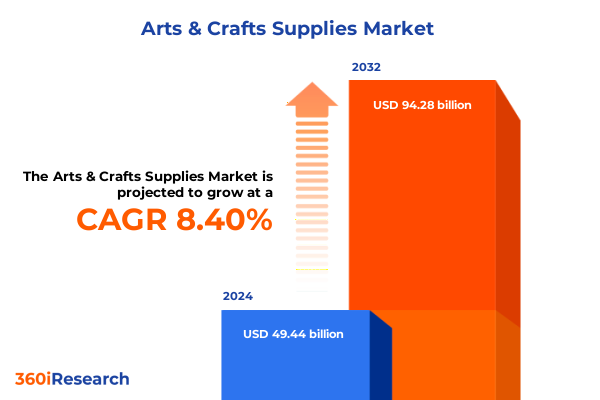

The Arts & Crafts Supplies Market size was estimated at USD 53.57 billion in 2025 and expected to reach USD 57.79 billion in 2026, at a CAGR of 8.41% to reach USD 94.28 billion by 2032.

Setting the Stage for a Thorough Exploration of the Dynamic Arts & Crafts Supplies Industry and Its Strategic Imperatives for Stakeholders

As the arts and crafts supplies sector continues to expand and diversify, understanding the underlying market dynamics has never been more critical for stakeholders seeking competitive advantage. Over recent years, the convergence of digital innovation, evolving consumer preferences, and heightened focus on sustainability has redefined how products are conceived, manufactured, and distributed. This introductory exploration sets the stage by outlining the key factors propelling market evolution, providing stakeholders with the context necessary to assess strategic imperatives.

At its core, the industry’s growth is anchored in a renewed enthusiasm for creative expression across demographic segments, from professional artisans to casual hobbyists. Concurrently, advances in manufacturing technologies-from precision tools to eco-friendly materials-have broadened the product spectrum and enabled agile, cost-efficient production models. Against this backdrop, the industry is witnessing intensified competition and an accelerated pace of product innovation, challenging established players while creating fertile ground for emerging entrants.

With this foundation established, subsequent sections will delve into the transformative shifts reshaping the competitive landscape, the ripple effects of regulatory and trade policy changes, and the critical segmentation and regional insights that inform sound decision-making. By synthesizing these elements, stakeholders can forge robust strategies to navigate uncertainties and harness opportunities inherent in the arts and crafts supplies market.

Examining the Pivotal Transformations Reshaping Arts & Crafts Supplies Through Technological Innovation and Consumer Behavior Shifts

In recent years, technological breakthroughs and shifting consumer behaviors have fundamentally altered the paradigm of arts and crafts supplies. The proliferation of digital platforms has democratized access to inspiration and instruction, fostering vibrant online communities where novices and experts alike converge. E-commerce channels now serve as primary touchpoints for product discovery and purchase, challenging traditional brick-and-mortar outlets to innovate or collaborate digitally. This digital acceleration has not only expanded market reach but also generated rich data streams, enabling manufacturers and retailers to tailor offerings with unprecedented precision.

Simultaneously, sustainability has emerged as a non-negotiable tenet guiding product development and brand positioning. Consumers increasingly prioritize natural and recycled materials, compelling suppliers to source responsibly and minimize environmental impact. As a result, manufacturers are expanding portfolios to include plant-based fibers, recycled fabrics, and biodegradable polymers, underscoring a broader industry commitment to circularity.

These converging forces-digital transformation, data-driven personalization, and sustainability-are collectively redefining value creation in the sector. Stakeholders must therefore adapt their business models to accommodate agile supply chains, transparent sourcing practices, and omnichannel engagement strategies. The next section will examine how recent tariff policies have further influenced these dynamics, highlighting the importance of regulatory agility in maintaining resilience and competitiveness.

Unraveling the Combined Impact of Recent United States Tariff Implementations on Arts & Crafts Supply Chains and Trade Dynamics in 2025

The implementation of new tariffs by the United States in 2025 has had far-reaching ramifications for the arts and crafts supplies market, particularly in categories heavily reliant on imported inputs. Tariffs on adhesives, specialty papers, and precision tools have increased input costs, prompting manufacturers to reassess sourcing strategies and explore domestic production alternatives. This shift has accelerated initiatives to qualify local suppliers, streamline logistics, and invest in automation to offset tariff-induced cost pressures.

Import-dependent channels have responded by diversifying vendor partnerships, with some distributors forming strategic alliances with manufacturers in tariff-exempt regions to maintain margin stability. Concurrently, a subset of suppliers has introduced value-engineered product lines, balancing cost and quality to retain price-sensitive end users. This adaptive approach underscores the sector’s resilience, as well as the critical role of tariff planning in supply chain management.

Despite these challenges, the recalibration of trade flows has generated opportunities for domestic manufacturers to capture incremental market share. Government incentives and accelerated approval processes for local production facilities have further bolstered this trend, positioning the United States as a more self-reliant player in certain arts and crafts segments. The interplay between tariffs, sourcing strategies, and regulatory support will remain a defining feature of the market’s competitive dynamics.

Unearthing Actionable Segmentation Insights That Illuminate Consumer Preferences and Supply Chain Nuances Across Products Materials Channels and Users

Diving into market segmentation reveals nuanced opportunities and challenges that vary by product categories, materials, distribution models, and end-use applications. In product type analysis, adhesives and glues remain foundational for both casual enthusiasts and professional artists, with growth driven by innovations in eco-friendly formulations and ease-of-use packaging. Art kits have surged in popularity among educational institutions and hobbyists seeking curated creative experiences, while fabric and needlecraft segments continue to attract a loyal base through the integration of sustainable textiles and DIY personalization options. The paints category benefits from technological advances in low-VOC and water-based formulations, delivering performance with reduced environmental impact. Paper and canvas, spanning canvas boards, drawing paper, paper rolls, and specialty paper, have experienced heightened demand from digital content creators and mixed-media artists alike. Tools and accessories-including brushes, cutting tools, precision instruments, and writing implements-are increasingly distinguished by ergonomic design and material innovation.

Material-wise, natural substrates such as metal components, plant fibers, and wood align with consumer sustainability priorities, while recycled inputs like fabric and paper underpin circularity efforts. Synthetic materials, particularly acrylics and engineered plastics, maintain relevance through durability and cost efficiency. Regarding distribution, offline channels are reinventing customer experiences via experiential retail and in-store workshops to complement the convenience of online platforms, which offer expansive product assortments, rapid fulfillment, and subscription-based models. Finally, end-user segments-spanning corporate and commercial buyers, educational institutions, hobbyists, and professional artists-exhibit distinct purchasing behaviors and value drivers. Educational buyers prioritize safety certifications and bulk pricing, while professionals demand premium-grade performance and customization. By aligning product development and go-to-market strategies with these segment-specific criteria, industry participants can optimize engagement and foster sustained loyalty.

This comprehensive research report categorizes the Arts & Crafts Supplies market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Distribution Channel

- End User

Highlighting Regional Market Nuances and Growth Drivers Across the Americas Europe Middle East Africa and Asia-Pacific in the Arts & Crafts Supplies Sector

Regional dynamics in the arts and crafts supplies sector reflect differing economic conditions, cultural preferences, and policy environments. In the Americas, a robust network of independent retailers and specialty chains coexists with a maturing e-commerce ecosystem. North American consumers exhibit strong interest in natural and recycled materials, driving manufacturers to localize sustainable sourcing initiatives. Latin American markets, while price-sensitive, present growth potential through expanding urban middle classes and rising digital connectivity, which enable cross-border online access to global brands.

Across Europe, the Middle East, and Africa, the landscape is characterized by fragmentation and regulatory diversity. Western European markets are notable for stringent environmental standards and high consumer awareness of product provenance, encouraging premium eco-friendly offerings. Meanwhile, Middle Eastern hubs leverage free-trade zones and infrastructure investments to serve regional distribution, and African markets are gradually integrating global e-commerce platforms as internet penetration deepens.

In the Asia-Pacific region, a blend of mature and emerging economies drives innovation and competitive intensity. Established markets in Japan and Australia prioritize quality and brand heritage, while Southeast Asian countries exhibit dynamic growth fueled by rising disposable incomes and digital adoption. Manufacturers and distributors targeting Asia-Pacific must navigate complex tariff regimes, cultural nuances, and rapidly shifting consumer trends to capitalize on this heterogeneous landscape.

This comprehensive research report examines key regions that drive the evolution of the Arts & Crafts Supplies market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Competitive Landscapes and Innovative Strategies of Leading Arts & Crafts Supplies Companies Driving Market Evolution and Differentiation

Leading companies in the arts and crafts supplies industry are deploying a range of strategic initiatives to secure competitive advantage. Several global manufacturers are intensifying research and development investments to pioneer eco-conscious formulations and materials, ensuring alignment with accelerating sustainability mandates. Strategic partnerships between material innovators and artisan collectives have emerged to bolster supply chain transparency and foster community engagement, reflecting a broader shift toward socially responsible business practices.

E-commerce specialists are differentiating through platform enhancements that deliver immersive digital experiences, such as augmented reality product previews and AI-driven recommendation engines. Meanwhile, established brick-and-mortar retailers are transforming physical spaces into community hubs, leveraging experiential programming like live demonstrations and maker events to deepen customer engagement.

On the consolidation front, merger and acquisition activity has increased, with larger players acquiring niche brands to expand category breadth and absorb unique intellectual property. These transactions are complemented by strategic investments in localized production capabilities, enabling agile responses to regional demand fluctuations and tariff environments. Collectively, these competitive maneuvers underscore an industry in the midst of redefinition, where innovation, agility, and customer-centricity drive market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Arts & Crafts Supplies market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arteza LLC

- Blick Art Materials

- Colart International S.A.

- Crayola LLC

- Cricut Inc

- Etsy Inc

- Fabbrica Italiana Lapis ed Affini S.p.A.

- Faber-Castell AG

- Fiskars Group

- Hobby Lobby Stores Inc

- IG Design Group PLC

- Jo-Ann Stores LLC

- Kokuyo Camlin Ltd

- Mundial S.A.

- Newell Brands Inc

- Pelikan International Corporation

- Pentel Co Ltd

- Royal Talens B.V.

- Sakura Color Products Corporation

- Sargent Art LLC

- Shanghai M&G Stationery

- Société Bic S.A.

- Staedtler Mars GmbH & Co. KG

- The Michaels Companies Inc

Delivering Strategic Recommendations for Industry Leaders to Capitalize on Emerging Trends Strengthen Resilience and Enhance Operational Excellence

To navigate the complex and fast-evolving arts and crafts supplies market, industry leaders should adopt a multifaceted strategic approach. First, embedding sustainability into core product pipelines by prioritizing natural and recycled materials will not only meet consumer expectations but also mitigate supply chain disruptions associated with regulatory changes. Second, cultivating omnichannel ecosystems that integrate seamless online ordering, subscription-based offerings, and experiential offline engagements will capture value across diverse consumer segments.

Third, diversifying supplier networks to include both domestic and tariff-exempt international partners enhances resilience against trade policy shifts and logistics bottlenecks. Fourth, leveraging data analytics platforms can uncover granular insights into purchasing patterns, enabling hyper-personalized marketing campaigns and dynamic inventory management. Fifth, forging collaborative partnerships with educational institutions, artist collectives, and influencer networks can amplify brand authenticity and accelerate product adoption.

By instituting these recommendations, companies can strengthen operational agility, foster deeper customer relationships, and secure sustained competitive advantage. Continuous monitoring of regulatory developments, consumer trends, and technological innovations will ensure that strategic plans remain aligned with market realities and emerging opportunities.

Detailing Rigorous Research Methodologies Employed to Ensure Credibility Reliability and Comprehensive Coverage in Arts & Crafts Supplies Market Analysis

This analysis leverages a rigorous, multi-pronged research methodology designed to ensure the accuracy, reliability, and comprehensiveness of findings. Primary research components include in-depth interviews with senior executives from manufacturing, distribution, and retail organizations, as well as surveys of end users spanning hobbyists, professionals, educators, and corporate buyers. These direct interactions provide nuanced perspectives on market pain points, innovation drivers, and buying behaviors.

Secondary research sources encompass trade publications, industry white papers, regulatory filings, and academic studies, which collectively establish a foundational understanding of historical trends and contextualize emerging developments. Data triangulation techniques reconcile insights from these diverse sources, while quantitative analyses of import-export statistics, tariff schedules, and corporate financial reports underpin key observations.

Analytical frameworks such as SWOT and Porter’s Five Forces are applied to evaluate competitive intensity, supply chain dynamics, and strategic positioning. Throughout the research process, stringent quality checks, peer reviews, and proprietary validation protocols are employed to safeguard objectivity and ensure that conclusions reflect the most current and actionable intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Arts & Crafts Supplies market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Arts & Crafts Supplies Market, by Product Type

- Arts & Crafts Supplies Market, by Material

- Arts & Crafts Supplies Market, by Distribution Channel

- Arts & Crafts Supplies Market, by End User

- Arts & Crafts Supplies Market, by Region

- Arts & Crafts Supplies Market, by Group

- Arts & Crafts Supplies Market, by Country

- United States Arts & Crafts Supplies Market

- China Arts & Crafts Supplies Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Drawing Comprehensive Conclusions That Synthesize Key Findings and Emphasize Strategic Imperatives for Stakeholders in the Arts & Crafts Supplies Landscape

In synthesizing the insights from market transformations, tariff impacts, segmentation intricacies, regional dynamics, and competitive strategies, several overarching themes emerge. The accelerating digitalization of the industry is reshaping how products are developed, marketed, and consumed, necessitating agile omnichannel capabilities. Sustainability has transitioned from a niche preference to a core driver of innovation, influencing material selection, manufacturing processes, and brand positioning.

Furthermore, the 2025 tariff adjustments underscore the critical importance of supply chain diversification and regulatory foresight. Companies that strategically rebalance their sourcing and manufacturing footprints have been able to protect margins while capturing new market share. Segmentation analysis highlights distinct value drivers across product types, materials, channels, and end users, offering a roadmap for tailored offerings and marketing precision. Regional insights reveal a mosaic of growth opportunities, each requiring localized approaches to pricing, distribution, and customer engagement.

Collectively, these findings reinforce the imperative for industry stakeholders to adopt integrated strategies that fuse sustainability, digital innovation, and supply chain resilience. By doing so, they can navigate ongoing uncertainties and capitalize on new avenues for differentiation and growth within the arts and crafts supplies market.

Engaging Directly with Ketan Rohom to Secure This Definitive Market Research Report and Propel Strategic Decision-Making in Arts & Crafts Supplies

To secure a comprehensive roadmap that navigates the complexities of evolving supply chains, fluctuating trade policies, and emerging consumer demands, stakeholders are encouraged to connect directly with Ketan Rohom, the Associate Director of Sales & Marketing at our firm. Ketan combines in-depth market intelligence with a consultative approach, ensuring each engagement addresses specific organizational challenges and growth objectives. Whether you seek tailored insights on segmentation strategies, tariff impacts, or regional growth drivers, Ketan’s expertise streamlines decision-making and aligns research outputs with your strategic goals.

Reach out to Ketan Rohom to schedule a personalized briefing, explore customized research packages, or gain immediate access to executive summaries and data modules. His consultative support extends from pre-purchase inquiry through post-purchase implementation, guaranteeing that your investment delivers actionable intelligence and measurable ROI. By partnering with Ketan, you’ll derive maximum value from the report’s findings, leveraging them to optimize product portfolios, refine distribution models, and future-proof your operations in the dynamic arts & crafts supplies market.

Don’t let strategic opportunities slip away-initiate the conversation today and position your organization at the forefront of industry innovation and resilience. Your next growth catalyst awaits.

- How big is the Arts & Crafts Supplies Market?

- What is the Arts & Crafts Supplies Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?