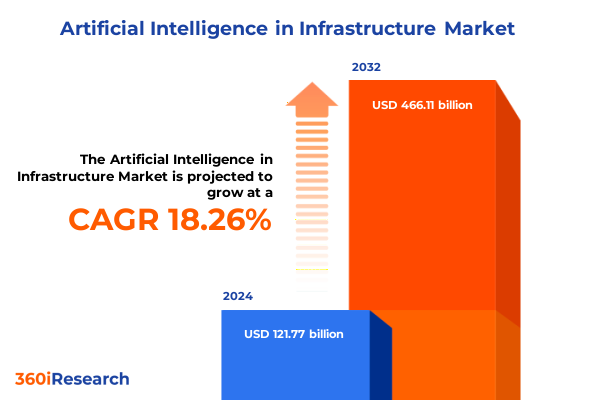

The Artificial Intelligence in Infrastructure Market size was estimated at USD 141.77 billion in 2025 and expected to reach USD 165.06 billion in 2026, at a CAGR of 18.53% to reach USD 466.11 billion by 2032.

Unveiling the Pivotal Role of Artificial Intelligence in Transforming Modern Infrastructure and Operational Paradigms for Future-Proof Performance

Artificial intelligence has rapidly evolved from a visionary concept to a foundational element in the design, optimization, and management of modern infrastructure. As organizations strive to meet escalating demands for performance, resilience, and sustainability, AI-driven systems have emerged as critical enablers for dynamic resource allocation, predictive maintenance, and automated orchestration. This introduction delineates the transformative power of AI in bridging the gap between traditional physical assets and intelligent, self-adaptive networks that align operational efficiency with strategic objectives.

The convergence of advanced analytics, machine learning algorithms, and real-time data streams is reshaping how infrastructure stakeholders envision capacity planning and risk mitigation. By fostering deeper visibility into system behavior and enabling rapid adjustments to fluctuating workloads, AI solutions are unlocking unprecedented opportunities to optimize energy consumption, reduce downtime, and accelerate innovative service delivery. Through this exploration, readers will gain clarity on the pivotal role of AI in redefining infrastructure paradigms and the implications for competitive advantage in an increasingly interconnected landscape.

Examining the Major Technological and Strategic Shifts Reshaping Infrastructure Through Artificial Intelligence Integration and Innovation

The landscape of infrastructure is undergoing a seismic shift driven by the integration of artificial intelligence across every layer of network, compute, and storage architectures. Traditional manual processes and rule-based management systems are giving way to self-learning models that automatically detect anomalies and prescribe corrective actions, resulting in marked improvements in reliability and throughput. Meanwhile, the rise of edge computing is decentralizing data processing, bringing intelligence closer to the point of use and reducing latency for critical applications in sectors such as manufacturing and telecommunications.

In parallel, the proliferation of software-defined networking and virtualized platforms has created an agile foundation upon which AI-driven orchestration tools can dynamically allocate resources to meet variable demand patterns. These transformative shifts are further accelerated by the adoption of open-source frameworks, tiered data lakes, and containerized workloads, which together facilitate rapid prototyping and seamless scale-up. The synergy between AI algorithms and infrastructure as code is ushering in a new era of operational agility, empowering organizations to deliver differentiated services while maintaining stringent governance and security standards.

Analyzing the Far-Reaching Cumulative Impact of Recent United States Tariff Measures on Artificial Intelligence Infrastructure Projects

Since the early months of 2025, a series of sweeping tariff measures enacted by the United States government have introduced tangible headwinds for the deployment of AI infrastructure. By imposing heightened duties on a broad spectrum of imported technology components, including specialized cooling systems, unassembled server racks, and networking hardware, the new trade policies have elevated project budgets and introduced uncertainty into capital planning cycles. Although exemptions were later extended to core semiconductors and certain end-user devices, ancillary elements essential for constructing and maintaining AI data centers remain subject to levies, compelling organizations to reevaluate sourcing strategies and accelerate components of domestic production.

The accumulative impact of these tariffs has led major cloud providers and technology integrators to postpone or scale back planned expansions. Reports indicate that cost increases driven by import duties could delay multi-hundred-million-dollar data center projects, such as the landmark Stargate initiative aimed at establishing a network of AI-focused facilities across the United States. In response, leading firms are exploring hybrid construction models, pre-negotiated equipment contracts, and strategic stockpiling of critical components to hedge against future policy fluctuations. This recalibration underscores the necessity for robust trade risk assessment and proactive supply chain diversification in the pursuit of uninterrupted AI infrastructure growth.

Uncovering Critical Segmentation Insights Across Components Infrastructure Types Industries and Deployment Models Driving Artificial Intelligence Adoption

A nuanced examination of the AI infrastructure market reveals distinct performance drivers when segmented by component, infrastructure type, end user industry, and deployment model. At the component level, hardware investments-including networking equipment, processors, and storage devices-tend to align with the urgent demands of compute-intensive workloads, while software elements such as middleware, platforms, and tools deliver the orchestration intelligence that underlies autonomous operations. Services play an equally critical role: strategy consulting, technical consulting, application and system integration, as well as onsite and remote support, collectively ensure that AI solutions are tailored, deployed, and maintained to achieve optimal outcomes.

Shifting focus to infrastructure type, compute resources split between edge devices-encompassing gateways and IoT sensors-and centralized servers in blade, rack, or tower form factors each address diverse latency and throughput requirements. Networking segments defined by traditional routers and switches coexist with software-defined networking layers that adaptively prioritize traffic flows for efficiency. Storage architectures range from high-throughput arrays for real-time analytics to scalable object stores for archival purposes, creating a balance between performance and cost-efficiency.

Within end user industries, financial services and energy companies leverage AI to enhance fraud detection and optimize grid performance, while government agencies deploy AI-driven analytics for defense, public safety, and smart city initiatives. Manufacturing verticals, including automotive and electronics, implement predictive maintenance and quality control, and telecom operators depend on AI for broadband and mobile network optimization. Finally, the dichotomy between cloud and on-premise deployment models presents distinct value propositions in terms of scalability, data sovereignty, and capital expenditure structures.

This comprehensive research report categorizes the Artificial Intelligence in Infrastructure market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Infrastructure Type

- End User Industry

- Deployment Model

Illuminating Key Regional Dynamics and Market Drivers Influencing the Growth Trajectory of Artificial Intelligence Infrastructure Worldwide

Regional market dynamics underscore divergent regulatory frameworks, infrastructure maturity, and investment priorities that shape AI infrastructure adoption. In the Americas, the concentration of hyperscale cloud providers and robust venture capital ecosystems fuels rapid innovation, particularly in data center construction and edge network rollouts. Meanwhile, regional policies aimed at enhancing digital sovereignty and incentivizing domestic manufacturing are influencing how organizations structure their AI projects across North and South America.

Across Europe, the Middle East, and Africa, a complex mosaic of regulations-such as stringent data privacy regimes in the European Union and nascent AI governance frameworks in emerging markets-creates both challenges and opportunities for infrastructure developers. Collaborative initiatives between government bodies and private sector consortia are fostering testbeds for smart grid deployments and intelligent transportation systems, often leveraging public-private partnerships to mitigate financial and operational risks.

In the Asia-Pacific region, relentless investment in 5G rollouts, coupled with national strategies to achieve AI self-sufficiency, is accelerating the deployment of edge and cloud infrastructures. Key markets are driving ambitious multi-sector digitalization efforts that encompass utilities, manufacturing, and telecommunications. These regional distinctions emphasize the importance of tailoring infrastructure strategies to local regulatory, economic, and technological landscapes.

This comprehensive research report examines key regions that drive the evolution of the Artificial Intelligence in Infrastructure market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Distilling Essential Insights on Leading Companies Shaping the Future of Artificial Intelligence Infrastructure and Competitive Landscape

A cadre of leading technology organizations is instrumental in defining the benchmarks for AI infrastructure performance and scalability. Major semiconductor manufacturers continue to push the boundaries of processing power, while cloud service giants integrate advanced orchestration frameworks to deliver elastic compute and storage services globally. Network equipment vendors are embedding AI capabilities directly into next-generation routers and switches to support real-time traffic management and anomaly detection.

Simultaneously, a growing ecosystem of systems integrators and professional services firms is refining best practices for designing, deploying, and optimizing AI-driven environments. These strategic partners blend deep domain expertise in data center architecture with specialized proficiency in AI model training and inferencing workflows, ensuring that infrastructure investments translate into measurable business value. The interplay between hardware innovators, software developers, and service providers forms a dynamic competitive landscape in which collaboration and co-innovation are key differentiators.

This comprehensive research report delivers an in-depth overview of the principal market players in the Artificial Intelligence in Infrastructure market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Micro Devices, Inc.

- Alphabet Inc.

- Amazon.com, Inc.

- Cisco Systems, Inc.

- Dell Technologies Inc.

- Hewlett Packard Enterprise Company

- Intel Corporation

- International Business Machines Corporation

- Microsoft Corporation

- NVIDIA Corporation

Actionable Strategic Recommendations for Industry Executives to Leverage Emerging Artificial Intelligence Infrastructure Opportunities Effectively

To capitalize on emerging opportunities in AI infrastructure, industry executives must adopt a holistic strategic approach that bridges technological, operational, and organizational domains. First, aligning infrastructure roadmaps with business use cases ensures that investments in compute, storage, and networking are targeted to maximize return on innovation. Prioritizing partnerships with experienced integration firms accelerates deployment timelines and mitigates execution risks associated with complex system rollouts.

Second, diversifying supply chains and fostering local manufacturing partnerships can reduce exposure to geopolitical and trade uncertainties. Organizations should conduct comprehensive risk assessments, scenario planning, and establish flexible procurement models to maintain resilience in an evolving policy environment. Third, investing in workforce development initiatives-such as immersive upskilling programs and cross-functional teams-builds the internal capabilities required to manage AI-driven infrastructure lifecycles effectively.

Finally, embedding sustainability metrics into infrastructure decision-making, from energy-efficient hardware selections to advanced cooling solutions enabled by AI, not only addresses environmental and regulatory imperatives but also delivers long-term cost efficiencies. By implementing these actionable recommendations, leaders can secure a competitive edge and ensure their infrastructure foundations remain adaptive and growth-oriented.

Detailing a Comprehensive Research Methodology Integrating Primary and Secondary Approaches to Deliver Artificial Intelligence Infrastructure Insights

This research integrates a multi-phase methodology combining primary and secondary data collection, qualitative expert interviews, and rigorous data triangulation. Initially, an extensive review of industry publications, regulatory filings, and corporate disclosures establishes a baseline understanding of AI infrastructure trends, technology roadmaps, and market drivers. Proprietary databases and public sources are cross-verified to ensure comprehensive coverage of emerging innovations and policy developments.

In parallel, structured interviews and workshops with senior executives, systems architects, and domain specialists provide deeper insights into real-world deployment challenges, best practices, and investment priorities. Quantitative analytics are applied to synthesized data points to identify performance benchmarks and adoption patterns across various segmentation dimensions. Validation of findings is achieved through peer review sessions with subject-matter experts, ensuring that conclusions accurately reflect the dynamic interplay of technological advances and market forces.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Artificial Intelligence in Infrastructure market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Artificial Intelligence in Infrastructure Market, by Component

- Artificial Intelligence in Infrastructure Market, by Infrastructure Type

- Artificial Intelligence in Infrastructure Market, by End User Industry

- Artificial Intelligence in Infrastructure Market, by Deployment Model

- Artificial Intelligence in Infrastructure Market, by Region

- Artificial Intelligence in Infrastructure Market, by Group

- Artificial Intelligence in Infrastructure Market, by Country

- United States Artificial Intelligence in Infrastructure Market

- China Artificial Intelligence in Infrastructure Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 3180 ]

Synthesizing Critical Conclusions on the Evolving Intersection of Artificial Intelligence and Modern Infrastructure for Informed Decision Making

The convergence of AI and infrastructure represents a watershed moment in the evolution of digital ecosystems, enabling organizations to transcend traditional operational boundaries. By harnessing machine learning, predictive analytics, and automated orchestration, stakeholders can unlock new levels of efficiency, resiliency, and service differentiation. As regulatory landscapes adapt to address data sovereignty and security considerations, agility in infrastructure planning and procurement becomes a critical competitive advantage.

Future success will hinge on an organization’s ability to integrate cross-segment insights-from hardware selection and deployment models to industry-specific use cases and regional nuances-into a cohesive strategy. Collaborative innovation between technology vendors, service providers, and end users will continue to drive breakthroughs in performance and cost optimization. Ultimately, adopting a forward-looking approach to AI infrastructure will equip enterprises to navigate disruption, scale effectively, and capitalize on the next wave of digital transformation.

Engage Today to Secure Exclusive Access to Transformative Artificial Intelligence Infrastructure Insights and Drive Strategic Growth Partnerships

To obtain unparalleled insights into the rapidly evolving field of artificial intelligence in infrastructure and translate them into actionable strategies, engage directly with Ketan Rohom, Associate Director of Sales & Marketing. By securing this comprehensive market research report, organizations can gain privileged access to an extensive analysis of technological advancements, strategic shifts, regional dynamics, and competitive landscapes. This tailored resource empowers decision-makers to benchmark current capabilities against industry best practices, identify high-potential investment opportunities, and navigate complex regulatory environments with confidence.

Interacting with Ketan Rohom also opens the door to customized briefings and implementation workshops designed to align the report’s findings with your organization’s unique objectives. Don’t miss the opportunity to leverage expert guidance and accelerate your journey toward scalable, resilient AI-driven infrastructure. Reach out now to secure your definitive roadmap to future-proof infrastructure success.

- How big is the Artificial Intelligence in Infrastructure Market?

- What is the Artificial Intelligence in Infrastructure Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?