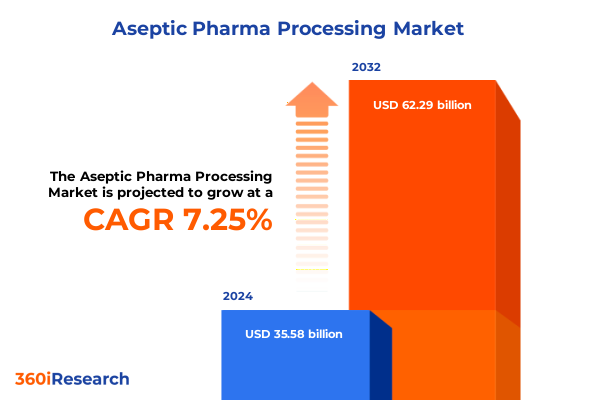

The Aseptic Pharma Processing Market size was estimated at USD 118.65 billion in 2025 and expected to reach USD 143.68 billion in 2026, at a CAGR of 21.71% to reach USD 469.60 billion by 2032.

Unveiling the Crucial Role and Growth Dynamics of Aseptic Pharmaceutical Processing in Modern Healthcare Supply Chains and Patient Safety Innovation

Modern healthcare systems are increasingly dependent on sterile manufacturing processes to deliver safe and effective pharmaceuticals to patients worldwide. Aseptic processing, which encompasses the design, sterilization, and filling of parenteral products in fully controlled environments, serves as a critical linchpin in the production of injectables, vaccines, and advanced biologics. This introduction delves into the multifaceted importance of aseptic techniques, highlighting their role in safeguarding patient health and meeting rigorous regulatory standards.

The evolution of aseptic processing has been driven by a convergence of factors including the rapid growth of biologics, the expansion of vaccine production, and heightened scrutiny from global health authorities. Technological advancements such as isolator systems, advanced filtration technologies, and environmental monitoring tools have progressively elevated process reliability and sterility assurance. Moreover, the integration of single-use systems has streamlined workflows and mitigated cross-contamination risks, underscoring the strategic value of aseptic platforms in achieving both quality and operational efficiency.

As demand for high-value injectable therapies continues its upward trajectory, understanding the foundational principles and current practices of aseptic processing is paramount. This overview establishes the context for the subsequent exploration of transformative trends, regulatory influences, and market dynamics that will shape the near-term and long-term trajectory of sterile pharmaceutical manufacturing.

Exploring the Technological and Regulatory Transformations Redefining Aseptic Pharma Processing Efficiency and Quality Control Standards

In recent years, aseptic pharmaceutical processing has undergone profound technological and regulatory transformations that are redefining efficiency benchmarks and quality control paradigms. The advent of continuous manufacturing principles, traditionally applied to solid dosage forms, has begun permeating sterile operations, offering opportunities to reduce batch variability and expedite time-to-market. Concurrently, digitalization has taken center stage, with real-time monitoring, predictive analytics, and artificial intelligence enhancing process transparency and enabling proactive risk management.

Regulatory bodies have responded to these advances by updating guidance frameworks to accommodate novel technologies such as closed-system transfer devices, single-use isolators, and robotics-enabled aseptic filling lines. The resulting shift places a premium on robust process validation and lifecycle management, challenging manufacturers to demonstrate sustained sterility assurance amidst evolving inspection criteria. Additionally, sustainability considerations are prompting a reevaluation of consumable use and energy-intensive sterilization cycles, driving investment in greener sterilization methods and waste reduction initiatives.

These intertwined drivers of innovation and compliance are reshaping the aseptic processing landscape. As the sector transitions from legacy batch processes towards more agile, data-driven paradigms, stakeholders must adapt to a dynamic environment where technological adoption and regulatory harmonization are key determinants of competitive advantage.

Analyzing the Comprehensive Impacts of 2025 United States Tariffs on Aseptic Pharmaceutical Equipment, Materials, and Supply Chain Economics

The introduction of a fresh round of United States tariffs in 2025 has triggered significant ripple effects throughout the aseptic pharmaceutical processing ecosystem. Equipment imports central to sterile filling operations, including precision filling machines and isolator systems, have experienced increased duty burdens, inflating capital expenditures for manufacturers. Similarly, tariffs on critical consumables such as single-use bags, sterile filters, and specialized packaging materials have driven up variable costs, compelling companies to reassess their supply chain strategies.

These cost pressures have manifested in multiple strategic responses. Some multinational corporations have accelerated regional manufacturing investments or shifted sourcing towards North American suppliers to mitigate tariff exposure, while others have negotiated volume-based agreements or pursued in-house manufacturing of certain components. The cumulative impact of these tariff-driven adjustments extends beyond cost containment, influencing lead times, inventory management, and the balance between in-house capabilities and contract manufacturing partnerships.

Moreover, regulatory authorities have been monitoring potential impacts on drug availability and pricing, evaluating avenues for tariff relief or exemption for critical healthcare inputs. Despite these efforts, the broader ecosystem remains challenged by uncertainties around trade policy and geopolitical shifts, underscoring the importance of flexible sourcing models and proactive engagement with policymakers to sustain uninterrupted aseptic production.

Uncovering Key Segmentation Insights Shaping Equipment, Packaging, Products, End Users, and Phase Applications in Aseptic Pharmaceutical Processing Markets

A nuanced understanding of market segmentation reveals how product typologies, packaging formats, equipment types, end-user profiles, phases of use, therapeutic applications, and component categories converge to shape aseptic processing strategies. Within product type classifications, liquid pharmaceuticals such as injectables and oral syrups command intensive sterile filling operations, while semi-solid forms including creams, gels, and ointments require precise container closure systems, and solid dosage formats leverage capsule and tablet filling lines. Each of these product variants necessitates tailored process controls and specialized equipment configurations.

Packaging material segmentation further delineates the sterile environment requirements, as glass vials and pipettes demand stringent particulate management, metal tubes require heat-sealed sterilization cycles, and plastics-encompassing ampoules and bottles-benefit from lightweight, single-use approaches. Equipment options traverse capping, filling, inspection, labeling, and sterilization domains, where distinctions between multi-head and single-head capping machines, liquid filling versus powder filling systems, and autoclaves versus tunnel sterilizers inform capital planning and operational workflows.

End-user distinctions amplify these considerations, with hospital pharmacies prioritizing small-batch flexibility, pharmaceutical companies seeking high-throughput platforms, and research institutes requiring adaptable setups for both preclinical investigations and clinical trial manufacturing. Similarly, the phase of use, from clinical development through pilot-scale production and up to commercial manufacturing, dictates degrees of process robustness and compliance rigor. Therapeutic application insights spotlight the growth in cardiology, infectious diseases, neurology-particularly in Alzheimer’s and Parkinson’s indications-oncology, and vaccine production, each with its own sterility risks and regulatory pathways. Finally, the balance between services such as equipment installation and maintenance and software domains encompassing data analysis and process control rounds out how market participants prioritize solutions.

This comprehensive research report categorizes the Aseptic Pharma Processing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Drug Type

- Operation Type

- Application

- End User

Revealing Regional Variations and Strategic Imperatives Across Americas, Europe Middle East, Africa, and Asia Pacific in Aseptic Pharma Processing

Regional markets exhibit distinct characteristics that influence aseptic processing adoption and strategic focus. In the Americas, particularly the United States, established regulatory frameworks and robust pharmaceutical infrastructure support rapid integration of innovative aseptic technologies. Heavy investment in single-use systems, advanced isolator solutions, and digital monitoring platforms underscores a commitment to maintaining global leadership in sterile manufacturing capabilities. Concurrently, Canadian and Latin American markets are expanding localized sterile fill lines to ensure supply security for both domestic and export needs.

Europe, the Middle East, and Africa present a mosaic of regulatory environments and investment appetites. Western European nations benefit from harmonized European Medicines Agency guidelines, extensive contract development and manufacturing organizations, and a skilled workforce adept at aseptic operations. In contrast, emerging markets in Eastern Europe, the Gulf region, and Africa signal growing demand for vaccines and generics, driving the need for scalable, cost-effective sterile manufacturing platforms. This region’s focus on sustainability and circular economy principles has accelerated interest in reducing energy consumption and plastic waste within aseptic operations.

Asia-Pacific continues to be a dynamic growth engine, as governments in China, India, Japan, and Southeast Asia prioritize self-sufficiency in vaccine production and biopharmaceutical manufacturing. The region is witnessing major capacity expansions, technology transfer initiatives, and talent development programs geared towards aseptic best practices. Strategic collaborations between local and international players are shaping next-generation sterile processing facilities, balancing regulatory compliance, production efficiency, and market accessibility.

This comprehensive research report examines key regions that drive the evolution of the Aseptic Pharma Processing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Industry Leaders Driving Innovation, Partnerships, and Competitive Strategies in Aseptic Pharmaceutical Processing Ecosystems Worldwide

Leading stakeholders in the aseptic pharmaceutical processing arena are distinguished by their innovation pipelines, strategic partnerships, and comprehensive solution portfolios. Equipment manufacturers specializing in isolator technologies, precision filling lines, and automated inspection platforms are forging alliances with biopharma companies to co-develop systems tailored to complex biologics and high-value therapies. Service providers offering integrated validation, maintenance, and calibration services are enhancing uptime and regulatory compliance for both established and emerging market participants.

Software firms are simultaneously advancing analytics-driven platforms that enable end-to-end process control, real-time deviation management, and predictive maintenance. These digital offerings are pairing with hardware solutions to deliver seamless, scalable aseptic environments. Key players are also pursuing mergers and acquisitions to broaden their geographic reach and strengthen capabilities in single-use systems, container closure integrity testing, and sterilization engineering.

Contract development and manufacturing organizations have increased their aseptic fill-finish capacities, responding to client demand for flexible, tech-enabled services during clinical development and at commercial launch. Partnerships spanning technology licensors, engineering consultancies, and regulatory experts are facilitating rapid facility mobilization, ensuring that new products can progress through clinical phases efficiently and with minimized risk.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aseptic Pharma Processing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Ajinomoto Bio-Pharma

- AST, Inc.

- Baxter International, Inc.

- Boehringer Ingelheim International GmbH

- Catalent, Inc.

- Dietrich Engineering Consultants SA

- Evonik Industries AG

- Grand River Aseptic Manufacturing

- IMA S.p.A.

- JBT Corporation

- Klenzaids Contamination Controls Pvt. Ltd.

- Körber AG

- Lonza Group Ltd.

- Maquinaria Industrial Dara, S.L.

- Micron HVAC Pvt. Ltd.

- OPTIMA Packaging Group

- PCI Pharma Services

- Pfizer Inc.

- SAE Media Group

- Steriline S.r.l.

- Syntegon Technology GmbH

- Thermo Fisher Scientific Inc.

- TriRx Pharmaceutical Services

- Vetter Pharma-Fertigung GmbH & Co. KG

Strategic and Actionable Recommendations for Industry Leaders to Enhance Resilience, Efficiency, and Innovation in Aseptic Pharmaceutical Processing Operations

Industry leaders looking to fortify their aseptic processing capabilities should prioritize integration of single-use and continuous manufacturing technologies to enhance flexibility and reduce changeover times. Embracing digital twins and predictive analytics will allow real-time optimization of sterile zones and proactive identification of contamination risks. Companies must also foster deeper collaboration with material suppliers to secure resilient supply chains for critical consumables, mitigating the volatility introduced by geopolitical shifts and tariff regimes.

Elevating environmental stewardship should be embedded in strategic planning, with organizations exploring green sterilization alternatives and lifecycle assessments to minimize waste streams. Rigorous training programs and talent development initiatives are crucial for cultivating a workforce proficient in modern aseptic techniques, regulatory compliance, and advanced troubleshooting. Establishing cross-functional teams that include quality assurance, manufacturing, and IT specialists will ensure holistic decision-making and agile responses to evolving market demands.

To capitalize on the burgeoning opportunities in biologics and vaccine production, firms should consider strategic partnerships or joint ventures that provide access to complementary capabilities in fill-finish, regulatory consulting, and specialty packaging. This collaborative approach will accelerate time-to-market while distributing risk. Ultimately, a proactive investment in technology, people, and partnerships will position organizations to thrive in an increasingly complex and competitive aseptic processing environment.

Detailing the Robust Research Methodology Incorporating Primary Insights, Secondary Analysis, and Data Triangulation for Aseptic Pharma Process Studies

This analysis is underpinned by a rigorous research methodology that integrates primary engagements and secondary data sources, ensuring a robust foundation for actionable insights. Primary research comprised in-depth interviews with senior executives from pharmaceutical companies, equipment suppliers, contract manufacturers, and regulatory bodies, capturing firsthand perspectives on technology adoption, supply chain dynamics, and policy impacts. These qualitative inputs were corroborated with facility tours, advisory board sessions, and technical roundtables to validate emerging trends.

Secondary research involved comprehensive review of peer-reviewed journals, industry whitepapers, conference proceedings, and regulatory publications to map historical developments and benchmark best practices. Data triangulation techniques were employed to reconcile disparate findings, ensuring consistency across market signals, stakeholder viewpoints, and technical specifications. Key performance indicators and case studies were systematically analyzed to assess technology efficacy, operational metrics, and cost implications.

Quantitative data were synthesized using statistical tools to identify significant correlations between process innovations and quality outcomes. Sensitivity analyses evaluated the impact of tariff fluctuations and regional regulatory changes on capital and operational expenditure. The combination of qualitative depth and quantitative rigor underpins the credibility of this study’s conclusions and recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aseptic Pharma Processing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aseptic Pharma Processing Market, by Product Type

- Aseptic Pharma Processing Market, by Technology

- Aseptic Pharma Processing Market, by Drug Type

- Aseptic Pharma Processing Market, by Operation Type

- Aseptic Pharma Processing Market, by Application

- Aseptic Pharma Processing Market, by End User

- Aseptic Pharma Processing Market, by Region

- Aseptic Pharma Processing Market, by Group

- Aseptic Pharma Processing Market, by Country

- United States Aseptic Pharma Processing Market

- China Aseptic Pharma Processing Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Synthesizing Core Findings and Strategic Implications to Illustrate the Future Trajectory of Aseptic Pharmaceutical Processing Innovation

The synthesis of market dynamics, technological advancements, and regulatory shifts underscores a clear trajectory toward more agile, data-driven, and sustainable aseptic processing operations. Continuous and single-use manufacturing paradigms are converging with advanced analytics to challenge traditional batch methodologies, promising reduced variability and enhanced sterility assurance. Regional investments and policy frameworks are evolving in tandem, as stakeholders across the Americas, EMEA, and Asia-Pacific adjust to geopolitical realities and healthcare imperatives.

Together, these factors signal an industry on the cusp of profound transformation, where strategic alignment between equipment providers, biopharma firms, and service organizations will dictate competitive positioning. Companies that invest judiciously in integrated technology platforms, resilient supply chains, and workforce capabilities will be best placed to navigate tariff fluctuations and regulatory complexities. Moreover, the pivot toward sustainable operations is likely to yield both environmental and economic benefits, reinforcing the business case for greener aseptic solutions.

As aseptic processing continues to underpin the future of injectable therapies, vaccines, and advanced biologics, the ability to synthesize cross-cutting trends into coherent strategies will determine success. This study illuminates the paths forward, offering a roadmap for stakeholders to capitalize on emerging opportunities and safeguard against potential disruptions.

Engage with Expert Associate Director Ketan Rohom to unlock comprehensive Aseptic Pharma Processing insights and secure your authoritative market research report

To gain unparalleled insights into aseptic pharmaceutical processing and drive informed strategic decisions, connect directly with Ketan Rohom, Associate Director of Sales & Marketing. His expertise in market dynamics and customer requirements will guide you through the report’s key findings and ensure you maximize value from its comprehensive analysis. Engage with him to discuss tailored solutions, clarify any methodological questions, and explore customized consultancy to address your organization’s unique challenges. Securing this report is a decisive step toward enhancing operational efficiency, navigating regulatory complexities, and capitalizing on emerging opportunities within the aseptic processing landscape. Reach out promptly to Ketan Rohom to secure your authoritative market research report and unlock the path to sustained competitive advantage

- How big is the Aseptic Pharma Processing Market?

- What is the Aseptic Pharma Processing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?