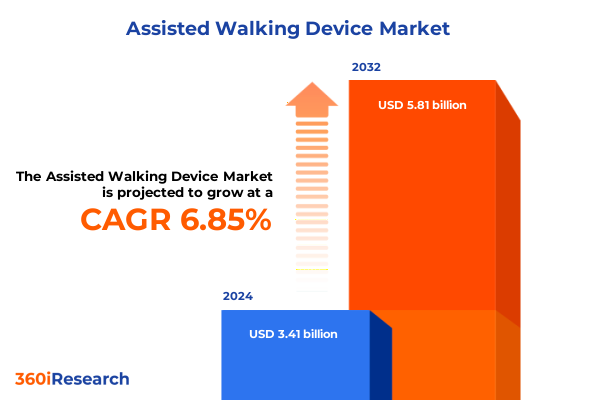

The Assisted Walking Device Market size was estimated at USD 3.62 billion in 2025 and expected to reach USD 3.83 billion in 2026, at a CAGR of 6.99% to reach USD 5.81 billion by 2032.

Pioneering Mobility Solutions Are Redefining Assisted Walking Device Applications and Patient-Centered Care with Advanced Technologies

Assisted walking devices are increasingly vital as demographic shifts and rising prevalence of mobility impairments converge to create urgent demand for advanced solutions. Individuals living with spinal cord injuries, neurological disorders, or age-related frailty require innovative technologies that restore autonomy and enhance quality of life. Early adopters like Esther Klang, who experienced independent ambulation for the first time in 18 years using Wandercraft’s Atalante X, underscore the transformative power of AI-driven exoskeletons in clinical and personal settings.

The spectrum of mobility aids has expanded far beyond traditional walkers and canes, encompassing full-body and lower-limb exoskeletons, indoor and outdoor robotic walkers, sensor-enabled smart canes and crutches, as well as advanced rollators. Manufacturers are integrating artificial intelligence and real-time data analytics to personalize support patterns, while ergonomic designs and lightweight materials improve user comfort and portability.

Clinical integration and reimbursement pathways are evolving to support broader adoption. For instance, Medicare began covering robotic exoskeletons for eligible beneficiaries in late 2024, enabling increased access through certified rehabilitation centers and personal use programs. Collaborative models between device makers, clinicians, and payers are accelerating pathways to market and fostering new distribution channels.

Breakthrough Robotics, AI, and Sensor Innovations Are Catalyzing a Transformative Era for Assisted Walking Devices Across Rehabilitation and Daily Mobility

Breakthrough advancements in robotics, artificial intelligence, and sensor technologies are propelling assisted walking devices into a new era of functional sophistication. Powered exoskeletons now employ machine learning algorithms to interpret muscle signals and predict gait patterns in real time, offering adaptive support that responds to individual user needs. These capabilities are enabling devices to operate autonomously outside of controlled clinical settings, extending their utility into daily life.

Sensor integration-ranging from motion and pressure sensors to ultrasonic detectors-is enhancing situational awareness and safety. Smart canes equipped with MEMS motion sensors and voice assistants can detect obstacles in both indoor and outdoor environments and provide real-time navigation prompts. Such features not only improve mobility for visually impaired users but also deliver critical health monitoring data to caregivers and healthcare providers.

Sustainability and eco-friendly manufacturing practices are gaining traction as companies seek to reduce environmental footprints and appeal to socially responsible consumers. Concurrently, telehealth and remote monitoring platforms are becoming integral, allowing clinicians to perform virtual assessments, adjust device parameters remotely, and deliver timely maintenance or software updates. This convergence of digital health and mobility technology is setting a new standard for patient support and continuity of care.

Assessing the Comprehensive Implications of 2025 US Tariff Policies on the Supply Chain and Affordability of Assisted Walking Devices

The introduction of new U.S. tariff policies in 2025 has reshaped the cost and logistical landscape for manufacturers and importers of assisted walking devices. A universal 10% import tariff on medical device imports eliminated longstanding duty-free treatments, while reciprocal measures imposed punitive rates of up to 54% on Chinese exports and 25% on Canadian and Mexican goods. These broad duties have disrupted global supply chains and heightened procurement costs for key components.

Industry stakeholders experienced immediate market reactions, with medical device stocks falling sharply as companies anticipated compressed margins and higher end-user prices. Firms dependent on overseas manufacturing and assembly, such as Boston Scientific, Medtronic, and Siemens Healthineers, faced one-time earnings adjustments that weighed on valuations before recovery strategies could be implemented.

Section 301 tariff increases on critical inputs-including up to 100% duties on syringes and needles and 50% on rubber medical gloves-further exacerbated cost pressures for consumable accessories used alongside walking aids. Manufacturers are compelled to reassess sourcing strategies and explore nearshoring or vertical integration to mitigate financial risks and maintain competitive pricing structures.

Decoding Market Opportunities Through Multifaceted Segmentation Insights Spanning Product Types, Channels, Applications, End Users, and Emerging Technologies

When analyzing the market through the lens of product type, assisted walking devices encompass a range of solutions from full-body and lower-limb exoskeletons to indoor and outdoor robotic walkers, smart canes and smart crutches, traditional rollators, and standard walkers. Each subcategory addresses distinct mobility challenges, driving specialized design considerations and clinical applications.

Distribution channels extend beyond conventional medical supply outlets to include home healthcare stores, hospitals and specialty clinics, e-commerce platforms, manufacturer websites, and retail pharmacies. These diversified pathways reflect evolving buyer preferences for convenience, clinical oversight, and integrated service models that bundle device delivery with training and maintenance support.

End users span adult, geriatric, and pediatric populations, each with unique physiological and functional requirements. Pediatric devices prioritize growth adaptability and engagement, adult solutions balance occupational or recreational demands, and geriatric aids emphasize ease of use, stability, and fall prevention.

Application areas range from home-based mobility assistance to structured rehabilitation programs in occupational and physical therapy, as well as sports and athletics contexts focused on injury prevention and performance training. The modularity of device features allows manufacturers to tailor offerings to these diverse use cases.

Technological segmentation highlights AI-assisted, mechanical, and sensor-based devices, with the latter subdivided into motion sensor and pressure sensor categories. This stratification underscores the progression from purely mechanical frameworks to data-driven systems that deliver real-time feedback and automation.

This comprehensive research report categorizes the Assisted Walking Device market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Application

- End User

- Distribution Channel

Unveiling Regional Dynamics and Growth Catalysts in the Americas, Europe Middle East & Africa, and Asia-Pacific Assisted Walking Device Markets

In the Americas, robust reimbursement frameworks in the United States-exemplified by Medicare coverage for personal exoskeletons-have catalyzed adoption in outpatient clinics and home settings. Canada’s collaboration between academic research centers and clinical providers fosters technology validation, while Brazil’s expanding private healthcare sector is beginning to integrate robotic-assisted devices into specialized rehabilitation programs.

Europe, the Middle East, and Africa present a mosaic of regulatory and economic conditions. Western Europe’s CE marking process ensures device safety and performance, supporting widespread use in rehabilitation centers. In the Middle East, government investments-such as the Dubai Health Authority’s multimillion-dollar allocation for robotic rehabilitation-signal strategic prioritization of advanced medical technologies, though cultural perceptions and infrastructure gaps in certain regions temper widespread acceptance.

Asia-Pacific markets are witnessing accelerated growth through strategic partnerships and supportive policies. For example, regional alliances between robotics innovators and distributors in Southeast Asia are streamlining market entry, while Japan’s METI and South Korea’s government subsidies for exoskeleton R&D have spurred clinical adoption rates. Nevertheless, variations in healthcare funding and clinician training across countries create uneven access and integration of these advanced mobility solutions.

This comprehensive research report examines key regions that drive the evolution of the Assisted Walking Device market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders and Innovative Entrants Driving Technological Advancements and Strategic Partnerships in Assisted Walking Devices

Leading industry players are forging partnerships and expanding distribution networks to strengthen their market positions. Ekso Bionics, for instance, established exclusive distribution agreements with National Seating & Mobility and Bionic Prosthetics & Orthotics Group to broaden access to its Ekso Indego Personal exoskeleton across the U.S. complex rehabilitation and orthotics channels. ReWalk Robotics continues to refine its at-home exoskeleton platforms, introducing stair and curb navigation capabilities designed for personal mobility enhancement.

Innovative entrants are also making inroads: Wandercraft’s Atalante X has garnered attention through high-profile demonstrations, and WeWALK’s Smart Cane 2 leverages TDK’s MEMS motion and ultrasonic sensors to offer real-time obstacle detection and voice-guided navigation for visually impaired users. These collaborative and technologically driven strategies underscore a competitive landscape focused on user-centric design, clinical validation, and strategic alliances.

This comprehensive research report delivers an in-depth overview of the principal market players in the Assisted Walking Device market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Drive DeVilbiss Healthcare, Inc.

- Dynarex Corporation

- Ekso Bionics Holdings, Inc.

- GF Health Products, Inc.

- Invacare Corporation

- Medline Industries, L.P.

- Nova Medical Products, Inc.

- Ottobock SE & Co. KGaA

- Permobil AB

- Pride Mobility Products Corporation

- Sunrise Medical LLC

Actionable Strategic Recommendations for Industry Stakeholders to Navigate Market Complexities and Drive Sustainable Growth in Assisted Walking Devices

Manufacturers and stakeholders should prioritize diversification of supply chains by identifying alternate sourcing regions and exploring nearshoring opportunities to mitigate exposure to broad tariff policies and import duties. By establishing regional manufacturing hubs or forging joint ventures with local partners, companies can secure more resilient operations and reduce lead times.

Investing in AI and sensor integration capabilities will differentiate product portfolios through enhanced personalization, predictive maintenance, and remote monitoring features. Strategic alliances with technology providers and healthcare platforms can accelerate product development cycles and facilitate seamless interoperability with digital health ecosystems.

Engagement with policymakers, industry associations, and payer organizations is essential to shape favorable regulatory and reimbursement pathways. Collaborative advocacy for targeted tariff exemptions and inclusion of assisted walking devices in public health programs will be critical to sustaining affordability, innovation, and patient access in the face of evolving trade policies.

Outlining Rigorous Research Methodology and Analytical Framework Underpinning Our Comprehensive Study of the Assisted Walking Device Market

This report’s insights derive from a rigorous multi-stage research methodology, encompassing primary interviews with device manufacturers, clinicians, payers, and distribution channel experts to capture diverse perspectives. Secondary research involved systematic review of industry publications, regulatory filings, corporate press releases, and government tariff notices to ensure comprehensive coverage of market dynamics and policy developments.

Quantitative data were triangulated across multiple sources, including company financial disclosures, healthcare supplier reports, and patent databases, to validate trends and identify emerging growth drivers. Analytical frameworks such as SWOT analysis, value chain assessment, and technology readiness evaluations underpinned our structured insights, ensuring a balanced and objective foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Assisted Walking Device market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Assisted Walking Device Market, by Product Type

- Assisted Walking Device Market, by Technology

- Assisted Walking Device Market, by Application

- Assisted Walking Device Market, by End User

- Assisted Walking Device Market, by Distribution Channel

- Assisted Walking Device Market, by Region

- Assisted Walking Device Market, by Group

- Assisted Walking Device Market, by Country

- United States Assisted Walking Device Market

- China Assisted Walking Device Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Concluding Perspectives on Key Insights and Strategic Imperatives Shaping the Future of Assisted Walking Device Innovation and Accessibility

The assisted walking device market is undergoing rapid transformation fueled by technological innovation, shifting regulatory landscapes, and evolving patient needs. Advanced robotics, AI-driven personalization, and enhanced sensor integration are converging to create more effective, user-friendly mobility solutions. At the same time, global trade policies and regional reimbursement environments present both challenges and opportunities for market participants.

By understanding the cumulative impact of tariffs, segmentation nuances, regional dynamics, and competitive strategies, stakeholders can navigate uncertainties and capitalize on growth levers. Collaborative partnerships across technology, clinical, and policy spheres will be essential to drive sustained innovation and broaden accessibility for populations worldwide.

Take Immediate Action to Enhance Patient Mobility and Operational Excellence—Secure Your Comprehensive Assisted Walking Device Market Report Today

To secure your competitive edge and empower decision-making in the assisted walking device market, contact Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. His expertise will guide you through the tailored insights and strategic analyses you need to optimize product development, distribution strategies, and stakeholder engagement. Reach out today to purchase the comprehensive market research report and gain unparalleled clarity on evolving technologies, regulatory shifts, and market dynamics.

- How big is the Assisted Walking Device Market?

- What is the Assisted Walking Device Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?