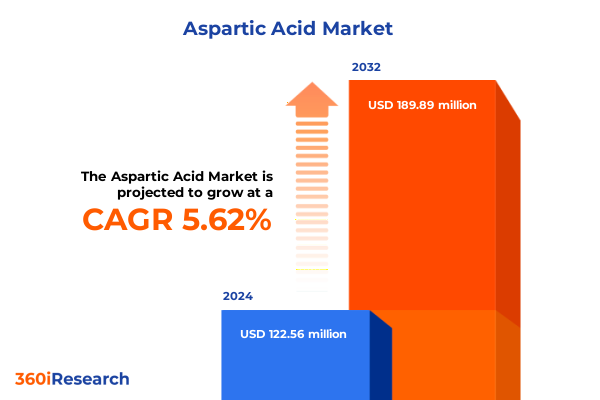

The Aspartic Acid Market size was estimated at USD 129.47 million in 2025 and expected to reach USD 138.16 million in 2026, at a CAGR of 5.62% to reach USD 189.89 million by 2032.

Unveiling the Expanding Role of Aspartic Acid Across Nutritional Pharmaceutical Cosmetic and Feed Applications Shaping Future Market Dynamics

Aspartic acid, a naturally occurring non-essential amino acid, plays a pivotal role across diverse industries ranging from agricultural feeds and food flavor enhancers to pharmaceuticals and personal care formulations. Its unique chemical structure enables functional versatility, acting as a building block for sweetener compounds, a performance booster in animal nutrition, and a key component in injectable and oral therapeutic products. In recent years, escalating emphasis on sustainability and clean-label preferences has intensified interest in green production methods, positioning aspartic acid at the intersection of environmental responsibility and commercial demand.

As global supply chains adapt to shifting consumption patterns, aspartic acid manufacturers and end users alike are exploring innovative production pathways, collaborative partnerships, and regulatory landscapes that support both economic and ecological goals. The growing integration of biotechnological advances further underscores aspartic acid’s emergence as a strategic ingredient poised to drive value creation in established and emerging markets. Against this backdrop, stakeholders require a nuanced, holistic overview to navigate complexities and capitalize on growth opportunities within the evolving aspartic acid ecosystem.

Navigating the Transformative Shifts Reshaping the Aspartic Acid Landscape Amid Technological Innovation and Regulatory Evolution

The aspartic acid industry is undergoing a profound transformation fueled by technological breakthroughs and regulatory momentum towards sustainable manufacturing. Biotechnological advances have catalyzed a shift from conventional chemical synthesis to bio-based production using renewable feedstocks, minimizing carbon footprints and enhancing operational efficiency. Innovations in enzymatic catalysts and genetic engineering have significantly increased fermentation yields, enabling manufacturers to scale up production while reducing energy consumption and waste generation.

Artificial intelligence and digitalization are also redefining production processes by optimizing fermentation parameters and predictive quality controls. Leading companies are deploying AI-driven models to forecast demand patterns and fine-tune operational efficiencies, thereby reducing material losses and streamlining supply chain logistics. The integration of these digital tools not only accelerates product development but also aligns with broader industry commitments to traceability and real-time monitoring of environmental performance.

Assessing the Cumulative Impact of 2025 United States Tariffs on Aspartic Acid Supply Chains Production Costs and Competitive Positioning

The 2025 tariff landscape in the United States has introduced a multilayered duty structure that directly affects the import economics of aspartic acid. In April, a universal 10% tariff was imposed on all imported goods under the IEEPA declaration, supplemented by higher country-specific rates for major trade partners. Concurrently, steel, aluminum, and select chemical products experienced steep increases, reflecting the administration’s strategic emphasis on domestic industry protection and supply chain resilience.

Under the Harmonized Tariff Schedule (HTS) code 2922.49.49.15, l-aspartic acid is subject to a baseline general duty rate of 4.2%. Imports originating from China incur an additional 25% ad valorem duty under Section 301 measures, resulting in a cumulative 29.2% duty rate for affected shipments. This classification underscores the dual impact of broad trade policy shifts and targeted anti-dumping actions on amino acid imports.

As importers and distributors reconcile these elevated cost structures, supply chain strategies have adapted through regional sourcing diversification and renegotiated commercial terms. The increased landed cost of aspartic acid imports has prompted greater reliance on domestic and nearshoring production facilities, while end users evaluate reformulation options to mitigate price volatility. In parallel, long-term service agreements and tariff mitigation programs have emerged as critical tools for managing financial exposure in this high-tariff environment.

Uncovering Essential Segmentation Insights Revealing Targeted Applications Product Types Production Processes Grades and Distribution Dynamics

A granular examination of aspartic acid market segmentation reveals distinct value drivers and application-specific dynamics. Across the animal feed segment, aspartic acid enhances nutrient absorption and growth rates in aquaculture, poultry, ruminant, and swine operations. Its functional attributes in cosmetic formulations are differentiated between haircare and skincare, where it serves as a conditioning agent and pH regulator. Within food and beverage, specialized formulations leverage aspartic acid for bakery freshness retention, beverage stabilization, confectionery flavor enhancement, dairy protein fortification, and extended shelf life in meat products.

Parallel to these application insights, product type segmentation identifies liquid and powder forms, each offering unique handling and formulation advantages in process efficiency and end-product stability. The production process dimension contrasts chemical synthesis methods-characterized by consistent batch quality and high throughput-with fermentation-based approaches, prized for their lower energy demands and renewable feedstock utilization. Grade-based segmentation further underscores the diversity of aspartic acid applications, encompassing cosmetic, feed, food, pharmaceutical, and technical grades, each requiring tailored quality specifications and regulatory compliance.

Distribution channels shape market accessibility, as direct supply agreements, distributor partnerships, and retail networks support offline demand, while digital platforms through company websites and e-commerce marketplaces expand market reach and enhance customer engagement. This integrated segmentation lens equips stakeholders with a comprehensive understanding of product positioning and growth levers across the aspartic acid value chain.

This comprehensive research report categorizes the Aspartic Acid market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Production Process

- Grade

- Application

- Distribution Channel

Highlighting the Key Regional Insights Across Americas Europe Middle East Africa and Asia Pacific Markets Driving Strategic Growth Opportunities

Regional market dynamics for aspartic acid are influenced by distinct economic, regulatory, and consumption patterns. In the Americas, growing demand from the United States and Brazil’s food and beverage sectors, coupled with investments in domestic specialty chemical facilities, has strengthened supply resilience. Regulatory frameworks that incentivize sustainable production practices are also driving investments in green fermentation infrastructure across North America.

Within Europe, Middle East & Africa, stringent environmental regulations and Clean Label mandates have elevated the importance of bio-based production routes and low-impact formulations. Western Europe’s robust pharmaceutical sector continues to absorb high-purity aspartic acid for injectable and oral products, while increasing healthcare spending in the Middle East and African markets opens new avenues for nutraceutical and functional feed applications.

Asia-Pacific remains the largest regional consumer, underpinned by significant fermentation capacity in China, India, and Southeast Asian nations. The expansion of animal protein production and rapid growth in cosmetic and personal care industries sustain strong aspartic acid demand. Government policies supporting bioeconomy initiatives, along with lower production costs, further bolster the region’s export competitiveness and capacity to supply mature and emerging markets alike.

This comprehensive research report examines key regions that drive the evolution of the Aspartic Acid market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Companies Shaping the Aspartic Acid Sector through Innovation Partnerships and Strategic Capacity Expansions

The competitive landscape of the aspartic acid market features both global chemical conglomerates and specialized amino acid producers. Leading importers in recent trade flows include Nouryon Functional Chemicals LLC, Ajinomoto Health & Nutrition, CJ America Inc, Invagen Pharmaceuticals Inc, and Valudor Products. These companies have leveraged robust supply networks and long-term sourcing strategies to maintain consistent market access amid shifting tariff regimes.

On the supply side, prominent manufacturers such as Nouryon Functional Chemicals B.V., Shijiazhuang Jackchem Co. Ltd, CJ Shenyang Biotech Co. Ltd, and Hunan Haili Chemical Industry have expanded capacity to meet growing global demand. Collaborative ventures between these suppliers and regional distributors have facilitated localized production and reduced logistics complexity. Simultaneously, strategic partnerships with feed millers, pharmaceutical formulators, and cosmetic contract manufacturers have reinforced tailored product offerings and accelerated time-to-market for new aspartic acid applications.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aspartic Acid market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aditya Chemicals

- Ajinomoto Co., Inc

- ALPS Pharmaceutical Ind. Co. Ltd

- AMINO GmbH

- Anaspec Inc.

- Anhui Huaheng Biotechnology Co., Ltd.

- BLD Pharmatech Ltd.

- ChemPep Inc.

- Donboo Amino Acids Co. Ltd

- Evonik Industries AG

- Fengchen Group Co.,Ltd

- Hugestone Enterprise Co., Ltd

- Iris Biotech GmbH

- Koninklijke DSM N.V.

- Kyowa Hakko Bio Co., Ltd.

- Merck KGaA

- PepTech Corporation

- Prinova Group

- Prinova Group LLC

- Senova Technology Co. Ltd.

- Sichuan Tongsheng Amino Acids Co. Ltd

- Spectrum Laboratory Products, Inc.

- Thermo Fisher Scientific Inc.

- Tocris Bioscience

- Tokyo Chemical Industry Co., Ltd.

Delivering Actionable Recommendations Empowering Industry Leaders to Capitalize on Aspartic Acid Market Opportunities and Navigate Emerging Challenges

Industry leaders must proactively align innovation roadmaps with evolving market requirements to sustain growth and resilience. Investing in pilot-scale bio-fermentation facilities and advanced separation technologies will enable cost-effective scale-up of high-purity grades, catering to the pharmaceutical and nutraceutical segments. At the same time, integrating AI-driven process controls and predictive maintenance systems can optimize operational efficiency and reduce unplanned downtime.

To navigate tariff-driven cost pressures, companies should evaluate geographic diversification strategies, including establishing joint ventures in preferential trade zones and pursuing qualified domestic production incentives. Strengthening supply chain visibility through digital platforms and collaborating with logistics specialists will mitigate tariff impact and ensure timely delivery.

Engagement with regulatory bodies to shape environmental and trade policy, alongside participation in industry consortia and standard-setting organizations, will reinforce a proactive stance on sustainability and market access. By fostering cross-industry partnerships-particularly with feed, cosmetic, and pharmaceutical stakeholders-businesses can co-develop value-added aspartic acid formulations and expand end-use applications.

Exploring Robust Research Methodology Ensuring Comprehensive Data Collection Rigorous Validation and Insightful Analysis to Illuminate Market Realities

This research synthesis combines rigorous secondary data analysis with targeted primary validation to ensure comprehensive market insights. Secondary sources include government trade statistics, customs databases, industry publications, and peer-reviewed journals. Harmonized Tariff Schedule records and global import-export data provided foundational visibility into trade flows and duty structures.

To validate findings, structured interviews with key opinion leaders-spanning feed nutritionists, pharmaceutical formulators, and chemical process engineers-offered qualitative context on production challenges and application trends. Data triangulation across independent sources ensured consistency and reliability, while sensitivity analyses stress-tested segmentation and regional insights under various policy scenarios.

The methodology adheres to established research standards, emphasizing transparency in data sourcing and clarity in analytical assumptions. Continuous monitoring of regulatory developments and technological innovations provided an up-to-date perspective, enabling dynamic updates to the market narrative and actionable recommendations for stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aspartic Acid market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aspartic Acid Market, by Product Type

- Aspartic Acid Market, by Production Process

- Aspartic Acid Market, by Grade

- Aspartic Acid Market, by Application

- Aspartic Acid Market, by Distribution Channel

- Aspartic Acid Market, by Region

- Aspartic Acid Market, by Group

- Aspartic Acid Market, by Country

- United States Aspartic Acid Market

- China Aspartic Acid Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Concluding Insights Synthesize Key Findings on Aspartic Acid Market Phenomena and Project Future Pathways for Stakeholder Decision Making

In summary, aspartic acid stands at a critical inflection point, where sustainable production innovations and evolving trade policies converge to reshape market dynamics. The ascent of bio-fermentation, empowered by enzymatic breakthroughs and AI-driven controls, underscores the transition toward greener, more efficient manufacturing. Concurrently, elevated tariff structures in the United States have prompted strategic realignments in sourcing strategies, compelling stakeholders to optimize cost management and supply resilience.

Segmentation analysis reveals nuanced growth pathways, from aquaculture feed enhancements and cosmetic pH regulation to specialty food fortification and injectable pharmaceutical formulations. Regional insights highlight the Americas’ regulatory incentives, EMEA’s sustainability mandates, and Asia-Pacific’s capacity advantages, collectively offering a mosaic of strategic opportunities.

As leading producers and end users navigate this landscape, collaborative innovation and data-informed decision-making will be paramount. The insights derived from this comprehensive review equip stakeholders to drive value creation, mitigate risks, and harness the full potential of aspartic acid in an increasingly competitive and sustainability-focused arena.

Engage Today with Associate Director Ketan Rohom to Secure Your Comprehensive Aspartic Acid Market Research Report and Gain Competitive Insights

To unlock a comprehensive understanding of the aspartic acid market’s transformative potential and equip your organization with strategic insights, reach out to Associate Director, Sales & Marketing, Ketan Rohom. Whether you seek in-depth analysis of tariff implications, segmentation dynamics, or regional trends, our team stands ready to guide you through the report’s findings and tailor solutions to your unique needs. Connect with Ketan today to secure a copy of the full market research report and position your business at the forefront of innovation in the aspartic acid sector.

- How big is the Aspartic Acid Market?

- What is the Aspartic Acid Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?