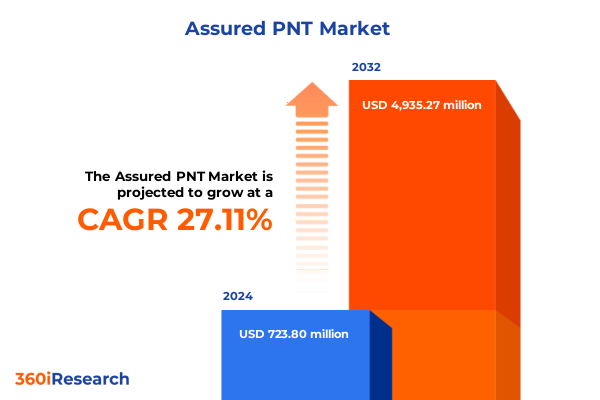

The Assured PNT Market size was estimated at USD 918.64 million in 2025 and expected to reach USD 1,136.45 million in 2026, at a CAGR of 27.14% to reach USD 4,935.27 million by 2032.

Unveiling the Crucial Role of Robust Positioning, Navigation, and Timing Capabilities in Enabling Modern Infrastructure, Commerce, and Defense

Positioning, navigation, and timing capabilities underpin nearly every aspect of modern technology and infrastructure. From enabling precision agriculture to guiding autonomous vehicles and safeguarding national defense systems, reliable PNT solutions are woven into the fabric of the global economy. Yet as dependency on satellite navigation grows, so too does the vulnerability of these systems to interference, jamming, and emerging cybersecurity threats. In this climate of heightened operational risk, organizations must adopt resilient and assured PNT strategies that balance accuracy, availability, and integrity.

This executive summary synthesizes the latest technological advancements, policy shifts, and market dynamics that are shaping the assured PNT sector. It outlines transformative innovations across satellite constellations, hybrid navigation architectures, and inertial sensing techniques. It also examines the ripple effects of 2025 United States tariff measures on supply chains and development incentives. By highlighting key segmentation and regional insights, as well as profiling leading industry players, this document lays the groundwork for strategic decision-making that addresses both immediate challenges and long-term opportunities in the PNT domain.

Exploring the Paradigm Shifts and Technological Convergence Reshaping Next Generation Positioning, Navigation, and Timing Ecosystems for Enhanced Resilience

The assured PNT landscape is undergoing a generational transformation driven by the convergence of next-generation satellite constellations, advanced inertial technologies, and emerging digital frameworks. Recent upgrades to legacy global navigation satellite systems have unlocked new frequencies and enhanced signal robustness, while hybrid navigation approaches seamlessly integrate GNSS data with inertial sensors to mitigate signal loss in contested environments. Concurrently, advances in fiber-optic and MEMS inertial units are delivering unparalleled precision, supporting applications that demand centimeter-level accuracy.

These technological shifts are further catalyzed by the proliferation of autonomous platforms and 5G-enabled positioning services, which require ultra-low latency and multi-modal redundancy to ensure mission-critical reliability. As artificial intelligence and machine learning techniques become more deeply embedded within navigation algorithms, the industry is poised to realize self-optimizing systems capable of real-time anomaly detection and adaptive error correction. This era of PNT innovation not only enhances resilience against spoofing and jamming but also paves the way for new use cases across transportation, urban infrastructure, and defense.

Assessing the Aggregate Effects of United States Tariff Policies on Assured Positioning, Navigation, and Timing Supply Chains and Innovation Incentives

In 2025, a suite of tariff actions enacted by the United States government has introduced significant headwinds across the assured PNT supply chain. Components critical to GNSS receivers and inertial measurement units-ranging from specialized semiconductors to precision oscillators-are now subject to elevated import duties. These measures have pressured margins for domestic integrators and compelled manufacturers to reassess sourcing strategies, accelerating a shift toward localized production and alternative supplier networks.

The cumulative effect of these tariffs extends beyond cost inflation; they have also influenced investment flows and innovation incentives. Faced with higher entry barriers for certain imported subcomponents, research and development initiatives are recalibrating toward modular architectures that can accommodate multiple sources of input. Meanwhile, defense agencies and government entities are exploring joint procurement frameworks to leverage economies of scale and mitigate individual vendor risks. This realignment underscores the growing imperative for robust policy engagement and supply-chain resilience planning among PNT stakeholders.

Revealing Critical Segmentation Perspectives That Uncover Technology, Component, Application and End-User Dynamics Driving Assured PNT Strategies

A nuanced examination of market segmentation reveals how technology, component type, application, and end-user dynamics collectively influence strategic priorities within the assured PNT sector. Technology-driven differentiation emerges as a pivotal factor: while global navigation satellite systems remain the cornerstone, the rise of hybrid navigation pathways and inertial solutions is redefining performance benchmarks. BeiDou, Galileo, GLONASS, and GPS each offer distinct resilience profiles, and organizations are tailoring multi-constellation deployments to safeguard critical operations against regional signal degradation.

Component type segmentation further delineates competitive landscapes, with antenna innovations spanning helical, horn, and patch designs that optimize gain and interference resilience. Receiver architectures are bifurcating into multi-frequency and single-frequency platforms to address cost versus performance trade-offs. In parallel, signal processor evolution-ranging from ASIC implementations to adaptable DSP and FPGA frameworks-enables bespoke navigation algorithms. Software capabilities, including augmentation, filtering, and multipath mitigation, serve as force multipliers, transforming raw sensor data into actionable navigation solutions.

Application-focused insights highlight diversified PNT adoption across agriculture, aviation, defense, maritime, transportation, and unmanned aerial systems. Precision farming and field mapping solutions are increasingly reliant on sub-decimeter accuracy, while commercial, cargo, and passenger aviation markets integrate assured PNT into cockpit and unmanned flight control systems. Defense applications span land, air, naval, and space domains where uninterruptible navigation is non-negotiable. Maritime stakeholders balance coastal shipping and offshore operations, and transportation operators leverage fleet management and real-time routing. The unmanned aerial vehicle segment is bifurcated into commercial inspection platforms and military reconnaissance drones.

End-user segmentation underscores distinct value propositions for aerospace and defense enterprises, agricultural producers, consumer electronics manufacturers, government agencies, infrastructure developers, and transportation and logistics organizations. Each cohort faces unique performance, regulatory, and lifecycle management considerations, informing tailored product roadmaps and service delivery models.

This comprehensive research report categorizes the Assured PNT market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Component Type

- Application

Mapping Geopolitical, Regulatory, and Infrastructure Influences Across Americas, Europe Middle East & Africa, and Asia-Pacific That Shape Assured PNT Adoption Pathways

Regional dynamics in the assured PNT market illustrate how geopolitical, regulatory, and infrastructure factors shape adoption trajectories. In the Americas, investments in resilient national PNT infrastructures are accelerating, supported by public-private partnerships and defense modernization programs that emphasize secure GNSS backup and anti-jamming capabilities. Local industry clusters are fostering innovation hubs focused on satellite augmentation and hybrid navigation solutions.

In Europe, Middle East & Africa, a mosaic of standards and spectrum policies is driving collaborative initiatives to harmonize regional PNT frameworks. The European GNSS Agency’s efforts to bolster Galileo services, coupled with emerging defense collaborations in the Gulf, are expanding demand for assured navigation products. Africa’s development corridors leverage satellite positioning for infrastructure planning and resource monitoring, presenting new entry points for hybrid and inertial technologies.

Asia-Pacific presents a fragmented yet high-growth environment, as national navigation system rollouts-including BeiDou domestic initiatives-spur indigenous manufacturing and integration expertise. Rapid urbanization and smart city programs in East Asia elevate requirements for centimeter-level positioning, while Southeast Asian maritime channels prioritize reliable navigation for commercial shipping and offshore energy sectors. Across the region, competitive subsidies and strategic alliances are shaping a diverse ecosystem of PNT solution providers.

This comprehensive research report examines key regions that drive the evolution of the Assured PNT market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Top Industry Innovators Leveraging Hardware, Software, and Service Synergies to Deliver Next-Level Assured PNT Solutions

Leading players in the assured PNT arena are distinguished by their ability to innovate across hardware, software, and services while navigating an evolving policy landscape. Established satellite system operators and chipset manufacturers continue to expand multi-frequency, multi-constellation product lines that enhance coverage and resilience. At the same time, specialist vendors of inertial sensors and signal processing modules are forging strategic partnerships to deliver integrated navigation subsystems.

Software-centric companies are differentiating through advanced augmentation services, cloud-based analytics, and adaptive filtering algorithms that enable clients to extract maximum fidelity from heterogeneous data sources. Meanwhile, system integrators and defense contractors are capitalizing on growing demand for turnkey assured PNT solutions, bundling hardware, middleware, and managed services to streamline deployment and lifecycle support. This collaborative ecosystem underscores a shifting value chain, where cross-domain alliances and open-architecture frameworks catalyze rapid innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Assured PNT market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apple Inc.

- BAE Systems plc

- Cobham Limited

- Garmin Ltd.

- General Dynamics Corporation

- Google LLC

- Honeywell International Inc.

- Intel Corporation

- Jackson Labs Technologies, Inc.

- L3Harris Technologies, Inc.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Qualcomm Incorporated

- Raytheon Technologies Corporation

- Safran S.A.

- Satelles, Inc.

- Septentrio N.V.

- Spirent Communications plc

- STMicroelectronics N.V.

- Trimble Inc.

- u-blox Holding AG

Empowering Industry Leadership Through Modular Architectures, Multi-Modal Redundancy, and Collaborative Innovation Ecosystems for Sustained Competitive Differentiation

Industry leaders seeking to capitalize on assured PNT opportunities should prioritize strategic investments in modular architecture and multi-modal redundancy. By adopting open standards and application programming interfaces, organizations can future-proof solutions against rapid technology cycles and policy shifts. Collaborative partnerships spanning satellite operators, sensor manufacturers, and software houses will be essential to integrate best-in-class components and deliver seamless end-to-end navigation resilience.

Moreover, embedding advanced analytics and machine learning capabilities into navigation systems can accelerate anomaly detection, predictive maintenance, and dynamic threat mitigation. Engaging proactively with regulatory bodies and participating in standards development forums will ensure that product roadmaps align with emerging compliance requirements. Finally, fostering a culture of continuous R&D investment and cross-sector knowledge sharing will position enterprises to stay ahead of adversarial threats and capitalize on new market segments.

Ensuring Analytical Rigor Through a Multi-Stage Methodology Integrating Primary Interviews, Secondary Sources, and Scenario-Based Modeling

This research employs a multi-stage methodology that combines primary interviews with key stakeholders, secondary data analysis, and scenario-based modeling to ensure comprehensive market coverage. Primary qualitative insights were gathered through in-depth discussions with satellite operators, chipset vendors, defense integrators, and end-user representatives across agriculture, transportation, and infrastructure sectors. These interviews provided nuanced perspectives on technology adoption, policy impacts, and future use cases.

Secondary research leveraged authoritative technical papers, regulatory filings, and patent databases to validate market trends and competitive positioning. A cross-validation approach reconciled disparate data points through triangulation, enhancing the accuracy and reliability of the findings. Scenario-based modeling was then applied to explore the implications of emerging tariff regimes, constellation modernization timelines, and hybrid navigation deployments under varying policy and technology adoption assumptions. This rigorous approach ensures that the report’s strategic recommendations are grounded in robust evidence and reflective of real-world constraints.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Assured PNT market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Assured PNT Market, by Technology

- Assured PNT Market, by Component Type

- Assured PNT Market, by Application

- Assured PNT Market, by Region

- Assured PNT Market, by Group

- Assured PNT Market, by Country

- United States Assured PNT Market

- China Assured PNT Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 2703 ]

Concluding Perspectives on Navigating Technological, Geopolitical, and Supply Chain Complexities to Secure Resilient Assured PNT Capabilities

The assured positioning, navigation, and timing sector stands at a critical juncture, where technological innovation intersects with geopolitical dynamics and evolving threat landscapes. As organizations integrate advanced satellite, inertial, and hybrid solutions, they will unlock new capabilities for precision agriculture, autonomous mobility, and resilient defense systems. However, supply chain disruptions and policy uncertainties-exemplified by the 2025 tariff measures-underscore the necessity of strategic agility.

By synthesizing insights across segmentation, regional analysis, and corporate profiling, this report equips decision-makers with a holistic understanding of the assured PNT ecosystem. It highlights both the immediate imperatives of resilience planning and the long-term promise of convergent navigation architectures. Ultimately, organizations that embrace modular, data-driven approaches and foster cross-industry collaborations will be best positioned to navigate the complexities of the modern PNT landscape and drive sustainable growth.

Positioning, Navigation, and Timing Leaders Are Invited to Secure Comprehensive Insights and Elevate Strategic Outcomes with Expert Guidance from Our Associate Director

For organizations seeking to deepen their strategic understanding of the assured positioning, navigation, and timing landscape, there is no better time to engage with our comprehensive market research. To explore how these insights can directly impact your operational resilience, drive innovation roadmaps, and secure competitive advantage, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan brings an unparalleled depth of expertise in translating complex market intelligence into actionable business strategies. Connect with him to obtain the full research report and embark on a data-driven journey to elevate your positioning and timing solutions initiatives.

- How big is the Assured PNT Market?

- What is the Assured PNT Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?