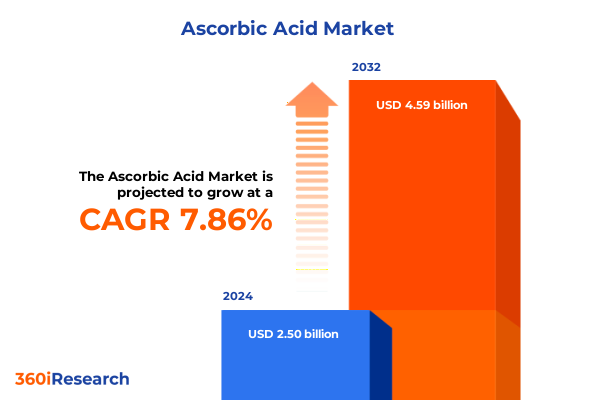

The Ascorbic Acid Market size was estimated at USD 2.70 billion in 2025 and expected to reach USD 2.88 billion in 2026, at a CAGR of 7.84% to reach USD 4.59 billion by 2032.

Setting the Stage for Ascorbic Acid Market Examination with Contextual Framing of Key Drivers and Emerging Functions Affecting Stakeholders

Ascorbic acid, commonly known as vitamin C, stands at the intersection of science and commerce as a versatile nutrient valued for its potent antioxidant properties and broad applicability across industries. At the molecular level, it functions as a free radical scavenger, safeguarding cellular components by donating electrons to neutralize reactive oxygen species, and it often regenerates other antioxidants such as tocopherol to maintain redox balance in biological systems. In parallel, its biochemical roles extend to serving as a cofactor for hydroxylase enzymes involved in collagen biosynthesis and neurotransmitter production, underscoring its indispensability in tissue repair, skin health, and neurological function.

Amidst this foundational understanding, the contemporary landscape for ascorbic acid has evolved significantly. The ingredient’s reputation as an immune system supporter and anti-aging agent has fueled a surge in R&D initiatives aimed at enhancing its stability, bioavailability, and integration into novel product formats. Driven by consumer interest in scientifically backed, multifunctional ingredients, formulators are incorporating ascorbic acid into everything from topical serums to fortified beverages and nutraceutical capsules. This broadening horizon has positioned vitamin C as a linchpin in product innovation, bridging the gap between health and beauty, and prompting stakeholders to reassess supply chains, raw material sourcing, and regulatory pathways.

Transitioning from its clinical and biochemical roots, the commercial journey of ascorbic acid exemplifies how a well-established nutrient can be revitalized through technological advancements and shifting market demands. This introduction frames our analysis by highlighting the core biochemical fundamentals, emerging formulation breakthroughs, and evolving stakeholder priorities that set the stage for a deeper exploration of market dynamics and strategic opportunities.

Mapping the Evolutionary Trajectory of the Ascorbic Acid Domain through Technological Breakthroughs Shifting Production and Consumption Patterns Globally

The ascorbic acid sector has undergone several transformative shifts in recent years, driven by both scientific breakthroughs and strategic imperatives. A critical development has been the advent of next-generation vitamin C derivatives, such as ethyl ascorbic acid and tetrahexyldecyl ascorbate, which offer enhanced stability, deeper skin penetration, and reduced irritation compared to traditional ascorbic acid. These innovations reflect the industry’s commitment to solving longstanding technical challenges and responding to consumer demands for potent yet skin-friendly actives.

Concurrently, the emphasis on clean beauty and green chemistry has reshaped ingredient selection and product development philosophies. The push for sustainable and renewable sources extends beyond natural labeling, encompassing principles of upcycling and biodegradability that minimize environmental footprints. In this context, biotechnologically derived vitamin C and lab-grown analogues are gaining traction, combining the purity and consistency of fermentation processes with the ethos of ethical sourcing. Environmental regulations, such as microplastics bans and expanded waste reduction mandates, have further catalyzed formulation shifts toward waterless and concentrated formats, positioning ascorbic acid as a critical building block in high-efficacy, low-waste systems.

These technological and sustainability-driven currents are accompanied by evolving consumer preferences that prize transparency and multifunctionality. The fusion of vitamin C with complementary actives like hyaluronic acid and niacinamide exemplifies effective ingredient synergy, enhancing efficacy while streamlining routines. Meanwhile, hybrid beauty products that integrate skincare benefits into makeup and body care formats illustrate how ascorbic acid is being repurposed to meet demands for simplicity and performance. Together, these transformative shifts underscore an industry in flux, where scientific ingenuity, sustainability considerations, and consumer-centric design converge to redefine the future of ascorbic acid applications.

Evaluating the Layered Consequences of Recent United States Tariff Adjustments on Ascorbic Acid Supply Chains and Cost Structures in 2025

In early 2025, sweeping U.S. tariff measures introduced broad-based duties on chemical imports, prompting concerns across multiple sectors, including food and beverages and specialty chemicals. Notably, the administration’s Annex II exemptions specifically excluded essential vitamins, among them vitamin C (ascorbic acid), ensuring that this critical dietary ingredient would not be subject to the newly imposed duties. This exemption has insulated ascorbic acid supply chains from direct cost escalations associated with the tariff package.

However, the ripple effects of these trade policies extend beyond exempted ingredients. Tariffs on adjacent inputs such as citric acid, xanthan gum, and artificial sweeteners have elevated production costs for manufacturers who integrate ascorbic acid into complex formulations. Food and beverage producers, for example, have experienced a 20–30% increase in input expenses for non-exempt additives sourced predominantly from China, leading to revised pricing strategies and a renewed focus on supplier diversification. Simultaneously, chemical distributors have flagged rising operational costs, with the Alliance for Chemical Distribution projecting annual cost escalations that could approach $1.25 billion in the broader sector if mitigation measures remain elusive.

Amid these dynamics, manufacturers are realigning procurement strategies, seeking alternative origins such as India, Brazil, and select European suppliers to balance cost, quality, and regulatory compliance. While ascorbic acid itself remains tariff-exempt, the surrounding ecosystem of ingredients and materials has compelled industry participants to refine their supply chain risk management, invest in local or nearshore partnerships, and accelerate reformulation programs to maintain uninterrupted production and profitability.

Unveiling Critical Segmentation Perspectives That Highlight Applications Forms Grades and Sources to Illuminate Strategic Opportunities in the Ascorbic Acid Market

A nuanced understanding of ascorbic acid’s market segmentation reveals distinct patterns of demand and opportunity. Based on application classifications, Animal Nutrition leverages vitamin C as an immunity booster and stress reducer in feed formulations, while Nutrition & Personal Care exploits its antioxidant function to combat environmental damage and signs of aging. In Food & Beverage, ascorbic acid serves both as a preservative and nutritional fortifier, complementing its recognized health benefits in dietary supplements within the Nutraceutical segment and its role in pharmaceutical formulations where dosage precision and purity are paramount.

Form-driven preferences further refine market positioning. Capsule presentations dominate nutraceutical and pharmaceutical spheres due to precise dosing, whereas serums and creams fortified with liquid or powdered ascorbic acid variants prevail in skincare applications for rapid absorption and targeted delivery. The tablet remains a mainstay format in mainstream dietary supplements, prized for its convenience and cost-effectiveness, while emerging liquid formats enable innovation in beverages and injectable therapeutic products.

Grade distinctions signal critical quality benchmarks: Cosmetic-grade ascorbic acid emphasizes cosmetic stability and compatibility with complex formulations, Food-grade aligns with regulatory norms for ingestion and preservation functions, and Pharmaceutical-grade underscores rigorous purity standards and tight impurity controls. Finally, the dichotomy of sourcing-Natural versus Synthetic-captures the tension between authenticity and scalability. Natural extracts, such as acerola cherry and camu camu derived vitamin C, fulfill premium positioning and clean-label narratives, whereas synthetic ascorbic acid underpins reliable supply and cost-efficient production, making it a staple in high-volume applications.

This comprehensive research report categorizes the Ascorbic Acid market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Grade

- Source

- Application

Illuminating Regional Dynamics and Distinctive Trends across the Americas Europe Middle East Africa and Asia Pacific Driving Ascorbic Acid Market Diversification

Regional dynamics in the ascorbic acid industry reveal divergent growth drivers and strategic imperatives. In the Americas, robust demand from the dietary supplement and food preservation sectors is complemented by rising interest in clean beauty innovations, propelling manufacturers to strengthen North American manufacturing footprints and secure upstream feedstocks. Regulatory harmonization between the United States and Canada on ingredient standards has also fostered a more streamlined environment for dual‐market launches.

Transitioning to the Europe, Middle East & Africa region, stringent environmental directives and consumer preference for sustainably sourced ingredients are reshaping supply chains. European Union restrictions on microplastics and non‐biodegradable packaging have accelerated the adoption of concentrated formulations and waterless delivery systems. Meanwhile, Middle Eastern markets are witnessing increased investment in nutraceutical facilities, buoyed by government initiatives to diversify economies beyond hydrocarbons, and African markets are emerging as both growth frontiers and alternative sourcing hubs for natural vitamin C derivatives.

In Asia-Pacific, the confluence of large-scale pharmaceutical manufacturing, expanding animal nutrition operations, and a burgeoning middle class demanding premium skincare has created a multifaceted landscape. China’s established production capacity for synthetic ascorbic acid continues to dominate global exports, while India’s investments in biotechnology and fermentation technologies are progressively augmenting its competitive standing. Across the region, public-private collaborations and localized R&D centers are accelerating product innovation, making the Asia-Pacific an essential focal point for strategic partnerships and market expansion.

This comprehensive research report examines key regions that drive the evolution of the Ascorbic Acid market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Stakeholders Showcasing Their Strategic Initiatives Innovations and Competitive Positioning Shaping the Global Ascorbic Acid Ecosystem

The competitive battleground within the ascorbic acid domain is defined by companies that excel in supply chain integration, R&D agility, and regulatory acumen. Global chemical leaders have leveraged economies of scale to sustain low‐cost production of synthetic ascorbic acid, while specialized extract producers have carved out premium niches with organic certification and traceability guarantees. Biotechnology firms, focusing on fermentation-based production, are emerging as disruptive contenders by offering nature-identical vitamin C with a reduced environmental footprint.

Strategic collaborations and joint ventures between ingredient suppliers and consumer brands are also reshaping the value chain. Formulation houses that co‐develop proprietary stabilized vitamin C derivatives with ingredient manufacturers are accelerating time‐to‐market for differentiated serums and nutraceutical blends. Simultaneously, contract manufacturers with end‐to‐end capabilities are attracting partnerships by facilitating rapid scale‐up, regulatory support, and co-innovation labs that cater to customized product pipelines.

Meanwhile, a subset of agile mid‐sized enterprises is leveraging digital platforms and data-driven market intelligence to target underserved segments, such as sport nutrition and medical-grade vitamin C formulations. These participants often outperform larger incumbents in responsiveness and niche expertise, underscoring the importance of strategic focus and operational flexibility in driving sustainable growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ascorbic Acid market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anhui Tiger Biotech Co., Ltd.

- Bactolac Pharmaceutical Inc.

- BASF SE

- DSM-Firmenich AG

- Gadot Biochemical Industries Ltd.

- Glanbia plc

- Hayashibara Co., Ltd.

- Kemin Industries Inc.

- Lycored Ltd.

- Novozymes A/S

- Piramal Pharma Solutions

- Roche Holding AG

- Sanofi S.A.

- Showa Denko K.K.

- Vertellus Holdings LLC

Defining Actionable Strategic Approaches for Industry Leaders to Capitalize on Emerging Opportunities and Strengthen Agility in the Ascorbic Acid Landscape

Industry leaders are well-positioned to capitalize on the evolving ascorbic acid landscape by adopting several strategic imperatives. Investing in the development of stabilized and derivative forms can address formulation challenges and expand the ingredient’s applicability in demanding matrices, thereby differentiating product portfolios and capturing premium pricing.

Equally critical is the pursuit of sustainable sourcing and manufacturing practices. Companies should evaluate the feasibility of integrating biotechnology pathways to produce nature-identical vitamin C, reducing environmental footprints and aligning with regulatory trends toward green chemistry. Concurrently, transparent supplier traceability systems can bolster brand trust and support compliance with evolving clean-label standards.

Supply chain diversification is another cornerstone of resilience. While synthetic ascorbic acid remains exempt from current U.S. tariffs, the volatility of associated inputs and geopolitical uncertainties necessitates proactive identification of alternative raw material origins and strategic stockpiling to mitigate potential disruptions. Leveraging advanced market intelligence and predictive analytics will enable leaders to anticipate policy shifts, optimize procurement decisions, and maintain continuity of production.

Finally, fostering collaborative partnerships between ingredient innovators, formulating experts, and key end-user segments can accelerate co‐innovation and reduce time‐to‐market for novel formulations. By aligning incentives across the value chain, industry participants can collectively drive adoption of next-generation vitamin C solutions while sharing R&D risks and rewards.

Outlining Robust Multimethod Research Design Combining Primary Expert Engagement and Comprehensive Secondary Analysis to Underpin Ascorbic Acid Market Insights

This analysis synthesizes insights derived from an integrated research methodology combining primary and secondary sources. Primary engagements included in-depth interviews with key executives, R&D scientists, and supply chain managers across leading ingredient suppliers, formulators, and end-user segments to capture firsthand perspectives on technological advancements, sourcing strategies, and regulatory impacts.

Complementing these qualitative insights, exhaustive secondary research encompassed reviewing peer-reviewed literature on ascorbic acid chemistry and applications, industry white papers on formulation trends, and trade publications covering tariff developments and supply chain dynamics. Regulatory and patent databases were systematically examined to track emerging derivative technologies and intellectual property landscapes.

Additionally, market intelligence platforms provided real-time tracking of trade flows, import-export data, and pricing indices to contextualize the effects of U.S. tariff adjustments and regional demand variations. The triangulation of these data streams enabled a robust, multidimensional view of the ascorbic acid ecosystem, ensuring the analysis is grounded in both empirical evidence and strategic foresight.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ascorbic Acid market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ascorbic Acid Market, by Form

- Ascorbic Acid Market, by Grade

- Ascorbic Acid Market, by Source

- Ascorbic Acid Market, by Application

- Ascorbic Acid Market, by Region

- Ascorbic Acid Market, by Group

- Ascorbic Acid Market, by Country

- United States Ascorbic Acid Market

- China Ascorbic Acid Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Drawing Conclusive Perspectives on Strategic Imperatives Learned from Ascorbic Acid Market Dynamics to Guide Future Innovations and Collaborative Ventures

Through our exploration of biochemical fundamentals, technological innovations, tariff impacts, segmentation dynamics, regional variations, and competitive positioning, several strategic imperatives emerge. First, the convergence of clean chemistry and consumer demand for multifunctional ingredients necessitates continued investment in next-generation ascorbic acid derivatives that deliver enhanced stability and bioavailability.

Second, the exemption of vitamin C from broad-based U.S. tariffs highlights the importance of proactive policy monitoring, yet adjacent input cost pressures underscore the need for diversified supply arrangements and agile procurement strategies. Third, regional nuances-from sustainability mandates in Europe to manufacturing expansions in Asia-Pacific-require tailored go-to-market approaches that align with local regulatory frameworks and consumer preferences.

Finally, success in this dynamic landscape hinges on collaborative innovation models that unite ingredient pioneers, formulators, and end-user brands in shared R&D ventures. By leveraging data-driven insights and cross-functional expertise, stakeholders can accelerate product development, optimize resource allocation, and secure competitive advantage in the rapidly evolving ascorbic acid arena.

Seize Direct Access Now to Comprehensive Ascorbic Acid Market Intelligence through a Personalized Consultation with Ketan Rohom to Accelerate Strategic Growth

For tailored guidance on harnessing the latest developments in ascorbic acid research and strategy, connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to secure your organization’s competitive edge with a customized market intelligence consultation.

- How big is the Ascorbic Acid Market?

- What is the Ascorbic Acid Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?