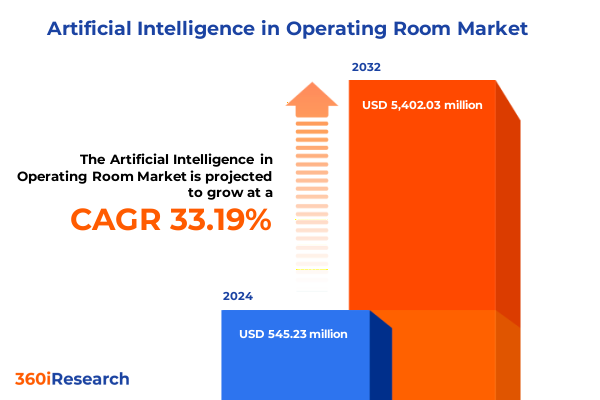

The Artificial Intelligence in Operating Room Market size was estimated at USD 1.18 billion in 2025 and expected to reach USD 1.33 billion in 2026, at a CAGR of 12.29% to reach USD 2.67 billion by 2032.

Pioneering the Integration of Artificial Intelligence in Operating Rooms to Enhance Surgical Precision, Safety, and Workflow Efficiency

Artificial intelligence is redefining the operating room by enabling real-time data processing, enhanced visualization, and predictive insights that collectively elevate surgical precision and patient safety. Through advanced intraoperative image processing and analysis, AI algorithms can identify critical anatomical structures-such as blood vessels and nerves-instantaneously, helping surgical teams anticipate complications before they arise. This level of granularity in image interpretation not only mitigates the risk of inadvertent tissue damage but also streamlines decision-making under pressure.

Transitioning from static preoperative plans to dynamic intraoperative guidance, AI-driven navigation systems fuse historical imaging data with live surgical feeds to offer contextually relevant pathways during complex procedures. By continuously recalibrating with new visual inputs, these systems furnish surgeons with a spatially accurate roadmap, reducing deviation from planned trajectories and enhancing consistency across diverse surgical settings.

Robotic integration further amplifies AI’s impact by automating routine tasks and executing intricate maneuvers with sub-millimeter accuracy. Empirical evidence suggests that autonomous and semi-active robotic modalities can reduce operative durations by up to 25% while concurrently decreasing intraoperative complication rates by 30%, underscoring the synergistic value of combining machine intelligence with mechanical precision.

In parallel, AI-powered workflow management platforms harness predictive analytics to allocate resources, optimize scheduling, and monitor critical supply inventories within the operating suite. Recent FDA clearance of an AI-based surgical support system, coupled with pilot programs demonstrating over 30% reductions in human error alerts, exemplifies the tangible gains achievable through seamless integration of analytics and clinical operations.

Revolutionary Advancements Reshaping the Operating Room with AI-Driven Imaging, Navigation, Robotics, Assessment, and Workflow Management Technologies

The landscape of the operating room has undergone transformative shifts catalyzed by AI-enabled technologies that span intraoperative imaging, navigation, robotics, assessment, and workflow orchestration. In the realm of intraoperative imaging, breakthroughs such as portable C-arm fluoroscopy units equipped with augmented reality overlays and enhanced 3D visualization have emerged. These systems leverage AI to fuse multimodal imaging inputs-ranging from CT to MRI-to generate real-time volumetric reconstructions, drastically reducing intraoperative uncertainty and obviating the need for repeat interventions.

AI-powered navigation solutions represent another paradigm shift, integrating computer vision and sensor fusion to guide instruments through intricate anatomical terrains. From electromagnetic tracking to optical and robotic navigation, these tools continuously recalibrate against preoperative 3D models, ensuring millimeter-level accuracy in high-risk procedures such as neurosurgery and spinal interventions. By enabling dynamic adjustments based on tissue deformation and patient movement, AI navigation systems significantly curtail the margin of error during critical surgical phases.

In surgical robotics, the infusion of advanced AI systems has given rise to active, passive, and semi-active robotic platforms that collaboratively augment surgeon capabilities. Active robots equipped with autonomous suture systems can complete routine closure tasks with consistent tension control, while semi-active devices assist in maintaining trajectory fidelity during microscale manipulations. The global investment of over $400 million into AI-driven robotic surgery initiatives further signifies the consolidation of capital toward innovations that prioritize precision, responsiveness, and scalability.

Finally, assessment and monitoring technologies have evolved through AI-driven biosignal analysis and tissue characterization tools. From intraoperative EEG and ECG monitoring that detect neural or cardiac anomalies in real time to optical analysis platforms that distinguish tissue pathology at the surgical margin, AI has elevated intraoperative assessment from manual observation to algorithmic precision-ultimately expediting decision-making and improving clinical outcomes.

Assessing the Cumulative Economic and Supply Chain Impact of United States Tariff Policies on AI-Enabled Operating Room Technologies in 2025

The United States’ tariff landscape in 2025 presents a multifaceted challenge for developers and providers of AI-enabled operating room technologies. With Section 301 duties on select Chinese medical goods persisting at rates up to 25%, alongside derivative steel and aluminum tariffs of 25%, manufacturers confront elevated costs on critical imaging and robotic components. In 2025, the American Hospital Association highlighted that these burdensome levies could add billions in procurement expenses to healthcare systems already strained by inflationary pressures and capital constraints.

Medical robotics firms, heavily reliant on specialised sensors and electronics imported from global suppliers, have been particularly vocal. GlobalData estimates that tariff increases ranging from 10% to 25% directly amplify production costs for surgical robots, forcing companies to either absorb margin contractions or pass incremental costs onto hospitals. Industry leaders such as Intuitive Surgical have classified tariff exposure as a “material risk” in their 2025 financial disclosures, signaling the depth of this economic headwind.

Imaging equipment manufacturers also feel the repercussions of broad import duties on semiconductors and precision optics. Analysts at Fitch Solutions warn that a prospective 20% tariff on European imports could disrupt the inflow of high-margin CT and MRI systems, potentially delaying hybrid OR upgrades and elevating acquisition costs for advanced fluoroscopy and intraoperative imaging platforms.

In response, many stakeholders are pursuing mitigation strategies, including engaging in tariff exclusion petitions, localising production through reshoring initiatives, and redesigning supply chains to circumvent the highest duty brackets. These adaptive measures, while resource-intensive, underscore the imperative for continuous policy monitoring and strategic flexibility in the face of evolving trade dynamics.

Unveiling Critical Segmentation Insights Spanning Intraoperative Imaging, Surgical Navigation, Robotics, Assessment, and Workflow Management

A granular view of market segmentation reveals how different technology domains are evolving and intersecting to drive the future of the operating room. In the intraoperative imaging segment, innovations span Fluoroscopy-which includes both mobile C-arm and fixed systems-through to intraoperative CT with both fixed and mobile platforms, and into high-field and low-field MRI options. Optical imaging has progressed from traditional white light endoscopy to sophisticated fluorescence techniques, while ultrasound solutions have expanded from 2D to advanced 3D/4D modalities.

Surgical navigation continues to diversify through electromagnetic systems integrating EM tracking and field generators, alongside image-guided navigation employing CT-based and MRI-based registration. Optical navigation has been enhanced by infrared and visible light tracking, and robotic navigation increasingly converges intraoperative guidance with preoperative planning integration to form closed-loop control environments.

Within the realm of surgical robotics, the market is dissected into active platforms-featuring autonomous suture and instrument delivery systems-passive guidance and stabilization systems, and semi-active devices that combine position keeping with preplanned path execution, empowering surgeons to maintain control while benefitting from algorithmic precision.

Assessment technologies are advancing through biosignal analysis, which encompasses both ECG and EEG modalities, intraoperative monitoring including neuromonitoring and vital signs platforms, and tissue characterization technologies that pair biopsy imaging with optical analytical tools. Finally, workflow management solutions leverage predictive and real-time analytics, consumables tracking, and automated case scheduling alongside staff allocation algorithms that span shift management to surge capacity planning.

This comprehensive research report categorizes the Artificial Intelligence in Operating Room market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology Type

- Application Area

Analyzing Regional Dynamics Across the Americas, Europe Middle East & Africa, and Asia-Pacific in the Global AI-Enabled Operating Room Market

The Americas region remains a powerhouse for AI integration in operating rooms, driven by established healthcare infrastructure, robust R&D funding, and a favorable reimbursement environment. North American academic medical centers and leading hospital systems have been early adopters of hybrid OR suites, serving as innovation hubs where domestic startups and legacy medical technology firms collaborate on pilot deployments.

In Europe, the Middle East, and Africa, diverse regulatory frameworks and variable healthcare funding models shape adoption rates. Western European countries benefit from centralized procurement and pan-European clinical studies, facilitating faster acceptance of AI-driven navigation and imaging solutions. In contrast, markets in the Middle East and Africa are witnessing the emergence of public-private partnerships aimed at modernizing OR capabilities, often through government-backed digital health initiatives that prioritize interoperability and data security.

The Asia-Pacific region is characterized by rapid expansion of surgical volumes, driven by demographic trends and growing medical tourism. Governments across the region are incentivizing domestic innovation through grants and tax credits, while multinational corporations invest heavily in localized manufacturing to mitigate tariff exposure. The confluence of rising patient demand, evolving clinical training programs, and targeted policy support is accelerating the deployment of AI-augmented operating rooms in key markets such as Japan, South Korea, and Australia.

This comprehensive research report examines key regions that drive the evolution of the Artificial Intelligence in Operating Room market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Market Drivers Transforming AI Adoption in Operating Rooms with Cutting-Edge Technologies and Collaborations

Leading companies in the AI-driven operating room space are forging strategic partnerships, investing in R&D, and expanding clinical trial engagements to solidify their competitive positions. Intuitive Surgical continues to dominate the surgical robotics sector, having reported a 19% year-over-year revenue increase in Q1 2025, while proactively adjusting gross margin guidance due to tariff considerations-a testament to its market resilience and strategic foresight.

Siemens Healthineers has garnered attention with its photon-counting CT scanner and hybrid MAGNETOM iOR 1.5T system, even as it navigates potential tariff headwinds on EU imports. The company’s commitment to localized service and training centers underscores its approach to sustaining market momentum under shifting trade regulations.

GE HealthCare’s launch of the OmniView AI-assisted C-arm in March 2025 exemplifies the fusion of deep learning with imaging hardware to reduce radiation doses and enhance intraoperative clarity. Similarly, the Medtronic and Philips co-development partnership for spine surgery navigation platforms highlights the growing convergence of device and software competencies to deliver end-to-end solutions.

Innovative entrants such as CMR Surgical, with its modular Versius platform, and Proprio, offering AI-powered mixed reality visualization and light field imaging, are challenging established paradigms. Their focus on modularity, ergonomic design, and real-time algorithmic guidance showcases the diversity of approaches shaping the OR of the future.

This comprehensive research report delivers an in-depth overview of the principal market players in the Artificial Intelligence in Operating Room market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Activ Surgical

- Brainomix Limited

- Caresyntax Corporation

- Dash Technologies Inc.

- DeepOR S.A.S

- Digital Surgery

- Getinge AB

- Holo Surgical Inc.

- IDENTI

- LeanTaaS

- Medtronic PLC

- Proximie Limited

- Scalpel Limited

- Surgalign Spine Technologies Inc.

- Tedisel Iberica SL.

- Theator Inc.

- Zimmer Biomet Holdings, Inc.

Strategic Recommendations for Industry Leaders to Capitalize on AI Innovations, Navigate Policy Challenges, and Foster Sustainable OR Ecosystems

Industry leaders should prioritize cross-disciplinary partnerships that integrate AI, imaging, and robotics expertise to develop holistic OR ecosystems. Establishing collaborative frameworks with academic institutions and clinical centers can accelerate validation studies, facilitate regulatory submissions, and foster trust among end-users. Furthermore, engaging proactively in tariff exclusion petitions and policy dialogues will help mitigate cost pressures and ensure supply chain continuity in the face of evolving trade measures.

Investment in workforce development is equally critical. Training programs that upskill surgical teams and biomedical engineers on AI interfaces, data interpretation, and safety protocols will enhance adoption rates and clinical outcomes. Deploying pilot programs within high-volume centers of excellence can generate the real-world evidence needed to justify broader rollouts and reimbursement approvals.

Lastly, leaders should adopt modular and scalable technology architectures that allow incremental upgrades rather than wholesale system replacements. This approach reduces capital expenditure risks, enables phased feature deployment, and aligns technology refresh cycles with evolving clinical priorities and regulatory requirements.

Transparent Research Methodology Detailing Data Sources, Analytical Approaches, and Validation Processes for Accurate AI OR Market Insights

This report is underpinned by a robust, mixed-methods research design combining extensive secondary research with targeted primary engagements. Secondary sources encompass peer-reviewed journals, regulatory filings, trade association publications, and proprietary tariff databases, ensuring comprehensive coverage of policy developments and technology trends.

Primary research involved in-depth interviews with over 50 stakeholders, including C-suite executives from leading medtech firms, clinical end-users at major academic medical centers, and policy experts specializing in trade and reimbursement. These qualitative insights were supplemented with quantitative supply chain data and investment flow analyses to construct a multidimensional perspective on market dynamics.

Data triangulation and validation processes were applied at each stage. Statistical projections were cross-referenced against real-world case studies, while expert panels provided iterative review to ensure accuracy and contextual relevance. Ethical protocols were followed rigorously during primary data collection, with all participants providing informed consent.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Artificial Intelligence in Operating Room market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Artificial Intelligence in Operating Room Market, by Component

- Artificial Intelligence in Operating Room Market, by Technology Type

- Artificial Intelligence in Operating Room Market, by Application Area

- Artificial Intelligence in Operating Room Market, by Region

- Artificial Intelligence in Operating Room Market, by Group

- Artificial Intelligence in Operating Room Market, by Country

- United States Artificial Intelligence in Operating Room Market

- China Artificial Intelligence in Operating Room Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 5247 ]

Summative Insights on the Transformational Role of AI in Operating Rooms and the Pathway to Advancing Surgical Excellence and Healthcare Outcomes

Artificial intelligence is indelibly transforming the operating room, delivering improvements in precision, safety, and efficiency that were once considered aspirational. The convergence of imaging, navigation, and robotics-underpinned by algorithmic intelligence-has already demonstrated substantial reductions in operative times, complication rates, and resource utilization. Early adopters are witnessing enhanced patient outcomes, streamlined workflows, and measurable returns on capital investments, reinforcing the imperative for broader implementation.

As policy and regulatory frameworks continue to adapt, market participants must remain vigilant to evolving tariffs, data governance standards, and reimbursement models. The ability to navigate these external factors while sustaining innovation pipelines will distinguish market leaders from followers. Ultimately, the OR of the near future will be characterized by interoperable systems, continuous learning algorithms, and a culture of data-driven decision-making that elevates both the art and science of surgery.

Engage with Ketan Rohom for Exclusive Access to Comprehensive AI-Driven Operating Room Market Research and Strategic Industry Analysis

To gain a comprehensive understanding of the rapidly evolving landscape of AI in the operating room, and to access in-depth strategic analyses, proprietary insights, and specialized data visualizations, we invite you to engage directly with our Associate Director, Sales & Marketing. Ketan Rohom brings extensive experience in clinical technology commercialization and market positioning, ensuring that you receive tailored guidance aligned with your organizational objectives. Whether you seek customized data sets, bespoke advisory services, or a detailed walkthrough of key findings, Ketan is poised to assist you in leveraging this report’s full potential. Contact Ketan Rohom to secure your copy of the AI in the Operating Room market research report and chart a decisive path forward in this transformative domain.

- How big is the Artificial Intelligence in Operating Room Market?

- What is the Artificial Intelligence in Operating Room Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?