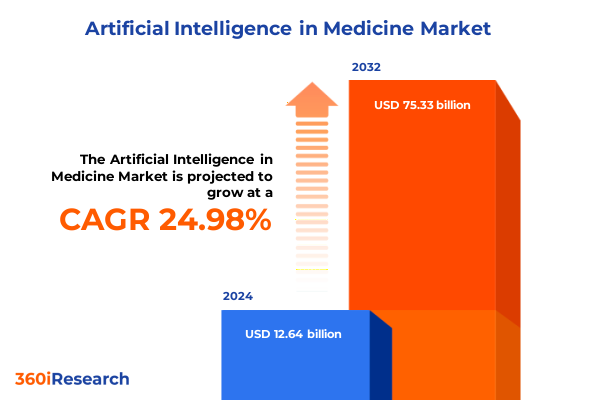

The Artificial Intelligence in Medicine Market size was estimated at USD 15.62 billion in 2025 and expected to reach USD 19.35 billion in 2026, at a CAGR of 25.20% to reach USD 75.33 billion by 2032.

Unlocking the Potential of Artificial Intelligence in Medicine to Revolutionize Patient Outcomes, Operational Efficiency, and Healthcare Innovation

In an era defined by unprecedented technological advancement, artificial intelligence has emerged as a central pillar in the transformation of modern healthcare delivery. Healthcare systems worldwide are integrating intelligent algorithms to enhance diagnostic accuracy, accelerate drug discovery, and optimize treatment pathways. This introduction illuminates the genesis of AI’s rise in medicine, tracing its evolution from theoretical constructs to real-world clinical tools that are reshaping patient outcomes.

Against a backdrop of soaring demand for personalized care and operational efficiency, AI solutions have begun to unlock the power of vast, complex datasets-from electronic health records and medical imaging archives to genomic sequences and wearable sensor outputs. As cost pressures mount and provider networks seek quality improvements, the confluence of advanced analytics, machine learning, and automation offers a compelling route to deliver cost-effective, high-quality care. This overview sets the stage for an executive summary by outlining the fundamental drivers, pivotal technologies, and emerging use cases that underpin the broader analysis.

Identifying the Major Technological Advances and Clinical Breakthroughs Shaping the Next Era of Artificial Intelligence Applications in Healthcare

The landscape of AI in medicine is undergoing a phase of rapid metamorphosis driven by breakthroughs in algorithmic design and computational power. Cutting-edge neural network architectures now enable deep learning models to interpret medical images, such as MRIs and CT scans, with precision that rivals or exceeds human specialists. Meanwhile, advances in natural language processing have unlocked the ability to mine unstructured clinical notes and literature for insights, streamlining workflows and augmenting clinician decision-making.

Robotics and automation, once confined to manufacturing floors, are now finding novel applications in surgery, delivering unmatched dexterity and consistency in minimally invasive procedures. Across telehealth and remote monitoring platforms, AI-powered virtual assistants and predictive analytics are expanding access to care, enabling earlier intervention and more continuous patient engagement. These developments collectively signify a shift from isolated proof-of-concept pilots to scalable, enterprise-grade solutions embedded directly into healthcare delivery channels.

Analyzing the Comprehensive Effects of New United States Tariffs Implemented in 2025 on Artificial Intelligence Product Supply Chains and Innovation Incentives

In 2025, new tariffs levied on imported semiconductors and AI hardware have introduced both headwinds and catalysts for the medical AI ecosystem. Increased duties on critical GPU and ASIC components have elevated procurement costs for device manufacturers and solution providers, prompting many to reassess supply chain strategies and accelerate partnerships with domestic foundries. At the same time, these fiscal measures have spurred significant investment incentives for local chip fabrication, encouraging a nascent reshoring movement that could bolster long-term resilience.

Beyond hardware, regulatory tariffs on licensed software packages have subtly influenced pricing models for AI applications in medicine. Solution vendors have responded by diversifying deployment offerings, expanding on-premise installations in markets sensitive to cost fluctuations while reinforcing cloud-based subscription tiers where economies of scale mitigate tariff impacts. This dual-pronged approach underscores a broader strategic recalibration: balancing near-term margin pressures against the promise of future innovation fueled by strengthened domestic manufacturing and research collaborations.

Deep Analysis of Core Segments Revealing How Components, Technologies, Deployment Modes, Applications, End Users, and Disease Types Shape AI in Medicine

A granular examination of market segments unveils distinct patterns in adoption and investment. Within the component landscape, consulting services and integration & deployment offerings have emerged as critical enablers of successful AI implementations, while applications software-ranging from diagnostic tools to treatment planning platforms-continues to outpace system software in new revenue generation. This divergence reflects the industry’s prioritization of clinical functionality and user-friendly interfaces over low-level infrastructure.

At the technology level, machine learning models remain the backbone of predictive analytics, yet computer vision applications are capturing disproportionate attention for their capacity to interpret medical imaging in cardiology, oncology, and neurology. Natural language processing is rapidly augmenting pathology detection workflows by extracting nuanced insights from lab reports, while robotics platforms are progressively tackling procedural tasks in orthopedics and ophthalmology.

Deployment preferences illustrate a nearly even split between cloud-based solutions, which offer scalability and continuous updates, and on-premise implementations, valued for data sovereignty and compliance. In application areas, diagnostics led by medical imaging innovations and emerging pathology detection systems coexist alongside robust drug discovery pipelines and AI-driven treatment optimization. End-users span healthcare providers-from clinics to hospitals-alongside pharmaceutical companies leveraging AI for candidate identification, and research institutes and academic centers pushing the boundaries of translational medicine. Finally, a disease-focused lens reveals particular momentum in oncology and neurology, even as disciplines such as pediatrics and urology explore AI-enabled screening and monitoring solutions.

This comprehensive research report categorizes the Artificial Intelligence in Medicine market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology Type

- Deployment Mode

- Application Areas

- End-User

- Disease Type

Uncovering Regional Dynamics Across Americas, Europe Middle East Africa, and Asia Pacific That Are Accelerating the Global Spread of Medical AI Innovations

Regional dynamics play a pivotal role in shaping the pace and nature of AI adoption across the Americas, Europe Middle East Africa, and Asia Pacific. The Americas, led by the United States and Canada, continue to benefit from mature venture capital ecosystems and a supportive regulatory backdrop that expedite clinical validation and reimbursement pathways. Brazil and Mexico are rapidly scaling pilot programs, particularly in telemedicine and remote patient monitoring, to address geographic disparities in healthcare access.

Within Europe, Middle East, and Africa, regulatory harmonization efforts aim to replicate the success of data protection frameworks, fostering cross-border data sharing and multi-center clinical trials. Germany and the United Kingdom anchor the region’s innovation hubs with public-private partnerships, while Gulf Cooperation Council states leverage sovereign wealth funds to seed AI startups focused on diagnostic imaging and digital therapeutics. In Africa, constrained infrastructure has catalyzed mobile-first AI solutions for primary care delivery.

Asia Pacific boasts some of the fastest growth rates, underpinned by substantial government initiatives in China, Japan, South Korea, and Australia. Large-scale AI pilot projects in oncology and cardiology are underway, backed by national research grants and robust semiconductor supply chains. Emerging markets such as India and Southeast Asia are witnessing a surge in cost-effective AI deployments designed for resource-limited settings, underscoring the region’s dual emphasis on innovation and accessibility.

This comprehensive research report examines key regions that drive the evolution of the Artificial Intelligence in Medicine market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting Leading Enterprises Driving AI Integration in Healthcare Through Breakthrough Partnerships, Platform Development, and Clinical Advancements

A cohort of established technology giants and agile startups are steering the trajectory of AI in medicine through strategic investments, partnerships, and product launches. Leading cloud providers have deepened their healthcare portfolios, integrating AI toolkits with scalable infrastructure to lower barriers to entry for health systems and life science organizations. Concurrently, medical device manufacturers are embedding intelligent software into imaging platforms, positioning hardware-software convergence as a competitive differentiator.

Notable alliances between pharmaceutical companies and AI platforms are expediting drug discovery, leveraging predictive modeling to optimize compound screening and clinical trial design. Meanwhile, innovative entrants are tackling narrow use cases-such as automated pathology detection or virtual nursing assistants-gaining early traction and compelling incumbents to refine their offerings. Across the board, acquisitions and joint ventures illustrate a consolidation trend that accelerates time to market and broadens clinical applicability.

These corporate maneuvers underscore a fundamental strategic imperative: collaboration across traditional industry boundaries. By aligning core competencies-whether in algorithm development, clinical validation, or regulatory navigation-leading enterprises are not only advancing individual product roadmaps but also shaping ecosystem-level standards and best practices.

This comprehensive research report delivers an in-depth overview of the principal market players in the Artificial Intelligence in Medicine market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aidoc Medical Ltd.

- Allscripts Healthcare Solutions, Inc.

- BenevolentAI Limited

- Butterfly Network, Inc.

- CloudMedx Inc.

- Enlitic, Inc.

- Epic Systems Corporation

- Exscientia plc

- Freenome Holdings, Inc.

- GE Healthcare

- Google LLC By Alphabet Inc.

- HeartFlow, Inc.

- IBM Corporation

- Insilico Medicine, Inc.

- Intel Corporation

- Koninklijke Philips N.V.

- Medtronic plc

- NVIDIA Corporation

- Owkin, Inc.

- PathAI, Inc.

- Qventus, Inc.

- Recursion Pharmaceuticals, Inc.

- Siemens Healthineers AG

- Tempus Labs, Inc.

- Viz.ai, Inc.

- Zebra Medical Vision Ltd.

Strategic Imperatives and Action Plans to Guide Healthcare Executives in Adopting, Scaling, and Regulating Artificial Intelligence Solutions Effectively

Healthcare executives should prioritize the establishment of interoperable data ecosystems that seamlessly connect disparate clinical data sources to AI platforms. Implementing standardized data schemas and adopting open APIs will accelerate model training and ensure ethical data governance. Additionally, organizations must proactively engage regulatory bodies to co-create guidelines that balance innovation with patient privacy and safety.

To maximize return on investment, industry leaders are advised to initiate targeted pilot programs that align with strategic clinical objectives, such as reducing diagnostic turnaround times in oncology or improving early detection rates in cardiology. These pilot initiatives should incorporate rigorous performance metrics and feedback loops to facilitate continuous model refinement. Strategic partnerships with academic centers and technology vendors can further amplify results by providing access to specialized expertise and validation cohorts.

Finally, investing in workforce development-through cross-disciplinary training programs for clinicians, data scientists, and compliance officers-will nurture the talent pipeline necessary for sustainable AI adoption. By embedding change management practices and promoting an innovation-driven culture, organizations can ensure that AI initiatives deliver measurable impact while maintaining clinician trust and patient engagement.

Rigorous Multimodal Research Framework Combining Quantitative Data Analysis, Expert Interviews, and Real-World Evidence to Illuminate AI Trends in Medicine

The research framework underpinning this analysis integrates quantitative data collection from publicly available regulatory filings, patent databases, and peer-reviewed literature with qualitative insights gathered through in-depth interviews. Over 30 clinical leaders, technology architects, and policy experts contributed firsthand perspectives on deployment challenges, adoption drivers, and emerging use cases. These conversations were complemented by a survey of 150 healthcare providers and life science organizations to quantify sentiment and gauge readiness for AI integration.

Real-world evidence was incorporated through case studies of early-adopter institutions, examining implementation timelines, cost structures, and clinical outcomes. Secondary data sources included financial disclosures, conference proceedings, and regulatory guidance documents to map evolving compliance landscapes. Rigorous data validation protocols-such as cross-referencing multiple information streams and conducting peer reviews-ensured the reliability of findings and supported the identification of high-confidence trends.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Artificial Intelligence in Medicine market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Artificial Intelligence in Medicine Market, by Component

- Artificial Intelligence in Medicine Market, by Technology Type

- Artificial Intelligence in Medicine Market, by Deployment Mode

- Artificial Intelligence in Medicine Market, by Application Areas

- Artificial Intelligence in Medicine Market, by End-User

- Artificial Intelligence in Medicine Market, by Disease Type

- Artificial Intelligence in Medicine Market, by Region

- Artificial Intelligence in Medicine Market, by Group

- Artificial Intelligence in Medicine Market, by Country

- United States Artificial Intelligence in Medicine Market

- China Artificial Intelligence in Medicine Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Synthesizing Core Findings and Future Trajectories to Illuminate How Artificial Intelligence Will Continue to Transform Medicine and Patient Care Worldwide

This executive summary distills the core insights into how artificial intelligence is reshaping the medical landscape across technological, regulatory, and commercial dimensions. From the acceleration of deep learning applications in diagnostic imaging to the nuanced effects of 2025 tariff measures on component sourcing, the collected evidence underscores a market in vigorous transformation. Segmentation analysis reveals differentiated growth pathways, while regional comparisons highlight diverse adoption strategies.

Looking forward, the convergence of expanding data ecosystems, maturing regulatory frameworks, and strategic corporate collaborations will continue to propel AI innovations into mainstream clinical practice. Organizations that embrace an integrated approach-combining robust data infrastructure, stakeholder engagement, and iterative validation-will be best positioned to capture value. As AI technologies evolve, stakeholders must remain vigilant in upholding ethical standards and patient-centric care models, ensuring that the promise of intelligent medicine translates into tangible health benefits.

Take Your Healthcare Strategy to the Next Level by Engaging with Ketan Rohom to Secure the Essential Artificial Intelligence in Medicine Report Today

Engaging with Ketan Rohom, Associate Director of Sales & Marketing, ensures your organization gains immediate access to the in-depth analysis and strategic intelligence necessary for thriving in the rapidly evolving landscape of artificial intelligence in medicine. By initiating a conversation today, you will secure a tailored research package that aligns with your specific priorities-whether that involves deep dives into regional adoption patterns, granular segmentation insights, or assessments of the latest regulatory and tariff developments.

Act now to transform your strategic planning with unparalleled insights that drive competitive advantage. Reach out directly to Ketan Rohom to explore flexible licensing options, exclusive data add-ons, and custom consulting engagements designed to accelerate your path from insight to impact. Don’t let critical opportunities in AI-driven healthcare innovation pass by-partner with our team to equip your executive decisions with the most robust, forward-looking intelligence available in the market.

- How big is the Artificial Intelligence in Medicine Market?

- What is the Artificial Intelligence in Medicine Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?