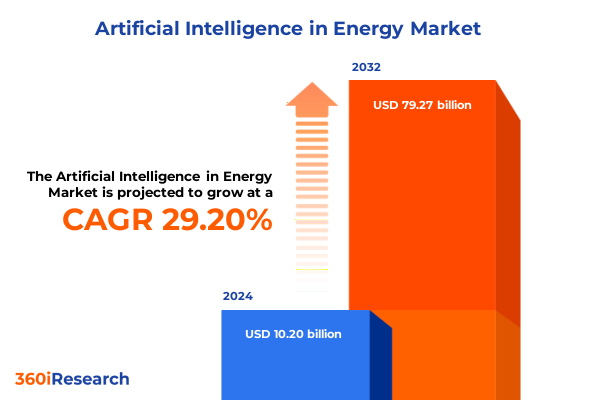

The Artificial Intelligence in Energy Market size was estimated at USD 10.20 billion in 2024 and expected to reach USD 13.01 billion in 2025, at a CAGR of 29.20% to reach USD 79.27 billion by 2032.

Artificial intelligence becomes a foundational force in modern energy systems, reshaping operations, investment priorities, and competitive dynamics worldwide

Artificial intelligence has moved from pilot projects on the grid edge to a structural force reshaping how energy is produced, traded, delivered, and consumed. Across generation fleets, transmission networks, distribution systems, and end-use environments, data volumes are growing exponentially and operational complexity is rising. At the same time, decarbonization targets, electrification of transport and industry, and surging digital demand from data centers and artificial intelligence workloads are placing unprecedented pressure on energy systems to become more flexible, resilient, and efficient.

In this context, artificial intelligence has emerged as a critical enabler of next-generation energy systems. Machine learning, computer vision, digital twins, and advanced optimization are now being embedded in everything from wind turbine control algorithms to real-time demand response platforms. Utilities and grid operators are using artificial intelligence to integrate variable renewable energy at higher penetrations, maintain stability as distributed resources proliferate, and manage growing cyber and physical risks. Industrial and commercial energy users, meanwhile, are turning to energy management software and predictive maintenance to control costs, improve reliability, and support sustainability commitments.

As these technologies mature, the strategic conversation is shifting from whether artificial intelligence has a role in energy to where it can deliver the fastest, most durable value. Executive attention is increasingly focused on the intersection of hardware, software, and services; the choice between cloud-based, on-premises, and hybrid deployment models; and the implications of evolving trade and industrial policy for critical inputs such as semiconductors and clean energy components. This executive summary frames those issues, highlights the most important structural shifts underway, and outlines practical considerations for industry leaders seeking to operationalize artificial intelligence at scale.

Surging data, decentralized renewables, and digitalized assets are driving a profound transformation in how artificial intelligence permeates the energy ecosystem

The landscape for artificial intelligence in energy is being transformed by three reinforcing forces: rapidly escalating electricity demand from data centers and advanced computing, accelerating deployment of variable renewables, and the digitalization of physical assets and customer interactions. As hyperscale and artificial intelligence-focused data centers expand, major energy and oilfield service companies are repositioning themselves as infrastructure partners, supplying turbines, distributed generation, and advanced monitoring platforms to serve multi-gigawatt campuses. This is tightening the linkage between progress in artificial intelligence and the evolution of generation portfolios, grid planning, and long-term capacity markets.

On the grid side, artificial intelligence is enabling a more dynamic, data-rich operating model. Reinforcement learning and other machine learning approaches are being tested to autonomously manage microgrids, optimize dispatch, and maximize local renewable penetration while preserving reliability, often outperforming rule-based strategies in complex, uncertain environments. Utilities are deploying digital twins of transmission and distribution networks to simulate contingencies, stress-test investment plans, and anticipate congestion. Computer vision, delivered through drone inspections and fixed cameras, is transforming asset inspection for lines, towers, and substations, cutting manual fieldwork and allowing faster detection of vegetation encroachment, corrosion, and safety hazards.

Within generation and storage assets, artificial intelligence-driven predictive maintenance is increasingly embedded in wind, solar, hydro, and battery systems. Models trained on sensor, vibration, acoustic, and environmental data detect anomalies far earlier than traditional methods, making it possible to plan outages more intelligently, extend component life, and reduce unplanned downtime. On the demand side, advanced forecasting and optimization algorithms are supporting demand-side management programs and virtual power plants, orchestrating flexible loads in commercial and residential buildings, and enabling time-differentiated tariffs, behind-the-meter storage, and electric vehicle charging to play active roles in balancing the grid.

Electricity markets and carbon frameworks are also being reshaped. Artificial intelligence-based trading systems analyze weather patterns, grid conditions, and fundamental signals to inform short-term and intraday decisions, while emission monitoring platforms convert raw operational data into auditable, near-real-time carbon insights. Combined, these shifts are moving the energy sector toward a more autonomous, software-defined paradigm in which value creation depends as much on algorithms, data, and integration capabilities as on physical assets alone.

Evolving United States tariffs on semiconductors and clean energy components are redefining cost structures and supply chains for artificial intelligence in energy

The cumulative impact of United States tariffs through 2025 is reshaping the economics and supply chains that underpin artificial intelligence deployments in the energy sector. Tariff measures targeting semiconductors, solar components, steel, aluminum, and a range of clean energy-related products are altering relative cost structures, influencing sourcing strategies, and affecting the pace and configuration of new projects. Proposed increases that would raise tariffs on certain semiconductor imports to fifty percent, along with substantial hikes on solar cells and modules, steel, and other industrial inputs, are particularly salient for energy applications that rely heavily on data centers, advanced control systems, and renewable generation.

Semiconductors sit at the heart of artificial intelligence hardware for energy, from processors in edge devices, controllers, and inverters to the servers that run grid optimization, forecasting, and trading algorithms. Policy analyses suggest that sustained tariffs on semiconductor imports could slow overall economic growth and erode competitiveness across digital industries, including artificial intelligence and advanced manufacturing. For energy-sector players, this translates into higher up-front costs for deploying monitoring and automation hardware, potentially longer payback periods for digitalization projects, and more pressure to maximize the utilization of existing compute resources through software efficiency and workload optimization.

Clean energy supply chains are experiencing similar tensions. Increased tariffs on Chinese-origin solar panels and components, as well as on products from other key manufacturing hubs, are designed to encourage domestic and allied manufacturing but also raise near-term project costs and complicate procurement. Developers and utilities seeking to harness artificial intelligence for renewable energy forecasting, dispatch optimization, and hybrid plant control must therefore balance policy-driven incentives for local sourcing against potential cost and timing constraints. Many are diversifying suppliers, reevaluating contract structures, and building more flexibility into designs so that hardware from multiple geographies can be integrated with minimal software modifications.

Looking ahead, the net effect of cumulative tariffs is unlikely to derail artificial intelligence adoption in energy, but it will shape where value is captured and who captures it. Organizations that proactively navigate tariff exposure, deepen relationships with a broader set of equipment manufacturers, and invest in modular, vendor-agnostic software architectures will be better positioned to maintain momentum even as the trade environment evolves.

Segmenting artificial intelligence in energy reveals how components, technologies, deployments, applications, and end users converge to create differentiated value

Understanding how artificial intelligence in energy is segmented illuminates where value is emerging and how different parts of the ecosystem depend on one another. From a component perspective, hardware, services, and software form a tightly coupled triad. Controllers, processors, sensors, and edge devices are now routinely instrumented with artificial intelligence-ready capabilities, enabling local decision-making at substations, wind farms, photovoltaic arrays, and within commercial buildings. This embedded intelligence only realizes its full impact when supported by consulting expertise that helps identify high-value use cases, deployment and integration services that connect operational technology with information technology, and ongoing support and maintenance that keep mission-critical systems secure and up to date.

Software is increasingly the strategic control layer across this stack. Analytical solutions ingest data from diverse sensors and operational systems to deliver diagnostics, forecasts, and recommendations, while energy management software turns these insights into actionable control strategies for tariffs, setpoints, and dispatch. In carbon emission monitoring, for example, advanced analytics reconcile meters, asset logs, and external datasets to produce highly granular, verifiable emissions profiles. In demand-side management, software orchestrates large portfolios of distributed loads and devices, relying on real-time optimization and reinforcement learning to maintain customer comfort and process requirements while responding to grid signals.

Across technology types, machine learning, computer vision, digital twins, natural language processing, and deep learning fulfill complementary roles rather than competing ones. Supervised and unsupervised learning models are widely used for anomaly detection, load and price forecasting, and condition monitoring, while reinforcement learning is gaining ground in autonomous control of microgrids and storage assets. Computer vision underpins drone inspections and substation monitoring, identifying defects and safety risks with far greater coverage than manual patrols. Digital twins knit these capabilities together, providing a high-fidelity representation of grid assets, power plants, and buildings where artificial intelligence models can be trained and validated under realistic conditions without putting real-world operations at risk.

Deployment models are another critical dimension. Cloud-based environments offer scalability and access to cutting-edge compute and storage, which is essential for training complex forecasting, trading, and optimization models. However, regulatory, latency, and resilience requirements mean that on-premises deployments remain vital for control rooms, critical substations, nuclear facilities, and some industrial sites. Hybrid approaches are therefore becoming the norm, with centralized model training and fleet-level analytics in the cloud, and inference or control workloads running on-premises or at the edge. This balance allows organizations to capture the benefits of both agility and compliance.

From an application standpoint, artificial intelligence is now woven into the full lifecycle of energy assets and markets. Grid management encompasses grid monitoring and microgrids, leveraging real-time data and predictive models to enhance reliability and integrate distributed energy resources. Predictive maintenance, which spans condition monitoring and fault prediction, is central to maintaining high availability in wind, solar, hydro, and thermal plants. Renewable energy forecasting supports more accurate scheduling and reduces balancing costs, while electricity trading platforms use algorithmic trading and monitoring of trades to navigate increasingly volatile markets. Meanwhile, carbon emission monitoring and demand-side management connect operational decisions to decarbonization outcomes, enabling companies and regulators to align financial performance with climate objectives.

End users bring their own distinct requirements and adoption patterns. Commercial and residential buildings, including office buildings and shopping malls, prioritize comfort, occupancy management, and energy cost optimization, often through integrated building management systems and behind-the-meter analytics. Nuclear power plants, oil and gas operators, and power and utilities players such as distribution system operators and generation companies rely on artificial intelligence to enhance safety, asset integrity, and system-wide optimization. Renewable energy developers in hydro, solar, and wind use artificial intelligence to improve resource assessment, forecasting, and asset performance. The interplay between these end-user segments and the underlying component, technology, deployment, and application layers will determine where the most sophisticated artificial intelligence solutions are adopted first and how they then diffuse across the broader sector.

This comprehensive research report categorizes the Artificial Intelligence in Energy market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology Type

- Energy Type

- Application

- End User

Regional dynamics across the Americas, Europe, Middle East, Africa, and Asia-Pacific shape distinct pathways for artificial intelligence adoption in energy

Regional dynamics play a decisive role in shaping how artificial intelligence is deployed across the energy sector, and in determining which business models prove most resilient. In the Americas, the United States is combining ambitious decarbonization and infrastructure agendas with growing concerns over grid adequacy for data centers and electrification. Collaborations between energy companies and technology investors are emerging to build multi-gigawatt natural gas plants and renewable hybrids dedicated to powering artificial intelligence data centers, underscoring the tight coupling between digital infrastructure and generation planning. Canada and several Latin American markets, meanwhile, are leveraging abundant hydro and emerging wind and solar resources to pilot artificial intelligence-enhanced grid balancing and cross-border power trading.

In Europe, the Middle East, and Africa, policy and resource diversity create a mosaic of opportunities and constraints. European Union climate and digital regulations are pushing utilities and retailers to adopt advanced analytics for carbon accounting, demand response, and customer engagement, while also imposing strict standards around privacy, cybersecurity, and model transparency. This environment favors energy technology platforms that can operate across multiple regulatory regimes and integrate distributed energy resources at scale. In the Middle East, artificial intelligence is being applied to optimize production and emissions in large oil and gas operations and to manage increasingly complex power systems that must serve both domestic demand and energy-intensive industries. Across parts of Africa, distributed solar and mini-grids provide fertile ground for artificial intelligence in remote microgrid management, pay-as-you-go business models, and theft detection, often leapfrogging traditional grid infrastructure.

Asia-Pacific presents a different mix of scale and speed. Rapid urbanization, industrial growth, and high penetration of renewables in countries such as China, India, and Australia are driving investment in grid stabilization, flexibility, and storage, all of which benefit from artificial intelligence. Advanced metering, rooftop solar, and electric vehicle uptake in several markets provide rich data streams for artificial intelligence-driven demand-side management and tariff innovation. At the same time, regional manufacturing strength in semiconductors, power electronics, and clean energy equipment positions Asia-Pacific as a critical supplier of hardware for artificial intelligence-enabled energy systems worldwide. This combination of manufacturing depth, policy-driven clean energy deployment, and growing digital maturity makes the region central to future innovation and cost reduction in artificial intelligence for energy.

This comprehensive research report examines key regions that drive the evolution of the Artificial Intelligence in Energy market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Energy incumbents, digital platforms, and specialist vendors are converging to define the evolving competitive landscape for artificial intelligence in energy

The competitive landscape for artificial intelligence in energy is characterized by convergence between traditional energy companies, digital natives, and specialized technology providers. Large oilfield service and energy technology firms are repositioning from a narrow focus on drilling and field services toward supporting artificial intelligence infrastructure and data centers, recognizing that surging power demand from advanced computing creates new markets for turbines, distributed generation, and digital monitoring platforms. These companies are also expanding industrial digital offerings that apply machine learning and analytics to optimize process efficiency, emissions, and maintenance across refineries, liquefied natural gas facilities, and other complex assets.

At the same time, energy technology platforms originally developed for retail supply and smart grid applications are scaling globally. Some of these platforms now manage tens of millions of customer accounts and are licensed to dozens of utilities across multiple continents, offering advanced customer analytics, dynamic tariff management, and orchestration of distributed energy resources through a unified digital backbone. Their architectures are well suited to embedding artificial intelligence modules for forecasting, anomaly detection, and personalization, making them natural partners for utilities seeking to accelerate digital transformation without building everything in-house.

Specialist vendors are emerging in key niches such as microgrid management, renewable asset optimization, and building energy management. Innovative players are developing modular systems that combine thermal storage and artificial intelligence-driven control to provide firm, low-carbon power to data centers, directly addressing the growing concern that artificial intelligence workloads may strain existing grids and impede decarbonization progress. In parallel, software-focused companies with roots in smart grid analytics and enterprise energy management continue to refine platforms that help large commercial and industrial customers monitor and reduce consumption, integrate on-site generation, and respond to price signals.

As competition intensifies, successful companies tend to share several attributes. They design solutions that are interoperable with a wide range of hardware, enabling customers to mitigate supply chain and tariff risks. They invest heavily in cybersecurity and compliance, recognizing the sensitivity of operational technology environments and the evolving regulatory scrutiny around artificial intelligence. They also blend deep domain expertise with advanced data science, ensuring that models can handle complex physical constraints and regulatory requirements rather than operating as black boxes disconnected from real-world engineering and market realities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Artificial Intelligence in Energy market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- C3.ai, Inc.

- E.ON One GmbH

- Eaton Corporation

- ENEL Group

- Engie SA

- General Electric Company

- Google LLC by Alphabet Inc.

- Grid4C

- Halliburton Company

- Hitachi Ltd

- Honeywell International Inc.

- International Business Machines Corporation

- Microsoft Corporation

- Schlumberger Limited

- Schneider Electric SE

- Siemens AG

- Tesla Inc.

- Uplight, Inc.

- Verdigris Technologies, Inc.

Industry leaders must align use cases, data architectures, talent, and governance to capture the full strategic value of artificial intelligence in energy

For industry leaders, converting the promise of artificial intelligence in energy into tangible results requires a disciplined, action-oriented approach. The first imperative is to ground artificial intelligence initiatives in clearly defined business problems, whether they relate to reducing unplanned outages, integrating higher shares of renewables, optimizing participation in electricity markets, or supporting new customer propositions. By prioritizing a small number of high-impact use cases such as predictive maintenance, renewable forecasting, and demand-side management, organizations can build momentum and demonstrate quick wins that justify broader investment.

Data and architecture decisions are equally critical. Executives should establish a coherent strategy for collecting, standardizing, and governing operational and market data across assets and regions, with explicit roles and accountabilities. At the same time, they should design target architectures that balance cloud-based scalability with the security and latency advantages of on-premises and edge processing, reflecting regulatory constraints and the criticality of specific applications. Investing early in modular, vendor-agnostic platforms reduces lock-in and facilitates adaptation to evolving hardware supply conditions and tariff regimes.

Talent, partnerships, and governance form the third pillar of effective execution. Energy companies should develop blended teams that combine power system engineers, asset operators, data scientists, and software architects, supported by structured training programs that build artificial intelligence literacy among operations and executive staff. Strategic partnerships with technology providers, universities, and startups can accelerate solution development and bring fresh perspectives. At the same time, robust governance frameworks are needed to oversee model validation, cybersecurity, data privacy, and ethical considerations, particularly for applications that influence market behavior or customer outcomes.

Finally, leaders should institutionalize strategic scanning and scenario planning around policy and trade developments. Regularly assessing the implications of new tariffs, industrial policies, and carbon regulations on artificial intelligence hardware, software, and deployment choices enables organizations to adjust sourcing strategies, capital plans, and product roadmaps proactively rather than reactively. By combining these elements into an integrated program, industry leaders can move beyond experimentation and embed artificial intelligence as a core capability in their energy businesses.

Robust, multi-source research underpins a holistic view of how artificial intelligence is reshaping the global energy ecosystem

The insights summarized in this executive overview are grounded in a structured research methodology designed to capture both the breadth and depth of artificial intelligence adoption in the energy sector. The starting point is extensive secondary research drawing on regulatory filings, policy documents, technical standards, academic publications, and publicly available information from energy companies and technology providers. This desk research maps key themes such as grid modernization, renewable integration, data center expansion, and trade policy developments, and identifies representative case examples across different regions and segments.

Building on this foundation, targeted primary research captures perspectives from stakeholders directly involved in planning, procuring, and implementing artificial intelligence solutions. Interviews and discussions with utility executives, independent power producers, oil and gas operators, technology vendors, and subject-matter experts provide qualitative insights into practical challenges, organizational capabilities, and evolving customer expectations. These conversations help validate emerging trends, clarify the drivers behind adoption in specific use cases, and surface context that is often absent from purely quantitative datasets.

The research process then synthesizes findings through comparative analysis and triangulation. Segmentation frameworks encompassing components, technology types, deployment models, applications, and end users are applied consistently to ensure that insights are comparable across regions and business models. Particular attention is given to aligning technical developments with policy and regulatory trajectories, including tariff measures and industrial strategies that affect semiconductors and clean energy technologies. Where possible, the analysis cross-references multiple independent sources to reduce bias and improve robustness. The result is a holistic view that connects technology, economics, regulation, and competitive dynamics into a coherent narrative for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Artificial Intelligence in Energy market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Artificial Intelligence in Energy Market, by Component

- Artificial Intelligence in Energy Market, by Technology Type

- Artificial Intelligence in Energy Market, by Energy Type

- Artificial Intelligence in Energy Market, by Application

- Artificial Intelligence in Energy Market, by End User

- Artificial Intelligence in Energy Market, by Region

- Artificial Intelligence in Energy Market, by Group

- Artificial Intelligence in Energy Market, by Country

- United States Artificial Intelligence in Energy Market

- China Artificial Intelligence in Energy Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2862 ]

Artificial intelligence is becoming integral to energy systems, and strategic, flexible adoption today will determine tomorrow’s industry leaders

Artificial intelligence is moving from the periphery of the energy sector to its core, becoming inseparable from how grids are operated, assets are managed, and customers are served. The combination of rising electrification, rapid growth in data center and artificial intelligence-related power demand, and ambitious decarbonization objectives is forcing organizations to rethink long-standing assumptions about planning and operations. In this environment, the ability to harness data, automate complex decisions, and foresee emerging risks and opportunities becomes a strategic differentiator rather than a technical curiosity.

The analysis presented here underscores that the evolution of artificial intelligence in energy will not be uniform. Outcomes will differ by component, technology type, deployment model, application, end user, and region. Policy choices, including tariff regimes affecting semiconductors and clean energy inputs, will influence cost structures and supply chains, while regulatory frameworks will shape acceptable uses of data and algorithms. Companies that understand these interdependencies and design flexible, interoperable solutions will be better positioned to adapt as conditions change.

Ultimately, artificial intelligence offers the energy sector a powerful toolkit to enhance reliability, reduce emissions, and unlock new sources of value. Realizing this potential requires more than technical pilots; it demands sustained investment, cross-functional collaboration, and a willingness to redesign processes and business models around data-driven insights. Organizations that make these commitments now stand to play a leading role in building the next generation of intelligent, low-carbon energy systems.

Partner with Ketan Rohom to unlock deeper insights on artificial intelligence in energy and convert emerging opportunities into decisive action

To translate the strategic insights in this executive summary into concrete competitive advantage, decision-makers should now move from exploration to execution. That begins with gaining a deeper, data-backed understanding of how artificial intelligence is reshaping the specific parts of the energy value chain that matter most to their organizations, from grid operations and trading desks to asset fleets and customer portfolios.

A comprehensive market research report on artificial intelligence in energy can provide that foundation by connecting use-case level detail, technology roadmaps, regulatory context, and competitor positioning in a single, structured view. It can also help leadership teams prioritize investments between hardware, services, and software, determine which technology types align best with their risk appetite, and identify the regional combinations of policy, infrastructure, and demand that are most attractive for near-term action.

To move confidently, engage with Ketan Rohom, Associate Director, Sales and Marketing at the organization, to discuss how a full report tailored to your strategic priorities can support board-level decisions, capital allocation, and go-to-market planning. By securing access to a robust evidence base now, industry leaders can accelerate their artificial intelligence in energy journey, reduce uncertainty created by evolving tariffs and regulation, and position their businesses to capture emerging value pools ahead of slower-moving competitors.

- How big is the Artificial Intelligence in Energy Market?

- What is the Artificial Intelligence in Energy Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?