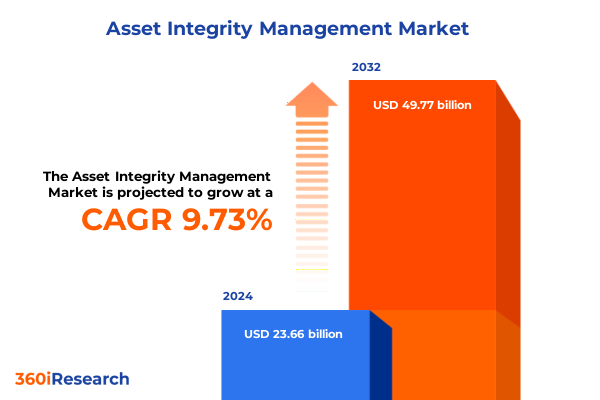

The Asset Integrity Management Market size was estimated at USD 25.66 billion in 2025 and expected to reach USD 27.83 billion in 2026, at a CAGR of 9.92% to reach USD 49.77 billion by 2032.

Proactive Frameworks for Safeguarding Industrial Asset Integrity and Optimizing Operational Continuity in Complex Industrial Environments

Organizations operating critical infrastructure increasingly depend on robust asset integrity management frameworks to ensure safety, reliability, and continuity of operations. By integrating best practices across inspection, maintenance, and monitoring, enterprises can preemptively identify degradation, mitigate risks, and avoid unplanned downtime. Asset integrity management transcends reactive repair strategies by embedding a culture of continuous evaluation and improvement, which directly supports regulatory compliance and environmental stewardship. In today’s high-stakes industrial environment, the ability to maintain assets at peak performance not only safeguards personnel and communities but also underpins financial stability and brand reputation.

As industry complexities multiply, driven by aging infrastructure and heightened performance expectations, the imperative for proactive stewardship of physical assets has never been greater. Rapid advances in sensing technologies, data analytics, and digital twins enable more precise condition assessments, while evolving regulatory frameworks demand rigorous documentation and traceability of integrity activities. Consequently, asset integrity management is morphing from a purely technical discipline into a strategic competency that aligns operations with broader business goals. Through a foundation of risk-based inspection, predictive maintenance, and real-time monitoring, organizations can transform their approach from episodic interventions to continuous asset health optimization.

Converging Technological Innovations and Regulatory Reforms Driving Transformative Shifts in Industrial Asset Integrity Management Practices

The asset integrity management landscape is undergoing a paradigm shift as digitalization, automation, and artificial intelligence converge to redefine inspection, maintenance, and monitoring paradigms. Advanced machine learning algorithms now analyze sensor streams in real time, detecting subtle anomalies that would elude traditional techniques. Meanwhile, robotics and drones are taking on hazardous inspection tasks in pipelines, tanks, and vessels, minimizing human exposure to safety risks and enhancing coverage in hard-to-reach areas. These technology-driven transformations foster a more agile, data-centric integrity framework, setting new performance benchmarks for accuracy, speed, and cost efficiency.

Equally influential are regulatory reforms and evolving industry standards that emphasize risk-based methodologies and lifecycle management. Regulators are increasingly mandating more stringent proof of asset fitness, compelling operators to adopt holistic strategies encompassing design validation, operational monitoring, and end-of-life decommissioning. In response, service providers are bundling multidisciplinary competencies-from nondestructive testing techniques to predictive analytics-into unified integrity solutions. The result is a more cohesive ecosystem where value flows from integrated service delivery, cross-domain expertise, and collaborative partnerships between operators, technology vendors, and certification bodies.

Assessing the Multifaceted Ripple Effects of 2025 United States Tariff Measures on Asset Integrity Management Costs Supply Chains and Compliance

In 2025, the United States implemented a series of tariff adjustments affecting raw materials, specialized inspection equipment, and instrumentation critical to asset integrity management. These measures have introduced upward pressure on procurement costs for high-precision sensors, advanced calibration tools, and corrosion-resistant alloys. Operators now face a more complex supply chain landscape, where strategic sourcing decisions must balance cost, availability, and compliance with evolving trade regulations. The net effect is a recalibration of vendor relationships, inventory management, and capital planning to maintain continuity of inspection and maintenance cycles.

Furthermore, the tarifas have prompted companies to reassess regional sourcing strategies and invest in alternative materials or domestically manufactured components. While the immediate impact has been a moderation in equipment utilization rates due to extended lead times, the long-term trajectory favors supply chain resilience and local ecosystem development. Industry stakeholders are collaborating to establish consortia that pool demand and coordinate procurement schedules, thereby diluting the tariff burden on individual operators. As a result, asset integrity management programs are evolving to incorporate greater flexibility and risk mitigation in vendor engagement frameworks.

Unveiling Critical Service End Use and System Type Dimensions That Shape Tailored Asset Integrity Management Solutions Across Diverse Industrial Scenarios

A nuanced understanding of service type segmentation reveals that inspection, maintenance, and monitoring each contribute distinct value streams to integrity management. Inspection spans predictive, preventive, and routine methodologies that balance early detection with scheduled evaluations. Maintenance, encompassing corrective, predictive, and preventive approaches, ensures that identified anomalies are addressed promptly to restore or enhance asset functionality. Monitoring, whether continuous or periodic, sustains real-time visibility into asset health and informs data-driven decision-making across both inspection and maintenance workflows.

When end use industry segmentation is considered, tailored integrity strategies emerge. In chemical processing environments, stringent regulatory mandates drive high-frequency monitoring and nondestructive testing via acoustic emission and ultrasonic techniques. Mining operations prioritize preventive maintenance in remote sites, while oil and gas enterprises integrate upstream, midstream, and downstream workflows with radiographic and eddy current testing. Power generation facilities demand continuous thermal and vibration diagnostics, and water treatment plants rely heavily on visual inspections and magnetic particle testing to uphold safety and quality standards.

Examining system type dimensions uncovers further granularity. Heat exchangers, with their complex tube bundles, benefit from ultrasonic thickness measurements, whereas pipelines and piping infrastructure demand inline and portable eddy current tools for corrosion detection. Tanks and vessels require acoustic emission and radiographic evaluation to detect flaws in high-pressure or cryogenic applications. Layering inspection technique segmentation ensures that each system type receives the optimal blend of visual, ultrasonic, radiographic, magnetic particle, and acoustic emission testing to maximize diagnostic accuracy and operational resilience.

This comprehensive research report categorizes the Asset Integrity Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- System Type

- Inspection Technique

- End Use Industry

Divergent Regional Dynamics Influencing Asset Integrity Management Approaches Across the Americas Europe Middle East Africa and AsiaPacific

Across the Americas, asset integrity management strategies emphasize advanced digital integration and stringent compliance with regulatory bodies such as OSHA and Environment Canada. North American operators are investing heavily in predictive analytics and real-time monitoring networks, while Latin American markets are accelerating adoption through publicprivate partnerships that upgrade aging infrastructure. These initiatives are underpinned by local technology providers forging alliances with global analytics firms to bridge capability gaps and transfer best practices.

In Europe, Middle East, and Africa, diverse regulatory environments and infrastructure maturity levels shape differentiated integrity approaches. Western Europe leads in lifecycle asset management, embracing digital twins and riskbased inspection protocols. The Middle East’s oil and gas sector invests in drone-enabled inspections and corrosion management alliances, whereas Africa’s mining regions prioritize preventive maintenance and capacity building through international cooperation. Crossregional collaboration is rising, as stakeholders seek to harmonize standards and leverage shared digital platforms for more efficient integrity workflows.

AsiaPacific markets display a blend of rapid industrial expansion and modernization of legacy assets. China and Southeast Asia are deploying continuous monitoring systems at scale, integrating IoT sensors with cloudbased analytics. Japan’s energy and petrochemical operators pioneer AIenhanced diagnostics, while Australia’s mining industry focuses on remote condition monitoring supported by satellite communications. Collectively, the region’s dynamism is driving competitive service offerings and localized innovation hubs that cater to both global standards and unique operational demands.

This comprehensive research report examines key regions that drive the evolution of the Asset Integrity Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Competitive Landscape Analysis Spotlighting Leading Asset Integrity Management Providers and Their Differentiated ValuePropositions

A set of leading providers have differentiated themselves through investments in integrated data analytics platforms, modular inspection fleets, and global service networks. These companies leverage proprietary software solutions that amalgamate historical inspection records, live sensor feeds, and predictive models to deliver prescriptive maintenance schedules. By bundling nondestructive testing techniques such as ultrasonic, radiographic, and magnetic particle inspections with advanced monitoring hardware, they offer turnkey integrity packages that reduce vendor complexity and accelerate deployment timelines.

Partnership strategies are also shaping competitive positioning. By aligning with specialized robotics manufacturers and AI startups, key companies can deploy autonomous inspection vehicles and machine vision systems that enhance coverage in hazardous or confined spaces. Furthermore, strategic alliances with certification bodies and academic research centers reinforce credibility and drive the development of industry standards. This collaborative model not only fortifies service portfolios but also accelerates innovation cycles, enabling providers to deliver nextgeneration integrity solutions that anticipate emerging industry needs.

This comprehensive research report delivers an in-depth overview of the principal market players in the Asset Integrity Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aker Solutions ASA

- Applus Services SA

- Axess Group

- Bureau Veritas SA

- Dacon Inspection Technologies Co., Ltd.

- Det Norske Veritas Group

- Dexon Technology PLC

- EM&I Ltd.

- Fluor Corporation

- Intertek Group PLC

- John Wood Group PLC

- LifeTech Engineering Ltd.

- Metegrity Inc.

- Oceaneering International, Inc.

- Rosen Swiss AG

- SGS Société Générale de Surveillance SA

- TechnipFMC plc

- Tuv Nord Group

- Twi Ltd.

Targeted Strategic Initiatives for Industry Leaders to Enhance Asset Availability Minimize Risk and Drive Sustainable Value Through Integrity Management

Industry leaders should embed a riskbased mindset across all levels of their organization, integrating real time monitoring outputs and predictive analytics into executive dashboards. By prioritizing highcriticality assets and aligning inspection schedules with operational risk profiles, decisionmakers can optimize resource allocation and minimize unplanned outages. Establishing crossfunctional teams that encompass operations, HSE, and engineering ensures that integrity considerations are woven into capital planning, design reviews, and procurement strategies from project inception through decommissioning.

Moreover, forging strategic partnerships with technology innovators and service specialists is essential to maintain a competitive edge. Co developing pilot programs for droneenabled inspections or AI driven corrosion modeling allows organizations to test and scale emerging solutions with minimal disruption. To sustain momentum, leaders should invest in upskilling workforces through targeted training in digital tools, data interpretation, and advanced NDT techniques. This human capital focus will amplify technology ROI and foster a culture of continuous improvement that elevates overall asset performance.

Rigorous MultiSource Data Collection and Analytical Techniques Underpinning Robust Insights in Asset Integrity Management Research

The research underpinning these insights employed a rigorous methodology combining primary and secondary data sources. Interviews with asset integrity managers, operations directors, and technical specialists across key industries provided firsthand perspectives on emerging challenges and solution adoption. These qualitative inputs were complemented by an extensive review of regulatory publications, industry standards, and peer reviewed journals to ensure a comprehensive understanding of best practices.

Quantitative analysis was conducted on aggregated performance metrics drawn from global service providers, equipment manufacturers, and end users. Statistical techniques, including multivariate correlation and trend analysis, were applied to operational data sets-such as inspection intervals, failure rates, and repair lead times-to identify performance drivers and benchmark levels. This structured approach, coupled with scenario planning and sensitivity testing, ensures that the conclusions and recommendations presented are both robust and adaptable to evolving market conditions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Asset Integrity Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Asset Integrity Management Market, by Service Type

- Asset Integrity Management Market, by System Type

- Asset Integrity Management Market, by Inspection Technique

- Asset Integrity Management Market, by End Use Industry

- Asset Integrity Management Market, by Region

- Asset Integrity Management Market, by Group

- Asset Integrity Management Market, by Country

- United States Asset Integrity Management Market

- China Asset Integrity Management Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Strategic Imperatives and Future Outlook for EnterpriseAsset Integrity Management in the Face of Evolving Industrial and Regulatory Pressures

As industrial ecosystems continue to evolve, asset integrity management emerges as a critical enabler of operational excellence, safety, and regulatory compliance. The convergence of digital technologies, shifting trade policies, and dynamic regional landscapes demands that organizations adopt a holistic integrity approach that spans inspection, maintenance, and monitoring. By doing so, enterprises can not only mitigate risk and avoid costly downtime but also unlock pathways to sustainable performance improvements.

Looking ahead, the integration of AI driven diagnostics, autonomous inspection vehicles, and digital twins will further revolutionize integrity practices, enabling more precise forecasting and adaptive maintenance strategies. Industry stakeholders who embrace these innovations, while anchoring their programs in riskbased frameworks and crossfunctional collaboration, will be best positioned to navigate complexity and seize value. Ultimately, a strategic commitment to asset integrity management will serve as the cornerstone for resilient and futureproof industrial operations.

Engage with Ketan Rohom Associate Director Sales and Marketing to Unlock Exclusive Asset Integrity Management Intelligence

To explore in-depth market dynamics and gain tailored insights into asset integrity management, please connect with Ketan Rohom, Associate Director, Sales & Marketing. Ketan can guide you through the breadth and depth of our comprehensive research report, ensuring you identify the critical intelligence needed to inform your strategic roadmap. Engaging directly will allow you to capitalize on the nuanced analysis, actionable recommendations, and segmentation insights that empower operational resilience and competitive advantage. Reach out to Ketan to unlock exclusive access to data-driven perspectives that will position your organization for sustained success in an increasingly complex industrial asset landscape.

- How big is the Asset Integrity Management Market?

- What is the Asset Integrity Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?