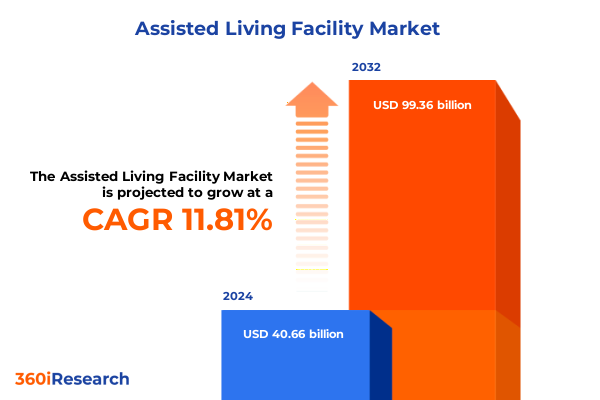

The Assisted Living Facility Market size was estimated at USD 45.08 billion in 2025 and expected to reach USD 50.00 billion in 2026, at a CAGR of 11.94% to reach USD 99.36 billion by 2032.

Changing Demographics, Elevated Resident Expectations, and Emerging Challenges Are Shaping the Future of Assisted Living Facilities in Today’s Care Landscape

The assisted living facility sector is being reshaped by demographic shifts, as the leading edge of the baby boomer generation enters advanced age and life expectancy continues to climb. The rapid expansion of the population aged eighty and older underscores the urgent need to expand and enhance supportive housing options for seniors who require varying levels of assistance with daily living activities. This demographic phenomenon is coupled with increasingly discerning resident expectations, spanning from personalized wellness programs to hospitality-inspired service models, placing unprecedented demands on operators to innovate and differentiate their offerings.

Concurrently, the sector grapples with significant workforce challenges driven by national staffing shortages and high turnover rates. Skilled nursing and caregiving roles face persistent vacancy pressures, prompting communities to adopt novel retention strategies and invest in virtual training platforms to upskill existing staff. These labor dynamics, combined with rising operational costs and regulatory evolution, establish a complex backdrop for industry stakeholders as they strategize for sustainable growth in an environment where quality of care and operational efficiency are paramount.

Technological Innovations, Holistic Wellness Models, and Multigenerational Engagement Initiatives Are Driving a New Era of Enhanced Assisted Living Experiences

Digital transformation and emerging wellness paradigms are converging to introduce a suite of innovative capabilities in assisted living facilities. Intelligent access control systems, powered by cloud-based platforms, now enable remote management of building security, energy controls, and resident mobility, while artificial intelligence algorithms analyze behavioral data to predict health risks and optimize staff deployment. Telehealth integration has become a standard offering, reducing hospital transfers and strengthening continuity of care through real-time monitoring and virtual consultations.

Simultaneously, assisted living communities are elevating lifestyle experiences through hospitality-led design and amenity diversification. Residents increasingly encounter culinary venues ranging from artisanal bistros to microbreweries, fostering social engagement and cultural enrichment within the community. Intergenerational programming and flexible living spaces accommodate shifts in resident preferences, enabling families to participate in lifelong learning opportunities and community events. This blend of high-tech solutions and wellness-first models is setting a new benchmark for quality of life in senior care environments.

Escalating Material Costs, Supply Chain Complexities, and Labor Pressures from 2025 U.S. Tariff Policies Are Reshaping Construction and Operations of Assisted Living Facilities Nationwide

The resurgence of broad tariffs on key imported materials has exerted upward pressure on construction and renovation projects for assisted living facilities. Industry participants report that levies on steel, aluminum, and copper have added between eight and ten percent to material expenses, complicating capital expenditure planning and potentially delaying new community openings. This tariff uncertainty has emerged alongside high interest rates, contributing to the most subdued spring development pipeline since 2019.

Moreover, the imposition of 25% duties on steel and aluminum imports has had a direct impact on structural framing, cladding, and critical HVAC systems. Residential construction costs have increased substantially, with industry associations warning that consumers and developers alike will bear these additional costs through higher project bids and protracted build timelines. Operators find themselves navigating price escalation clauses and renegotiating financing arrangements to maintain project viability amid escalating input costs.

Supply chain complexities and labor market dynamics further compound these challenges. Longer lead times for metal fabrication and specialized components have become commonplace, while immigration enforcement policies threaten to shrink the skilled labor pool by up to fifteen percent. As a result, assisted living facility operators are adjusting procurement strategies, stockpiling critical materials, and exploring domestic sourcing options to mitigate the cumulative impact of tariffs on both construction and ongoing maintenance costs.

Diverse Facility Types, Service Portfolios, Demographic Profiles, Ownership Models, and Care Focus Dimensions Provide Nuanced Insights into Assisted Living Facility Market Dynamics

The assisted living facility market reveals a nuanced tapestry of community formats and specialized care pathways that correspond to diverse resident profiles and preferences. Community-Based Residential Facilities and Residential Care Apartment Complexes typically cater to residents seeking a blend of communal amenities and private living spaces, while Adult Family Homes offer a personalized, home-like environment with a lower resident-to-caregiver ratio. This range of facility types underscores the need for operators to tailor their service models to accommodate varying degrees of independence and supervision.

Service offerings within these communities span both medical and non-medical domains. Primary healthcare services provide routine assessments and chronic disease management, whereas specialized therapies address rehabilitative and cognitive health needs. Non-medical services such as housekeeping, meal delivery, and transportation form the backbone of daily life support, contributing significantly to resident satisfaction and quality of life. The intersection of these service streams creates opportunities for operators to bundle care solutions that align with individual wellness goals.

Demographic segmentation further informs strategic positioning, with facility preferences and care requirements evolving across age cohorts ranging from residents under sixty-five to those exceeding eighty-five years of age. Younger seniors may prioritize social engagement programs and fitness-focused activities, while older cohorts often require enhanced physical health and wellness interventions, including memory care. Meanwhile, the operational scale-whether a community is categorized as large, medium, or small-affects economies of scale, capital allocation, and the ability to deploy advanced technologies.

Ownership models also play a pivotal role in shaping market dynamics. Private ownership structures may pursue aggressive expansion and premium amenity rollouts, whereas non-profit organizations often prioritize affordability and community outreach. Government-owned facilities tend to emphasize regulatory compliance and public accountability. Across these ownership frameworks, a growing emphasis on memory and cognitive health, alongside physical wellness and social engagement programs, is driving innovation in care delivery and programming effectiveness.

This comprehensive research report categorizes the Assisted Living Facility market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Facility Type

- Services

- Age Group

- Facility Size

- Ownership Model

- Care Focus

Distinct Regulatory Environments, Cultural Preferences, and Demographic Patterns Across the Americas, EMEA, and Asia-Pacific Are Influencing Assisted Living Facility Growth Trajectories

In the Americas, particularly within the United States and Canada, the assisted living landscape is marked by mature regulatory environments and highly competitive metropolitan markets where occupancy rates exceed ninety percent. Persistent supply shortages in key urban centers are driving pre-leasing strategies, with prospective residents and their families securing placements years in advance to hedge against limited inventory. Operators in this region are also navigating evolving licensure requirements and public funding frameworks that influence capital deployment and service reimbursement models.

Across Europe, Middle East, and Africa, aging populations are exerting pressure on care provider networks as the share of individuals over sixty-five is projected to approach thirty percent of the European Union’s population by 2055. Germany stands at the forefront with the highest number of institutional beds, supported by government-backed infrastructure funds and regulatory adjustments that facilitate facility expansion. In the United Kingdom, private-sector operators dominate the market, leveraging financial incentives and rightsizing policies to encourage seniors to transition into age-appropriate living environments. Emerging markets in the Middle East and Africa remain relatively underpenetrated but show potential through public–private partnerships and targeted foreign investment.

In the Asia-Pacific region, rapid demographic shifts are propelling market growth, with China’s over-sixty population nearing twenty percent and India’s senior demographic forecasted to swell dramatically by midcentury. Providers in these markets are experimenting with hybrid models that blend traditional familial care paradigms with Western-style community amenities. Technological adoption, including AI-assisted monitoring and telehealth, is being championed in Singapore to address workforce constraints, while private developers in India are racing to bridge the gap between growing demand and limited supply.

This comprehensive research report examines key regions that drive the evolution of the Assisted Living Facility market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Growth, Technological Adoption, and Service Differentiation from Leading Assisted Living Providers Reveal Competitive Trends and Performance Drivers

Brookdale Senior Living continues to assert its market leadership by operating over fifty thousand units across the United States and deploying capital toward strategic acquisitions that expand its geographical footprint. The company has also been at the vanguard of implementing AI-driven health monitoring systems and predictive maintenance technologies to enhance resident safety and facility efficiency. Brookdale’s scale advantage enables it to negotiate favorable supply agreements for both construction materials and medical equipment, supporting its cost management efforts.

Atria Senior Living has distinguished itself through a hospitality-centric service ethos, focusing on upscale amenities and wellness programming that cater to affluent residents seeking a lifestyle-driven environment. The company’s investments in smart living technologies and resident engagement platforms position it to deliver personalized experiences, from curated dining events to on-demand telehealth integrations. Atria’s urban presence in multiple metropolitan areas underscores its strategy of meeting high-end demand in densely populated locales.

Life Care Services (LCS) manages a diversified portfolio of continuing care retirement communities, balancing independent living with assisted living and memory care offerings. LCS has forged partnerships with healthcare providers to streamline medical service delivery and leverage telemedicine for specialty consultations. The company’s proficiency in community development and asset management enables it to optimize occupancy and enhance operational resilience in a competitive market landscape.

Other notable operators, including sector stalwarts and regional challengers, are increasingly pursuing strategic collaborations, technology alliances, and service differentiation as they seek to capture share in an environment where scale efficiencies and care quality are the primary competitive levers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Assisted Living Facility market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aegis Living

- AlerisLife Inc.

- Atria Senior Living, Inc.

- Belmont Village, L.P.

- BlueAtria Assisted Living Pte Ltd.

- Bonaventure Senior Living

- Brookdale Senior Living Inc.

- Catholic Eldercare

- Chartwell Retirement Residences

- Clariane

- Enlivant

- Extendicare

- Frontier Management, LLC

- Gardant Management Solutions

- Heritage Operations Group

- Infinite Australia Aged Care Pty Ltd.

- Ingenia Lifestyle

- Integral Senior Living, LLC

- Juniper Communities, LLC

- Kaijian Elderly Care

- Kisco Senior Living

- Lebenshilfe Hanover

- Merrill Gardens L.L.C.

- ORPEA Group

- Red Crowns

- Renshoutang by Perennial Holdings Private Limited

- Retiregenie Pte Ltd

- Sonida Senior Living Corporation

- Sunrise Senior Living, Inc.

- The Ensign Group, Inc.

- The Windsor Retirement Residence

- Verve Senior Living

Actionable Strategies Emphasizing Technology Integration, Service Diversification, and Operational Resilience to Empower Assisted Living Facility Leaders for Sustainable Success

Industry leaders should prioritize the integration of advanced technology ecosystems across clinical, operational, and lifestyle domains. Investments in predictive analytics, remote monitoring platforms, and digital engagement tools not only improve care outcomes but also streamline workforce utilization and regulatory compliance. By adopting agile technology roadmaps, operators can phase implementations to balance capital deployment with measurable performance gains.

Simultaneously, diversifying service portfolios to encompass holistic wellness, therapeutic programming, and social engagement will meet rising resident expectations and unlock ancillary revenue streams. Partnerships with health systems and community organizations can facilitate the delivery of specialized care services, while branded hospitality collaborations enhance amenity offerings and resident satisfaction.

To mitigate input cost pressures, operators should develop strategic sourcing alliances and explore alternative procurement channels for construction materials and medical supplies. Leveraging group purchasing organizations and regional cooperative models can provide scale-based cost advantages. In parallel, adopting flexible workforce strategies-such as cross-training, remote staffing support, and incentive-based retention programs-will address labor shortages and sustain service quality.

Finally, tailoring offerings to specific demographic and psychographic segments-ranging from active seniors seeking lifestyle-oriented communities to residents requiring memory and cognitive health support-allows operators to create differentiated value propositions. Structured go-to-market plans should reflect regional regulatory nuances and cultural preferences, ensuring that community design and service programming resonate with target audiences.

Comprehensive Primary Interviews, In-Depth Secondary Analysis, and Rigorous Data Triangulation Define the Research Approach Underpinning Our Assisted Living Facilities Market Insights

This analysis is founded upon a blend of primary and secondary research methodologies designed to ensure depth and accuracy. Primary research encompassed structured interviews with senior executives from leading assisted living operators, discussions with regulatory authorities, and consultation sessions with senior care specialists to capture firsthand insights into operational strategies and market challenges.

Secondary research involved an exhaustive review of public filings, trade association reports, government data sets, and industry publications. Data triangulation techniques were applied to resolve discrepancies and validate trends across multiple sources, ensuring a robust evidence base. Quantitative data pertaining to demographic patterns, care utilization rates, and construction cost indices were cross-referenced with qualitative perspectives from thought leaders and frontline practitioners.

The research framework adhered to ethical standards for confidentiality and data integrity. All proprietary information was anonymized when presented in aggregate form, while publicly available data were cited to maintain transparency. The comprehensive approach ensures that findings reflect the latest industry developments and provide a reliable foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Assisted Living Facility market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Assisted Living Facility Market, by Facility Type

- Assisted Living Facility Market, by Services

- Assisted Living Facility Market, by Age Group

- Assisted Living Facility Market, by Facility Size

- Assisted Living Facility Market, by Ownership Model

- Assisted Living Facility Market, by Care Focus

- Assisted Living Facility Market, by Region

- Assisted Living Facility Market, by Group

- Assisted Living Facility Market, by Country

- United States Assisted Living Facility Market

- China Assisted Living Facility Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Integrated Insights on Emerging Trends, Segment Dynamics, and Strategic Imperatives Offer a Holistic Perspective on the Assisted Living Facility Sector’s Future Directions

The assisted living facility sector stands at a pivotal juncture where demographic imperatives, technological innovation, and policy dynamics converge to create both significant challenges and exciting opportunities. Demographic trends driven by an expanding population of older adults underscore the necessity for differentiated service models that combine clinical excellence with lifestyle enrichment.

Technological advancements and tariff-driven cost pressures are reshaping how operators approach facility development, resource management, and resident engagement. The imperative to adopt digital solutions and strategic procurement practices has never been greater. At the same time, the diverse spectrum of facility types, service offerings, and ownership models requires nuanced strategies that align with regional and demographic specificities.

By incorporating holistic wellness frameworks, fostering strategic industry partnerships, and embracing data-driven decision-making, assisted living providers can navigate the evolving landscape with agility and resilience. The insights presented herein offer a roadmap for leaders seeking to deliver exceptional care, optimize operational performance, and achieve sustainable growth in a sector poised for continued transformation.

Engage Directly with Ketan Rohom to Access In-Depth Assisted Living Facility Market Intelligence and Secure Your Strategic Advantage with the Full Research Report

To explore these comprehensive findings and gain a competitive edge in the assisted living facilities sector, contact Ketan Rohom, Associate Director of Sales & Marketing. He can guide you through the insights and tailor the report to your organization’s strategic objectives, ensuring you have the detailed market intelligence required to make informed decisions and drive growth.

- How big is the Assisted Living Facility Market?

- What is the Assisted Living Facility Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?