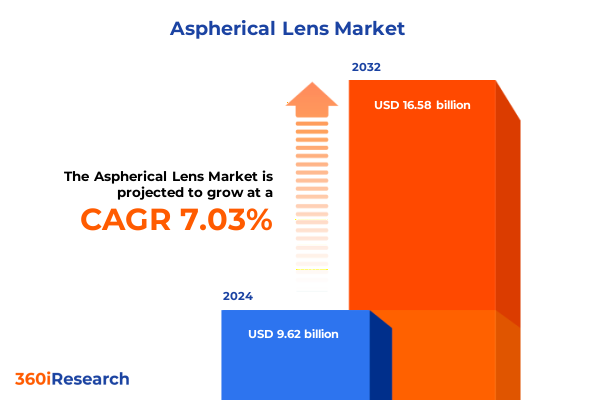

The Aspherical Lens Market size was estimated at USD 10.29 billion in 2025 and expected to reach USD 10.96 billion in 2026, at a CAGR of 7.04% to reach USD 16.58 billion by 2032.

Unveiling the Power of Aspherical Lens Technology to Revolutionize Optical Performance and Enable Next-Generation Imaging Solutions in Multiple Sectors

Aspheric lenses represent a paradigm shift in optical engineering by redefining how light is focused and aberrations are managed. Unlike conventional spherical lenses, which rely on a uniform curvature across their surfaces, aspherical lenses feature complex, non-spherical profiles that enable more precise convergence of light rays, dramatically improving clarity and resolution in optical systems. Their unique geometry minimizes common distortions such as spherical aberrations and astigmatism, allowing a single asphere to perform the function of an entire multi-element assembly while delivering superior image fidelity and light transmission.

Beyond their optical performance, aspheric lenses drive significant reductions in size and weight, addressing the growing demand for miniaturized and portable devices. By replacing multiple spherical elements with a single asphere, optical designers reduce material usage, assembly complexity, and mechanical tolerances. This efficiency has transformed product design in industries ranging from consumer electronics-where smartphones achieve DSLR-level imaging in compact form factors-to aerospace systems seeking lightweight precision optics for satellite imaging platforms.

Moreover, the adoption of aspheric elements has accelerated innovation in medical devices, virtual and augmented reality headsets, and automotive advanced driver-assistance systems. In clinical environments, high-precision aspheres enable compact endoscopes and real-time AI-integrated diagnostic scopes, enhancing patient outcomes. Simultaneously, their integration into AR/VR optics reduces distortion and motion sickness, improving user immersion. As industries continue to prioritize performance, portability, and cost-effectiveness, aspherical lens technology stands at the forefront of next-generation optical solutions.

Exploring the Transformative Shifts Driving the Evolution of Aspherical Lens Applications from Consumer Electronics to Advanced Medical Imaging Platforms

The aspherical lens landscape is experiencing unprecedented transformation driven by rapid innovation in digital imaging and consumer demands for superior visual experiences. At the heart of this shift is the smartphone camera revolution: aspheric elements are now integral to nearly every flagship device, enabling high-resolution photos even in low-light conditions by correcting spherical aberrations and reducing lens count for slimmer form factors. This trend has been further amplified by periscope zoom modules, where manufacturers leverage tailored aspheric curvatures to achieve impressive optical zoom ratios without compromising device thickness.

Concurrently, the automotive industry’s pivot toward advanced driver-assistance systems and autonomous vehicles has elevated the role of aspheric lenses in safety and navigation optics. These lenses ensure that cameras and lidar units capture accurate, distortion-free images critical for real-time object detection and collision avoidance. Automakers are increasingly collaborating with optics specialists to develop aspheric solutions that withstand automotive environmental stresses while delivering the high-precision performance necessary for lane-keeping assistance and parking guidance.

In parallel, medical imaging and life sciences are harnessing aspheric innovations to shrink device footprints and enhance diagnostic capabilities. Compact aspheric modules in endoscopes offer surgeons unprecedented clarity during minimally invasive procedures, while AI-powered diagnostic platforms rely on aspheric optics to feed high-resolution imagery into machine-learning algorithms. Likewise, immersive head-mounted displays in VR/AR applications benefit from aspheric surfaces that deliver wide fields-of-view with minimal edge distortion, enriching both entertainment and professional training experiences. These converging forces illustrate how aspherical lens technology is reshaping multiple industry verticals, underscoring its central role in future-proofing optical systems

Assessing the Cumulative Impact of 2025 United States Tariff Policies on the Supply Chain Dynamics and Cost Structures of Aspherical Lens Manufacturers

Throughout 2025, United States tariff policies have introduced a series of complexities affecting aspherical lens supply chains and cost structures. The initial imposition of a universal 10% “reciprocal” tariff on all imports on April 5 was quickly followed by a 90-day pause for non-retaliating nations announced on April 9, restoring most to the standard 10% rate except China. However, reciprocal duties on Chinese‐origin optical products were raised to a cumulative 145%, combining the base MFN duties, Section 301 levies, and additional IEEPA-related tariffs. Subsequent developments, including a temporary mutual tariff reduction agreement with China on May 12 and a U.S. Court of International Trade decision on May 28 enjoining IEEPA tariffs, have further complicated the landscape for importers and manufacturers alike.

These fluctuating policies have prompted leading industry players to adjust pricing strategies and diversify sourcing to mitigate margin erosion. For instance, EssilorLuxottica announced single-digit price increases across U.S. product lines to offset up to 145% tariffs on China-made lenses and frames, while intensifying efforts to shift production towards lower-tariff jurisdictions. Such measures reflect the broader imperative for aspherical lens manufacturers to agilely reconfigure global supply chains and reevaluate production footprints in response to evolving trade barriers.

Moreover, elevated duties on plastic frames, lens processing systems, and specialized manufacturing machinery-now subject to combined rates ranging from approximately 155% to 190%-have strained cost structures for U.S. companies dependent on imports for both finished optics and components. As importers face higher landed costs, there is a rising imperative to explore reshoring, alternative material sourcing, and tariff engineering strategies. These cumulative impacts underscore the importance of proactive trade risk management in preserving competitiveness and sustaining innovation in aspherical lens production.

Dissecting Key Segmentation Insights Revealing Material, End-Use, Distribution, Application, and Price Dynamics Shaping the Aspherical Lens Industry

Material type plays a pivotal role in aspherical lens design and performance, with glass variants like borosilicate and crown glass offering superior thermal stability and refractive index consistency for high-precision applications, while plastic polymers such as PC and PMMA deliver lightweight, impact-resistant solutions ideal for wearable devices. End-use segmentation reveals distinct vertical markets: in automotive, headlight and lidar systems demand rugged aspheres capable of accurate light projection and object detection; consumer electronics rely on camera and smartphone modules requiring compact, multi-function optics; industrial sectors integrate aspheres into laser equipment and machine vision platforms; and medical devices leverage endoscopy and ophthalmic applications for precise, minimally invasive diagnostics.

Distribution channels further influence market dynamics, as direct sales and distributor networks continue to serve high-touch, enterprise clients through offline channels, while manufacturer websites and third-party e-commerce platforms offer rapid prototyping, customization, and volume ordering online. Application segmentation underscores the diverse functional niches of aspherical lenses: illumination modules benefit from tailored light shaping, imaging systems encompass both medical imaging and surveillance optics, and laser systems exploit the precise beam collimation inherent in aspheric geometries. Finally, price range segmentation-from economy options suitable for cost-sensitive markets to standard configurations balancing performance and affordability, through premium lenses engineered for the most demanding optical requirements-shapes procurement strategies and product roadmaps, as manufacturers tailor portfolios to meet the varied needs of global customers.

This comprehensive research report categorizes the Aspherical Lens market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Price Range

- Application

- End Use

- Distribution Channel

Examining Key Regional Insights Highlighting Market Nuances and Growth Drivers Across the Americas, EMEA, and Asia-Pacific Regions for Aspherical Lenses

The Americas represent a mature aspherical lens ecosystem characterized by robust demand in both consumer and industrial segments. In the United States, widespread smartphone penetration and ongoing advancements in smart device cameras continue to fuel demand for precision aspheric optics, while the automotive sector’s investment in ADAS and autonomous vehicle sensor systems drives growth in high-performance lens modules. Concurrently, the region’s leading medical device manufacturers integrate compact aspheres into a wide range of diagnostic and surgical instruments, leveraging local innovation hubs to maintain a competitive edge.

Europe, Middle East & Africa (EMEA) benefits from established optical manufacturing clusters in Germany and France, where companies like Carl Zeiss AG and Schott AG lead in specialty glass aspheres for scientific instruments and industrial inspection systems. European markets emphasize sustainability and precision, encouraging advancements in low-waste production methods and high-index glass formulations. Meanwhile, the Middle East and Africa are witnessing emerging demand in automotive lighting and surveillance applications, supported by infrastructure development and increased security spending in key markets.

Asia-Pacific stands out as the fastest-growing region, with strong adoption of aspherical lenses in consumer electronics manufacturing centers such as China, Taiwan, and South Korea, alongside expanding automotive and medical device sectors. Sales in the Asia-Pacific region increased by over 10% year-on-year in Q1 2025, driven by rising domestic consumption and export-oriented production for global brands. This dynamic region’s combination of high-volume manufacturing capabilities and evolving end-use portfolios positions it at the forefront of aspherical lens innovation and market expansion.

This comprehensive research report examines key regions that drive the evolution of the Aspherical Lens market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Companies Forging Innovation and Competitive Strategies to Dominate the Aspherical Lens Market Landscape Globally

In the fiercely competitive aspherical lens landscape, Nikon Corporation and Canon Inc. continue to lead through their storied heritage in precision optics and ongoing investments in R&D. Nikon leverages its expertise in imaging and metrology to develop aspheric elements for high-end camera systems, scientific microscopes, and industrial inspection tools, while Canon’s broad portfolio spans camera lenses, medical imaging modules, and semiconductor lithography optics, underscoring its commitment to technical excellence and cross-industry applications.

Japanese glass and lens specialists such as HOYA Corporation and Asahi Glass Co. (AGC) hold prominent positions, offering premium high-index glass aspheres for demanding industrial and scientific use cases. European stalwarts Carl Zeiss AG and Schott AG distinguish themselves through cutting-edge glass formulations and advanced manufacturing processes, driving innovation in sectors ranging from aerospace surveillance to high-resolution medical imaging. These established players maintain market share through strategic partnerships and continuous technology enhancements.

Meanwhile, a growing cohort of Asia-based manufacturers-including Sunny Optical Technology, Largan Precision, and Tokai Optical-are capitalizing on regional production efficiencies to supply high-volume aspheric components to leading consumer electronics brands. Their agile manufacturing approaches, coupled with investments in polymer molding and precision non-rotational molding techniques, are enabling rapid scale-up to address surging global demand for compact optical modules. This diverse competitive landscape underscores the ongoing convergence of quality, cost, and innovation imperatives among key industry players.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aspherical Lens market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Asphericon GmbH

- Canon Inc.

- Edmund Optics Inc.

- GSEO Inc.

- Jenoptik AG

- Largan Precision Co., Ltd.

- LightPath Technologies, Inc.

- Nikon Corporation

- Olympus Corporation

- Optimax Systems, Inc.

- Panasonic Holdings Corporation

- Precision Optics Corporation, Inc.

- Ross Optical Industries

- Schott AG

- Sony Group Corporation

- Sumita Optical Glass, Inc.

- Thorlabs, Inc.

- Universe Kogaku (America) Inc.

- Zeiss Group

Offering Actionable Recommendations to Strategic Industry Leaders for Navigating Tariff Challenges and Capitalizing on Emerging Aspherical Lens Opportunities

Industry leaders should prioritize diversification of manufacturing and sourcing strategies to mitigate the impact of volatile tariff environments and geopolitical risks. By establishing production capacities in multiple low-tariff jurisdictions-and leveraging free-trade agreements-companies can reduce their exposure to abrupt duty increases while maintaining supply chain resilience. Furthermore, strategic partnerships with local optical firms and contract manufacturers can facilitate quicker market entry and optimize logistics costs, ensuring continuity in material flow and inventory planning.

To address the high production costs associated with precision aspherical optics, firms must invest in advanced manufacturing technologies such as ultra-precision CNC machining, diamond turning, and injection molding of polymer aspheres. These methods not only deliver tighter tolerances but also shorten lead times and lower per-unit costs at scale. Implementing Industry 4.0 practices-incorporating real-time process monitoring and predictive maintenance-will further enhance throughput and product quality, enabling rapid iteration on optical designs and accelerating time-to-market for new lens models.

Lastly, companies should expand digital distribution channels by enhancing their e-commerce capabilities and developing direct-to-consumer platforms. Providing virtual prototyping tools, online customization interfaces, and data-driven supply chain transparency can streamline customer experiences and capture growth in online procurement. Collaboration with third-party marketplaces and B2B portals will allow manufacturers to tap into broader buyer networks, driving volume growth and increasing brand visibility in both mature and emerging markets.

Detailing the Rigorous Research Methodology Underpinning This Comprehensive Analysis of the Aspherical Lens Market Spectrum

This report’s comprehensive analysis draws upon a blend of primary and secondary research methodologies to ensure accuracy and depth. Primary research included structured interviews with industry executives, engineers, and supply chain experts across key geographies, as well as detailed surveys of optical component purchasers in target end-use verticals. These engagements provided firsthand perspectives on market challenges, innovation trajectories, and evolving customer requirements.

Secondary research encompassed an exhaustive review of trade publications, technical journals, company annual reports, and government trade data to contextualize market trends and policy impacts. Industry conferences and webinars, including presentations by leading optics associations, informed our understanding of emerging manufacturing techniques and regulatory developments. In addition, reputable news outlets and specialized blogs were monitored to capture real-time insights into tariff adjustments and competitive moves.

Quantitative data analysis involved synthesizing publicly available shipment volumes, patent filings, and import/export statistics to construct a robust framework for segment and regional insights. We employed both qualitative assessments and quantitative triangulation to validate critical findings and ensure consistency across multiple data sources. Rigorous cross-verification of information underpins the credibility of the strategic recommendations and segmentation insights presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aspherical Lens market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aspherical Lens Market, by Material Type

- Aspherical Lens Market, by Price Range

- Aspherical Lens Market, by Application

- Aspherical Lens Market, by End Use

- Aspherical Lens Market, by Distribution Channel

- Aspherical Lens Market, by Region

- Aspherical Lens Market, by Group

- Aspherical Lens Market, by Country

- United States Aspherical Lens Market

- China Aspherical Lens Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Concluding Insights Summarizing the Strategic Significance and Future Trajectory of Aspherical Lens Technology in Modern Optics

Aspherical lens technology stands at the confluence of optical performance, miniaturization, and cost efficiency, driving its adoption across a broad spectrum of industries. From enabling cutting-edge smartphone cameras to enhancing the safety of autonomous vehicles, and from refining medical imaging tools to powering next-generation AR/VR devices, the versatility of aspheric optics is unparalleled. By capturing critical segmentation, regional, and competitive insights, this summary has illuminated the diverse factors shaping the market landscape and identified concrete levers for strategic differentiation.

The cumulative impact of U.S. tariff policies in 2025 has underscored the necessity for agile supply chain strategies and proactive risk management. At the same time, the accelerating convergence of high-precision manufacturing and digital distribution channels presents compelling opportunities for market players to optimize their value chains and capture emerging application niches. As organizations chart their growth trajectories, the ability to integrate advanced manufacturing techniques, leverage diversified sourcing, and engage in data-driven customer outreach will determine competitive positioning.

Ultimately, the aspherical lens market is poised for sustained evolution, fueled by innovation in materials science, optical design, and system-level integration. Companies that adopt the actionable recommendations outlined herein-grounded in empirical research and real-world case studies-will be best placed to navigate uncertainties and harness the transformational potential of aspheric optics in the years ahead.

Take Action Today to Unlock Advanced Aspherical Lens Market Intelligence and Propel Your Business Forward with an Exclusive Industry Report

Ready to gain an unparalleled strategic edge through expert market intelligence on aspherical lenses? Contact Ketan Rohom, Associate Director of Sales & Marketing, to unlock the full breadth of insights your organization needs to navigate complex global dynamics, address tariff challenges head-on, and capitalize on emerging opportunities in material innovation, advanced manufacturing, and digital distribution channels. This comprehensive report delivers deep-dive analyses, robust segmentation insights, and actionable recommendations-from optimizing supply chains to designing premium product portfolios-and is tailored to support your decision-making at the highest levels. Secure your copy today to empower your teams with data-driven strategies and position your business at the forefront of the aspherical lens industry’s growth trajectory.

- How big is the Aspherical Lens Market?

- What is the Aspherical Lens Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?