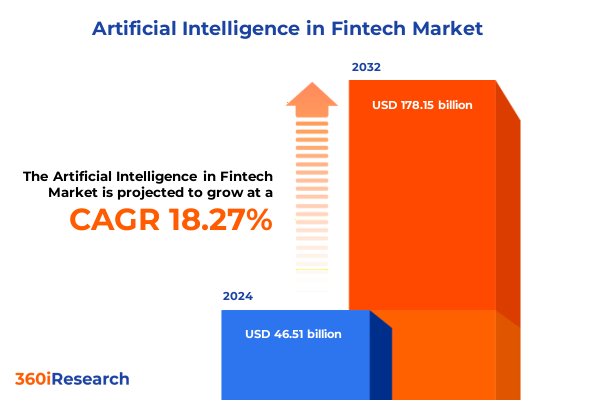

The Artificial Intelligence in Fintech Market size was estimated at USD 54.55 billion in 2025 and expected to reach USD 63.99 billion in 2026, at a CAGR of 18.41% to reach USD 178.15 billion by 2032.

Unveiling the Catalyst for Next-Generation Financial Services through Artificial Intelligence-Driven Innovation, Resilience, and Competitive Differentiation

Artificial intelligence has rapidly evolved from a nascent technology into a foundational element reshaping the financial services industry. As institutions navigate an increasingly complex digital landscape, AI enables them to automate critical processes, uncover hidden patterns in vast data sets, and anticipate market shifts with unprecedented accuracy. From algorithmic trading platforms leveraging predictive analytics to personalized banking experiences powered by advanced chatbots, AI’s influence permeates every corner of fintech.

This convergence of AI and finance is fueled by exponential growth in computational capabilities, the proliferation of cloud infrastructure, and the maturity of machine learning frameworks. Financial organizations are no longer limited by manual workflows; instead, they harness AI to process real-time transaction data, detect anomalous behavior instantly, and tailor offerings to individual customer needs. Moreover, the integration of generative AI and natural language understanding is ushering in a new era of human-machine collaboration, where virtual assistants anticipate client requests and streamline advisory services seamlessly.

The imperative to adopt AI is driven by competitive pressures as well as regulatory mandates that demand robust risk management and transparent decision models. Institutions that successfully embed AI across their value chains gain operational resilience, accelerate time to revenue, and strengthen customer loyalty-factors that define market leadership in an era of digital disruption.

Examining the Transformative Shifts Redefining Risk Management, Fraud Prevention, and Customer Engagement within AI-Enabled Financial Ecosystems

The fintech sector is undergoing transformative shifts as artificial intelligence redefines traditional operating paradigms. Risk management and fraud prevention have emerged as priority domains where AI’s real-time analytical prowess thwarts sophisticated threats. Institutions employ behavioral biometrics and predictive fraud analytics to monitor transactions across channels, substantially reducing false positives and enabling proactive interventions before financial losses occur.

Simultaneously, algorithmic trading has advanced beyond simple rule-based systems into high-frequency frameworks underpinned by predictive machine learning models. These systems analyze multivariate market signals-spanning economic indicators, social sentiment scores, and global news feeds-executing trades within microseconds to capture fleeting arbitrage opportunities. In parallel, AI-powered underwriting is accelerating credit decisions by incorporating alternative data sources and dynamic risk scores that adjust continuously to market volatility and customer behavior.

On the customer-facing front, chatbots and virtual assistants now leverage sophisticated language generation and sentiment analysis to deliver personalized banking advice, handle complex inquiries, and streamline onboarding processes. Robotic process automation, augmented with intelligent algorithms, is replacing manual legacy workflows, resulting in faster loan approvals, automated compliance checks, and optimized back-office efficiency. These transformative shifts, spanning front-line interactions to core risk functions, are setting the stage for a new generation of agile, data-driven financial institutions.

Analyzing the Cumulative Impact of United States Tariffs Implemented in 2025 on Technology Investment, Operational Costs, and Compliance Dynamics in Fintech

In 2025, United States tariff measures targeting imported technology components have introduced significant headwinds for fintech organizations dependent on global supply chains. The imposition of duties on semiconductors, networking hardware, and advanced processors has elevated costs for critical infrastructure, compelling firms to reassess capital expenditure and procurement strategies. These cost increases reverberate through data center expansion plans and cloud service contracts, influencing the total cost of ownership for digital banking platforms and payment gateways.

Beyond hardware, changing trade policies have complicated compliance demands. Fintech firms now contend with evolving tariff classifications, sanctions screening, and cross-border tax regulations, all of which require meticulous policy mapping and real-time rule updates. In response, many organizations are turning to AI-driven compliance tools that can ingest regulatory bulletins, identify relevant mandates, and dynamically adjust workflows, significantly reducing manual oversight.

At the same time, tariff-induced supply chain disruptions have accelerated interest in localized sourcing and hybrid cloud architectures, as firms seek to mitigate geopolitical risk. Strategic partnerships with domestic hardware vendors and investments in on-premise edge deployments enable continued service reliability. By leveraging AI for predictive inventory planning and cost simulation, businesses can navigate tariff volatility with agility, transform compliance from a reactive burden into a competitive advantage, and sustain innovation despite external policy shifts.

Exploring Deep-Dive Segmentation Insights Illuminating How Applications, Technologies, Deployments, Components, End Users, and Organization Sizes Shape Market Dynamics

A granular examination of market segmentation reveals distinct pathways through which artificial intelligence is reshaping financial services. When considering the landscape by application, algorithmic trading divides into high frequency and predictive analytics strategies, driving superior trade execution speeds and market foresight. In parallel, chatbots and virtual assistants manifest in text-based and voice-enabled interfaces, each enhancing client engagement with tailored conversational experiences. Fraud detection, partitioned between identity theft and payment fraud detection, underscores a security framework fortified by continuous monitoring and adaptive learning. Personalized banking bifurcates into customer recommendations and customized offers, enabling hyper-targeted financial solutions, while risk assessment spans credit and market risk domains, providing dynamic insights for balanced portfolio management.

From a technological standpoint, the market branches into computer vision applications-spanning image recognition and OCR for document verification-and machine learning architectures composed of supervised and unsupervised models refining predictive accuracy. Natural language processing extends across language generation and sentiment analysis, fortifying advisory services and social media monitoring. Robotic process automation operates in attended and unattended modes, orchestrating end-to-end process automation and reinforcing workforce augmentation.

Deployment choices oscillate between cloud variants-public, private, and hybrid-and on-premise solutions such as centralized data centers and edge-based nodes, reflecting divergent priorities in scalability versus latency. Components include hardware arrays of networking equipment and servers, services portfolios covering consulting and integration, and software ecosystems built on modular platforms and toolkits. End users range from commercial and retail banks to lending and payment-oriented fintech startups, alongside life and non-life insurance providers. Finally, organizations of every scale-from large and midsize enterprises to medium and small businesses-adopt AI tailored to their distinct resource profiles and strategic objectives.

This comprehensive research report categorizes the Artificial Intelligence in Fintech market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Component

- Organization Size

- Deployment

- Application

- End User

Highlighting Key Regional Insights into AI Adoption Patterns, Regulatory Frameworks, and Growth Trajectories across the Americas, EMEA, and Asia-Pacific Zones

Across the Americas, investment in AI for financial services continues to accelerate. North American institutions, supported by robust venture capital ecosystems and favorable regulatory environments, are pioneering advanced fraud detection frameworks and next-generation digital banking experiences. Latin American markets, meanwhile, are leapfrogging legacy infrastructure by embracing mobile-first AI solutions for payments and lending, closing the financial inclusion gap at scale.

Within Europe, Middle East & Africa, regulatory rigor coexists with innovation hubs. The European Union’s emphasis on data privacy and explainable AI has catalyzed development of compliance-centric platforms, particularly in the UK and Germany, where open banking initiatives further stimulate competitive dynamics. In the Middle East, sovereign wealth funds are underwriting ambitious digital transformation programs, and African markets are leveraging AI-driven credit scoring to extend financial services to historically underserved populations.

Asia-Pacific stands at the forefront of mass adoption. China’s fintech giants integrate AI into virtually every customer journey, from super-apps providing unified financial services to AI-powered underwriting models that process millions of loan applications daily. In India and Southeast Asia, regulatory sandboxes and government-sponsored incubators are fueling a vibrant fintech startup culture focused on personalized banking, risk management, and embedded insurance solutions.

This comprehensive research report examines key regions that drive the evolution of the Artificial Intelligence in Fintech market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Market Leaders and Innovators Shaping AI-Driven Fintech Advancements through Strategic Investments, Partnerships, and Product Launches

Market leaders are charting diverse strategies to harness AI’s potential. Global investment banks deploy proprietary machine learning models to optimize portfolio construction and enhance liquidity provisioning. Fintech challengers partner with cloud providers to scale AI-driven services, leveraging managed infrastructure and pre-built analytics modules for rapid time to market. Technology incumbents market semiconductor innovations tailored to AI workloads, balancing performance with energy efficiency to meet the demands of large-scale model training and inference.

In the consumer finance arena, digital payment platforms integrate real-time risk scoring engines to balance frictionless transactions with robust security. Robo-advisory firms manage trillions in assets under management, applying reinforcement learning techniques to refine asset allocation continuously. Insurance companies adopt AI-enabled underwriting tools that underwrite policies in minutes, while banks embed natural language interfaces within mobile apps to streamline customer support and cross-sell financial products.

Professional services organizations and system integrators are differentiating through specialized AI practice groups, offering end-to-end capabilities from strategy formulation to solution deployment. Collectively, these actors are defining best practices, fostering interoperability standards, and setting the pace for the next generation of AI-infused fintech innovations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Artificial Intelligence in Fintech market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alteryx, Inc.

- Amazon Web Services Inc.

- Amelia US LLC by SOUNDHOUND AI, INC.

- American Express

- ComplyAdvantage Company

- Feedzai – Consultadoria e Inovação Tecnológica, S.A.

- Fidelity National Information Services, Inc.

- Fiserv, Inc.

- Google LLC by Alphabet Inc.

- Gupshup Inc.

- HighRadius Corporation

- IBM Corporation

- Intel Corporation

- Intuit Inc.

- JP Morgan Chase & Co.

- Kasisto, Inc.

- Mastercard Incorporated

- Microsoft Corporation

- MindBridge Analytics Inc.

- NVIDIA Corporation

- Oracle Corporation

- SentinelOne, Inc.

- SESAMm SAS

- Signifyd, Inc.

- SoFi Technologies, Inc.

- Square, Inc. by Block, Inc.

- Stripe, Inc.

- Vectra AI, Inc.

- Visa Inc.

- ZestFinance, Inc.

Delivering Actionable Recommendations for Industry Leaders to Optimize AI Integration, Strengthen Security Postures, and Enhance Operational Efficiency

To capitalize on AI’s transformative power, leaders should prioritize end-to-end data governance frameworks that ensure data quality, security, and compliance from ingestion to insight derivation. Investing in explainable AI architectures will bolster transparency, enabling stakeholders to trust algorithmic outputs and satisfy evolving regulatory requirements.

Organizations must also cultivate multidisciplinary teams combining data scientists, subject-matter experts, and compliance specialists, fostering collaborative environments where domain knowledge informs model development and validation. Embracing cloud-native AI services while maintaining hybrid and on-premise flexibility guarantees resilience against geopolitical and operational disruptions.

Furthermore, firms should adopt a measured approach to AI pilot programs, validating use cases through iterative deployments that generate quick wins and build stakeholder confidence. Strategic partnerships with technology vendors and academic institutions can accelerate innovation, while continuous upskilling programs empower employees to adopt AI tools effectively. By embedding these practices into a cohesive AI strategy, financial organizations will drive cost efficiencies, differentiate customer experiences, and fortify their competitive positions.

Outlining a Rigorous Research Methodology Combining Primary Interviews, Secondary Analysis, and Data Triangulation to Ensure Insightful Market Perspectives

This analysis employs a rigorous research methodology combining primary and secondary sources to ensure comprehensive coverage and analytical depth. Primary research includes structured interviews with senior executives from leading financial institutions, fintech startups, and technology providers, capturing firsthand perspectives on the evolving AI landscape and strategic priorities.

Secondary research encompasses an extensive review of industry publications, regulatory filings, academic journals, and market reports, supplemented by open-source financial data and technical whitepapers. Data triangulation validates key insights through cross-referencing disparate sources, while trend analysis identifies recurring themes and emergent patterns.

Segmentation frameworks were developed based on application, technology, deployment model, component, end user, and organization size, facilitating granular analysis of market dynamics. Regional insights draw on economic indicators and investment trends within the Americas, EMEA, and Asia-Pacific. Finally, iterative expert reviews and editorial oversight ensure accuracy, relevance, and actionable clarity across all sections.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Artificial Intelligence in Fintech market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Artificial Intelligence in Fintech Market, by Technology

- Artificial Intelligence in Fintech Market, by Component

- Artificial Intelligence in Fintech Market, by Organization Size

- Artificial Intelligence in Fintech Market, by Deployment

- Artificial Intelligence in Fintech Market, by Application

- Artificial Intelligence in Fintech Market, by End User

- Artificial Intelligence in Fintech Market, by Region

- Artificial Intelligence in Fintech Market, by Group

- Artificial Intelligence in Fintech Market, by Country

- United States Artificial Intelligence in Fintech Market

- China Artificial Intelligence in Fintech Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3339 ]

Concluding Reflections on the Strategic Imperatives of Artificial Intelligence Integration and Future Directions for Sustainable Fintech Growth

The integration of artificial intelligence within financial services represents a strategic inflection point, offering the dual promise of operational excellence and enhanced customer engagement. As AI technologies mature, institutions that thoughtfully balance innovation with governance will achieve sustainable competitive advantages while mitigating emergent risks associated with fraud, bias, and regulatory complexity.

This executive summary has highlighted transformative shifts across risk management, customer engagement, and operational automation, along with the influences of geopolitical factors such as U.S. tariffs on technology inputs. Segmentation insights illuminate the multifaceted applications and deployment models driving market evolution, while regional and company analyses underscore the varied pathways to AI-powered growth.

Ultimately, the future of fintech lies in orchestrating an ecosystem where data, algorithms, and domain expertise converge to deliver transparent, secure, and personalized financial services. Organizations that embrace this paradigm will unlock new revenue streams, fortify resilience, and lead the industry forward in the age of intelligent finance.

Seize Competitive Advantage by Partnering with Ketan Rohom to Access a Comprehensive AI in Fintech Market Research Report and Drive Strategic Growth

Elevate your strategic initiatives by partnering with Ketan Rohom, Associate Director of Sales & Marketing, to unlock unmatched depth and clarity in AI-driven financial services research. Engaging directly with Ketan provides the opportunity to tailor the market research report to your organization’s unique demands, ensuring you receive targeted insights, detailed analyses, and scenario planning that drive decision-making with precision. His expertise in interpreting the convergence of artificial intelligence and fintech will equip your team with actionable intelligence on emerging technologies, regulatory shifts, and competitive dynamics. Secure your organization’s leadership position by taking the next step today: collaborate with Ketan to access the comprehensive AI in Fintech market research report and empower your finance and technology strategies with data-backed confidence.

- How big is the Artificial Intelligence in Fintech Market?

- What is the Artificial Intelligence in Fintech Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?