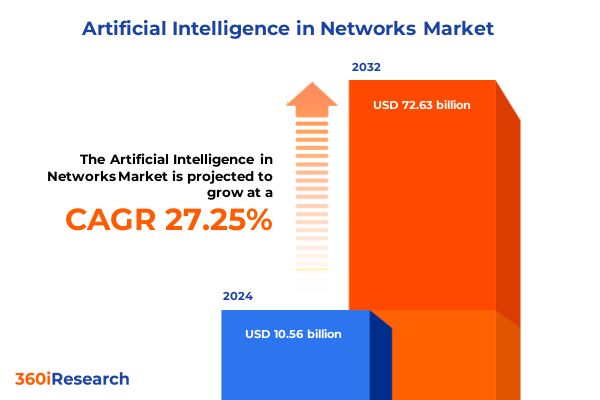

The Artificial Intelligence in Networks Market size was estimated at USD 13.27 billion in 2025 and expected to reach USD 16.73 billion in 2026, at a CAGR of 27.47% to reach USD 72.63 billion by 2032.

Exploring How Artificial Intelligence Is Revolutionizing Network Infrastructure and Transforming Connectivity, Security, and Operational Agility

Artificial intelligence has emerged as a cornerstone of network evolution, fundamentally altering how connectivity, security, and operational agility are orchestrated. As enterprises grapple with unprecedented volumes of data and escalating performance demands, AI-driven intelligence offers a pathway to automate complex tasks, optimize resource utilization, and preempt emerging threats. By embedding machine learning algorithms and deep learning models directly into network infrastructure, organizations can shift from reactive troubleshooting to proactive self-healing capabilities.

Concurrently, the convergence of 5G rollouts, edge computing proliferation, and the Internet of Things has created an environment where traditional, manually managed networks no longer suffice. Network architects are now tasked with designing dynamic, adaptive systems that can intelligently route traffic, balance loads, and enforce security policies in real time. This introduction lays the groundwork for understanding why AI is no longer an optional enhancement but a strategic imperative for businesses seeking to maintain high availability, seamless user experiences, and resilient architectures.

Moving beyond theory, the integration of AI-driven analytics into network operations establishes end-to-end visibility across physical and virtual layers, fostering a new paradigm of observability. This comprehensive overview paves the way for deeper exploration into the shifts reshaping network landscapes, the impact of recent regulatory measures, nuanced segmentation trends, and regional differentiators that will define competitive positioning in the years ahead.

Identifying the Pivotal Technological and Architectural Shifts Driving the Next Wave of Intelligent Networking and Enhanced Operational Resilience

The network landscape is undergoing a seismic transformation driven by AI-enabled automation, programmability and intelligent orchestration. In the past, network management relied heavily on static configurations and manual interventions, leaving organizations vulnerable to misconfigurations, downtime, and siloed analytics. Today, software-defined networking (SDN) and intent-based architectures serve as the backbone for AI models to learn from real-time telemetry and historical performance logs. As a result, the network itself becomes a self-optimizing organism, capable of realigning traffic flows, reallocating resources, and neutralizing threats without human delay.

Moreover, advances in model architectures have accelerated the adoption of deep learning for anomaly detection, enabling predictive maintenance that identifies potential failures before they impact service levels. Generative AI is also carving out new roles in network design, automatically generating optimized configuration templates and even simulating what-if scenarios to guide strategic planning. Natural language processing interfaces are reducing the barrier to entry for network operators, allowing operations teams to query performance metrics, trigger diagnostics, and update policies through conversational commands.

Edge intelligence has emerged as another defining shift, as AI-optimized processors and specialized edge devices distribute analytic workloads closer to end-points. This reduces latency and preserves bandwidth, which is critical for use cases such as autonomous vehicles, augmented reality, and real-time industrial control systems. Together, these transformative shifts underscore a new era of intelligent networking-one in which continuous learning, adaptive control loops, and collaborative human-machine interfaces converge to deliver unprecedented levels of reliability and performance.

Analyzing the Multifaceted Effects of 2025 United States Tariff Measures on Artificial Intelligence Components and Network Ecosystem Dynamics

Since the initial wave of tariffs on semiconductor imports in the late 2010s, United States trade measures have progressively reshaped supply chain dynamics for AI network hardware and related components. By 2025, cumulative duties on select processors and telecommunications equipment have resulted in higher acquisition costs for both AI-optimized processors and edge devices. This has prompted global vendors and enterprise buyers to reassess sourcing strategies, prioritize supplier diversification, and explore nearshoring options to mitigate tariff exposure.

In response to these measures, leading equipment manufacturers have accelerated partnerships with domestic foundries and invested in regional fabrication facilities. As a result, while upfront costs have risen, longer-term supply resilience has improved, offering a hedge against future tariff escalations. At the same time, the services segment-comprising managed offerings as well as installation, integration, maintenance, and consulting-has seen a shift in pricing models. Organizations are increasingly adopting consumption-based engagement frameworks to offset capital expenditure pressures and align costs with operational outcomes.

Software-centric network management platforms and machine learning frameworks have largely remained unaffected by direct trade restrictions, though downstream subscriptions occasionally absorb hardware-related cost increases. Consequently, network architects are placing greater emphasis on virtualization and cloud-native deployments that decouple software innovation from the volatility of hardware tariffs. Ultimately, the cumulative impact of these trade measures has driven the industry toward more resilient supply chains, flexible deployment strategies, and an elevated focus on service-based consumption models.

Delving into Component, Technology, Application, Industry Vertical, and Deployment Mode Perspectives to Uncover AI Network Market Drivers and Nuances

Understanding the AI in networks landscape requires a granular view of how hardware, services, and software intersect to deliver end-to-end intelligence. At the component level, vendors continue to enhance AI-optimized processors and edge computing devices to support real-time inference, while managed services and professional services-including installation, integration, maintenance, support, training, and consulting-are critical for successful deployments. Meanwhile, software ecosystems span threat detection, AI-powered network management, and machine learning frameworks, forming the invisible but essential layer that drives automated decision-making.

From a technology standpoint, deep learning remains central to pattern recognition and anomaly detection, while generative AI accelerates design workflows and configuration management. Traditional machine learning algorithms underpin adaptive traffic routing and lifecycle management, and natural language processing interfaces simplify operator interactions with complex environments. Application use cases range from intelligent routing and traffic optimization to predictive maintenance and quality of service enhancements, each leveraging tailored AI approaches to meet specific performance objectives.

Industry verticals exhibit distinct adoption patterns based on operational priorities: financial services and government sectors focus on security and compliance, energy and utilities leverage predictive maintenance for infrastructure reliability, healthcare emphasizes patient-centric QoS and data protection, while IT, telecommunications, logistics, and retail drive efficiency and user experience improvements. Deployment mode-whether cloud-based or on-premise-further influences architecture decisions, as organizations balance agility, control, and regulatory considerations. These segmentation insights reveal the nuanced interplay of technology, application, and industry context shaping the future of AI-infused networks.

This comprehensive research report categorizes the Artificial Intelligence in Networks market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology

- Deployment Mode

- Application

- Organization Size

- Application

- Industry Vertical

Unpacking Regional Dynamics Across the Americas, Europe Middle East Africa, and Asia Pacific to Illuminate AI Networking Adoption and Growth Patterns

Regional dynamics play a pivotal role in defining how AI in networks evolves across global markets. In the Americas, strong cloud adoption and widespread deployment of next-generation data centers have accelerated pilot initiatives and large-scale rollouts. Enterprises in North America are leveraging hyperscale infrastructure alongside AI-native analytics to automate routing, security enforcement, and service assurance at unprecedented scale.

Europe, the Middle East, and Africa present a tapestry of regulatory landscapes and maturity levels. Data sovereignty mandates in Europe have catalyzed private network deployments and on-premise solutions, particularly within government and defense sectors. Meanwhile, Gulf Cooperation Council nations are pioneering smart city and 5G use cases, driving demand for AI-enhanced network security and traffic management. Across sub-Saharan Africa, telecom operators are exploring AI-driven optimization to extend coverage and reduce operational costs in challenging geographies.

Asia-Pacific stands out for its rapid 5G rollouts and expansive edge computing investments. Telecommunications providers across China, Japan, South Korea, and India are integrating AI capabilities to manage ever-growing data volumes and service complexities. Additionally, regional manufacturing hubs and burgeoning digital economies in Southeast Asia and Australia are creating fertile ground for AI-driven network modernization initiatives, from intelligent routing to predictive maintenance.

This comprehensive research report examines key regions that drive the evolution of the Artificial Intelligence in Networks market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Leading Technology Providers and Strategic Collaborators Shaping the Evolution of AI-Enabled Network Solutions and Services

Key technology providers and systems integrators are advancing AI-enabled network solutions through a combination of internal innovation, strategic alliances, and targeted acquisitions. Major networking vendors are embedding machine learning and deep learning modules into their core platforms, while cloud hyperscalers are extending network management capabilities deep into edge and on-premise environments. Simultaneously, specialized pure-play firms are differentiating through sophisticated analytics, intuitive operability, and domain-specific security features.

Service integrators and consulting firms play an equally critical role by bridging the gap between vendor roadmaps and enterprise requirements. Their expertise in installation, integration, maintenance, support, and training ensures that AI models are properly calibrated, continuously optimized, and integrated with existing IT and operational technology stacks. This collaborative ecosystem fosters rapid innovation cycles, reduces time to value, and strengthens the feedback loop between live network performance and algorithm refinement.

As partnerships become more fluid, companies are co-developing solutions that leverage the strengths of multiple players-combining advanced AI research labs, developer frameworks, and channel networks to accelerate adoption. These alliances not only accelerate feature velocity but also deliver scalable, secure, and interoperable architectures that meet the rigorous demands of diverse industry verticals.

This comprehensive research report delivers an in-depth overview of the principal market players in the Artificial Intelligence in Networks market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alibaba Group Holding Limited

- Amazon Web Services, Inc.

- Arista Networks, Inc.

- Atos SE

- Broadcom Inc

- Check Point Software Technologies Ltd.

- Ciena Corporation

- Cisco Systems, Inc.

- CommScope, Inc.

- Dell Technologies Inc.

- Extreme Networks, Inc.

- Fortinet, Inc.

- Fujitsu Limited

- Google LLC by Alphabet Inc.

- Granite Telecommunications, LLC.

- Hewlett Packard Enterprise Company

- Huawei Technologies Co. Ltd.

- Intel Corporation

- International Business Machines Corporation

- Microsoft Corporation

- NetScout Systems, Inc.

- Nokia Corporation

- NTT Ltd.

- NVIDIA Corporation

- Palo Alto Networks, Inc.

- Qualcomm Technologies, Inc.

- SAP SE

- Schlumberger Limited

- Telefonaktiebolaget LM Ericsson

Charting Actionable Roadmaps for Industry Leaders to Accelerate AI Network Integration, Strengthen Competitive Positioning, and Drive Sustained Innovation

To capitalize on the transformative potential of AI in networking, industry leaders should initiate comprehensive pilots that validate performance improvements against stringent service level objectives. By establishing a controlled environment for testing AI-driven routing, threat detection, and self-healing workflows, organizations can identify integration challenges, optimize training data pipelines, and refine model deployment strategies.

Building on successful pilots, executives must secure cross-functional alignment between networking, cybersecurity, data science, and operations teams. This collaborative approach ensures that AI initiatives are supported by robust governance frameworks, clearly defined key performance indicators, and iterative refinement cycles. Moreover, investing in workforce upskilling programs-ranging from basic data literacy to advanced AI model tuning-will sustain long-term innovation and reduce reliance on external consultants.

Strategic partnerships with hyperscale cloud providers, specialized AI startups, and edge hardware manufacturers are essential for achieving agility and minimizing vendor lock-in. By negotiating flexible consumption-based contracts and co-innovation agreements, enterprises can align technology investments with evolving business outcomes. Finally, establishing continuous monitoring and feedback loops enables real-time performance adjustments, driving both cost efficiencies and tangible improvements in user experience.

Outlining Comprehensive Qualitative and Quantitative Research Frameworks Employed to Assess AI in Network Infrastructure and Emerging Technology Trends

This research combines primary and secondary methodologies to deliver an unbiased, evidence-based perspective on artificial intelligence in networks. Primary inputs include in-depth interviews with network architects, C-level executives, and technology specialists across leading enterprises and service providers. These discussions illuminate real-world challenges, deployment best practices, and strategic priorities shaping AI adoption.

Secondary research sources encompass vendor documentation, industry whitepapers, academic publications, and publicly available regulatory filings. Quantitative data sets are triangulated with qualitative insights to validate thematic trends and identify emerging use cases. The research process also incorporates interactive workshops and validation sessions with domain experts to ensure the accuracy of segmentation frameworks, regional analysis, and scenarios.

Finally, data extraction and synthesis leverage analytical tools for text mining and trend mapping, which inform the development of comprehensive segmentation matrices and competitive assessments. This multi-phased approach guarantees that findings are robust, reproducible, and immediately actionable for technology decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Artificial Intelligence in Networks market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Artificial Intelligence in Networks Market, by Component

- Artificial Intelligence in Networks Market, by Technology

- Artificial Intelligence in Networks Market, by Deployment Mode

- Artificial Intelligence in Networks Market, by Application

- Artificial Intelligence in Networks Market, by Organization Size

- Artificial Intelligence in Networks Market, by Application

- Artificial Intelligence in Networks Market, by Industry Vertical

- Artificial Intelligence in Networks Market, by Region

- Artificial Intelligence in Networks Market, by Group

- Artificial Intelligence in Networks Market, by Country

- United States Artificial Intelligence in Networks Market

- China Artificial Intelligence in Networks Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 3180 ]

Synthesizing Core Findings and Strategic Imperatives That Define the Transformational Impact of AI on Modern Network Architectures and Operations

The convergence of artificial intelligence and network infrastructure has set the stage for a new era of intelligent connectivity, where automated orchestration, proactive security, and adaptive resource allocation become the norm. Transformative shifts in SDN, edge intelligence, and generative design are redefining operational paradigms, while evolving tariff landscapes have reinforced the imperative for resilient supply chains and flexible consumption models.

By analyzing detailed segmentation across components, technologies, applications, and industry verticals, organizations gain clarity on where to prioritize investments and how to tailor strategies for maximum impact. Regional insights further underscore that adoption patterns are deeply influenced by regulatory frameworks, infrastructure maturity, and local innovation ecosystems. Meanwhile, leading vendors and integrators are forging partnerships that accelerate deployment cycles and deliver integrated solutions capable of meeting diverse enterprise needs.

Ultimately, the strategic imperatives distilled in this executive summary equip decision-makers with the context, insights, and recommended action plans necessary to harness AI’s full potential in modern network environments. As network complexity and data demands continue to rise, the organizations that embrace AI-driven intelligence will differentiate themselves through superior performance, security, and operational agility.

Engage Directly with the Associate Director of Sales and Marketing to Secure the Comprehensive AI in Networks Market Research Report

To access the definitive analysis of artificial intelligence adoption, transformative industry shifts, and strategic pathways within modern network infrastructures, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan can guide your organization through the full breadth of actionable insights, technology deep dives, and regional intelligence contained in the AI in Networks Market Research Report. Engage with him to schedule a personalized briefing, obtain comprehensive deliverables tailored to your strategic priorities, and secure competitive intelligence that will inform your next innovation cycle.

- How big is the Artificial Intelligence in Networks Market?

- What is the Artificial Intelligence in Networks Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?