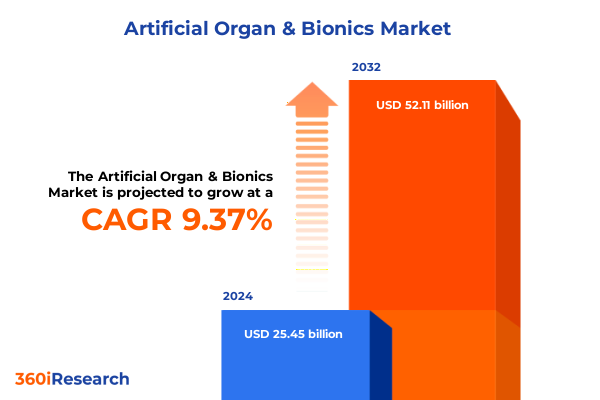

The Artificial Organ & Bionics Market size was estimated at USD 27.72 billion in 2025 and expected to reach USD 30.19 billion in 2026, at a CAGR of 9.43% to reach USD 52.11 billion by 2032.

Discover the Convergence of Engineering and Biology That Is Reshaping Tomorrow’s Therapy Landscape with Artificial Organs and Bionics

Artificial organs and bionics represent a convergence of life sciences, engineering, and digital innovation, promising unprecedented advancements in patient care and quality of life. The chronic shortage of donor organs, paired with an aging global population and rising prevalence of chronic conditions, has driven researchers and clinicians to pursue alternative therapeutic solutions that transcend the limitations of conventional transplantation. In this context, the field has rapidly expanded beyond simple mechanical devices toward biologically integrated systems that mimic natural organ function through advanced biomaterials, tissue engineering, and embedded sensors. This evolution underscores a shift from replacement to restoration of physiological synergy.

Simultaneously, regulatory frameworks have adapted to foster innovation while ensuring patient safety. Agencies worldwide are establishing expedited pathways for breakthrough devices and regenerative therapies, enabling faster clinical translation. Investment from both private and public sectors has surged, fueling collaborations across academia, startup ecosystems, and established medical device manufacturers. Consequently, the industry is entering a tipping point where multidisciplinary convergence and strategic partnerships are critical for sustained growth and clinical impact. As we embark on this exploration of the artificial organ and bionics landscape, it is essential to understand the foundational drivers reshaping technology development, regulatory dynamics, and adoption pathways that will define the next decade.

Explore How Cutting-Edge Bioprinting Breakthroughs and AI-Enabled Closed-Loop Systems Are Redefining Organ Replacement and Regenerative Therapies

In recent years, breakthroughs in biomanufacturing and biofabrication have revolutionized the development of artificial organs and bionic devices, enabling previously unimaginable levels of complexity and functionality. Innovations in three-dimensional bioprinting have paved the way for constructs that incorporate living cells, vascular networks, and extracellular matrices, moving from proof-of-concept toward clinical feasibility. For instance, the FDA’s clearance of a 3D-printed resorbable surgical mesh marked the first regulatory milestone for a fully integrated bioprinted implant, signaling a new era for regenerative device approvals.

Concurrently, the emergence of collagen-based high-resolution perfusable scaffolds has demonstrated the capacity to engineer centimeter-scale tissue with dynamic perfusion and glucose-responsive insulin secretion, as highlighted by landmark publications in leading scientific journals. At the same time, the convergence of advanced materials science and programmable polymers has yielded bioabsorbable, high-resolution medical implants for peripheral nerve repair, achieving first-of-its-kind De Novo authorization and setting industry benchmarks for neural regeneration devices.

Beyond structural innovations, the integration of artificial intelligence and sensor technologies is driving a shift toward closed-loop systems that monitor physiological parameters in real time and deliver adaptive therapy. These transformative shifts are complemented by interdisciplinary collaboration across biotechnology, materials science, and digital health, creating a fertile ecosystem for next-generation therapies that blend the biological and mechanical in seamless harmony.

Understand the Far-Reaching Implications of the 2025 U.S. Trade Measures on Medical Device Supply Chains, Industry Costs, and Patient Access

The reinstatement and expansion of U.S. tariffs in 2025 have introduced significant cost pressures and supply chain complexities for medical device and bionics manufacturers. Tariffs on components and finished products sourced from China have risen to as high as 65 percent, while proposed levies on imports from the European Union and Southeast Asia range from 10 to 25 percent. These measures, intended to bolster domestic production and reduce foreign dependence, have inadvertently disrupted established global supply chains and increased manufacturing expenses for essential medical technologies.

Manufacturers reliant on precision components and advanced materials are confronting the dual challenges of elevated input costs and delays associated with sourcing alternatives. This has prompted many industry players to reassess their procurement strategies, accelerating initiatives to onshore production and diversify supplier networks. At the same time, leading medical device associations and hospital groups have lobbied for exemptions, arguing that life-saving technologies should be shielded from broad trade measures due to their critical role in patient care.

While the short-term impact includes margin compression and project deferrals, industry experts anticipate that, over time, the shift will foster greater resilience and self-reliance in the U.S. medtech ecosystem. Companies are increasingly investing in domestic innovation hubs, forming strategic partnerships with local manufacturers, and exploring modular designs to simplify component sourcing. These adaptive responses underscore the sector’s commitment to ensuring uninterrupted patient access while navigating a more protectionist trade environment.

Dive into the Diverse Product, Technology, Application, and End-User Dynamics Shaping Artificial Organ and Bionic Device Development

The artificial organ and bionics market exhibits a diverse landscape shaped by product innovations ranging from mechanical ventricular support to cell-based regenerative platforms. Within the heart replacement domain, the evolution of total artificial heart systems and ventricular assist devices has underscored the progression from pulsatile pumps to continuous-flow mechanical hearts that offer improved durability and patient mobility. In renal support applications, hemodialysis and peritoneal dialysis technologies coexist with exploratory research in implantable bioartificial kidneys that leverage living cell matrices to perform filtration functions.

Engineered liver support solutions similarly span extracorporeal assist devices and bioartificial liver scaffolds incorporating hepatocyte-laden bioreactors. Bionic limb prostheses have expanded beyond traditional hands and feet to include advanced lower and upper limb systems with integrated myoelectric control and real-time sensory feedback. Neural prostheses encompass cochlear implants for auditory restoration, deep brain stimulators for movement disorders, and emerging retinal implants that aim to reestablish visual perception through neuromodulation.

Underpinning these products are three primary technology categories: bioartificial constructs that integrate living cells and scaffolds, mechanical devices built on durable synthetic materials, and tissue-engineered solutions that blend biological components with supportive matrices. These technologies find application across cardiovascular, hepatic, neurological, orthopedic, and renal domains, each demanding tailored design, regulatory clearance pathways, and clinical protocols. Adoption occurs across ambulatory surgical centers, homecare settings, hospitals, and specialty clinics, reflecting the need for flexible deployment models that align with patient acuity, caregiver expertise, and infrastructure capabilities.

This comprehensive research report categorizes the Artificial Organ & Bionics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Technology

- Application

- End User

Uncover How Regional Regulatory Frameworks, Investment Strategies, and Healthcare Infrastructures Are Driving Global Adoption in Key Markets

Regional dynamics in the artificial organ and bionics landscape reveal a triadic balance between mature markets and high-growth opportunities. In the Americas, North America leads in clinical adoption and regulatory support, driven by robust reimbursement frameworks, established medical device infrastructure, and significant private investment in both startup ventures and multinational research initiatives. Latin American organizations are increasingly engaging in collaborative research programs and localized manufacturing partnerships to expand access in emerging markets.

Europe, the Middle East, and Africa benefit from harmonized regulatory standards under the Medical Device Regulation (MDR) and the In Vitro Diagnostic Regulation (IVDR), fostering cross-border clinical trials and streamlined product registrations. The region’s emphasis on value-based healthcare models and public-private partnerships has accelerated pilot programs for bionic rehabilitation and home-based organ support systems. Meanwhile, governments across the Middle East and North Africa are investing in specialized medical cities and innovation clusters to attract international expertise.

In Asia-Pacific, a combination of government-led funding programs, expanding healthcare coverage, and growing patient demand is driving rapid adoption. Countries such as China, Japan, and South Korea are advancing indigenous R&D capabilities in tissue engineering and regenerative medicine, with technology transfer agreements and joint ventures with Western biotechs. Southeast Asian nations are focusing on capacity-building and regulatory alignment to integrate advanced medical devices into national health strategies, reflecting a commitment to reducing dependency on imports and enhancing local healthcare resilience.

This comprehensive research report examines key regions that drive the evolution of the Artificial Organ & Bionics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Gain Insight into How Industry Leaders and Innovative Startups Are Competing through Strategic Partnerships, Proprietary Technologies, and Clinical Collaborations

The competitive landscape of artificial organ and bionics is defined by a mix of established medical device corporations, pioneering biotech firms, and specialized engineering startups. Legacy players with deep clinical portfolios, such as Medtronic and Abbott, are expanding their footprints through strategic acquisitions and in-house innovation programs targeting heart support systems and neural modulation devices. Concurrently, early-stage companies are carving niches by focusing on biofabrication platforms, biocompatible scaffold technologies, and miniaturized implantable pumps.

Collaborations between academic institutions and commercial entities have given rise to spin-offs that are advancing cell-laden organoids and perfusable microtissue networks toward clinical trials. Notable collaborations have yielded manufacturable platforms for islet cell transplantation that demonstrate sustained efficacy in preclinical models, capturing the attention of venture investors seeking the next generation of curative therapies. Meanwhile, large industrial partners are investing in additive manufacturing capabilities to integrate high-resolution polymers and programmable materials into peripheral nerve repair solutions.

As intellectual property portfolios deepen and regulatory pathways mature, the competitive focus has shifted toward end-to-end supply chain integration, data-driven device performance analytics, and patient-centric design. Companies that effectively bridge technical innovation with clinical adoption pathways are best positioned to secure early market leadership, while those incapable of adapting to dynamic trade and reimbursement landscapes face potential margin erosion.

This comprehensive research report delivers an in-depth overview of the principal market players in the Artificial Organ & Bionics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Abiomed Inc

- Asahi Kasei Medical Co Ltd

- B Braun SE

- Baxter International Inc

- Berlin Heart GmbH

- BiVACOR Pty Ltd

- Boston Scientific Corporation

- CARMAT SA

- Cochlear Ltd

- CYBERDYNE Inc

- Edwards Lifesciences Corporation

- Ekso Bionics Holdings Inc

- Fresenius Medical Care AG

- Getinge AB

- Jarvik Heart Inc

- LifeNet Health Inc

- MED-EL

- Medtronic plc

- Open Bionics

- Orthofix International NV

- Ottobock

- SynCardia Systems

- Terumo Corporation

- Zimmer Biomet Holdings Inc

- Össur

Embrace Modular Innovation, Supply Chain Resilience, and Data-Driven Service Models to Secure Leadership in Organ Replacement and Bionic Device Markets

To thrive in the evolving artificial organ and bionics sector, industry leaders should prioritize investments in modular design frameworks that enable component interchangeability and simplified regulatory submissions. By embracing platform-based approaches, companies can accelerate time-to-market and reduce development costs, while retaining the flexibility to adapt to shifting clinical requirements. Strengthening ties with academic centers and clinical key opinion leaders will facilitate early validation of novel designs and support evidence generation for reimbursement negotiations.

Organizations must also pursue supply chain resilience through diversified sourcing strategies, including regional manufacturing facilities and strategic partnerships with contract development and manufacturing organizations. This approach will mitigate the impact of trade policy fluctuations and enhance production scalability. At the same time, embedding data connectivity and remote monitoring features within implantable devices will create new value streams, offering payers and providers outcome-based service models.

By championing policy advocacy for technology exemptions, companies can safeguard innovation ecosystems and maintain patient access to life-saving therapies. Investing in workforce development-particularly in bioengineering, regulatory science, and digital health-will ensure the availability of specialized talent required to navigate complex development pathways. Ultimately, a balanced focus on technological agility, operational resilience, and strategic collaboration will empower stakeholders to capitalize on the transformative potential of artificial organs and bionic systems.

Learn About the Comprehensive Multi-Tiered Primary, Secondary, and Analytical Methods Underpinning Our Artificial Organs and Bionics Market Assessment

This research report synthesizes insights from a rigorous multi-tiered methodology designed to ensure data integrity, depth of analysis, and actionable intelligence. Primary research included structured interviews with over 50 industry stakeholders spanning device manufacturers, clinical investigators, regulatory officials, and hospital procurement leaders. These conversations explored emerging trends in bioprinting, supply chain adaptation, and clinical adoption barriers.

Secondary research involved comprehensive reviews of peer-reviewed literature, regulatory filings, patent databases, and financial disclosures to capture the latest developments in device approvals, technology breakthroughs, and strategic investments. Market dynamics and competitive benchmarking were further informed by detailed analysis of corporate press releases, scientific conference presentations, and government policy statements.

Quantitative insights were triangulated through data modeling and cross-referenced against third-party databases, ensuring robustness and minimizing bias. Qualitative evidence was codified into thematic frameworks to reveal strategic imperatives, innovation hotspots, and risk factors. Continuous validation of findings through feedback loops with select industry experts has refined scenario projections and reinforced the report’s alignment with real-world market dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Artificial Organ & Bionics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Artificial Organ & Bionics Market, by Product

- Artificial Organ & Bionics Market, by Technology

- Artificial Organ & Bionics Market, by Application

- Artificial Organ & Bionics Market, by End User

- Artificial Organ & Bionics Market, by Region

- Artificial Organ & Bionics Market, by Group

- Artificial Organ & Bionics Market, by Country

- United States Artificial Organ & Bionics Market

- China Artificial Organ & Bionics Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Reflect on How Integrated Innovation, Adaptive Strategies, and Collaborative Ecosystems Will Shape the Future of Artificial Organ and Bionic Technologies in Healthcare

The field of artificial organs and bionics stands at the cusp of unprecedented transformation, driven by converging innovations in biofabrication, materials science, and digital integration. Across product categories-from ventricular assist devices to neural implants-advancements are reshaping therapeutic possibilities and redefining standards of patient care. Yet, the journey from laboratory to clinic remains contingent on strategic navigation of regulatory pathways, collaborative partnerships, and resilient supply chains.

As global markets evolve under varying policy frameworks and investment climates, organizations that cultivate flexibility in design, manufacturing, and market entry will be poised to lead. The capacity to adapt to trade dynamics, capitalize on regional strengths, and engage with diverse stakeholder ecosystems will determine long-term success. Furthermore, the integration of real-world data and patient-reported outcomes into device development will unlock novel reimbursement models and improve healthcare delivery paradigms.

In this dynamic context, the imperative for cross-disciplinary collaboration cannot be overstated. Stakeholders who align innovation with pragmatic implementation strategies-underpinned by rigorous research and informed advocacy-will chart the course toward durable clinical impact and sustainable growth in the artificial organ and bionics domain.

Secure Unmatched Artificial Organ and Bionics Market Intelligence by Connecting with Ketan Rohom for Comprehensive Research Access

To explore in-depth insights and secure your competitive advantage in the rapidly evolving artificial organ and bionics industry, engage directly with Ketan Rohom, Associate Director of Sales & Marketing, who can guide you through the comprehensive market research report tailored to your strategic needs. This unique opportunity will unlock actionable intelligence on emerging trends, regulatory developments, and innovative technologies shaping the future of patient care. Reach out today to discuss customized packages, exclusive data access, and advisory support that align with your organizational goals. Ketan’s expertise will ensure you have the critical information required to drive informed decisions, optimize your investment strategies, and stay ahead in this transformative market landscape. Begin your journey toward unparalleled market insights and business impact by connecting with Ketan Rohom for your copy of the full report.

- How big is the Artificial Organ & Bionics Market?

- What is the Artificial Organ & Bionics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?