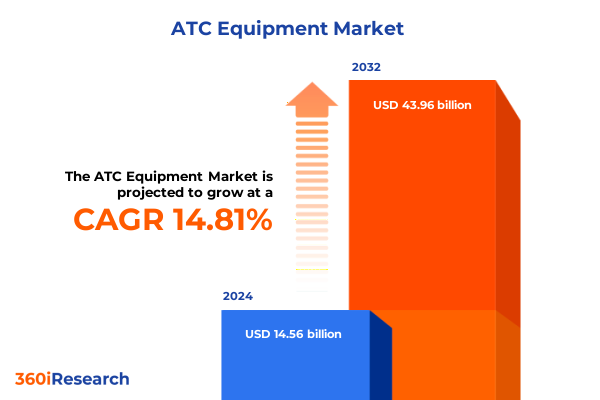

The ATC Equipment Market size was estimated at USD 16.70 billion in 2025 and expected to reach USD 19.16 billion in 2026, at a CAGR of 14.82% to reach USD 43.96 billion by 2032.

Setting the Stage for a New Era of Air Traffic Control Modernization and Equipment Innovation to Address Aging Infrastructure and Rising Demand

The air traffic control equipment landscape stands at a critical inflection point, shaped by decades of operational demands, evolving regulatory expectations, and the unrelenting growth of global air travel. As aviation networks expand to accommodate increasing passenger and cargo volumes, the supporting infrastructure-ranging from radar and surveillance systems to navigation and communication platforms-faces mounting pressure to deliver heightened safety, efficiency, and resilience. This convergence of factors underscores the strategic importance of investing in modernized solutions that address both the current operational backlog and the future trajectory of airspace management.

Embracing Technological Transformation and Integrated Systems That Are Revolutionizing Air Traffic Management Operations and Efficiency

A profound wave of technological transformation is reshaping air traffic management, driven by integrated system architectures, software-defined platforms, and advanced connectivity protocols. The emergence of 5G Integrated Communications, Navigation, and Surveillance (ICNS) envisions a unified CNS stack that leverages terrestrial and non-terrestrial networks to deliver unprecedented throughput and reliability. This future state promises reduced latency for critical data exchanges and enhanced situational awareness for all airspace actors, catalyzing the next phase of operational efficiency and safety in both traditional and emerging aviation segments.

Assessing the Comprehensive Impact of United States Tariff Measures in 2025 on Air Traffic Control Equipment Supply Chains and Cost Structures

United States trade policy shifts in 2025 have introduced significant tariff measures across aerospace and defense components, directly affecting air traffic control equipment supply chains. A 25 percent levy on imported aircraft parts, including radar antenna subassemblies and avionics modules, has elevated procurement costs and prompted system integrators to reassess sourcing strategies. Concurrently, a 20 percent duty on advanced composite materials and a 10–15 percent import tax on defense-grade electronics further compound these pressures, intensifying the need for alternative supply networks and localized manufacturing partnerships.

Uncovering Critical Segmentation Insights Across Product Types, Applications, End Users, and Technological Platforms in the ATC Equipment Sector

Disaggregating the air traffic control equipment market along multiple segmentation axes reveals distinct dynamics and adoption patterns. The product type dimension spans radar, communication, navigation, automation, and surveillance systems, with each category branching into specialized subsegments such as primary and secondary radar, satellite and VHF communications, GNSS constellations, and multilateration surveillance platforms. These configurations cater to varied operational requirements and integration points within national airspace systems. Application-based analysis differentiates the requirements for airport tower management, en route control centers, military airspace oversight, and terminal maneuvering areas, illustrating how operational contexts dictate equipment specifications and system robustness. Likewise, end users-from commercial hub airports through government air traffic service agencies to military air bases-impose unique performance, security, and lifecycle demands that shape procurement decisions. Underpinning these classifications, the evolution from analog to digital technology, including the proliferation of IP-based architectures and software-defined functionalities, marks a decisive shift toward more adaptable, scalable, and data-driven ATC ecosystems.

This comprehensive research report categorizes the ATC Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Application

- End User

Exploring Regional Dynamics and Strategic Variations in ATC Equipment Adoption Across the Americas, EMEA, and Asia-Pacific Markets

Regional analysis of air traffic control equipment adoption highlights three core clusters with divergent priorities and investment rhythms. In the Americas, particularly within the United States, a concerted push toward completing the FAA’s NextGen program by year-end 2025 underscores a commitment to satellite-based navigation, digital data exchanges, and phased decommissioning of legacy radar infrastructure. Congressional appropriations and executive directives are driving rapid deployment of IP-based communication networks and automation upgrades in major en route centers. Within Europe, the Middle East, and Africa, coordinated efforts under the SESAR initiative and regional air navigation service providers emphasize harmonized standards, cybersecurity reinforcements, and remote tower trials, reflecting a broader mandate to optimize cross-border traffic flows and bolster resilience against emerging threats. Across Asia-Pacific, robust air traffic growth in China, India, Japan, and Southeast Asia is fueling demand for advanced surveillance, multilateration, and satellite navigation enhancements; initiatives such as India’s GAGAN program and expanding VSAT networks illustrate the strategic integration of GNSS and terrestrial communications to support densely populated corridors and remote airspace operations.

This comprehensive research report examines key regions that drive the evolution of the ATC Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Air Traffic Control Equipment Providers and Their Strategic Positioning in a Competitive and Evolving Global Marketplace

Leading equipment providers are carving differentiated value propositions within this fast-changing landscape. RTX, shaped by its Raytheon and Pratt & Whitney businesses, remains integral to radar and defense-grade communication platforms, leveraging extensive manufacturing scale and embedded software expertise. Thales continues to advance its TopSky automation and tower solutions with AI-enabled flow management and UAS airspace coordination, drawing on a legacy of European and global deployments. L3Harris and Honeywell are intensifying efforts in secure digital communications and avionics integration, focusing on sustainable, software-defined radio architectures built for cyber resilience. Verizon and AT&T, traditionally telecom operators, are translating their network modernization contracts into managed service offerings for the FAA’s next-generation communications backbone. Meanwhile, Leidos and Palantir are pioneering data analytics and command-and-control software services, augmenting traditional hardware-centric models with cloud-native ecosystems and predictive analytics capabilities.

This comprehensive research report delivers an in-depth overview of the principal market players in the ATC Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ACAMS AS

- Adacel Technologies Limited

- ALTYS Technologies Inc.

- ARTISYS, s.r.o.

- BAE System PLC

- Cyrrus Limited

- Elcome Integrated Systems Pvt. Ltd.

- Frequentis AG

- General Dynamics

- Honeywell International Inc.

- Indra Sistemas, S.A.

- Intelcan Technosystems Inc.

- L3Harris Technologies, Inc.

- Leonardo S.p.A

- NATS Limited

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- Saab AB

- Saipher ATC

- Searidge Technologies

- Siemens AG

- SkySoft-ATM

- Thales Group

- The Aeronav Group

Deriving Actionable Strategic Recommendations to Drive Innovation, Resilience, and Growth for Air Traffic Control Equipment Industry Leaders

Industry leaders should recalibrate supply chain strategies to mitigate tariff-induced cost volatility by diversifying sourcing across allied markets and expanding domestic manufacturing collaborations. Embracing modular, software-defined platforms will enhance upgrade flexibility and reduce dependency on monolithic hardware cycles. Moreover, prioritizing integrated cybersecurity frameworks from design through deployment safeguards system integrity as digital connectivity intensifies. Investments in artificial intelligence and predictive analytics can optimize traffic flow management and preempt capacity constraints. Ultimately, forging collaborative partnerships with regulators and end users ensures alignment on performance requirements, certification pathways, and sustainable funding models to sustain long-term network resilience.

Detailing the Rigorous Research Methodology Underpinning Comprehensive Analysis of the Air Traffic Control Equipment Market Landscape

This analysis synthesizes primary insights from structured interviews with air navigation service providers, equipment integrators, and regulatory officials, supplemented by field-level observations of major ATC modernization projects in North America, Europe, and Asia-Pacific. Extensive secondary research encompassed review of government reports, industry whitepapers, patent filings, and technology briefs to triangulate emerging trends and vendor roadmaps. A rigorous validation process involved cross-referencing data points against public financial disclosures, infrastructure investment announcements, and third-party feasibility studies to ensure factual accuracy. Segmentation assessments were conducted using a top-down framework aligned with ICAO and FAA classification standards, while regional dynamics were contextualized through comparative policy analysis and capital expenditure reviews.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our ATC Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- ATC Equipment Market, by Product Type

- ATC Equipment Market, by Technology

- ATC Equipment Market, by Application

- ATC Equipment Market, by End User

- ATC Equipment Market, by Region

- ATC Equipment Market, by Group

- ATC Equipment Market, by Country

- United States ATC Equipment Market

- China ATC Equipment Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Synthesizing Key Insights and Concluding Perspectives on the Future Trajectory of Air Traffic Control Equipment and Industry Evolution

The convergence of aging networks, evolving operational demands, and disruptive technologies has charted a new paradigm in air traffic control equipment. Modernization initiatives, from NextGen and SESAR to remote and virtual towers, underscore the imperative for resilient, data-driven systems that can adapt to rapid growth and emerging aviation modalities. Concurrently, the impact of U.S. tariffs has reinforced the necessity for strategic supply chain diversification and domestic capability development. Regional variations in funding priorities and regulatory frameworks further shape a complex competitive terrain where vendors must balance innovation with compliance. As the industry transitions toward integrated, software-centric platforms, decision-makers are tasked with harmonizing performance, security, and scalability to secure safer, more efficient airspace management for the decades ahead.

Initiating a Strategic Partnership With Ketan Rohom to Gain Exclusive Access to the Full Air Traffic Control Equipment Market Research Insights

Elevate your strategic decision-making and gain immediate access to in-depth analysis, comprehensive insights, and tailored recommendations by engaging directly with Ketan Rohom, the Associate Director of Sales & Marketing at 360iResearch, for a detailed walkthrough of the complete air traffic control equipment market research report. Ketan’s expertise in guiding stakeholders through complex market dynamics will ensure you leverage our findings to optimize your investments, refine your competitive positioning, and address emerging challenges in air traffic management. Connect with Ketan today to explore bespoke solutions, secure priority onboarding for your team, and capitalize on the actionable intelligence that will shape the next generation of air traffic control innovation.

- How big is the ATC Equipment Market?

- What is the ATC Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?