learning in predictive modeling, and natural language processing in knowledge extraction. Each platform category addresses specific research pain points, from automated image processing to automated literature synthesis. In therapeutic area segmentation, oncology continues to receive substantial focus as AI algorithms uncover novel biomarker relationships and therapeutic targets. Infectious disease research has accelerated thanks to rapid predictive modeling of viral protein interactions, while central nervous system and cardiovascular domains are exploring AI to decode complex pathophysiological mechanisms and tailor patient-centric therapies.

Evaluating end-user segmentation highlights the distinct requirements of academic and research institutes, which prioritize flexibility and open-source tool integration, versus biotechnology companies that demand scalable platforms and collaborative ecosystems. Contract research organizations are integrating AI modules into service offerings to differentiate on speed and quality, and pharmaceutical companies are embedding AI capabilities directly into R&D divisions to establish continuous innovation loops. Finally, deployment mode preferences-cloud based, hybrid, and on premises-reflect varied security considerations, regulatory compliance mandates, and data sovereignty requirements, shaping how organizations architect their AI infrastructures.

This comprehensive research report categorizes the Artificial Intelligence in Drug Discovery market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Therapeutic Area

- Application

- End User

- Deployment Mode

Regional Dynamics Highlight Divergent Adoption Patterns of AI-Powered Drug Discovery Solutions across the Americas, Europe Middle East Africa, and Asia-Pacific Markets

Regional market dynamics exhibit distinct adoption curves and strategic priorities across global territories. In the Americas, a concentration of leading pharmaceutical hubs and technology centers has fueled rapid integration of AI into drug discovery pipelines. Venture capital influx into US and Canadian startups has catalyzed the development of next-generation algorithms, while cross-border collaborations with academic powerhouses continue to drive translational research.

Across Europe, the Middle East, and Africa, regulatory harmonization efforts have sought to balance patient safety with innovation incentives, enabling a growing number of convergence projects between biotech clusters in Germany, the United Kingdom, and Switzerland. Meanwhile, emerging markets in the Gulf Cooperation Council and South Africa are establishing incubators and innovation zones to cultivate local capabilities, often in partnership with global technology vendors.

In the Asia-Pacific region, robust government investment programs and national AI strategies have underpinned significant strides in algorithm development and infrastructure expansion. China’s leading quantum computing initiatives, Japan’s precision medicine alliances, South Korea’s digital health frameworks, and India’s burgeoning biotech incubators collectively underscore the region’s accelerating influence. Australia’s focus on translational research further complements these efforts, creating a dynamic mosaic of AI-driven discovery across the Asia-Pacific skyline.

This comprehensive research report examines key regions that drive the evolution of the Artificial Intelligence in Drug Discovery market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading AI Drug Discovery Companies Are Driving Innovation through Strategic Collaborations, Proprietary Platforms, and Rapid Iterative Development Pipelines

A cohort of pioneering companies is spearheading the commercialization of AI in drug discovery, each leveraging proprietary platforms, strategic alliances, and integrated R&D models. Atomwise has gained recognition for its convolutional neural network–based virtual screening engine that rapidly evaluates billions of molecular structures against therapeutic targets. Insilico Medicine continues to expand its generative chemistry portfolio, partnering with pharmaceutical giants to co-develop preclinical candidates through reinforcement learning frameworks. Exscientia’s focus on end-to-end drug design pipelines has resulted in multiple AI-designed molecules advancing into clinical trials, underscoring the viability of its platform.

DeepMind’s breakthroughs in protein folding have had downstream impacts on drug discovery workflows, inspiring spin-out ventures and collaborations that translate structural insights into small-molecule design. Recursion Pharmaceuticals combines high-content imaging with machine learning analytics to systematically map phenotypic responses across diverse disease models. Schrödinger’s physics-based modeling suite continues to integrate AI modules, offering customers hybrid solutions that balance interpretability with predictive performance. Other notable players are focusing on oncology-specific AI algorithms, decentralized trial design platforms, and NLP-driven knowledge graphs, illustrating the breadth of innovation within this competitive landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Artificial Intelligence in Drug Discovery market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AstraZeneca plc

- Atomwise, Inc.

- BenevolentAI Limited

- Exscientia plc

- Iktos SAS

- Insilico Medicine

- insitro, Inc.

- Isomorphic Labs Limited

- Novartis AG

- Owkin, Inc.

- Pfizer Inc.

- Recursion Pharmaceuticals

- Schrödinger, Inc.

- Tempus Labs, Inc.

Actionable Strategic Recommendations Empower Industry Leaders to Leverage AI Technologies, Optimize Partnerships, and Navigate Regulatory Complexity in Drug Discovery

Leaders in drug discovery must adopt a cohesive strategy to harness AI’s potential effectively. Prioritizing data governance and quality assurance frameworks will ensure that machine learning models are trained on accurate, reproducible datasets, thereby enhancing predictive reliability. Concurrently, forging partnerships with academic institutions and specialized technology vendors can accelerate access to cutting-edge algorithms while mitigating internal development risks. Organizations should also evaluate hybrid deployment architectures, balancing the agility of cloud environments with the control and security of on-premises systems.

To foster cross-functional collaboration, establishing integrated teams of computational scientists, medicinal chemists, and regulatory experts is essential. This multidisciplinary approach enables iterative feedback loops between algorithm development and experimental validation, streamlining decision-making and reducing time-to-insight. In parallel, engaging regulatory bodies early in the development cycle can clarify validation requirements for AI-assisted assays and support pathways for accelerated approval programs. Finally, investing in explainable AI techniques will build stakeholder confidence by elucidating model logic and facilitating transparent risk assessments. Through these actionable steps, industry leaders can navigate the evolving landscape with agility and precision.

Comprehensive Research Methodology Combines Primary Interviews, Secondary Data Analysis, and Advanced Analytical Techniques to Ensure Robust Market Insights

This analysis is underpinned by a rigorous research methodology that integrates primary and secondary data streams. Primary insights were gathered through in-depth interviews with leading drug discovery researchers, technology developers, and regulatory authorities, providing firsthand perspectives on AI adoption challenges and success factors. Secondary research encompassed a systematic review of peer-reviewed journals, patent filings, conference proceedings, and public company disclosures, ensuring comprehensive coverage of technological advancements and market activities.

Quantitative data analysis employed statistical trend mapping and algorithmic performance benchmarking to evaluate solution efficacy across application domains. Additionally, a series of competitive landscape assessments, including SWOT and Porter’s Five Forces analyses, were conducted to identify strategic positioning and potential market entry barriers. Insights were further validated through expert panel discussions and scenario planning exercises, which stress-tested key assumptions under varying regulatory and geopolitical conditions. This multi-layered approach guarantees robust, data-driven findings that inform strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Artificial Intelligence in Drug Discovery market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Artificial Intelligence in Drug Discovery Market, by Technology

- Artificial Intelligence in Drug Discovery Market, by Therapeutic Area

- Artificial Intelligence in Drug Discovery Market, by Application

- Artificial Intelligence in Drug Discovery Market, by End User

- Artificial Intelligence in Drug Discovery Market, by Deployment Mode

- Artificial Intelligence in Drug Discovery Market, by Region

- Artificial Intelligence in Drug Discovery Market, by Group

- Artificial Intelligence in Drug Discovery Market, by Country

- United States Artificial Intelligence in Drug Discovery Market

- China Artificial Intelligence in Drug Discovery Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesis of Key Findings Underscores the Transformative Potential of AI in Drug Discovery and Charts a Clear Path Forward for Stakeholders Across the Value Chain

The confluence of advanced algorithms, expansive data ecosystems, and collaborative innovation frameworks is heralding a new era in drug discovery. By enabling precise prediction of molecular interactions, streamlining clinical trial design, and facilitating the rational engineering of novel compounds, AI is addressing longstanding challenges of cost, time, and complexity. As tariff adjustments and supply chain dynamics reshape operational costs, organizations that proactively adapt procurement strategies and forge local partnerships will gain a competitive edge. Segmentation insights illustrate that diverse application domains, technological modalities, and user requirements necessitate tailored approaches, while regional analysis underscores the importance of market-specific strategies.

Key players are demonstrating how proprietary platforms and strategic alliances can translate AI capabilities into tangible therapeutic candidates, and actionable recommendations provide a roadmap for organizations aiming to replicate this success. Together, these findings affirm that the maturation of AI technologies, coupled with targeted investments in infrastructure and talent, will redefine the boundaries of what is possible in drug discovery. The industry stands at a pivotal juncture where embracing these innovations can unlock unprecedented value and deliver transformative patient outcomes.

Engage with Ketan Rohom to Secure Your Detailed Market Research Report and Unlock Strategic Insights into the AI-Enabled Drug Discovery Ecosystem

For tailored strategic guidance and in-depth analysis, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to obtain comprehensive insights and data-driven perspectives on the AI in drug discovery landscape. Securing this report will enable your organization to capitalize on emerging opportunities, navigate complex regulatory environments, and accelerate your innovation pipeline. Engage with Ketan today to unlock the full potential of your research and development initiatives.

- How big is the Artificial Intelligence in Drug Discovery Market?

- What is the Artificial Intelligence in Drug Discovery Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?