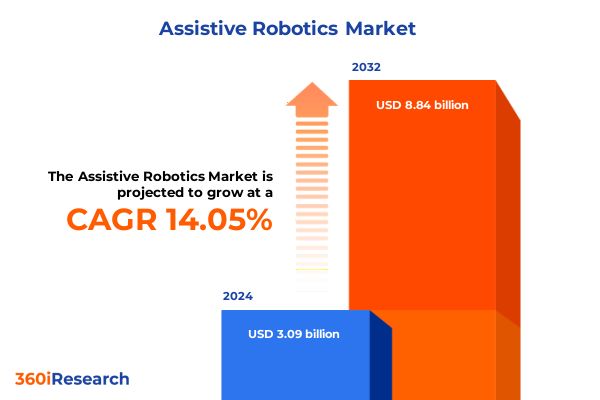

The Assistive Robotics Market size was estimated at USD 3.49 billion in 2025 and expected to reach USD 3.96 billion in 2026, at a CAGR of 14.19% to reach USD 8.84 billion by 2032.

Unveiling the Emergence of Assistive Robotic Technologies Shaping Human Capability Enhancement across Diverse Environments

Assistive robotics stands at a pivotal juncture, redefining the interface between humans and intelligent machines. What began as basic automation to aid repetitive industrial tasks has evolved into sophisticated systems capable of physical support, emotional engagement, and contextual understanding. Today’s assistive robots integrate cutting-edge sensors, advanced machine learning, and adaptive control algorithms, enabling responsive interactions that align with human behavior and intent. This convergence of technological strides has broadened the potential of assistive machines from controlled environments into daily living, therapeutic regimens, and public safety.

In the context of aging demographics and rising demand for remote care solutions, assistive robots present transformative opportunities for healthcare providers, social institutions, and family caregivers. Innovations in socially assistive designs now foster companionship and cognitive stimulation, while physically assistive systems enhance mobility and task execution for individuals with impairments. As organizations explore deployment pathways, strategic alignment with user needs, regulatory frameworks, and ethical considerations is essential. Consequently, understanding this market’s trajectory requires a nuanced examination of technological capabilities, stakeholder motivations, and emerging value propositions.

Mapping the Radical Transformations Revolutionizing Accessibility and Integration of Assistive Robotics within Healthcare and Social Support Systems

The last decade has witnessed radical transformations that redefine what assistive robotics can achieve. Machine learning architectures have shifted from deterministic rule-based frameworks to self-supervised models capable of real-time adaptation. This evolution enables robots to navigate unstructured environments, recognize nuanced human expressions, and learn novel tasks without exhaustive programming. Concurrently, advancements in lightweight materials and compact actuation have reduced power requirements, facilitating extended operation in home and field settings. These technical breakthroughs, coupled with more affordable sensing modules, accelerate the proliferation of both research prototypes and commercial offerings.

Furthermore, the integration of cloud computing platforms and edge-AI infrastructures is catalyzing new service models, such as remote monitoring and predictive maintenance for assistive solutions. Transitioning from one-off device purchases to service-oriented engagements encourages ecosystem development, where data-driven insights inform continuous improvement. As a result, end users benefit from increasingly personalized support, and service providers can optimize performance through iterative learning loops. This shift underscores a broader movement toward democratizing assistive technology, making sophisticated robotics accessible across socioeconomic strata.

Evaluating the Far-Reaching Consequences of United States Tariff Adjustments on Assistive Robotics Supply Chains and Stakeholder Dynamics

The implementation of revised tariff schedules in 2025 has introduced a complex layer of supply chain recalibration for companies deploying assistive robotics in the United States. Prior to the adjustments, a significant portion of critical components, including specialized sensors and precision actuators, was imported under favorable duty regimes. With the reclassification of certain product categories and higher ad valorem duties on subassemblies, manufacturers face elevated costs that ripple through procurement, production, and end-user pricing.

In response, OEMs are reevaluating sourcing strategies, seeking to diversify suppliers across non-tariffed regions and exploring domestic partnerships for niche component fabrication. These shifts add logistical complexity, as firms must balance lead-time constraints with cost optimization. Additionally, stakeholders are witnessing an uptick in vertical integration efforts, where end-equipment manufacturers collaborate closely with component producers to safeguard supply continuity and mitigate duty impacts. This collaboration is also fueling co-innovation initiatives focused on tariff-compliant design modifications, such as modular component architectures that redistribute value across lower-duty classifications.

Moreover, the tariff-driven cost pressures have stimulated renewed interest in robotic reuse, refurbishment, and aftermarket service offerings. As acquisition becomes more resource-intensive, both public institutions and corporate buyers are increasingly evaluating total lifecycle economics. They seek solutions that extend operational lifespan through software upgrades and component retrofits, thereby deferring full-scale capital outlays. The cumulative effect of these strategies reshapes the landscape for service providers, maintenance networks, and financing entities, underscoring the need for flexible business models that can accommodate shifting regulatory and fiscal environments. In parallel, advocacy groups are engaging in policy dialogues to highlight the societal implications of elevated costs on vulnerable populations reliant on assistive solutions.

Illuminating Core Market Segmentation Patterns That Drive Adoption and Customization of Assistive Robotics in Varied Operational Contexts

Market segmentation offers a lens through which the diversity and specialization within assistive robotics become apparent. By type, the divide between physically assistive robots, which support mobility and task execution, and socially assistive robots, designed for interaction and cognitive engagement, underscores the dual axes of functional and emotional utility. These distinctions influence product development priorities, as physically focused systems demand robust mechanical design and motion control, while socially oriented platforms emphasize natural language processing, affective computing, and user experience.

When examined through the mobility perspective, mobile robots capable of navigating dynamic environments unlock new applications in assisted living and public service, whereas stationary units excel in controlled settings like rehabilitation clinics and manufacturing lines. The balance between portability and operational stability further dictates hardware specifications and power management considerations. In application terms, assistive robotics spans companionship roles that combat social isolation, defense applications that enhance operational readiness, elderly assistance that promotes autonomy, handicap support that restores functional independence, industrial deployments for process augmentation, public relations use cases to humanize brand interactions, and surgical assistance platforms that increase procedural precision and safety.

Distribution channel segmentation also plays a critical role in market penetration. Offline channels remain vital for demonstrations, personalized fitting, and training services that accompany complex robotics, whereas online platforms accelerate access to standardized solutions and digital support. The interplay between these channels shapes go-to-market strategies, as providers calibrate the balance between hands-on sales experiences and scalable e-commerce frameworks. Together, these segmentation pillars delineate a multifaceted ecosystem in which design, deployment, and distribution converge to meet diverse end-user needs.

This comprehensive research report categorizes the Assistive Robotics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Mobility

- Application

- Distribution Channel

Uncovering Significant Regional Dynamics Shaping the Growth, Adoption Patterns, and Deployment of Assistive Robotics Across Global Territories

Regional dynamics profoundly influence the pace and nature of assistive robotics adoption. In the Americas, expansive healthcare networks and robust venture capital activity have accelerated pilot programs in hospitals and senior care facilities, enabling rapid prototyping and iterative feedback loops. Meanwhile, regulatory pathways in North America emphasize safety validation and data privacy, prompting developers to integrate secure communications and fail-safe mechanisms from the outset. Cross-border collaboration between the United States and Canada has further fostered knowledge exchange, particularly in assistive devices for aging populations.

Across Europe, the Middle East & Africa, diverse policy frameworks and socioeconomic conditions yield a spectrum of adoption scenarios. Western Europe’s advanced regulatory standards and established insurance reimbursements support clinical trials and home-deployment case studies. In contrast, emerging markets in the Middle East and Africa present untapped demand for cost-effective, ruggedized assistive platforms that address infrastructure constraints and healthcare accessibility gaps. Partnerships between public health agencies and robotics firms are thus pivotal, as they finance localized adaptations and training programs.

In the Asia-Pacific region, governmental initiatives to enhance eldercare services and improve surgical outcomes have driven significant investments in assistive robotics. Domestic manufacturers in countries like Japan and South Korea leverage deep semiconductor and mechatronics expertise to bring next-generation solutions to market rapidly. Meanwhile, emerging economies across Southeast Asia are witnessing pilot deployments in community health centers, supported by international development grants that prioritize scalable, low-cost designs. The result is a heterogeneous regional landscape characterized by both cutting-edge innovation hubs and burgeoning adoption corridors.

This comprehensive research report examines key regions that drive the evolution of the Assistive Robotics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Market-Leading Organizations Pioneering Innovations and Strategic Collaborations in the Assistive Robotics Ecosystem

A cohort of pioneering organizations is shaping the trajectory of assistive robotics through visionary R&D investments and strategic alliances. Leading manufacturers of industrial automation are extending their portfolios to include physically assistive robots tailored for rehabilitation centers and eldercare settings. Simultaneously, technology startups are emerging with platform-agnostic designs that emphasize modularity and rapid customization, challenging traditional hardware incumbents. These startups frequently collaborate with academic institutions and medical centers to co-develop prototypes and refine user-centric features based on clinical feedback.

Major players in the consumer electronics domain are leveraging their experience in mass-market production to drive down costs and scale socially assistive models for educational and companionship applications. Collaborations with healthcare providers are also on the rise, enabling seamless integration between therapeutic protocols and robotic interventions. Moreover, established medical device companies are entering the space by incorporating assistive robotics into surgical suites and physical therapy regimens, reinforcing the convergence between robotics and traditional medical equipment.

Beyond product innovation, these organizations are forging value-chain partnerships with software providers, system integrators, and financing firms to deliver end-to-end solutions. Such alliances facilitate bundled offerings that combine hardware, software as a service, and post-sales support under unified contracts. As a result, buyers benefit from simplified procurement processes and comprehensive maintenance agreements, while providers gain recurring revenue streams and deeper customer engagement. This collaborative ecosystem underscores the multifaceted nature of the assistive robotics market and highlights the need for agile strategies that balance technological differentiation with ecosystem orchestration.

This comprehensive research report delivers an in-depth overview of the principal market players in the Assistive Robotics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bionik Laboratories Corp.

- Blue Frog Robotics SAS

- Cyberdyne Inc.

- Double Robotics, Inc.

- Dream Face Technologies LLC

- Ekso Bionics Holdings, Inc.

- Focal Meditech BV

- Gogoa Mobility Robots SL

- Hocoma AG

- Hyundai Motor Company

- Intuitive Surgical, Inc.

- Kinova Inc.

- Mojin Robotics GmbH

- Neofect Co., Ltd

- Open Bionics Ltd.

- Palladyne AI Corp.

- Panasonic Corporation

- ReWalk Robotics Ltd.

- Rex Bionics Plc

- SoftBank Robotics Group Corp.

- Stryker Corporation

- Tyromotion GmbH

- Ubtech Robotics Corp.

- UBTECH Robotics, Inc.

- Wandercraft SAS

Proposing Targeted Strategic Imperatives for Industry Stakeholders to Capitalize on Emerging Opportunities in Assistive Robotics

Industry stakeholders must prioritize the integration of adaptive learning capabilities to ensure that assistive systems evolve in tandem with user needs. By investing in modular software frameworks that support over-the-air updates, organizations can deliver continuous performance enhancements and respond swiftly to emerging safety requirements. At the same time, forging cross-sector partnerships with healthcare providers, insurers, and academic centers will enable co-validation of efficacy and cost-effectiveness, building trust among end-users and payers.

Additionally, establishing localized manufacturing and service hubs can mitigate tariff-related risks and reduce lead times for critical component replacements. Such geographic diversification also strengthens resilience against geopolitical disruptions and supply-chain bottlenecks. From a go-to-market perspective, blending experiential offline demonstrations with digital trial platforms will expand reach while maintaining the personalized guidance essential for complex robotic solutions. Finally, embracing transparent data-governance practices and ethical AI frameworks will safeguard user privacy and foster social acceptance, ultimately accelerating regulatory approvals and adoption rates.

Detailing Rigorous Methodological Approaches Employed to Analyze Assistive Robotics Market Dynamics and Technology Integration Trends

This research adopts a blended methodology, combining primary qualitative interviews with industry leaders and end-users alongside secondary analysis of public filings, patent databases, and academic publications. Field engagements at clinical pilot sites and manufacturing facilities provided firsthand observations of deployment challenges and user interactions. These site visits were complemented by structured expert panels comprising engineers, healthcare practitioners, and regulatory specialists to validate technical feasibility and compliance considerations.

Quantitative insights were derived from triangulation across multiple proprietary and open-source datasets, focusing on adoption indices, technology readiness levels, and supply-chain risk metrics. Advanced analytics techniques, including cluster analysis and causal impact modeling, were applied to uncover hidden correlations between design parameters and user satisfaction outcomes. Throughout, rigorous data cleaning protocols and bias-mitigation strategies were employed to ensure the reliability and integrity of findings. This comprehensive approach enables robust insights into both current market dynamics and future trajectories of assistive robotics innovation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Assistive Robotics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Assistive Robotics Market, by Type

- Assistive Robotics Market, by Mobility

- Assistive Robotics Market, by Application

- Assistive Robotics Market, by Distribution Channel

- Assistive Robotics Market, by Region

- Assistive Robotics Market, by Group

- Assistive Robotics Market, by Country

- United States Assistive Robotics Market

- China Assistive Robotics Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Synthesizing Key Insights to Illuminate the Strategic Imperatives and Future Trajectory of Assistive Robotics Development and Adoption

In synthesizing the insights from technological shifts, tariff impacts, segmentation nuances, regional disparities, and corporate strategies, it becomes evident that the assistive robotics domain is at an inflection point. The convergence of machine learning advancements and service-oriented business models is unlocking new use cases that extend far beyond traditional automation. Meanwhile, evolving regulatory landscapes and cost pressures compel stakeholders to adopt more flexible sourcing and lifecycle management approaches.

Ultimately, organizations that embrace cross-functional collaboration, agile product development, and ethical AI principles will emerge as leaders in this rapidly evolving field. By aligning innovation roadmaps with real-world user needs and policy frameworks, they can deliver solutions that drive both societal impact and sustainable growth. This strategic orientation will define the next era of assistive robotics, marked by inclusive design, accessible deployment, and resilient value chains.

Engaging Industry Leaders to Access Premium Market Research Insights in Assistive Robotics Through Direct Collaboration with Sales & Marketing Experts

To secure unparalleled intelligence on trends, competitive landscapes, and strategic inflection points, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Engaging directly will provide exclusive access to the full market research report, designed to equip decision-makers with deep insights into product development roadmaps, partnership opportunities, and investment prioritization. The tailored briefing offers customized data extracts, scenario modeling, and expert interpretation to drive informed strategy. Don’t miss this opportunity to accelerate your market positioning and unlock the next frontier in assistive robotics innovation.

- How big is the Assistive Robotics Market?

- What is the Assistive Robotics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?