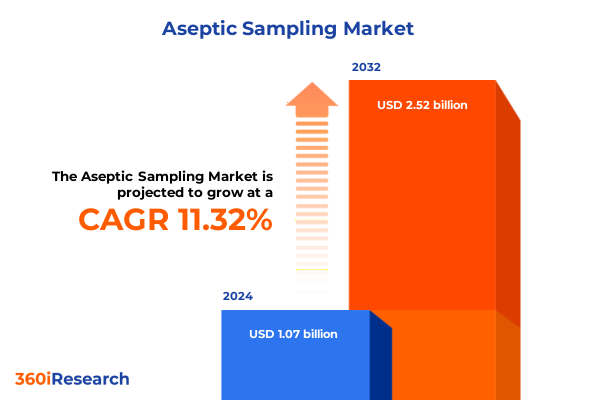

The Aseptic Sampling Market size was estimated at USD 1.17 billion in 2025 and expected to reach USD 1.29 billion in 2026, at a CAGR of 11.55% to reach USD 2.52 billion by 2032.

Setting the Stage for Aseptic Sampling Excellence Through Technological Innovation, Regulatory Rigor, Supply Chain Resilience and Quality Assurance Leadership

Aseptic sampling has emerged as a cornerstone of quality assurance across pharmaceutical, biopharmaceutical, cosmetics, and food and beverage industries. At its core, sampling under aseptic conditions safeguards the integrity of products intended for human consumption and medical applications. By preventing microbial contamination during sample collection, organizations can secure reliable data that underpins process validation, stability testing, and regulatory compliance. As regulatory agencies heighten scrutiny on sterility assurance, aseptic sampling transcends routine practice to become a critical enabler of patient safety and product efficacy.

Contemporary aseptic sampling protocols reflect decades of technological evolution and regulatory refinement. Traditional manual approaches gave way to semi-automated autosamplers that reduced human contact and variability. More recently, the advent of single-use technologies and digital automation platforms has redefined sample handling, streamlining workflows and consolidating data integrity. This introduction outlines the multifaceted importance of aseptic sampling, setting the stage for a comprehensive exploration of emerging shifts, tariff implications, segmentation nuances, regional dynamics, and strategic imperatives that will define market developments in 2025 and beyond.

Charting the Transformative Shifts Redefining Aseptic Sampling Practices with Automation Advancements Regulatory Harmonization and Digital Integration Dynamics

The landscape of aseptic sampling is undergoing transformative shifts driven by automation advancements, digital integration, and a growing emphasis on supply chain resilience. Automation has matured from simple liquid-handling devices to fully integrated autosampler systems equipped with robotic arms, in-line analytical sensors, and connected manufacturing execution systems (MES). These innovations streamline sample preparation and transfer, eliminate manual handling errors, and provide real-time data capture that aligns with electronic batch records. As a result, manufacturers can achieve faster throughput, reduced contamination risk, and comprehensive traceability from sample collection to analysis.

Simultaneously, the regulatory environment is converging toward harmonization across major markets. The European Union’s recent Annex 1 revision emphasizes risk-based approaches for sampling, mandating closed-system technologies and routine environmental monitoring. In the United States, the FDA’s enhanced focus on quality metrics and process analytical technology (PAT) encourages adoption of automated sampling solutions that deliver continuous quality by design. Together, these regulatory drivers incentivize investment in single-use aseptic sampling platforms that minimize cross-contamination risks and support rapid changeovers between production campaigns.

Digital integration represents another significant shift. The deployment of Internet of Things (IoT) sensors within sampling systems enables predictive maintenance, environmental monitoring, and remote process control. By leveraging cloud-based analytics and machine learning algorithms, operations teams can detect trends indicative of contamination events, optimize sampling frequencies, and validate process consistency. This convergence of data and automation fosters a proactive quality culture, where decisions are guided by actionable insights rather than reactive troubleshooting.

Examining the Multifaceted Impact of 2025 Tariff Policies on Aseptic Sampling Supply Chains Innovation Incentives and Market Access in the United States

In 2025, the imposition of updated tariff measures on critical materials has reverberated across the United States’ aseptic sampling supply chain. Tariffs targeting specialty polymers, stainless steel components, and precision sensors have elevated input costs for manual and automated sampling equipment alike. Manufacturers heavily reliant on imported autosampler modules and single-use consumables are experiencing margin pressures, prompting strategic reassessments of procurement channels and supplier partnerships.

Faced with higher import duties, several market participants have accelerated efforts to localize production of high-value components. This trend has spurred investment in domestic tooling capabilities, enabling faster lead times and mitigating exposure to geopolitical fluctuations. Concurrently, tier-one suppliers are reevaluating their global footprint, diversifying manufacturing bases to include near-shoring options in Mexico and Southeast Asia. Such reshoring initiatives are instrumental in balancing cost containment with the agility required for customizable aseptic sampling solutions.

Beyond cost implications, tariffs have influenced innovation incentives. Equipment developers are exploring alternative polymers and metal alloys not subject to the highest duties, fostering material science research and collaborative development agreements. These efforts aim to maintain product performance standards while reducing tariff burdens. As the market adapts, stakeholders are recognizing that supply chain resilience and agile sourcing strategies are no longer optional-they are fundamental drivers of long-term competitiveness.

Unveiling Holistic Segmentation Insights Revealing How Equipment Types Technologies Applications End Users and Sales Channels Shape the Aseptic Sampling Market

Deep segmentation analysis illuminates how distinct market categories drive differentiated product requirements and adoption curves. When considering equipment type, the choice between autosamplers and manual samplers hinges on throughput demands and contamination risk tolerance. High-volume biopharmaceutical and food production lines often mandate fully automated autosamplers to minimize operator intervention, whereas smaller laboratories and clinical settings may continue to rely on manual samplers for their cost flexibility and compact footprints.

From a technology standpoint, the divide between multi-use and single-use systems underscores the trade-off between lifecycle costs and contamination control. Multi-use platforms deliver lower per-sample costs over extensive operational cycles, yet they demand rigorous sterilization validation. Conversely, single-use assemblies eliminate the need for cleaning validation and cross lot-contamination checks, supporting rapid product changeovers in contract research organizations and multiproduct facilities.

Application segmentation further refines market dynamics. Within biopharmaceutical processing, downstream and upstream stages impose distinct sampling protocols: upstream sampling focuses on cell culture monitoring, necessitating aseptic interfaces with bioreactors, while downstream sampling centers on purified intermediates and final fill-finish assays. In the cosmetics sector, color cosmetics require stringent sterility to ensure consumer safety, hair care formulations demand compatibility with surfactant-rich matrices, and skin care products call for delicate sampling of emulsions. Food and beverage applications range from alcoholic beverage sampling that prioritizes volatile compound retention to dairy testing that requires cold chain integration, as well as non-alcoholic beverage sampling where pH and carbonation pose unique equipment challenges.

Examining end users reveals further stratification. Academic and research institutes, including government research labs and university labs, emphasize flexibility and educational value in their sampling tools. Contract research organizations balance high throughput with compliance rigor to serve diverse clients. Hospitals and clinics require reliable, compact samplers for point-of-care sterility testing, while pharmaceutical companies drive large-scale implementations aligned with commercial manufacturing standards. Finally, sales channels differentiate original equipment manufacturer offerings-characterized by fully supported, end-to-end solutions-from third-party vendor options that deliver modular components and aftermarket service models.

This comprehensive research report categorizes the Aseptic Sampling market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Equipment Type

- Technology

- Application

- End User

- Sales Channel

Highlighting Key Regional Dynamics Driving Aseptic Sampling Adoption and Innovation Across the Americas Europe Middle East Africa and Asia Pacific Markets

Regional dynamics play a pivotal role in shaping adoption patterns and innovation trajectories within the aseptic sampling market. In the Americas, rapid expansion of biopharmaceutical manufacturing hubs across the United States and Canada has fueled demand for advanced autosampling systems and consumables. Regulatory frameworks emphasizing quality by design and real-time monitoring drive early adoption of closed-system aseptic sampling, while domestic tariff pressures encourage local sourcing of bespoke materials.

Across Europe, the Middle East, and Africa, a diverse regulatory landscape presents both opportunities and challenges. Stringent EU regulations and alignment with World Health Organization guidelines accelerate the uptake of single-use sampling cartridges in pharmaceutical clusters such as Germany, Switzerland, and the United Kingdom. Meanwhile, emerging markets in the Middle East and Africa prioritize cost-effective manual sampling tools, supporting regional research initiatives and food safety programs. Collaborative R&D consortia between European universities and African research institutes have begun exploring low-cost, portable aseptic sampling solutions for field applications.

In the Asia-Pacific region, strong government incentives for biologics manufacturing in China, India, and Singapore are generating significant growth in automated aseptic sampling equipment. Local manufacturers are scaling production to address domestic demand, while international suppliers establish strategic partnerships to navigate regional certification requirements. Additionally, rapid expansion of the food and beverage sector across Southeast Asia amplifies interest in aseptic sampling solutions that ensure product quality and compliance with international export standards.

This comprehensive research report examines key regions that drive the evolution of the Aseptic Sampling market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Strategic Company Actions Innovations Partnerships and Investments Steering Growth in the Evolving Aseptic Sampling Equipment and Technology Space

Key industry participants are advancing aseptic sampling through strategic product development, alliances, and targeted investments. Leading laboratory instrumentation manufacturers are introducing next-generation autosamplers with integrated sensor suites capable of measuring pH, conductivity, and turbidity in tandem with microbial checks. These modular platforms allow end users to customize configurations based on specific application requirements while maintaining consistent user interfaces across product lines.

Partnerships between equipment suppliers and software developers are enhancing digital quality ecosystems. Through these collaborations, manufacturers can embed advanced analytics dashboards directly into the sampling workflow, offering unified visibility into system performance, environmental conditions, and compliance metrics. This integration reduces manual reporting burdens and accelerates deviation investigations when anomalies are detected.

In parallel, targeted acquisitions have bolstered company portfolios with innovative consumable technologies. Single-use cartridge providers have joined forces with established instrument vendors to deliver fully validated sampling solutions that streamline regulatory submissions. Joint ventures between polymer scientists and engineering firms are exploring sustainable materials to reduce environmental footprints without compromising sterility standards. Collectively, these strategic moves underscore an industry trajectory toward fully integrated, digitally enabled aseptic sampling ecosystems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aseptic Sampling market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Microdevices Pvt Ltd

- Alfa Laval AB

- Avantor Inc.

- Cole-Parmer Instrument Company LLC

- Danaher Corporation

- Eppendorf AG

- Flownamics Analytical Instruments Inc.

- GEA Group AG

- GEMÜ Gebr. Müller Apparatebau GmbH & Co. KG

- Keofitt A/S

- Lonza Group Ltd.

- Meissner Filtration Products Inc.

- Merck KGaA

- Mettler-Toledo International Inc.

- Parker-Hannifin Corporation

- QualiTru Sampling Systems LLC

- Sartorius AG

- Thermo Fisher Scientific Inc.

- Trace Analytics LLC

- W. L. Gore & Associates Inc.

Delivering Actionable Recommendations on Digital Transformation Supply Chain Resilience Talent Development and Collaborative Innovation in Aseptic Sampling

To navigate the evolving aseptic sampling landscape, industry leaders should prioritize digital transformation initiatives that integrate sampling instruments with enterprise data platforms. By deploying IoT-enabled autosamplers and cloud-based analytics, organizations can achieve real-time oversight of sterility controls, predict maintenance needs, and continuously optimize sampling frequencies based on risk assessments.

Strengthening supply chain resilience is equally critical. Businesses must diversify sourcing strategies for critical materials impacted by tariffs and global disruptions, evaluating partnerships with domestic and nearshore suppliers. Establishing dual-source agreements and maintaining strategic inventory buffers will safeguard against component shortages and production delays.

Talent development and collaborative innovation will drive competitive differentiation. Companies should invest in workforce training programs that blend sterile process expertise with data science skills, fostering a generation of professionals able to harness advanced analytics within quality frameworks. Finally, forging partnerships with academic research centers and contract research organizations can accelerate co-development of specialized sampling solutions, ensuring market readiness for emerging modalities such as cell and gene therapies.

Detailing Rigorous Research Methodologies Leveraging Primary Interviews Data Triangulation and Quality Control for Aseptic Sampling Market Insights

This research report integrates both primary and secondary methodologies to achieve comprehensive insights into the aseptic sampling market. Primary data collection entailed structured interviews with senior quality assurance managers, process engineers, and regulatory affairs experts across pharmaceutical, cosmetics, and food and beverage sectors. These interviews provided firsthand perspectives on technology adoption, sampling protocol challenges, and investment priorities.

Secondary research encompassed analysis of regulatory archives, academic publications, and industry white papers to map evolving compliance requirements and technological benchmarks. Proprietary databases supplemented this work by delivering up-to-date information on product launches, patent filings, and corporate partnerships. Triangulation of primary interview findings with secondary sources and historical data ensured robust validation of market narratives and emerging trends.

Quality control measures included multiple rounds of peer review, cross-verification of quantitative data, and validation workshops with independent subject-matter experts. The result is a reliable, rigorously vetted analysis that captures the complexities of aseptic sampling practices and provides actionable intelligence for decision makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aseptic Sampling market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aseptic Sampling Market, by Equipment Type

- Aseptic Sampling Market, by Technology

- Aseptic Sampling Market, by Application

- Aseptic Sampling Market, by End User

- Aseptic Sampling Market, by Sales Channel

- Aseptic Sampling Market, by Region

- Aseptic Sampling Market, by Group

- Aseptic Sampling Market, by Country

- United States Aseptic Sampling Market

- China Aseptic Sampling Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Concluding Perspectives on Aseptic Sampling Evolution Integrating Innovation Compliance and Collaboration to Navigate Future Challenges and Opportunities

Aseptic sampling stands at the intersection of technological innovation, regulatory evolution, and global supply chain dynamics. As organizations strive to uphold sterility standards amidst mounting competitive pressures, the adoption of automated, single-use, and digitally integrated sampling solutions will accelerate. Regulatory harmonization across major markets will further propel investment in closed-system designs and real-time monitoring capabilities.

Looking ahead, collaboration among equipment vendors, research institutions, and end users will be essential to tackle emerging challenges such as complex biologics characterization and decentralized manufacturing models. By aligning innovation roadmaps with regulatory imperatives and supply chain strategies, stakeholders can navigate future uncertainties while upholding the paramount objective of product safety and quality assurance.

Engage Directly with Ketan Rohom Associate Director Sales Marketing to Secure Your Aseptic Sampling Report and Drive Strategic Decision Making

We invite you to engage directly with Ketan Rohom, Associate Director of Sales and Marketing, to secure your comprehensive aseptic sampling report. Partnering with Ketan will empower your team to access in-depth insights into the latest technological advances, regulatory developments, and strategic growth opportunities shaping the market today.

By collaborating with Ketan, your organization can accelerate decision making with expert guidance on how to optimize sampling protocols, integrate digital quality frameworks, and mitigate supply chain risks. Connect now to drive strategic planning and position your business at the forefront of aseptic sampling excellence.

- How big is the Aseptic Sampling Market?

- What is the Aseptic Sampling Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?