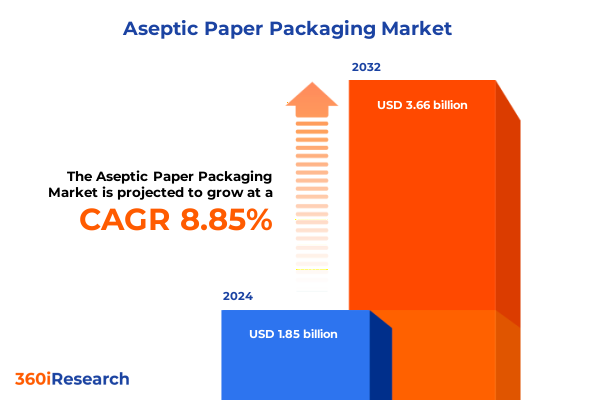

The Aseptic Paper Packaging Market size was estimated at USD 1.99 billion in 2025 and expected to reach USD 2.14 billion in 2026, at a CAGR of 9.05% to reach USD 3.66 billion by 2032.

Unveiling the Dawn of Aseptic Paper Packaging with Sustainable Innovations and Consumer Wellness Priorities Shaping Market Trajectories

Aseptic paper packaging is rapidly emerging as a defining solution at the intersection of sustainability, consumer safety, and supply chain efficiency. This technology leverages sterilization at ambient temperatures, enabling the preservation of sensitive liquid and semi-liquid products without the environmental burden associated with traditional plastic and multi-layered packaging formats. As brands and regulators intensify their focus on reducing carbon footprints and integrating circular economy principles, aseptic paper packaging has gained unprecedented traction across a variety of end uses. Decision makers now view this innovation not merely as an alternative, but as a strategic enabler for responding to consumer demands for transparency, clean labels, and minimized environmental impact.

Amid tightening regulatory directives on single-use plastics, aseptic paper packaging has demonstrated resilience and adaptability. Advances in barrier technologies-ranging from innovative plant-based polymer coatings to optimized aluminum foil laminations-ensure product integrity while reducing reliance on fossil-based films. Simultaneously, consumer awareness campaigns surrounding microplastics have elevated the profile of paper-based packaging as a safer, more natural medium. Consequently, manufacturers, brand owners, and retail channels are uniting around this platform to address both performance criteria and sustainability objectives within their portfolios. In this context, understanding the drivers, challenges, and market dynamics behind aseptic paper packaging is critical for industry stakeholders aiming to stay ahead.

Disruptive Innovations and Evolving Regulatory Landscapes Reshape the Competitive Terrain of Aseptic Paper Packaging Worldwide

Recent years have witnessed transformative shifts that are redefining the competitive landscape of aseptic paper packaging. Technological breakthroughs in barrier materials have yielded novel composites that combine plant-based polymers with micro-laminate structures, significantly enhancing oxygen and moisture resistance without sacrificing recyclability. Parallel to these material innovations, automation and digital quality-control systems are driving down unit costs and accelerating production throughput, even in highly customized format runs. Such advancements have lowered the entry barrier for emerging players and intensified competitive pressure among incumbent suppliers, prompting strategic realignments across the value chain.

Regulatory momentum toward extended producer responsibility and stringent recyclability targets is also catalyzing a wave of process redesigns. Producers are reengineering their supply networks to prioritize post-consumer fiber collection, optimizing mill processes for higher recycled content, and implementing closed-loop trials. At the same time, consumer-facing brands are pioneering on-pack coding and blockchain-enabled traceability to validate environmental claims, thereby deepening engagement and trust. These converging forces-material science innovation, digital transformation, and evolving regulatory frameworks-are jointly sculpting the next era of aseptic paper packaging, setting new benchmarks for environmental performance, operational resilience, and market differentiation.

Analyzing the Ripple Effects of 2025 United States Tariff Measures on Global Supply Chains for Aseptic Paper Packaging Materials

In 2025, the United States enacted a series of tariff measures on imported coated paper substrates, polymer films, and aluminum laminates commonly used in aseptic packaging. These levies have reverberated across global supply chains, elevating raw material costs and prompting manufacturers to reconfigure sourcing strategies. Many suppliers have accelerated nearshoring initiatives, forging partnerships with domestic paper mills and polymer extruders to mitigate tariff-induced price volatility. While this shift has bolstered local production capabilities, it has also pressured margins, driving companies to seek efficiencies through consolidation of production lines and optimization of inventory management.

Furthermore, the tariff landscape has encouraged innovation in substitute materials and hybrid structures. Barrier technology developers are intensifying R&D into advanced coatings that rely less on aluminum foil and more on polymer blends or wax emulsion systems, thereby reducing exposure to import duties. At the same time, downstream converters and brand owners have increased collaborative pilot programs to validate these alternatives for regulatory compliance and product shelf-life. As a result, the cumulative impact of the 2025 tariff regime is twofold: it has heightened cost awareness across the ecosystem, and it has catalyzed a wave of creative supply chain and material science responses that are reshaping future product architectures.

In-Depth Examination of Consumer and Industrial End-Use, Packaging Formats, Materials, Channels, and Size Preferences in Aseptic Paper Packaging

A granular assessment of aseptic paper packaging reveals nuanced variations across multiple segmentation dimensions that influence adoption patterns and strategic priorities. In terms of end use, the beverages category-encompassing dairy drinks, functional drinks, juices, and water-continues to lead due to rigorous safety requirements and high consumer turnover. Food applications, which include ready-to-drink products, sauces, and soups, are rapidly gaining traction as brands seek shelf-stable, preservative-free options. Pharmaceutical products, differentiated into liquid formulations and powder formulations, represent a specialized segment where aseptic integrity and regulatory compliance are paramount.

Examining packaging formats highlights distinct preferences: bottles and pouches have carved out lean, convenience-driven niches, while cartons-spanning brick pack, gable top, and Tetra Pak–style designs-dominate when extended shelf life and graphic real estate are critical. Distribution channels further shape demand profiles, with supermarkets and hypermarkets driving large-volume deployments, online retail fostering innovative convenience bundles, specialist retailers emphasizing premium formats, and convenience stores capitalizing on single-serve pack sizes. Material composition adds another layer of complexity: barrier technologies, including metallic barriers such as aluminum foil and advanced polymer barriers like ethylene vinyl alcohol, polyethylene, and polyethylene terephthalate, contrast with paperboard substrates such as folding box board and solid bleached board in terms of cost, performance, and recyclability.

Lastly, package sizes ranging from up to 250 milliliters through to above 1000 milliliters dictate design and logistics considerations, influencing material allocation and distribution economics. Understanding these segmentation drivers is essential for stakeholders aiming to tailor propositions, optimize manufacturing footprints, and align sustainability objectives with consumer expectations.

This comprehensive research report categorizes the Aseptic Paper Packaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Packaging Type

- Material

- Package Size

- End Use

- Distribution Channel

Regional Dynamics and Emerging Opportunities in the Americas, EMEA, and Asia-Pacific Influencing the Aseptic Paper Packaging Industry’s Growth

Regional dynamics play a pivotal role in shaping the trajectory of aseptic paper packaging, as each geography presents unique regulatory drivers, supply chain configurations, and consumption patterns. In the Americas, proactive environmental policies and robust recycling infrastructures are catalyzing broad acceptance of paper-based aseptic formats within both retail and foodservice sectors. Leading players are leveraging domestic fiber sources and advanced recycling technologies to meet stringent sustainability commitments, while brand owners invest in consumer education campaigns to reinforce the value proposition of low-carbon packaging.

Across Europe, the Middle East, and Africa, regulatory frameworks such as single-use packaging directives and extended producer responsibility schemes are driving accelerated shifts away from fossil-based laminates. Innovative pilot programs in several EU member states are testing optimized collection and sorting systems, enabling higher levels of recycled fiber content without compromising barrier performance. In the Middle East and Africa, rapid urbanization and emerging consumer segments are fostering demand for cost-effective aseptic solutions, prompting global suppliers to establish local conversion facilities and collaborate with regional distribution partners.

Asia-Pacific markets exhibit a dichotomy between mature economies demanding premium, high-performance formats and high-growth regions where cost sensitivity and infrastructure gaps predominate. Japan, South Korea, and Australia continue to prioritize product integrity and recyclability through rigorous regulatory oversight and industry consortiums, while China, India, and Southeast Asian nations are driving volume growth through partnerships that balance affordability with incremental sustainability gains. These regional distinctions underscore the importance of tailored market entry and expansion strategies for industry participants.

This comprehensive research report examines key regions that drive the evolution of the Aseptic Paper Packaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Competitive Landscape Reveals How Leading Manufacturers Are Positioning Themselves in the Aseptic Paper Packaging Market

The competitive landscape in aseptic paper packaging is shaped by a mix of established global suppliers and agile regional innovators. Tetra Pak remains a dominant force, continuously expanding its service portfolio to include digital processing solutions and remote monitoring platforms that optimize line efficiency and reduce downtime. SIG Combibloc has differentiated its offering through polymer reduction initiatives and commitments to renewable energy in its manufacturing footprint, underscoring a holistic approach to sustainability. Elopak has carved a niche with its focus on forest stewardship certifications and high-content paperboard solutions, attracting brands with stringent environmental mandates.

In North America, WestRock has aggressively grown its composite carton capacity through strategic acquisitions and retrofitting existing plants for aseptic applications, while Evergreen Packaging has leveraged its integrated fiber-to-board capabilities to enhance supply chain transparency and minimize waste. Graphic Packaging International has invested in next-generation barrier development labs, pursuing collaborations with material science startups to accelerate novel coating formulations. Meanwhile, regional players in Europe and Asia are forging partnerships with local mills and converters to meet specific market requirements, such as halal certification in Middle Eastern markets or lightweight formats in Southeast Asia. Together, these competitive dynamics highlight how innovation, vertical integration, and strategic alliances are defining the success contours in the aseptic paper packaging arena.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aseptic Paper Packaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amcor plc

- BillerudKorsnäs AB

- Elopak AS

- Evergreen Packaging LLC

- Graphic Packaging Holding Company

- Huhtamäki Oyj

- International Paper Company

- IPI S.r.l.

- Mondi Group plc

- Nippon Paper Industries Co., Ltd.

- Printpack, Inc.

- Sealed Air Corporation

- SIG Combibloc Group AG

- Smurfit Kappa Group plc

- Stora Enso Oyj

- Tetra Pak International S.A.

- Uflex Limited

- WestRock Company

Practical Strategic Imperatives for Industry Leaders to Capitalize on Sustainability, Efficiency, and Innovation in Aseptic Paper Packaging

To harness growth opportunities in aseptic paper packaging, industry leaders should prioritize investment in advanced barrier research, accelerating development of hybrid coatings that minimize reliance on tariff-exposed materials while ensuring regulatory compliance. Equally important is the optimization of supply chain resilience through diversified sourcing strategies, including partnerships with domestic fiber suppliers and polymer extruders to buffer against geopolitical and trade disruptions. Embracing digitalization-such as real-time quality monitoring and predictive maintenance-will also deliver operational efficiencies and reduce total cost of ownership, enabling more competitive pricing structures.

Furthermore, companies should deepen cross-sector collaborations, engaging brand owners, regulatory bodies, and waste management entities in joint initiatives to enhance recycling infrastructure and consumer education. Implementing robust life cycle assessments will help quantify environmental benefits, providing a clear narrative for sustainability claims and facilitating compliance with emerging extended producer responsibility legislation. Finally, fostering an agile innovation culture-through open innovation platforms and co-creation labs-will ensure that product development cycles align with rapidly evolving consumer preferences and sustainability standards. By executing on these imperatives, leaders can strengthen market positioning, enhance stakeholder trust, and drive enduring value creation.

Comprehensive Multi-Stage Research Framework Leveraging Qualitative and Quantitative Techniques to Analyze Aseptic Paper Packaging Trends

This research employs a comprehensive multi-stage framework designed to capture both qualitative insights and quantitative validations. The primary phase involved in-depth interviews with C-level executives, packaging engineers, and sustainability directors from leading converters, material suppliers, and brand owners. These conversations provided first-hand perspectives on innovation pipelines, tariff mitigation strategies, and regional market dynamics. Complementing this, an extensive secondary review was conducted across industry publications, regulatory filings, technical patents, and scientific journals to ensure a holistic understanding of material science breakthroughs and legislative developments.

Data triangulation and validation workshops with subject matter experts formed a critical part of the methodology, enabling alignment of divergent viewpoints and refinement of key thematic insights. The approach also integrated case study analyses of pilot programs in recycling infrastructure, barrier material substitutions, and digital quality-control implementations. Wherever applicable, statistical trend analyses were employed to contextualize growth patterns, though specific market sizing and forecasting data have been withheld to maintain an objective qualitative narrative. This rigorous methodology ensures that the findings reflect a balanced, fact-based view of the aseptic paper packaging ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aseptic Paper Packaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aseptic Paper Packaging Market, by Packaging Type

- Aseptic Paper Packaging Market, by Material

- Aseptic Paper Packaging Market, by Package Size

- Aseptic Paper Packaging Market, by End Use

- Aseptic Paper Packaging Market, by Distribution Channel

- Aseptic Paper Packaging Market, by Region

- Aseptic Paper Packaging Market, by Group

- Aseptic Paper Packaging Market, by Country

- United States Aseptic Paper Packaging Market

- China Aseptic Paper Packaging Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Summarizing Critical Insights and Strategic Imperatives That Will Drive the Future Evolution of Aseptic Paper Packaging Solutions

The evolution of aseptic paper packaging is marked by a convergence of sustainability mandates, technological strides, and strategic responses to shifting trade policies. Barrier innovations are enhancing performance while reducing environmental impact, and digital solutions are streamlining operations and reinforcing quality assurance. At the same time, the 2025 tariff regime has underscored the importance of supply chain agility, prompting manufacturers to diversify sourcing and explore substitute materials. Segmentation analysis reveals that beverages, particularly functional drinks and dairy applications, continue to drive adoption, while food and pharmaceutical applications are capitalizing on the aseptic attributes to deliver longer shelf life and cleaner labels.

Regionally, differentiated growth trajectories across the Americas, EMEA, and Asia-Pacific necessitate tailored go-to-market strategies, with each geography exhibiting unique regulatory stimuli and consumer behaviors. The competitive landscape is defined by global titans investing in digital and sustainable solutions, complemented by regional players leveraging local partnerships to meet market-specific requirements. By embracing the actionable recommendations-investing in advanced barrier research, fortifying supply chain resilience, and fostering ecosystem collaborations-stakeholders can capitalize on the significant potential inherent in this transformative packaging segment. As the industry continues to mature, those who integrate environmental stewardship with operational excellence will emerge as the definitive leaders.

Engage with Ketan Rohom to Unlock Custom Insights and Propel Strategic Decisions in Aseptic Paper Packaging Market Intelligence

To explore how these actionable insights can propel your strategic initiatives and secure a competitive edge in the aseptic paper packaging ecosystem, connect with Ketan Rohom, Associate Director, Sales & Marketing. Engage directly to discuss custom research modules, tailored workshops, and strategic advisory sessions designed to address your unique business challenges. Leverage this market research report as a springboard for data-driven decision making, and partner with Ketan Rohom to translate robust intelligence into sustainable growth and innovation.

- How big is the Aseptic Paper Packaging Market?

- What is the Aseptic Paper Packaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?