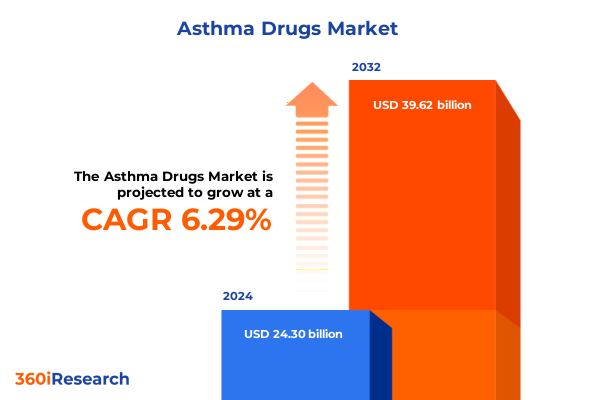

The Asthma Drugs Market size was estimated at USD 25.75 billion in 2025 and expected to reach USD 27.31 billion in 2026, at a CAGR of 6.34% to reach USD 39.62 billion by 2032.

Emerging Opportunities and Evolving Patient Needs Are Reshaping the Asthma Therapeutics Landscape for Strategic Stakeholders to Drive Future Growth

Asthma remains a formidable public health challenge in the United States, affecting nearly one in every thirteen adults and one in fifteen children. As of 2021, an estimated 24.9 million Americans were living with current asthma, encompassing 20.3 million adults and 4.7 million children, representing 7.7% of the total population. During the same period, adult prevalence has trended upward, while pediatric rates showed a modest decline, underscoring the complexity of disease dynamics across age groups. In 2023 alone, 8.9% of adults and 6.7% of children were reported to have current asthma, translating into 4.9 million annual office visits and 1.4 million emergency department encounters, with approximately 3,624 fatalities due to asthma complications.

Against this backdrop, the asthma therapeutics market is evolving in response to shifting patient demographics, regulatory pressures, and technological advancements. Increasing urban air pollution, growing awareness of disease management, and the integration of personalized medicine have collectively elevated expectations for more effective and patient-centric treatment modalities. Concurrently, healthcare payers and providers are demanding demonstrable value through improved adherence and measurable outcomes. These dynamics have set the stage for a broader transformation in how asthma is treated, monitored, and managed across the continuum of care.

This report synthesizes the pivotal trends, regulatory developments, and strategic imperatives that are currently redefining the asthma drugs landscape. It offers a concise yet thorough exploration of the factors driving change-ranging from digital health innovations to macroeconomic policy shifts-and delivers clear, actionable insights tailored for pharmaceutical executives, healthcare stakeholders, and investment decision-makers. By framing the discussion within the context of the latest clinical, technological, and policy-related milestones, this introduction lays the groundwork for a deeper analysis of the opportunities and challenges confronting the market.

Breakthrough Innovations and Digital Connectivity Are Driving Transformative Shifts in Asthma Treatment Paradigms and Care Delivery Models

Over the past two years, the asthma treatment paradigm has witnessed an unprecedented confluence of scientific breakthroughs and digital health integration. Smart inhalers equipped with Bluetooth sensors now offer real-time monitoring of medication use, providing patients and clinicians with actionable adherence data that can reduce avoidable exacerbations. Pilot programs like AIR Louisville demonstrated that environmental trigger detection, when combined with patient nudges and clinician notifications, can decrease rescue inhaler use by 78% and increase symptom-free days by 48% over twelve months. These outcomes underscore not only the promise of connected therapeutics but also the growing importance of data-driven care coordination.

Concurrently, the biologics segment has matured with expanded indications and novel approvals. In May 2025, the FDA approved GSK’s mepolizumab (Nucala) for add-on maintenance treatment in eosinophilic COPD, marking its transition from a severe asthma therapy into chronic obstructive pulmonary disease management and broadening the patient population that can benefit from targeted interleukin-5 inhibition. Biosimilar competition is also accelerating, as evidenced by the FDA’s March 2025 interchangeability designation for Celltrion’s Omlyclo, a biosimilar to Roche’s Xolair, which offers equivalent efficacy and safety for moderate to severe persistent asthma and related indications. These developments collectively signal a shift toward more personalized and cost-effective biologic strategies.

Meanwhile, emerging pipeline candidates are poised to further disrupt the respiratory space. Ultra-long-acting monoclonal antibodies such as depemokimab are targeting IL-5 with six-month dosing intervals, promising to enhance patient convenience and adherence. Novel inhaled therapies, including dry powder JAK inhibitors, aim to provide local anti-inflammatory effects with reduced systemic exposure. On the digital front, artificial intelligence and predictive analytics are being layered onto inhaler data streams to forecast exacerbations and optimize personalized action plans. Taken together, these innovations are not incremental improvements but transformative shifts that redefine both the clinical and commercial frameworks of asthma management.

Assessing the Far-Reaching Consequences of 2025 United States Import Tariffs on Asthma Medications and Supply Chain Resilience

In April 2025, the United States implemented a sweeping 10% global tariff on imported pharmaceutical goods, including active pharmaceutical ingredients (APIs), medical devices, and finished asthma medications. Subsequent escalations have adjusted rates based on country of origin, with duties ranging from 20% on EU-sourced products to over 100% on select Chinese imports. These measures, enacted under emergency trade powers, were designed to catalyze domestic manufacturing but have had significant ripple effects throughout the asthma supply chain.

The immediate impact of these tariffs has been felt in API procurement, where a reliance on bulk imports-especially from China and India-meant that many generic inhalers and tablet formulations saw production cost increases of up to 25%. Biopharma companies have been compelled to reassess their global sourcing strategies, entering into expedited negotiations with alternative suppliers or investing in domestic API facilities to mitigate supply disruptions. Yet, building resilient manufacturing capabilities for complex biologics and sophisticated inhaler devices requires substantial capital and extended timelines, leaving an interim period vulnerable to price volatility.

Critics warn that these import levies could exacerbate existing generic drug shortages, as smaller margin products are less able to absorb added duties. Hospital pharmacies and home care providers may face higher acquisition costs, potentially shifting greater financial burden onto patients and payers. While proponents argue that reshoring will ultimately enhance security of supply, the short-term consequences have already included isolated stockouts and contract renegotiations. As the policy landscape evolves, stakeholders must navigate this tariff environment with agile procurement models and strategic partnerships to sustain access to essential asthma therapies.

Deep-Dive Analysis Reveals Key Market Segmentation Insights Across Product Types Drug Classes Delivery Modes and Distribution Channels

When the asthma drugs market is examined through the lens of product type, inhalers continue to dominate owing to their rapid onset of action and established role in both rescue and controller therapy. Nebulizers offer an alternative for pediatric and severe cases, while tablets and pills-though less central-still serve as valuable adjuncts, especially for leukotriene modifiers and oral corticosteroids. These variations in drug delivery underscore the need for tailored patient interventions that align with clinical severity and patient lifestyle.

Analyzing by drug class reveals that traditional bronchodilators and corticosteroids remain foundational in chronic management, but next-generation agents are reshaping treatment algorithms. Albuterol and other beta agonists preserve their status as first-line rescue options, yet biologic therapies targeting IL-5, IL-4/13, and IgE pathways are increasingly prescribed for severe, refractory asthma. Leukotriene modifiers occupy a specialized segment for patients who require oral maintenance therapy, highlighting the broad spectrum of molecular targets in contemporary regimens.

Delivery mode plays a critical role in adherence and outcome. Inhalable therapies benefit from direct airway deposition, minimizing systemic exposure, whereas oral therapies offer convenience and ease of administration. This dichotomy informs product development strategies that balance pharmacokinetics with patient preference, driving investment in novel inhaler technologies and patient-centric device design.

Finally, understanding the distribution channel dynamics is essential. Hospital pharmacies account for acute inpatient needs, while retail and online pharmacies deliver maintenance therapies for chronic outpatients. The rise of digital pharmacy platforms has broadened access, but also introduced regulatory and logistical complexities. Aligning distribution models with evolving patient behaviors and healthcare settings-from ambulatory surgery centers to home care environments-is crucial to ensuring that therapies reach the right patients at the right time.

This comprehensive research report categorizes the Asthma Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Drug Class

- Delivery Mode

- Distribution Channel

- End Users

Critical Regional Dynamics from the Americas to Asia-Pacific That Are Shaping the Future of Asthma Therapeutics and Patient Access

The Americas continue to serve as the epicenter of respiratory innovation, with the United States leading in both R&D investment and digital health adoption. High prevalence rates, supportive regulatory frameworks, and established reimbursement pathways enable rapid clinical trial execution and seamless market entry for new therapies. Latin American markets, while growing, exhibit variable access and pricing constraints, highlighting a need for flexible strategies that accommodate diverse healthcare infrastructures.

In Europe, Middle East & Africa, heterogeneity defines the regional landscape. Western European countries benefit from centralized healthcare systems and robust reimbursement mechanisms, fostering uptake of premium biologic therapies. Conversely, Middle Eastern and North African markets often face procurement challenges and price sensitivities, prompting an emphasis on cost-effective generics and biosimilar introductions. Regulatory harmonization efforts within the European Union facilitate streamlined approvals, though post-Brexit dynamics in the UK add complexity to market access planning.

Asia-Pacific represents both the largest patient pool and a region of rapid transformation. China, India, and Southeast Asian nations grapple with high asthma burdens, yet are simultaneously driving domestic pharmaceutical capabilities and digital health initiatives. National programs to bolster local manufacturing coexist with public–private partnerships targeting telehealth deployment, offering a fertile environment for both multinational corporations and indigenous biotech ventures. To capture long-term growth, stakeholders must tailor their approaches to accommodate region-specific epidemiology, pricing policies, and digital infrastructure maturity.

This comprehensive research report examines key regions that drive the evolution of the Asthma Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Landscape Analysis Uncovers Strategic Moves Alliances and Product Portfolios of Leading Asthma Drug Developers and Innovators

Leading pharmaceutical and biotech firms are intensifying collaborations and expanding respiratory portfolios to capitalize on emerging opportunities. GlaxoSmithKline’s expansion of mepolizumab into COPD marks a strategic pivot into adjacent chronic inflammatory conditions, underscoring the value of lifecycle management for established assets. Similarly, Celltrion’s launch of Omlyclo, a biosimilar to omalizumab with FDA interchangeability status, exemplifies how biosimilars are leveraging cost advantages to gain rapid formulary inclusion and address affordability concerns.

Large-cap innovators such as AstraZeneca, Sanofi, and Novartis are concurrently investing in ultra-long-acting biologics and inhalable small molecules to diversify their pipelines. Teva and other generic-focused companies are pursuing differentiated device combinations to maintain market share in core inhaler segments. Digital health partnerships, notably between traditional pharma players and health-tech startups, are facilitating the development of integrated care platforms that combine medication delivery with remote monitoring and predictive analytics. Licensing agreements and merger-and-acquisition activity remain robust, driven by the imperative to secure late-stage assets and digital capabilities.

Meanwhile, disruptive entrants from the medtech and digital therapeutics space are challenging the status quo. These nimble organizations deliver patient engagement solutions and AI-enabled adherence support, compelling legacy players to accelerate their own digital transformations. The resulting competitive landscape is not merely a race for novel molecules, but a contest to own the patient interface and capitalize on the growing importance of real-world data.

This comprehensive research report delivers an in-depth overview of the principal market players in the Asthma Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ALK-Abelló A/S

- Amphastar Pharmaceuticals, Inc.

- AstraZeneca PLC

- Bayer AG

- Boehringer Ingelheim International GmbH

- CHIESI Farmaceutici S.p.A.

- Cipla Limited

- Dr.Reddy’s Laboratories Ltd

- F. Hoffmann-La Roche Ltd.

- GlaxoSmithKline PLC

- Hetero Labs Limited

- Lallemand Inc.

- Merck KGaA

- Mundipharma International Limited

- NIOX Group PLC

- Novartis AG

- Novo Holdings

- OPKO Health, Inc.

- Pfizer Inc.

- Sanner GmbH

- Sanofi S.A.

- Sunovion Pharmaceuticals Inc.

- Teva Pharmaceutical Industries Ltd.

- Verona Pharma PLC

- Viatris, Inc.

Actionable Strategies for Industry Leaders to Navigate Regulatory Tariffs Leverage Digital Health and Optimize Respiratory Portfolio Management

To navigate the evolving asthma market, industry leaders must adopt a multifaceted strategy that addresses both clinical innovation and operational resilience. Prioritizing the development and deployment of connected inhaler technologies will enhance patient adherence, generate real-world evidence, and bolster payer negotiations. By forming strategic alliances with digital health platforms, companies can accelerate time-to-market for integrated care solutions and differentiate their offerings in value-based reimbursement models.

In parallel, organizations should proactively reassess their supply chain footprints to mitigate tariff-induced cost pressures. Establishing dual sourcing agreements for critical APIs and investing in regional manufacturing hubs will not only reduce exposure to import duties but also strengthen supply continuity. Engaging with regulatory authorities to advocate for balanced policy frameworks that support both domestic production and import flexibility can further safeguard long-term market stability.

Finally, portfolio optimization is paramount. Firms must evaluate their current product mix against emerging segmentation trends-such as the shift toward biologics and combination therapies-to identify candidates for lifecycle extension or divestiture. Integrating patient insights through targeted market research and stakeholder interviews will ensure that pipeline prioritization aligns with unmet clinical needs and payer expectations. This holistic approach will enable industry leaders to capitalize on transformative shifts and maintain competitive advantage.

Robust Multi-Source Research Methodology Combining Primary Stakeholder Insights Secondary Data Analysis and Rigorous Validation Protocols

Our research methodology combines rigorous primary and secondary data collection with advanced analytical techniques to ensure robust and credible insights. Primary information was gathered through structured interviews with key opinion leaders, including pulmonologists, regulatory experts, and pharmacy directors, who provided qualitative perspectives on treatment adoption, patient adherence challenges, and the impact of recent tariff policies. Supplementing these interviews, we conducted quantitative surveys of healthcare professionals and payers to validate hypotheses around market dynamics and value perceptions.

Secondary sources comprised peer-reviewed literature, regulatory filings, and authoritative public databases, including the CDC’s National Health Interview Survey and FDA drug approval announcements. We also leveraged proprietary proprietary trial registries and patent databases to map the competitive landscape and identify emerging pipeline candidates. Advanced data triangulation techniques were applied to reconcile discrepancies and ensure consistency across diverse information streams.

To enhance depth of analysis, we performed cross-regional comparisons, examining healthcare infrastructure metrics, reimbursement frameworks, and epidemiological patterns. Supply chain assessments incorporated tariff schedules, import volumes, and manufacturing capacity data, allowing us to model potential cost and access implications. Finally, our validation process included peer review by external consultants specializing in pharmaceutical forecasting and regulatory affairs, ensuring methodological integrity and strategic relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Asthma Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Asthma Drugs Market, by Product Type

- Asthma Drugs Market, by Drug Class

- Asthma Drugs Market, by Delivery Mode

- Asthma Drugs Market, by Distribution Channel

- Asthma Drugs Market, by End Users

- Asthma Drugs Market, by Region

- Asthma Drugs Market, by Group

- Asthma Drugs Market, by Country

- United States Asthma Drugs Market

- China Asthma Drugs Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Concluding Perspectives Synthesizing Transformative Trends Tariff Impacts Segmentation and Regional Performance for Informed Decision Making

In summary, the asthma therapeutics landscape is experiencing a fundamental shift driven by digital innovation, biologic expansions, and evolving policy environments. Smart inhalers and AI-enabled adherence platforms are redefining patient engagement, while pipeline biologics and biosimilars are broadening treatment paradigms and cost considerations. The introduction of 2025 U.S. import tariffs has intensified the need for resilient supply chain strategies and proactive regulatory engagement.

Segmentation analysis highlights the nuanced demands across inhaler, nebulizer, and oral formulations, underscoring the importance of tailored product and delivery models. Regional insights reveal a dichotomy between mature markets with established digital ecosystems and emerging regions that require adaptable pricing and access strategies. Competitive intelligence underscores a dynamic interplay between incumbent pharma giants, biosimilar entrants, and digital health disruptors vying for position in an increasingly data-driven marketplace.

Collectively, these trends present both challenges and opportunities. Success will hinge on the ability to integrate clinical innovation with digital services, optimize operational footprints in light of tariff pressures, and align portfolio priorities with evolving patient and payer expectations. Leaders who embrace these imperatives stand to secure a strategic advantage in a market undergoing rapid transformation.

Connect with Ketan Rohom for Exclusive Access to the Comprehensive Asthma Drugs Market Research Report and Empower Strategic Planning

Ready to elevate your strategic initiatives with actionable intelligence and tailored insights, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your comprehensive market research report on the asthma drugs landscape today and gain a competitive edge.

- How big is the Asthma Drugs Market?

- What is the Asthma Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?