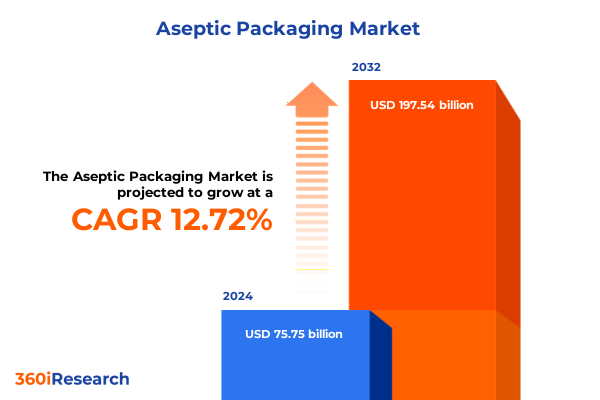

The Aseptic Packaging Market size was estimated at USD 85.03 billion in 2025 and expected to reach USD 95.46 billion in 2026, at a CAGR of 12.79% to reach USD 197.54 billion by 2032.

Unveiling the Strategic Foundations of Aseptic Packaging: Contextualizing Industry Drivers, Market Evolution, and Stakeholder Imperatives for Informed Decision-Making

The aseptic packaging sector has emerged as a critical nexus between rigorous product integrity and consumer demands for freshness, safety, and sustainability. This summary opens by situating the industry within broader shifts in production paradigms, regulatory environments, and consumer expectations that have collectively elevated aseptic solutions from niche applications to mainstream adoption across multiple end markets.

Within this context, decision-makers require a clear understanding of the foundational drivers-from technological breakthroughs in sterilization processes to the growing premium placed on sustainable packaging materials. As global supply chains navigate complex trade dynamics and heightened quality standards, the ability to preemptively adapt to change becomes indispensable. This introduction sets the stage for a deeper exploration of the landscape, emphasizing the strategic value of comprehensive insights that bridge high-level trends with granular segment analyses.

Examining Paradigm-Altering Shifts Shaping the Aseptic Packaging Sphere: From Digital Integration to Sustainability Imperatives and Consumer-Driven Innovations

Recent years have witnessed a confluence of forces reshaping the aseptic packaging arena in unprecedented ways. Digital integration has ushered in smart packaging solutions that enable real-time monitoring of sterility parameters, thereby enhancing transparency and mitigating risk. Concurrently, intensifying environmental scrutiny has accelerated the shift toward recyclable materials and energy-efficient filling technologies, prompting established players and new entrants alike to reimagine product lifecycles through the lens of circularity.

Furthermore, consumer preferences are no longer confined to price and convenience; they extend to ethical sourcing, traceability, and the ability to minimize packaging waste. This demand has inspired innovative collaborations between material scientists, equipment manufacturers, and brand owners, paving the way for composite structures that balance barrier performance with recyclability. Regulatory developments continue to reinforce these trends by setting stricter guidelines around sterilization validation and post-consumer material recovery, fostering an environment where agility and cross-industry partnerships become pivotal for sustained growth.

Understanding the Far-Reaching Effects of New United States Tariffs on the Aseptic Packaging Ecosystem and Their Strategic Implications for Supply Chains

The introduction of new tariff measures by the United States in 2025 has reverberated across the aseptic packaging ecosystem, impacting raw material imports and equipment sourcing strategies. Facing increased duties on select imports, manufacturers have had to reassess supplier contracts and explore alternative routes for securing components at competitive price points. These adjustments have, in turn, spurred a wave of nearshoring initiatives that aim to reduce reliance on higher-cost import channels while preserving the stringent quality standards inherent to aseptic production.

In parallel, equipment providers serving this space have responded by strengthening local manufacturing footprints, facilitating service networks closer to end users, and redesigning sterile filling lines with modular configurations that accommodate shifting trade parameters. The cumulative effect has been a more diversified supply chain landscape, where resilience is cultivated through geographical flexibility and cross-border collaboration. As stakeholders navigate the evolving tariff environment, strategic sourcing decisions are increasingly informed by a dual focus on cost optimization and regulatory compliance.

Decoding Segment Dynamics Driving Aseptic Packaging Evolution Across Applications, Technologies, Materials, Product Varieties, End Users, and Distribution Models

A nuanced view of the segment landscape reveals that aseptic packaging intersects with a diverse array of applications, technologies, materials, and channels that each exhibit unique dynamics. In beverages, dairy products, fruit juices, and water benefit from stringent sterilization processes that safeguard freshness, while liquid and semi-solid food items leverage customized form-fill-seal configurations to maintain product integrity without relying on preservatives. Personal care formulations and pharmaceutical injectables, on the other hand, demand high-purity materials and specialized blow-fill-seal equipment to uphold sterility standards.

At the technological level, equipment offerings range from high-speed form-fill-seal machines optimized for flexible pouches to blow-fill-seal systems that integrate dispensing and sealing in a single step. Material innovation continues to be a critical focus, with aluminum and glass maintaining strong barrier properties, paperboard emerging as a sustainable alternative, and plastics-particularly HDPE, PET, and PP-remaining prized for their lightweight versatility. Product formats such as bottles, jars, cartons, cups, trays, and pouches each present distinct fill line requirements, while end users spanning cosmetics, food and beverages, and healthcare sectors prioritize different performance attributes. Finally, distribution networks extend from modern trade environments, including convenience stores, departmental outlets, and hypermarkets, to online platforms and traditional trade channels served by local retailers and wholesalers, underscoring the importance of tailored packaging solutions that align with channel-specific logistics and consumer purchasing behaviors.

This comprehensive research report categorizes the Aseptic Packaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Material

- Application

- End User

- Distribution Channel

Exploring Distinct Regional Landscapes Shaping Aseptic Packaging Developments in the Americas, Europe Middle East Africa, and Asia-Pacific Market Dynamics

Regional distinctions in demand, regulation, and investment are central to understanding where growth opportunities lie within the global aseptic packaging landscape. In the Americas, stakeholders benefit from mature supply chains and a strong emphasis on sustainability initiatives, which have fostered the adoption of recyclable materials and energy-efficient filling lines. This environment supports innovation in convenience-driven formats, enabling brands to differentiate through on-the-go solutions.

Across Europe, the Middle East, and Africa, stringent regulatory frameworks and a growing focus on circular economy principles shape material selection and process validation practices. European markets, in particular, drive premiumization, with an emphasis on high-barrier packaging for sensitive products, while emerging markets in the Middle East and Africa present opportunities for capacity expansion as healthcare infrastructure and consumer disposable incomes rise.

In Asia-Pacific, rapid industrialization and rising consumption rates have fueled demand for high-speed aseptic filling solutions, particularly in densely populated urban centers. Investments in local manufacturing capabilities and partnerships with global equipment providers have accelerated technology transfer, enabling regional brands to compete on quality and cost efficiency. These geographical insights illuminate the strategic imperatives for tailoring product and service offerings to diverse market conditions.

This comprehensive research report examines key regions that drive the evolution of the Aseptic Packaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Strategic Moves and Competitive Postures of Leading Enterprises Steering the Aseptic Packaging Sector Toward Innovation and Sustainability

Leading enterprises in the aseptic packaging arena continue to differentiate through a blend of technological prowess, strategic alliances, and sustainability commitments. Equipment manufacturers have pursued joint ventures with material scientists to integrate bio-based polymers within existing fill lines, while service providers have expanded remote monitoring capabilities to ensure real-time process optimization across global operations.

At the brand level, major players are collaborating with packaging specialists to co-develop novel formats that enhance shelf life without compromising recyclability, aligning with consumer demand for eco-friendly solutions. Several organizations have also fortified their positions through targeted acquisitions of niche technology providers, thereby expanding their portfolios to address specialized sterile filling requirements in the pharmaceutical sector and beyond. The combined effect of these moves underscores an industry-wide push toward end-to-end solutions that blend equipment excellence, material innovation, and digital connectivity.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aseptic Packaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amcor plc

- Becton, Dickinson & Company

- Bihai Packaging Co., Ltd.

- Coesia Group S.p.A.

- DS Smith plc

- Ecolean AB

- Elopak AS

- GEA Group AG

- Greatview Aseptic Packaging Company Ltd.

- Indorama Ventures Public Company Limited

- IPI S.r.l.

- Krones AG

- Lami Packaging Co., Ltd.

- Mondi Group plc

- Reynolds Group Holdings Limited

- Robert Bosch GmbH

- Scholle IPN Corporation

- Sealed Air Corporation

- SIG Combibloc Group AG

- Smurfit Kappa Group plc

- Sonoco Products Company

- Stora Enso Oyj

- Tetra Pak International S.A.

- UFlex Limited

- Visy Industries Holdings Pty Ltd

Delivering Practical Strategic Recommendations to Propel Aseptic Packaging Industry Leaders Forward Through Innovation, Collaboration, and Sustainable Practices

Industry leaders are advised to cultivate an integrated approach that aligns R&D investments with sustainability roadmaps and digital transformation strategies. Prioritizing partnerships with material innovators can accelerate the adoption of advanced barrier structures, while collaborative forums with regulatory bodies can streamline validation protocols and reduce time to market.

At the operational level, embracing modular and scalable filling systems can provide the agility needed to pivot between product formats and respond swiftly to changing trade and tariff conditions. Embedding IoT-enabled sensors within aseptic lines not only enhances process visibility but also supports predictive maintenance, reducing downtime and ensuring consistent quality. To further bolster competitive positioning, stakeholders should assess opportunities for localizing key supply chain nodes, thereby mitigating exposure to geopolitical fluctuations and import restrictions. By integrating these recommendations, organizations can reinforce their strategic resilience and capture emerging value pools across the aseptic packaging spectrum.

Detailing a Comprehensive Methodology Integrating Qualitative Insights, Quantitative Evaluation, and Expert Validation for the Aseptic Packaging Landscape

This research synthesizes insights derived from a multilayered methodology combining qualitative and quantitative techniques. Initial desk research encompassed academic publications, industry standards documentation, and regulatory filings to establish a foundational understanding of aseptic processing principles and material characteristics. These efforts were complemented by in-depth interviews with subject matter experts spanning equipment manufacturers, brand owners, materials specialists, and regulatory advisors to capture firsthand perspectives on emerging trends and operational challenges.

Quantitative analysis involved tracking adoption rates of various aseptic technologies through proprietary shipment data and cross-referencing with production capacity metrics to gauge equipment utilization patterns. Findings were validated against third-party trade statistics to ensure consistency and reliability. Finally, interactive workshops with cross-functional stakeholders facilitated iterative feedback loops, refining segmentation frameworks and strengthening the robustness of regional and company-level insights. This comprehensive approach ensures that the resulting intelligence accurately reflects the multifaceted dynamics influencing the aseptic packaging domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aseptic Packaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aseptic Packaging Market, by Product Type

- Aseptic Packaging Market, by Technology

- Aseptic Packaging Market, by Material

- Aseptic Packaging Market, by Application

- Aseptic Packaging Market, by End User

- Aseptic Packaging Market, by Distribution Channel

- Aseptic Packaging Market, by Region

- Aseptic Packaging Market, by Group

- Aseptic Packaging Market, by Country

- United States Aseptic Packaging Market

- China Aseptic Packaging Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Summarizing Critical Takeaways and Strategic Pathways to Uplift Competitiveness and Resilience in the Rapidly Evolving Aseptic Packaging Sector

The aseptic packaging sector stands at a critical juncture where technological innovation, environmental stewardship, and agile supply chain practices converge to define the next wave of industry leadership. As digitalization enhances process control and material scientists unveil novel barrier structures, the balance between product safety and sustainability has never been more attainable. Equally important is the ability to navigate evolving trade regimes by deploying flexible sourcing and manufacturing strategies that safeguard continuity and cost efficiency.

In summation, stakeholders that embrace a holistic, data-driven perspective-one that harmonizes consumer expectations, regulatory mandates, and operational realities-will be best positioned to capitalize on the accelerating evolution of aseptic packaging. By synthesizing segment-specific intelligence with regional and competitive insights, decision-makers can chart informed pathways that bolster resilience and secure sustainable growth in this dynamic market landscape.

Connect with Ketan Rohom to Secure Exclusive Aseptic Packaging Market Research Insights and Propel Strategic Growth Opportunities in Your Organization

Engaging with the evolving demands of global business landscapes requires access to in-depth, actionable data that drives competitive advantage. Connect directly with Associate Director of Sales & Marketing Ketan Rohom to explore how tailored insights in aseptic packaging can underpin strategic initiatives. This collaboration offers an opportunity to delve into proprietary research methodologies, examine nuanced regional and segment-specific trends, and leverage expert guidance to inform critical investment decisions.

By securing this comprehensive market intelligence, organizations can identify untapped growth corridors, align innovation roadmaps with sustainability imperatives, and optimize supply chain resilience in the face of evolving regulatory frameworks. Partner with Ketan Rohom to gain unparalleled clarity on emerging technologies, competitive dynamics, and consumer preferences that will shape the aseptic packaging frontier. Begin your journey toward more informed, confident decision-making and position your enterprise for long-term success in this dynamic sector.

- How big is the Aseptic Packaging Market?

- What is the Aseptic Packaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?