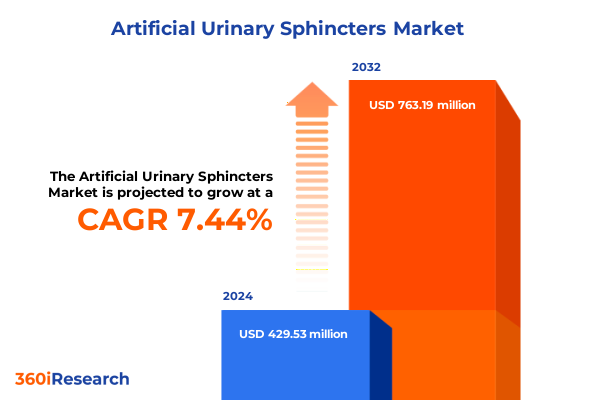

The Artificial Urinary Sphincters Market size was estimated at USD 460.99 million in 2025 and expected to reach USD 497.51 million in 2026, at a CAGR of 7.46% to reach USD 763.18 million by 2032.

Navigating the Evolution and Clinical Significance of Artificial Urinary Sphincters in Modern Urological Care Driving Precision Patient Outcomes

Artificial urinary sphincters have emerged as a cornerstone in the management of severe urinary incontinence, offering life-changing outcomes for patients grappling with sphincter dysfunction. Originally conceptualized in the early 1970s, these implantable devices have evolved from rudimentary prototypes into sophisticated therapeutic solutions that mimic natural sphincter function. Their clinical adoption accelerated particularly in post-prostatectomy patients, where intrinsic sphincter deficiency often leads to chronic leakage and significant quality-of-life impairment. As a result, urologists and pelvic floor specialists increasingly rely on these devices as a gold-standard intervention for stress urinary incontinence, underscoring their vital role in contemporary urological care.

Over the decades, design refinements have prioritized patient comfort, surgical ease, and long-term reliability. Modern systems boast modular components that streamline implantation and reduce operative time, while advanced materials enhance durability and biocompatibility. Beyond technical sophistication, the therapeutic impact extends into psychosocial domains, alleviating stigma and fostering greater autonomy for users. Consequently, the intersection of innovation and clinical need has cemented artificial urinary sphincters as indispensable assets in managing complex incontinence cases, driving ongoing research and continued enhancements in device performance.

Looking ahead, the synergy between evolving surgical techniques, precision engineering, and patient-centric design promises to expand adoption further. With demographic shifts toward aging populations and rising prevalence of prostate cancer treatments, demand is poised to intensify. In response, manufacturers, clinicians, and stakeholders must remain attuned to the interplay of technology, regulatory landscapes, and healthcare infrastructure to optimize outcomes and ensure broad access to these transformative interventions.

Exploring Revolutionary Technological Advancements and Demographic Trends Redefining Artificial Urinary Sphincter Use and Patient Care Dynamics

The landscape of artificial urinary sphincter therapy is undergoing transformative shifts, propelled by converging demographic trends and breakthroughs in medical engineering. Aging populations and increased survivorship following oncological procedures have elevated the incidence of urinary sphincter deficiencies, prompting device makers to pursue incremental innovations. In parallel, advances in minimally invasive surgical techniques have reduced recovery times and enhanced procedural precision, encouraging clinicians to integrate sphincter implants more readily into their practice. This confluence of patient need and procedural refinement is redefining therapeutic paradigms and reshaping standard of care across urology.

Technological progress is equally impactful, with next-generation systems incorporating features such as antimicrobial coatings, adjustable pressure regulation, and telemetric monitoring. These enhancements not only mitigate infection risks but also permit noninvasive postoperative adjustments, fostering personalized treatment plans that adapt to patient activity levels and tissue characteristics. Furthermore, digital health integration is on the rise, as real-time data capture and remote patient monitoring become increasingly viable. By leveraging connected technologies, providers can track device performance and patient status, enabling earlier detection of complications and data-driven refinements to care protocols.

Simultaneously, regulatory frameworks are evolving to accommodate rapid device iterations, streamlining pathways for approval while maintaining safety and efficacy standards. This regulatory agility accelerates time-to-market for breakthrough solutions and facilitates global market entries, particularly in regions with burgeoning healthcare infrastructure. As these dynamics converge, the artificial urinary sphincter ecosystem stands on the cusp of unprecedented transformation, characterized by enhanced device sophistication, refined surgical approaches, and a patient-centered ethos that prioritizes both functional outcomes and quality of life.

Assessing the Far-Reaching Consequences of 2025 United States Tariffs on Artificial Urinary Sphincter Supply Chains Pricing and Clinical Adoption

In April 2025, the U.S. administration introduced a baseline 10% tariff on a wide array of imported medical devices, with higher duties applied to select trading partners, amplifying costs across the value chain. Under Section 301 of U.S. trade law, certain critical components sourced from China now face levies up to 25%, while medical consumables such as syringes and gloves carry tariffs as high as 100% from January 1, 2025. These measures, intended to bolster domestic manufacturing, have instead strained supply chains and elevated input costs for artificial urinary sphincter manufacturers, who rely on precision-engineered parts from global suppliers.

The immediate consequence has been an uptick in manufacturing expenses, which manufacturers have partially absorbed through strategic sourcing and operational efficiencies. However, downstream stakeholders including hospitals and clinics report budgetary pressures attributable to these tariffs. A recent analysis revealed that industry-wide earnings per share for leading medtech firms could decline by as much as 13.8% due to tariff-related cost escalations, with Boston Scientific and Medtronic among those witnessing share price adjustments on tariff announcements. In response, manufacturers are exploring alternative production hubs in tariff-exempt jurisdictions, leveraging nearshoring strategies to Mexico and Southeast Asia to mitigate fiscal impacts and maintain stable supply lines.

While some trade associations are advocating for carve-outs to preserve patient access to life-saving devices, the uncertainty surrounding reciprocal levies on European exports further complicates long-term planning. Extended lead times for component approval and the intricate regulatory requirements for device revalidation in new manufacturing locations exacerbate these challenges. Consequently, the cumulative effect of 2025 tariffs has been to decelerate investment in device enhancements, redirect capital toward supply chain resilience, and underscore the need for targeted policy interventions to safeguard medical innovation and patient care continuity.

Unveiling Strategic Market Segmentation Across Type End User Distribution Channel Gender and Application for Optimal Positioning in Artificial Urinary Sphincter Market

A granular understanding of market segmentation reveals distinct opportunities and challenges across multiple dimensions of the artificial urinary sphincter landscape. Device design variants span from streamlined single component systems to modular three component platforms, with two component alternatives providing a balance between surgical simplicity and functional versatility. Single component devices have gained traction for outpatient procedures, yet three component solutions remain the preferred choice for complex cases requiring precise pressure regulation and reservoir placement nuances. As surgeons weigh ease of implantation against tailoring physiological control, these design distinctions shape adoption patterns and influence clinical guidelines.

End user settings also diverge, with ambulatory surgical centers, clinics, and hospitals each commanding unique strategic considerations. Freestanding ambulatory surgical centers favor rapid-turnover, cost-effective models, while hospital-affiliated ASCs leverage integrated care pathways and broader reimbursement channels. Multispecialty clinics accommodate diverse urological services alongside general surgery, whereas urology clinics concentrate specialty expertise and patient education resources. In larger institutions, private hospitals often prioritize premium device offerings and advanced technology adoption, contrasted with public hospitals that emphasize cost containment and standardized protocols.

Distribution channels bifurcate into direct sales forces and distributor networks, each with nested operational nuances. In-house sales teams foster deep customer relationships and tailored support programs, whereas original equipment manufacturer sales divisions offer targeted training initiatives. Distributor-led outreach extends through online platforms and established third party networks, amplifying market reach but requiring meticulous coordination to uphold technical service levels. Gender-specific considerations further refine segmentation, as female-oriented sphincter applications address pelvic floor rehabilitation distinct from male-centric solutions optimized for post-prostatectomy outcomes. Finally, indication-driven segmentation highlights neurogenic bladder dysfunction cases-where device resilience under variable pressure conditions is critical-and stress urinary incontinence treatments, which prioritize precise occlusive control. These intertwined segmentation layers inform strategic positioning and guide product development roadmaps.

This comprehensive research report categorizes the Artificial Urinary Sphincters market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Gender

- Distribution Channel

- Application

- End User

Integrating Regional Market Dynamics Across Americas Europe Middle East Africa and Asia Pacific to Illuminate Growth Opportunities in Urinary Sphincter Devices

Regional market dynamics exhibit considerable variation, shaped by healthcare infrastructure, regulatory regimes, and patient demographics. In the Americas, the United States leads with established reimbursement frameworks and high procedural volumes, buoyed by a robust network of specialist surgical centers and advanced training programs. Canada follows closely, with publicly funded health systems emphasizing cost-effectiveness and technology assessments. Latin American markets are evolving rapidly, driven by private healthcare expansion and an uptick in medical tourism, although disparities in access and regulatory harmonization persist.

Europe, the Middle East and Africa (EMEA) present a heterogeneous environment. Western European nations benefit from the European Medical Device Regulation, ensuring high safety standards and expedited market access for innovative implants. In contrast, Central and Eastern European markets are in earlier stages of adoption, constrained by budgetary limits and nascent reimbursement pathways. Gulf Cooperation Council countries are investing heavily in healthcare infrastructure upgrades, opening avenues for premium device introductions. Meanwhile, selective African markets leverage donor-funded programs to improve urological care access, though supply chain constraints and workforce shortages pose ongoing challenges.

Asia-Pacific is characterized by divergent growth trajectories. Mature markets such as Japan and Australia adopt sophisticated device technologies backed by generous public and private reimbursement. China’s burgeoning healthcare expenditure and regulatory reforms are catalyzing domestic manufacturing capacity, while India’s expanding surgical base signals untapped potential despite pricing sensitivities. Southeast Asian nations incrementally integrate advanced sphincter therapies into tertiary care centers, balancing volume-driven procurement with emerging standards of clinical excellence. Across the region, telemedicine and digital health initiatives amplify remote training and postoperative monitoring, accelerating best practice diffusion and spotlighting artificial urinary sphincters as integral components of comprehensive continence management.

This comprehensive research report examines key regions that drive the evolution of the Artificial Urinary Sphincters market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Competitive Forces and Innovation Strategies of Leading Manufacturers Shaping the Artificial Urinary Sphincter Industry Landscape

Leading manufacturers are fiercely innovating to capture market advantage, deploying differentiated strategies across product development, strategic partnerships, and geographic expansion. Boston Scientific has long held prominence with its AMS 800 platform, leveraging incremental enhancements such as antibiotic surface treatments and pressure balloon variants to uphold clinical leadership. The company’s emphasis on surgeon training programs and patient support services cements its status as a reference-point provider of three component systems.

Coloplast, meanwhile, channels substantial R&D investments into novel device architectures, exemplified by its Virtue® sling system extension into sphincter technologies. By integrating advanced biocompatible materials and streamlined pump mechanisms, Coloplast underscores a patient-centric ethos that resonates in both hospital and ambulatory settings. Swiss-based Zephyr Surgical Implants has carved out a niche with its ZSI 375 model, offering a prefilled two component design that reduces operating room time and inventory complexity-a compelling proposition for high-volume clinics.

Promedon and UroMed have also emerged as formidable competitors, each concentrating on specialized indications and regional partnerships to bolster market presence. Promedon’s ProACT™ system appeals to surgeons seeking minimally invasive options for stress urinary incontinence, while UroMed’s collaborations with leading urology centers in Asia and Latin America facilitate localized training and distribution. Across the competitive landscape, strategic acquisitions and co-development agreements continue to reshape market structure, as firms pursue scale, broaden portfolios, and expedite time-to-market for next-generation sphincter solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Artificial Urinary Sphincters market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Affluent Medical

- Albyn Medical Ltd.

- Andromeda Medizinische Systeme GmbH

- Anhui Longterm Medical Products Co., Ltd.

- Boston Scientific Corporation

- Coloplast A/S

- CooperSurgical Inc.

- Dualis MedTech GmbH

- GT Urological LLC

- LABORIE Medical Technologies Inc.

- MyoPowers Medical Technologies SAS

- Promedon S.A.

- Rigicon Inc.

- Uromedical AG

- Zephyr Surgical Implants AG

Charting an Actionable Roadmap for Industry Leaders to Optimize Innovation Supply Chain Efficiency and Patient Centric Growth in Urinary Sphincter Solutions

To maintain a competitive edge, industry leaders should prioritize a multifaceted approach that integrates supply chain resilience, digital innovation, and patient engagement. Firstly, diversifying component sourcing through nearshoring and regional manufacturing partnerships will mitigate tariff-induced cost volatility. By establishing strategic alliances with local suppliers in tariff-exempt jurisdictions, manufacturers can secure production continuity and optimize lead times.

Secondly, investing in connected device platforms and telemonitoring infrastructure can elevate patient care paradigms. Integrating remote pressure adjustment capabilities and data analytics not only enhances postoperative support but also fuels evidence-based device refinement. Collaborating with healthcare providers to develop interoperable digital ecosystems will bolster clinical outcomes and generate real-world evidence for payer negotiations.

Thirdly, fostering cross-sector collaborations with payers and regulatory bodies will streamline reimbursement pathways and facilitate rapid product launches. Engaging in early dialogue on health economic models and outcomes-based contracting can align manufacturer value propositions with stakeholder priorities. Moreover, co-creating training modules with surgical societies and leveraging virtual reality simulations can accelerate surgeon proficiency and enhance procedural consistency.

Finally, embedding patient-centric design principles into R&D roadmaps-such as user-friendly activation mechanisms and personalized cuff sizing-will differentiate offerings in a crowded field. By harnessing human-centered design methodologies and capturing patient feedback at each development milestone, companies can deliver solutions that resonate with end users and drive long-term adherence.

Demonstrating a Rigorous Research Methodology Leveraging Primary Insights Secondary Analysis and Quantitative Validation for Comprehensive Market Understanding

This research employs a robust methodology that integrates both primary and secondary sources to ensure comprehensive market insights. The primary research phase comprised in-depth interviews with key opinion leaders, including urologists, pelvic floor specialists, and supply chain executives across major healthcare institutions. These conversations provided nuanced perspectives on surgical practices, device performance parameters, and emerging clinical needs. Supplementing expert interviews, quantitative surveys captured data on procedural volumes, device preferences, and reimbursement experiences across diverse end user segments.

Parallel to primary efforts, secondary research entailed rigorous analysis of peer-reviewed journals, regulatory filings, company financial statements, and industry conference proceedings. This enabled triangulation of data points such as device approvals, material innovations, and competitive dynamics. Publicly available customs and trade databases were examined to quantify the impact of tariffs on import volumes and pricing trends. Furthermore, regulatory databases in key regions were reviewed to map approval timelines and compliance frameworks.

Analytical techniques combined bottom-up assessments-aggregating device adoption metrics at the facility level-with top-down evaluations that contextualized macroeconomic indicators and demographic shifts. Data validation protocols included cross-referencing interview insights with published benchmarks and subjecting findings to advisory panel review. This iterative approach ensured methodological rigor, minimized bias, and delivered a holistic understanding of the artificial urinary sphincter market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Artificial Urinary Sphincters market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Artificial Urinary Sphincters Market, by Type

- Artificial Urinary Sphincters Market, by Gender

- Artificial Urinary Sphincters Market, by Distribution Channel

- Artificial Urinary Sphincters Market, by Application

- Artificial Urinary Sphincters Market, by End User

- Artificial Urinary Sphincters Market, by Region

- Artificial Urinary Sphincters Market, by Group

- Artificial Urinary Sphincters Market, by Country

- United States Artificial Urinary Sphincters Market

- China Artificial Urinary Sphincters Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Concluding Strategic Imperatives Emphasizing Innovation Collaboration and Supply Chain Resilience to Advance Artificial Urinary Sphincter Adoption

The artificial urinary sphincter market stands at a pivotal juncture, shaped by technological innovation, regulatory evolution, and shifting global trade paradigms. As tariffs exert pressure on supply chains, manufacturers must recalibrate sourcing strategies to preserve cost efficiency and sustain R&D momentum. In parallel, the ascent of next-generation device features-including antimicrobial coatings and remote monitoring-underscores the imperative for continuous innovation grounded in patient-centric design.

Segmentation analysis highlights the importance of tailoring solutions to specific clinical contexts, whether through modular three component platforms for complex cases or streamlined two component systems for rapid outpatient procedures. Regional insights reveal that while the Americas and Western Europe maintain leadership in device adoption, Asia-Pacific and select EMEA markets offer fertile ground for expansion, driven by healthcare infrastructure upgrades and evolving reimbursement models.

Competitive dynamics are intensifying, with established players and emerging innovators pursuing strategic collaborations, acquisitions, and targeted product launches. Success in this environment will hinge on the ability to harmonize supply chain resilience, digital health integration, and stakeholder engagement. By adopting a holistic strategy that balances operational agility with clinical excellence, industry participants can advance patient outcomes, reinforce market leadership, and navigate the complexities of a rapidly evolving urological device sector.

Connect with Ketan Rohom Associate Director Sales Marketing to Secure Your Customized Artificial Urinary Sphincter Market Research Report

For organizations seeking a deeper dive into the nuances of the artificial urinary sphincter landscape, personalized guidance is now available. Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore tailored insights and unlock the full potential of this comprehensive market research report. This exclusive opportunity ensures that decision-makers receive targeted analysis aligned with their strategic goals, driving more informed choices and enhanced competitive advantage. Reach out today to secure your customized investigation and elevate your understanding of critical trends shaping the future of urinary sphincter solutions.

- How big is the Artificial Urinary Sphincters Market?

- What is the Artificial Urinary Sphincters Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?