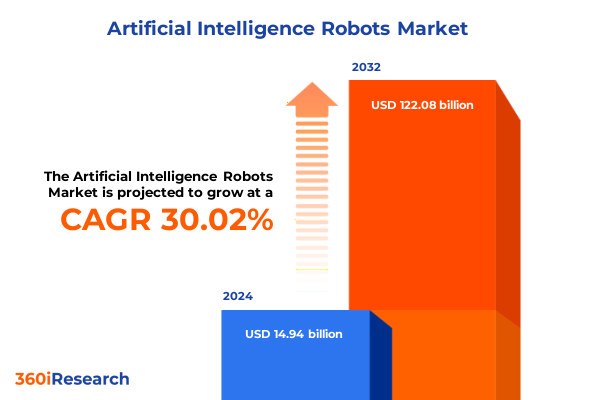

The Artificial Intelligence Robots Market size was estimated at USD 7.03 billion in 2025 and expected to reach USD 9.54 billion in 2026, at a CAGR of 36.89% to reach USD 63.38 billion by 2032.

Exploring the Revolutionary Emergence of AI-Powered Robotics Across Industries and Their Transformative Economic Implications

Over the past decade, robotics have evolved from specialized industrial tools into ubiquitous assets that reshape operations across manufacturing, healthcare, logistics, and consumer domains. Artificial intelligence integration has accelerated this transformation, enabling robots to perform complex tasks автономously, interpret real-time data, and learn adaptive behaviors. According to the International Federation of Robotics, the global population of industrial robots reached 4.2 million units in 2023, underscoring the pervasive deployment of automation solutions across sectors. Simultaneously, household-level adoption continues its upward trajectory, with over 2.1 million floor cleaning robots sold worldwide in 2023 as service robotics mature into indispensable domestic assistants.

This convergence of AI, advanced sensors, and cloud connectivity empowers modern robotic systems to drive productivity improvements and operational consistency at scale. Manufacturers leverage collaborative robots to offload repetitive tasks and augment human performance, while medical institutions deploy surgical and telepresence robots to enhance procedural precision and extend specialist reach. In parallel, last-mile delivery robotics are navigating urban environments with the support of significant capital investments, surpassing $3.5 billion since 2019 to optimize logistics costs and customer experience.

As this landscape expands, understanding the underpinnings of AI-driven robotics has never been more critical for decision makers. This executive summary lays the groundwork for exploring technological breakthroughs, policy influences, market segmentation, regional dynamics, and strategic imperatives that define the current robotics revolution. Each section delves into specific dimensions, offering a foundation for informed strategy and competitive advantage.

Unveiling the Game-Changing Technological Advances Redefining Robotics Through AI Integration, Digital Twins, and Collaborative Automation in 2025

The robotics ecosystem of 2025 is distinguished by a convergence of AI algorithms, digital twin simulations, and collaborative automation platforms that together redefine operational paradigms. Digital twins create virtual replicas of physical assets, allowing engineers to simulate complex scenarios, optimize workflows, and preemptively identify system failures before deploying robots on the shop floor. This synergy between AI-driven analytics and high-fidelity digital models accelerates deployment cycles while mitigating risk in high-stakes environments.

Concurrently, collaborative robots-or cobots-are transcending traditional boundaries between man and machine. Next-generation cobots feature modular designs, intuitive programming interfaces, and advanced safety protocols that support seamless human-robot collaboration. These systems adapt in real time to dynamic production requirements, performing intricate assembly and quality inspection tasks with agility. Enhanced connectivity through edge computing ensures low-latency decision making, while built-in AI capabilities enable predictive maintenance and on-the-fly calibration to sustain peak performance.

Beyond factory floors, embodied AI applications are gaining traction in service and public sectors, spearheaded by deployments in Asian innovation hubs. In Shenzhen and other leading cities, humanoid attendants navigate retail centers, provide wayfinding in transportation hubs, and conduct routine surveillance, reflecting a bold vision of AI-robot integration in everyday life. Simultaneously, wheeled and aerial delivery robots are revolutionizing urban logistics, merging LIDAR-based navigation with machine learning to ensure reliable food and parcel delivery under evolving regulatory frameworks. These transformative shifts underscore a robotics era characterized by intelligent autonomy, deep integration, and cross-industry applicability.

Assessing the Far-Reaching Consequences of United States Tariff Measures on Robotics Supply Chains, Costs, and Strategic Sourcing Decisions in 2025

Tariff policies enacted in 2025 have reverberated through global robotics supply chains, reshaping cost structures and strategic sourcing decisions for companies across segments. Industry estimates reveal that tariffs on key components such as semiconductors, sensors, and rare earth elements have introduced cumulative cost pressures exceeding 20% on imported assemblies. For instance, Chinese-made actuators and motors now face duties of up to 34%, driving hardware expenses sharply higher and challenging existing pricing models.

These trade measures have not only inflated the cost of robotic hardware but have also disrupted international manufacturing networks. At the Boston Robotics Summit, developers flagged delays in Tesla’s Optimus humanoid rollout due to constraints on rare earth shipments, while import tariffs nearly tripled the price of Unitree’s G1 platforms from $16,000 to approximately $40,000, underscoring the acute impact of cross-border levies on both cost competitiveness and innovation timelines. In the medical robotics domain, Intuitive Surgical highlighted tariffs as a material risk in its 2025 earnings statements, reflecting the broader strain on high-precision surgical systems that depend on specialized imported components.

Amid these challenges, companies are charting strategic responses to navigate uncertainty. Diversification of supply chains toward Southeast Asia and nearshore locations is gaining momentum, while domestic reshoring initiatives seek to balance geopolitical risk with operational resilience. Simultaneously, policy discussions and industry advocacy are intensifying as stakeholders lobby for targeted tariff exclusions to preserve automation momentum. Despite the short-term headwinds, these developments are catalyzing a strategic realignment that prioritizes supply chain agility, cost transparency, and regulatory engagement.

Exploring the Multifaceted Market Segmentation Landscape Across Robot Types, Applications, Industries, End Users, and Component Categories for Strategic Insights

The robotics landscape encompasses a diverse array of machine categories, each tailored for specific market requirements and operational contexts. Domestic robots now include home assistance units that support aging populations, alongside advanced cleaning and lawn mowing solutions. Entertainment robots span educational platforms that foster STEM learning, social companions designed for wellness applications, and interactive toy robots reflecting the growing consumer appetite for intelligent engagement. Industrial robots, from articulated arms to delta and Cartesian configurations, underpin heavy-duty manufacturing processes, while scara robots drive high-speed assembly operations.

Applications for these platforms cover the full spectrum of factory and logistics activities. Assembly solutions leverage precise pick-and-place abilities, material handling systems streamline intralogistics, and robotic packaging cells enhance throughput with consistent palletizing cycles. Vision-guided quality inspection units detect defects with micrometer accuracy, sorting and picking robots optimize e-commerce fulfillment, and specialized welding cells deliver repeatable weld quality in automotive and heavy machinery production.

Across industry verticals, robotics are woven into aerospace and defense manufacturing lines, automotive assembly plants, chemical processing environments, electronics fabrication hubs, and food and beverage production lines, while pharmaceutical facilities integrate robotic automation to uphold sterile handling standards. End users range from agricultural operations deploying field and milking robots, defense and security agencies utilizing unmanned systems, and healthcare institutions employing surgical and rehabilitation robots, to hospitality venues, logistics warehouses, manufacturing plants, and retail and e-commerce outlets adopting interactive service robots.

The component ecosystem driving these innovations hinges on hardware elements such as actuators, controllers, power solutions, sensors, and vision systems; services encompassing consulting, integration, maintenance, and modernization; and software layers including AI and machine learning frameworks, control software, middleware platforms, and simulation and testing tools. Each segmentation dimension offers unique insights into adoption drivers, technology preferences, and investment considerations that inform strategic decision making.

This comprehensive research report categorizes the Artificial Intelligence Robots market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Technology

- Robot Type

- Mobility

- Autonomy Level

- Application

- End User

- Deployment Environment

Revealing Key Regional Dynamics Influencing Growth and Adoption Trends Across the Americas, Europe Middle East Africa, and Asia Pacific Robotics Markets

The Americas region continues to anchor global robotics leadership, driven by robust R&D investments, dynamic venture capital activity, and supportive policy frameworks that foster domestic innovation. North American manufacturers leverage flexible automation to address labor constraints, while startups in Silicon Valley and Boston accelerate breakthroughs in humanoids and industrial AI integrations. Government initiatives and private partnerships advance semiconductor and component manufacturing capabilities, solidifying the region’s strategic autonomy and export potential.

In Europe, Middle East, and Africa, a diverse robotics ecosystem is emerging, drawing on advanced engineering expertise and integrated supply networks. European robotics companies maintain a dominant presence in service and medical robotics, supported by strong university-industry collaborations and harmonized regulatory standards. Strategic clusters in Germany, France, and the Nordics drive advanced manufacturing applications, while investment in digitalization and Industry 4.0 programs strengthens resilience against global volatility. Regional alliances and trade agreements further enable EMEA stakeholders to navigate tariff uncertainties and cultivate nearshore partnerships.

Asia-Pacific has cemented its status as the largest robotics market, with China leading deployments across industrial, service, and consumer segments. Government-backed innovation hubs in Shenzhen and Seoul expedite the commercialization of embodied AI solutions, while the recently launched K-Humanoid Alliance underscores South Korea’s ambition to become a top global humanoid innovator by 2030. Rapid urbanization, demographic shifts, and digital infrastructure expansion fuel adoption of delivery drones, warehouse automation, and smart city integrations, positioning the region at the forefront of next-generation robotics development.

This comprehensive research report examines key regions that drive the evolution of the Artificial Intelligence Robots market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Movements and Innovations from Leading Robotics Industry Players Shaping the Competitive Landscape of AI-Driven Automation

Leading industrial automation conglomerates are undertaking bold structural and portfolio moves to sharpen their robotics focus. ABB has announced the spin-off of its robotics division, aiming to create an independent entity that can harness focused capital markets attention and specialized governance, while its China-centric lineup expansion addresses mid-market demand with user-friendly automation families. FANUC and Yaskawa maintain their longstanding positions at the top of industrial robotics rankings, delivering high-precision controllers and energy-efficient servo systems that power articulations across automotive and electronics lines. KUKA continues to refine preconfigured robotic cells and open-architecture platforms that accelerate integration for diverse manufacturing ecosystems.

In the medical robotics sphere, Intuitive Surgical leads with advanced surgical platforms yet flags tariff-related margin pressures that require adaptive supply chain strategies to maintain competitive pricing and market reach. Meanwhile, Boston Dynamics and Agility Robotics showcase dynamic humanoid and legged robots for logistics, inspection, and mobile manipulation, though their roadmaps face cost headwinds from import levies and talent mobility challenges. Emerging players such as Unitree navigate a complex trade environment, adjusting pricing models and accelerating domestic production to mitigate tariff impacts on flagship platforms.

This comprehensive research report delivers an in-depth overview of the principal market players in the Artificial Intelligence Robots market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- FANUC CORPORATION

- Yaskawa Electric Corporation

- Kuka AG

- Universal Robots A/S

- NVIDIA Corporation

- Tesla Inc.

- Hyundai Motor Group

- Agility Robotics, Inc.

- Intuitive Surgical, Inc.

- Comau S.p.A.

- Sony Corporation

- Google LLC by Alphabet Inc.

- Samsung Electronics Co., Ltd.

- Sanctuary Cognitive Systems Corporation

- Intel Corporation

- Doosan Corporation

- iRobot Corporation

- Advanced Micro Devices, Inc.

- Agile Robots SE

- AIBrain Inc.

- BLUE FROG ROBOTICS SAS

- Diligent Robotics Inc.

- HANSON ROBOTICS LTD.

- International Business Machines Corporation

- Keyence Corporation

- LG Electronics, Inc.

- Mentee Robotics

- PAL ROBOTICS SL.

- Palladyne AI Corp.

- Stäubli International AG

- Ubtech Robotics Corp Ltd.

- United Robotics Group GmbH

- Zebra Technologies Corp.

Delivering Actionable Recommendations for Industry Leaders to Navigate Technological Disruption, Supply Chain Volatility, and Strategic Investment in AI Robotics

Industry leaders should prioritize the diversification of sourcing footprints to hedge against geopolitical disruptions and tariff shocks. Evaluating alternative suppliers in Southeast Asia and nearshore manufacturing partners can preserve cost structures while minimizing exposure to single-country dependencies. Simultaneously, investing in in-house component capabilities, including sensor calibration and precision actuator assembly, strengthens resilience and enables faster response to policy changes.

Adoption of digital twin simulations and AI-driven predictive maintenance frameworks will be instrumental in reducing deployment risk and sustaining operational uptime. By creating virtualized environments that mirror physical systems, companies can accelerate time to production, validate new workflows, and optimize resource utilization before committing to capital investments. Integrating condition-based service contracts tied to uptime metrics aligns supplier incentives with plant performance and bolsters lifecycle returns.

Collaboration with government agencies and industry consortia is essential to influence tariff policy and secure targeted exemptions for critical robotics components. Engaging in policy advocacy, participating in standards development, and pursuing R&D partnerships can yield favorable trade outcomes and accelerate technology adoption. Lastly, upskilling workforces through AR/VR training and specialized technical programs will ensure human talent remains integral to guiding, maintaining, and co-working with increasingly sophisticated robotic fleets.

Outlining the Robust Research Methodology Underpinning Market Analysis Through Primary, Secondary Data Collection, Validation, Advanced Statistical Techniques

This report synthesizes insights drawn from a rigorous research framework combining both secondary and primary data sources. Comprehensive secondary research included analysis of technical whitepapers, regulatory filings, academic journals, and authoritative data from the International Federation of Robotics. Trade publications, corporate financial reports, and reputable news outlets provided market context and event-driven perspectives.

Primary research comprised in-depth interviews with C-suite executives, R&D heads, systems integrators, and end users across key verticals. These structured engagements enabled the validation of trends, identification of adoption drivers, and refinement of segment-specific insights. Quantitative data collection through targeted surveys supported cross-validation of perceptions and technical requirements for robotic system deployments.

Collected data underwent meticulous validation using advanced statistical techniques, including outlier detection, consistency checks, and cross-tabulation analyses. Triangulation methods aligned qualitative inputs with quantitative findings to ensure robustness and credibility. Finally, scenario analysis and technology benchmarking established clear linkages between emerging innovations and strategic imperatives, underpinning the executive summary’s actionable recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Artificial Intelligence Robots market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Artificial Intelligence Robots Market, by Offering

- Artificial Intelligence Robots Market, by Technology

- Artificial Intelligence Robots Market, by Robot Type

- Artificial Intelligence Robots Market, by Mobility

- Artificial Intelligence Robots Market, by Autonomy Level

- Artificial Intelligence Robots Market, by Application

- Artificial Intelligence Robots Market, by End User

- Artificial Intelligence Robots Market, by Deployment Environment

- Artificial Intelligence Robots Market, by Region

- Artificial Intelligence Robots Market, by Group

- Artificial Intelligence Robots Market, by Country

- United States Artificial Intelligence Robots Market

- China Artificial Intelligence Robots Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 2226 ]

Summarizing the Strategic Implications of Artificial Intelligence Robotics and Charting Future Opportunities for Innovation, Collaboration, and Market Expansion

The convergence of artificial intelligence, advanced hardware, and supportive policy frameworks has propelled robotics from niche applications to a cornerstone of modern operational strategies. Across diverse segments, from industrial cobots to household assistants, robotics platforms are elevating productivity, consistency, and safety standards, while digital twin technologies and AI-driven controls are unlocking new efficiencies.

Geopolitical factors, notably tariff regimes, have introduced complexity into global sourcing, yet they have also catalyzed supply chain diversification and domestic capacity-building efforts. Regional dynamics further shape the adoption curve, with leading markets in the Americas, EMEA, and Asia-Pacific each leveraging unique strengths in innovation, regulation, and infrastructure.

For businesses navigating this rapidly evolving landscape, focused investments in resilient supply networks, digital simulation tools, and workforce development are critical to sustaining competitiveness. By embracing collaborative automation, engaging with policy stakeholders, and capitalizing on advanced analytics, organizations can harness the full potential of AI-powered robotics to drive future growth and operational excellence.

Empowering Decision Makers with Expert Support from Ketan Rohom to Secure Your Comprehensive AI Robotics Market Research Report

To secure an in-depth exploration of these critical trends, detailed analyses, and strategic frameworks, prospective clients are encouraged to connect directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. With his expert guidance, businesses can access tailored insights, customized data sets, and comprehensive market intelligence that address unique organizational challenges and growth objectives. Ketan’s extensive experience in AI robotics research ensures that every interaction delivers actionable value and clarity. Reach out today to discuss how this report can empower your strategic initiatives and investment decisions in the evolving robotics landscape

- How big is the Artificial Intelligence Robots Market?

- What is the Artificial Intelligence Robots Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?