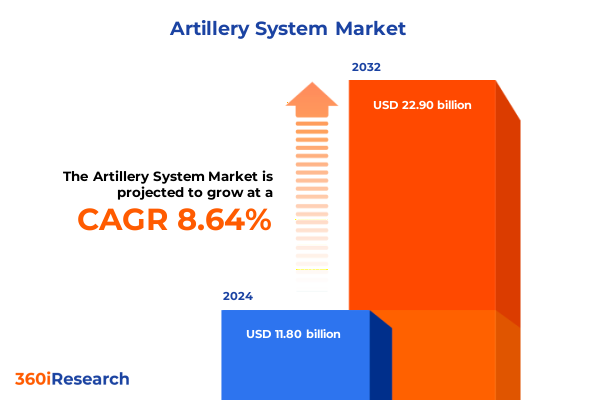

The Artillery System Market size was estimated at USD 12.60 billion in 2025 and expected to reach USD 13.47 billion in 2026, at a CAGR of 8.89% to reach USD 22.90 billion by 2032.

Unveiling Strategic Dynamics and Technological Drivers Redefining Artillery Systems in the Context of Modern Conflict and Defense Priorities

Artillery systems have long been a cornerstone of land warfare, delivering decisive firepower that shapes operational outcomes across the globe. The unprecedented intensity of artillery employment in recent conflicts, particularly in Ukraine, has underscored critical gaps in range, mobility, and precision that militaries must urgently address to maintain battlefield dominance. As the U.S. Army acknowledges pressing shortcomings and invests in next-generation howitzers like the Extended Range Cannon Artillery, defense stakeholders are accelerating innovation to meet evolving mission demands underpinned by modern logistics and strategic imperatives.

Amid this transformative era, the artillery landscape is further influenced by shifting geopolitical tensions, trade policy rigor, and rapid digitalization. Escalating tariffs have amplified production costs for key materials, while key emerging technologies-ranging from AI-driven fire control to autonomous platforms-are redefining traditional procurement paradigms. Against this backdrop, decision-makers must navigate a complex interplay of cost, capability, and regulatory pressures to craft resilient, high-impact artillery solutions for contemporary combat theaters.

Exploring the Paradigm Shifts in Artillery Warfare Driven by AI, Autonomous Platforms, Precision Munitions, and Emerging Battleground Demands

The artillery domain is witnessing a seismic shift as advanced digital and AI-enabled capabilities transition from concept to combat reality. Precision-guided munitions are rapidly becoming standard issue, with GPS- and laser-guided shells delivering first-round effects that were once unthinkable. Simultaneously, open-source development models for advanced 155mm rockets, pioneered by new market entrants, are challenging centuries-old procurement conventions and fostering a more agile innovation ecosystem.

Concurrently, survivability and mobility have emerged as critical demands in drone-dense battlefields. Artillery crews now operate under the constant threat of unmanned aerial surveillance and counter-battery fire, compelling forces to embrace rapid shoot-and-scoot tactics and invest in platform hardening. These operational adjustments reflect lessons learned in Eastern Europe, where dispersed fire units and swift logistical support have proven decisive in maintaining sustained operations under adversary pressure.

The pursuit of network-centric operations has also reshaped artillery doctrine, enabling real-time targeting and dynamic mission retasking through seamless integration with ISR assets and battlefield management systems. Germany’s recent surge in defense spending prioritizes battlefield AI and autonomous robotics, signaling a broader trend of merging traditional firepower with digital warfare capabilities to achieve unparalleled responsiveness and operational depth.

Assessing the Compounding Effects of Recent U.S. Tariff Policies on Artillery Production Costs, Supply Chains, and Defense Budgetary Pressures

U.S. trade policies enacted in recent years have significantly reshaped the cost structure of artillery production by imposing steep levies on steel, aluminum, and select imported materials. The doubling of tariffs on domestic steel and aluminum to 50 percent, coupled with additional 10 percent duties on strategic imports, has directly increased material costs and created new budgetary pressures for defense manufacturers and government contractors alike.

Major defense firms have already begun to internalize these increased expenses, with leading contractors projecting substantial profit impacts. RTX has disclosed an estimated $850 million reduction in its 2025 operating profit due to ongoing tariff exposure, while GE Aerospace anticipates approximately $500 million of additional costs. These combined headwinds, exceeding $1.3 billion, underscore the far-reaching influence of trade policy on defense industrial economics and program timelines.

The ripple effects extend beyond prime contractors to the broader industrial base, where small and mid-tier suppliers face compressed margins and heightened risk of attrition. In response, senior policymakers have raised concerns that tariffs could erode Defense Department purchasing power, constrict innovation pipelines, and hinder the readiness of critical artillery programs by driving up procurement costs without delivering new capabilities.

Despite these challenges, a renewed focus on near-shoring and domestic supply chain diversification offers potential long-term benefits. By incentivizing U.S.-based production of key alloys and precision components, policymakers aim to bolster strategic autonomy and mitigate future disruptions in a volatile geopolitics-driven trade environment.

Illuminating Segment-Specific Insights into Artillery System Types, Critical Components, Engagement Ranges, and Caliber Variations Shaping Market Dynamics

A nuanced understanding of market segmentation reveals distinct demand drivers across artillery system types, each with unique operational imperatives. Anti-aircraft artillery continues to evolve in response to increasingly sophisticated aerial threats, while traditional howitzer platforms are being modernized with extended barrel calibers and digital fire control. Mortar systems remain indispensable for rapid-response indirect fire support at shorter ranges, and rocket artillery offers strategic area-denial capabilities that complement tube-fired guns in high-intensity engagements.

Component-level innovation further delineates market dynamics as manufacturers focus on integrating advanced ammunition, robust auxiliary equipment, and next-generation chassis and engine solutions. Efforts to enhance accuracy and reduce logistical footprint have spurred development of intelligent fire control systems, while optimized gun turret architectures aim to improve crew protection and accelerate target acquisition cycles.

The pursuit of operational depth has heightened emphasis on engagement range, driving demand for systems capable of long-range precision engagement beyond 60 kilometers. At the same time, medium-range platforms covering 31 to 60 kilometers strike a balance between strategic reach and tactical flexibility, whereas short-range systems under 30 kilometers remain vital for dynamic frontline support and urban operations.

Caliber distinctions continue to shape platform design and mission profiles: large-caliber systems above 155mm deliver heavy firepower for deep-strike missions, medium-caliber platforms between 105mm and 155mm offer versatile multi-role capabilities, and small-caliber artillery under 105mm remain essential for mobile air defense and specialized direct-fire roles.

This comprehensive research report categorizes the Artillery System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- System Type

- Component

- Range

- Caliber

- End User

Differentiating Regional Dynamics Impacting Artillery Systems Adoption, Procurement Strategies, and Operational Requirements Across Global Defense Theaters

In the Americas, enduring commitments to force modernization and joint exercises underscore the strategic importance of artillery capabilities within U.S. and allied military doctrines. Collaborations between prime contractors and defense research agencies fuel continuous upgrades, while domestic procurement frameworks adapt to balance innovation with cost and industrial base considerations. Heightened defense budgets in North America reflect both deterrence priorities and efforts to revitalize heavy manufacturing through policy incentives.

Europe, the Middle East, and Africa display diverse procurement climates shaped by regional security challenges and alliance structures. European NATO members focus on interoperability and advanced networked fire support, investing in digital fire control and multi-domain integration. Concurrently, Middle Eastern nations pursue rapid capacity expansion through acquisitions of proven self-propelled howitzers, and select African states emphasize mobility and cost-effective solutions amid budgetary constraints.

Asia-Pacific defense authorities are prioritizing long-range precision strike and anti-access/area-denial capabilities to address regional flashpoints. Investments in extended-range artillery systems reflect strategic imperatives in contested maritime environments, while technology transfer agreements accelerate domestic production of advanced munitions. Multinational exercises increasingly incorporate live-fire demonstrations to validate emerging concepts in joint expeditionary operations.

This comprehensive research report examines key regions that drive the evolution of the Artillery System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Defense Contractors and Emerging Innovators at the Forefront of Artillery System Development, Partnerships, and Technological Advancements

Major defense contractors continue to spearhead artillery system innovation through extensive R&D and strategic partnerships. RTX leverages its overarching aerospace-defense portfolio to integrate advanced propulsion and materials science into next-generation howitzers, while GE Aerospace collaborates with ordnance specialists to optimize ammunition handling and engine performance under extreme conditions. Traditional systems integrators such as Lockheed Martin and BAE Systems focus on enhancing fire control architectures and network-enabled interoperability across multi-domain theaters.

Simultaneously, international players are reshaping competitive dynamics. Hanwha’s K9 Thunder series and its upgraded variants demonstrate South Korea’s ascendancy in self-propelled artillery, gaining traction through technology transfers and local production agreements. European manufacturers, including Rheinmetall and Nexter, are at the forefront of modular turret designs and automated loading systems, catering to diverse mission requirements.

Emerging innovators are also challenging the status quo. Tech entrepreneur-led ventures promote open-source artillery shells with software-style update cycles, democratizing access to advanced munitions designs while raising questions around quality control and supply chain security. Defense-AI startups are collaborating with established prime contractors to embed machine learning into fire control, ushering in an era of intelligent decision-support systems that enhance operational tempo and precision.

This comprehensive research report delivers an in-depth overview of the principal market players in the Artillery System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BAE Systems PLC

- Bharat Forge Limited

- China North Industries Corporation

- Denel SOC Ltd.

- Elbit Systems Ltd.

- General Dynamics Corporation

- Hanwha Corporation

- KNDS Deutschland GmbH & Co. KG

- Larsen & Toubro Limited

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Rheinmetall AG

- Rostec

- RTX Corporation

- RUAG MRO Holding Ltd.

- Singapore Technologies Engineering Ltd.

- Tata Advanced Systems Limited

- Thales Group

- The Japan Steel Works, LTD.

- Yugoimport SDPR J.P.

Guiding Industry Leaders with Practical Strategies to Navigate Technological, Supply Chain, and Regulatory Challenges in the Evolving Artillery Ecosystem

To thrive in this evolving environment, industry leaders must prioritize integration of digital and AI technologies from the outset of platform design. Establishing cross-sector collaborations and leveraging open architecture frameworks can accelerate delivery of precision-guided solutions while mitigating interoperability risks. Diversifying supply chains to incorporate resilient domestic and allied sources for critical materials will help buffer against tariff-induced cost surges and geopolitical disruptions.

Moreover, a modular, scalable approach to system upgrades enables incremental capability insertion that aligns with dynamic threat environments. Defense firms should engage early with procurement authorities to shape regulatory frameworks that support agile acquisition practices and facilitate rapid prototyping. Equally, meaningful investment in workforce upskilling-particularly in data analytics, AI, and advanced manufacturing-will ensure that personnel can effectively operate and sustain next-generation artillery systems.

Finally, embracing a mission-driven mindset that emphasizes lifecycle value over unit cost will foster more strategic decision-making. By adopting predictive maintenance and digital twin technologies, operators can optimize readiness and reduce total ownership expenses, thereby reinforcing long-term program viability and sustaining combat effectiveness.

Detailing Rigorous and Multi-Source Research Methodologies Employed to Ensure Accuracy, Relevance, and Insight Integrity in Artillery System Analysis

This analysis is grounded in a comprehensive research methodology combining primary and secondary intelligence. Primary insights were derived from structured interviews with defense procurement officials, program managers, and subject-matter experts across allied militaries. Secondary research incorporated a thorough review of open-source intelligence, including government whitepapers, defense trade press, and authoritative news outlets.

Quantitative data supporting component-level and range-based segmentation were validated through cross-referencing published contract awards, budget appropriations, and official procurement notices. Regional analyses leveraged defense expenditure databases and alliance communiqués to contextualize procurement drivers. Company profiles were constructed through examination of financial disclosures, R&D investment trends, and collaborative announcements.

Rigorous triangulation and expert peer review ensured the accuracy and relevance of all findings. This methodology provides a credible foundation for strategic decision-making, offering stakeholders a nuanced understanding of market dynamics and technology trajectories shaping the future of artillery systems.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Artillery System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Artillery System Market, by System Type

- Artillery System Market, by Component

- Artillery System Market, by Range

- Artillery System Market, by Caliber

- Artillery System Market, by End User

- Artillery System Market, by Region

- Artillery System Market, by Group

- Artillery System Market, by Country

- United States Artillery System Market

- China Artillery System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Key Findings on Technological Innovation, Tariff Implications, Market Segmentation, and Regional Variations in Artillery Systems

The convergence of AI, precision munitions, and modular design represents a fundamental shift in artillery capabilities that is reshaping operational doctrine worldwide. Concurrently, U.S. tariff policies have created immediate cost pressures that underscore the necessity of resilient domestic supply chains and strategic procurement partnerships. Segmentation by system type, component, range, and caliber reveals differentiated market drivers that require tailored approaches to design, acquisition, and sustainment.

Regional dynamics further highlight divergent priorities: deterrence and modernization in North America, interoperability and cost-efficient expansion across EMEA, and strategic reach in Asia-Pacific. Leading defense contractors and agile new entrants alike are responding through targeted R&D investments and innovative collaboration models. Industry leaders must adopt a holistic strategy that balances technological adoption, supply chain diversification, and procurement agility to sustain future combat readiness.

Through an integrated perspective encompassing technological, economic, and geopolitical factors, this executive summary equips stakeholders to anticipate emerging artillery system requirements and to make informed decisions that will define the next generation of land warfare capabilities.

Empowering Decision Makers to Access Comprehensive Artillery System Intelligence and Engage with Associate Director Ketan Rohom to Secure the Full Research Report

Unlock unparalleled insights into artillery system developments, technological trajectories, and strategic implications by partnering directly with Ketan Rohom, our Associate Director of Sales & Marketing. Engage with Ketan to discuss tailored research solutions, receive exclusive preview materials, and explore special advisory opportunities designed to address your organization’s unique challenges. By contacting him, you’ll gain expedited access to comprehensive proprietary data, customized analytical briefings, and priority support that empower actionable decision-making. Reach out today to secure your copy of the full artillery systems market research report and position your team at the forefront of defense innovation and competitive intelligence.

- How big is the Artillery System Market?

- What is the Artillery System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?