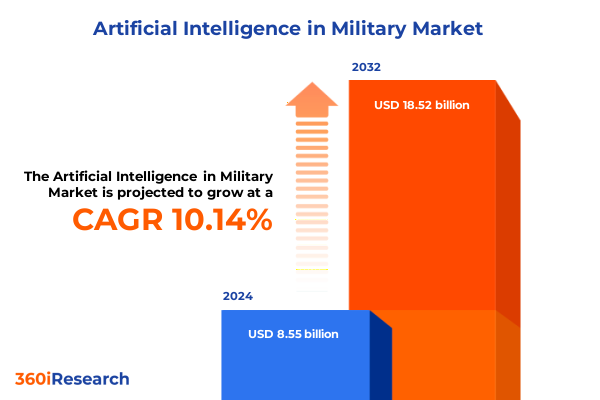

The Artificial Intelligence in Military Market size was estimated at USD 9.25 billion in 2025 and expected to reach USD 10.00 billion in 2026, at a CAGR of 10.42% to reach USD 18.52 billion by 2032.

Establishing the Strategic Imperative and Core Objectives Driving Artificial Intelligence Integration Across Contemporary Military Operations Worldwide

Artificial intelligence (AI) is redefining the character of modern warfare, ushering in capabilities that span autonomous systems, network-centric operations, and decision augmentation. As defense stakeholders integrate advanced algorithms into platforms, the imperative to understand both the technological and strategic implications of these tools has never been greater. This study provides a focused examination of how AI-driven solutions are influencing military planning, procurement, and execution across global theaters.

In evaluating the current landscape, we begin by assessing the catalysts behind AI adoption in military contexts, from the drive for operational efficiency to the need for information superiority. We explore how foundational investments-from government research programs to private sector partnerships-are converging to accelerate innovation, and how these efforts shape battlefield agility. By framing the core questions that defense leaders face, this summary sets the stage for deeper insights into transformative shifts, regulatory influences, segmentation patterns, regional dynamics, and corporate strategies within military AI.

Examining the Pivotal Technological Milestones and Operational Paradigm Shifts Revolutionizing Artificial Intelligence Applications in Defense Sectors

Defense innovation has entered a new era, characterized by breakthroughs in machine learning models, edge computing solutions, and integrated sensor networks that enable real-time data fusion. The Department of Defense’s Joint All-Domain Command and Control initiative epitomizes this shift, connecting disparate branch sensors into a unified architecture powered by artificial intelligence and enabling instantaneous coordination across air, land, sea, space, and cyber domains. Concurrently, secure edge computing deployments are being prioritized to ensure autonomous systems maintain situational awareness and decision-making capabilities even in disconnected or contested environments.

Moreover, advances in computational hardware-driven by collaborations between defense integrators and semiconductor manufacturers-are raising the performance ceiling of military AI applications without compromising ruggedization or energy efficiency. These technological strides are propelling a paradigm in which human operators and AI agents operate in seamless synergy, whether guiding unmanned aerial vehicles to high-value targets or enabling predictive maintenance for armored brigades. Such developments mark a defining moment in the trajectory of defense capabilities, setting the course for next-generation operational concepts.

Assessing the Far-Reaching Consequences of 2025 United States Tariff Policies on the Military Artificial Intelligence Supply Chain and Technological Advancement

The U.S. government’s imposition of elevated duties on imported semiconductors and related components in 2025 has significantly influenced the defense AI ecosystem. Under proposed modifications, tariffs on semiconductor imports could reach as high as 50 percent for advanced chips in 2025, a measure aimed at boosting domestic manufacturing yet creating cost pressures for defense contractors reliant on specialized hardware. These levies have amplified procurement budgets, leading some prime manufacturers to absorb additional costs while others have faced delays in system deployment as supply chains adjust to shifting duties and exclusion processes.

Complementing these policy measures, economic analyses indicate that broad-based semiconductor surcharges-modeled at 25 percent-would constrain U.S. gross domestic product growth by nearly 0.2 percent in the first year, with cumulative impacts approaching 0.8 percent by year ten; sectors such as artificial intelligence infrastructures, including hyperscale data centers supporting defense algorithms, are particularly vulnerable to elevated chip prices and reduced global supply flexibility. As a result, defense agencies and contractors have been compelled to pursue supplier diversification strategies, invest in domestic fabrication incentives, and collaborate on exemption requests, all to mitigate the risk of project slowdowns and capability gaps.

Unpacking Critical Segmentation Dynamics Across Platform Types Technologies End Users Applications and Deployment Modes to Illuminate Defense AI Growth Drivers

Analysis of the defense AI landscape reveals five critical segmentation pillars that shape procurement and innovation dynamics. When viewed through the lens of platform type, aerial systems encompass both fixed wing and rotary wing unmanned aerial vehicles, offering varied endurance and mission profiles; ground assets range from heavily armored tracked vehicles to agile unmanned ground vehicles; naval capabilities include deep-diving submersibles as well as surface vessels; while space segment activities hinge on the orchestration of ground stations and orbital satellites. Technology segmentation underscores the centrality of computer vision, data analytics, machine learning, natural language processing, and robotics, each driving discrete use cases from target recognition to autonomous logistics planning.

End users in this domain span the Air Force, which prioritizes rapid sensor-to-shooter loops, the Army, which focuses on soldier augmentation and force protection, and the Navy, where maritime domain awareness underpins fleet defense. Application areas include autonomous weapon systems that can independently detect and engage threats, command and control architectures that support networked decision-making, cybersecurity frameworks protecting critical infrastructure, logistics and supply chain optimizations ensuring timely sustainment, surveillance and reconnaissance suites enhancing battlefield visibility, and training and simulation environments preparing forces for complex scenarios. Deployment modes further differentiate solutions into cloud-hosted platforms delivering scalable analytics and on-premise installations satisfying stringent security requirements. Each segmentation dimension offers unique insights into purchasing criteria, integration challenges, and technology maturation pathways within military AI initiatives.

This comprehensive research report categorizes the Artificial Intelligence in Military market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Platform Type

- Technology

- Application

- End User

- Deployment Mode

Illuminating Regional Variations Strategic Drivers and Adoption Patterns of Defense Artificial Intelligence Solutions Across the Americas EMEA and Asia-Pacific

Regional analyses unveil divergent drivers and adoption trajectories for defense AI capabilities. In the Americas, robust defense budgets and strategic partnerships between the United States and Canada accelerate procurement of autonomous systems and AI-enabled C4ISR solutions, supported by national initiatives to bolster domestic semiconductor production and resilient supply chains. Cross-border exercises and harmonized acquisition frameworks further streamline the deployment of advanced sensor fusion technologies across allied forces.

Europe, the Middle East, and Africa (EMEA) present a mosaic of defense priorities, where NATO member states in Western Europe invest heavily in secure edge computing and zero-trust architectures to counter evolving threats, while nations in the Gulf region pursue ambitious AI programs to modernize force structures and reinforce maritime security. Collaboration frameworks-spanning the European Defence Agency and UAE-led joint ventures-catalyze standardization efforts for interoperability in coalition operations.

In the Asia-Pacific, regional tensions and the rise of near-peer competitors have spurred accelerated AI adoption among major powers. Countries such as Japan and Australia are forging partnerships with U.S. defense primes to integrate machine learning algorithms into unmanned platforms, even as India ramps up indigenous AI research for border surveillance. These dynamics underscore the criticality of regional alliances, technology transfers, and policy harmonization in navigating a rapidly evolving security environment.

This comprehensive research report examines key regions that drive the evolution of the Artificial Intelligence in Military market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Competitive Strategies Driving Breakthroughs in Defense-Grade Artificial Intelligence Development and Deployment

Industry leaders are leveraging a combination of organic research and strategic collaborations to maintain technological edge in defense AI. Major defense integrators are embedding AI accelerators within their flagship platforms and forging ties with commercial technology firms specializing in algorithm development and sensor miniaturization. These partnerships have yielded breakthroughs such as advanced airborne targeting pods equipped with real-time computer vision and integrated signal processing modules for electronic warfare.

At the same time, pure-play AI startups-often spun out of academic research programs-are advancing niche capabilities like autonomous navigation for unmanned vehicles, predictive maintenance analytics for armored fleets, and generative AI tools for wargaming simulations. By aligning with prime contractors through joint development agreements and research consortia, these agile innovators gain access to defense-grade validation environments and secure data feeds, accelerating their pathway to fielded solutions. Collectively, this ecosystem of incumbents and new entrants is reshaping competitive dynamics, fostering a cycle of accelerated innovation in both core platforms and supporting software stacks.

This comprehensive research report delivers an in-depth overview of the principal market players in the Artificial Intelligence in Military market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbus SE

- Anduril Industries, Inc.

- BAE Systems plc

- Elbit Systems Ltd.

- Hanwha Group Co., Ltd.

- Israel Aerospace Industries Ltd.

- L3Harris Technologies, Inc.

- Leidos Holdings, Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- QinetiQ Group plc

- Rafael Advanced Defense Systems Ltd.

- Thales Group S.A

- The Boeing Company

Delivering Targeted Recommendations to Empower Defense Technology Leaders in Maximizing Value and Operational Impact from Artificial Intelligence Investments

To navigate the evolving defense AI landscape, stakeholders should prioritize resilience, interoperability, and agility. First, establishing robust supply chain resilience through multi-sourcing strategies and participation in exclusion request processes helps mitigate tariff-induced disruptions. This approach ensures continuity of critical component delivery and supports program schedules.

Second, adopting modular, open-architecture frameworks facilitates rapid integration of new AI models and hardware upgrades, enabling forces to pivot quickly in response to emerging operational requirements. Integrating these frameworks with zero-trust security protocols and validated encryption standards further safeguards mission-critical data across deployed assets.

Third, fostering collaborative ecosystems through co-development initiatives and knowledge-sharing alliances with academic institutions and tech incubators accelerates capability maturation while de-risking investment. By embedding AI literacy programs within the workforce and aligning talent pipelines with evolving technical requirements, organizations can build the human capital necessary to maximize the impact of AI deployments in complex, contested environments.

Detailing the Rigorous Research Framework and Analytical Approaches Employed to Deliver Comprehensive Insights into Military Artificial Intelligence Trends

This study is underpinned by a rigorous multi-stage research framework combining primary and secondary methodologies. Primary data collection encompassed in-depth interviews with military acquisition officials, program managers, and technology providers, ensuring direct insights into procurement processes, integration challenges, and field performance criteria. These qualitative engagements were complemented by expert roundtables convened with defense attachés and leading AI research centers.

Secondary research leveraged open-source government publications, defense white papers, trade association reports, and academic journals to triangulate quantitative and contextual data. We systematically analyzed policy directives, tariff schedules, and legislative actions to assess regulatory impacts on technology flows. Additionally, a regional market synthesis was carried out using defense budget allocations, reported procurement awards, and alliance cooperation frameworks to illuminate geographic variation in AI adoption. The resultant findings were validated through cross-referencing with industry consortium forecasts and corroborated by technical due diligence reviews.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Artificial Intelligence in Military market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Artificial Intelligence in Military Market, by Platform Type

- Artificial Intelligence in Military Market, by Technology

- Artificial Intelligence in Military Market, by Application

- Artificial Intelligence in Military Market, by End User

- Artificial Intelligence in Military Market, by Deployment Mode

- Artificial Intelligence in Military Market, by Region

- Artificial Intelligence in Military Market, by Group

- Artificial Intelligence in Military Market, by Country

- United States Artificial Intelligence in Military Market

- China Artificial Intelligence in Military Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Core Findings and Emphasizing Strategic Imperatives While Outlining the Future Trajectory for Military Artificial Intelligence Deployment

The intersection of advanced algorithms, resilient architectures, and evolving regulatory landscapes is reshaping defense capabilities at an unprecedented pace. Our analysis demonstrates that successful military AI integration hinges on harmonizing technological innovation with strategic procurement policies, regional collaboration frameworks, and supply chain robustness. By adopting modular design principles and fostering cross-sector partnerships, defense stakeholders can accelerate capability delivery while mitigating the risks associated with trade tensions and emerging threats.

Looking forward, the trajectory of military AI will be defined by advances in edge autonomy, secure communications, and generative intelligence applications, all operating within a framework of zero-trust security and multi-domain interoperability. As defense organizations navigate this complex environment, the need for actionable insights and a clear understanding of segmentation dynamics, regional drivers, and competitor strategies remains paramount. This study provides a strategic compass for those seeking to harness the full potential of artificial intelligence in the service of national security.

Engage Directly with Ketan Rohom Associate Director Sales and Marketing to Secure Your Access to the Comprehensive Combat AI Solutions Research Report Today

I invite you to engage with Ketan Rohom, Associate Director of Sales and Marketing, to unlock unparalleled insights from our latest market research report on combat artificial intelligence solutions. Through a direct conversation with Ketan, you will gain tailored guidance on how this study addresses the critical questions shaping defense AI procurement, development, and deployment strategies. As you consider the report’s in-depth analysis of technological trends, supply chain dynamics, and competitive landscapes, Ketan can help you identify the most relevant data excerpts and contextualize them for your organization’s strategic needs. By reaching out today, you will secure priority access to the research findings that can underpin your decision-making in an era of rapidly evolving military AI capabilities, ensuring you stay ahead of both emerging threats and innovation opportunities in the defense sector.

- How big is the Artificial Intelligence in Military Market?

- What is the Artificial Intelligence in Military Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?