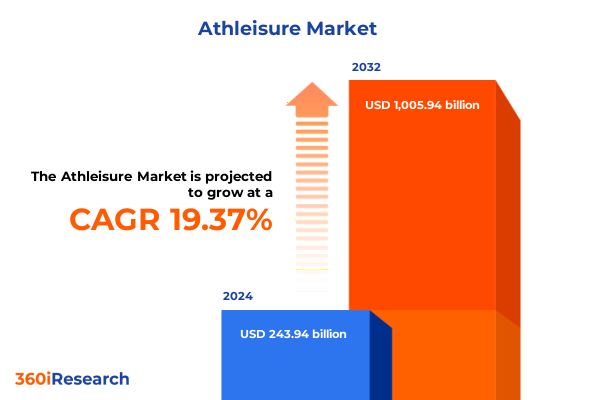

The Athleisure Market size was estimated at USD 290.23 billion in 2025 and expected to reach USD 345.32 billion in 2026, at a CAGR of 19.43% to reach USD 1,005.94 billion by 2032.

Exploring the Unstoppable Rise of Athleisure as a Cultural Phenomenon Uniting Fashion Innovation with Everyday Athletic Performance

The convergence of athletic performance and everyday fashion has given rise to athleisure as a cultural phenomenon reshaping how consumers dress, move, and express personal style. Initially adopted by a niche group of fitness enthusiasts, athleisure’s appeal has broadened to encompass professionals seeking comfort without sacrificing polish, students prioritizing versatility between classes and workouts, and trend-conscious shoppers drawn to the effortless blend of practicality and self-expression. As the sartorial boundary between gym and street disappears, the sector’s influence extends beyond apparel into lifestyle services, digital communities, and experiential marketing that reinforce the ethos of versatile living.

Market participants have observed that the pace of athleisure adoption is accelerating as new generations prioritize wellness, sustainability, and seamless technology integration. Consumer research indicates that Millennials and Gen Z engage with athleisure multiple times per week, reflecting a preference for garments that transition across diverse daily contexts with ease. This tendency underscores a shift in purchasing criteria, where stretchability, moisture management, and refined silhouettes hold equal weight in buying decisions as brand heritage and aesthetic appeal.

Furthermore, the rise of remote and hybrid work models has entrenched athleisure as a wardrobe cornerstone, replacing formal attire with adaptable pieces that support productivity and digital connectivity. In turn, brands are forging alliances with fitness apps, wellness influencers, and tech platforms to deliver holistic offerings that transcend the garment itself. Ultimately, athleisure’s blend of form and function represents a broader cultural embrace of active living, democratizing performance features beyond the gym and into everyday experiences.

Unveiling the Transformative Forces Redefining Athleisure from Textile Innovation to Digital Engagement and Sustainable Consumer Experiences

The athleisure landscape has been transformed by an array of forces that now define consumer expectations and industry direction. Personalization has emerged as a cornerstone, with brands offering chaotic customization experiences that engage Gen Z’s desire for self-expression through one-of-a-kind embellishments, DIY kits, and limited-edition collaborations. This celebration of individual voices calls for digital-first platforms and in-store activations that allow consumers to co-create designs and foster deeper emotional ties with products.

At the same time, sustainability has evolved from a differentiator into a baseline requirement, compelling sportswear houses to pioneer plastic-free stretch fabrics and biodegradable alternatives to elastane. Leading innovators are developing plant-based rubbers, recycled polyesters, and bio-sourced nylons that reduce environmental footprints without sacrificing performance. Yet, scaling these technologies demands cross-industry partnerships, capital investment in manufacturing infrastructure, and consumer education campaigns to make eco-friendly apparel accessible and aspirational.

Moreover, the integration of smart textiles and wearable sensors is unlocking new value propositions, from biometric monitoring in compression gear to adaptive temperature regulation in layering systems. Materials science collaborations are yielding fabrics that manage moisture, regulate heat, and even harvest solar energy, creating a seamless bridge between apparel and personal health data. Complementing these advances, direct-to-consumer models and omnichannel experiences leverage first-party data to deliver hyper-targeted recommendations, dynamic pricing, and immersive digital storefronts, enabling brands to anticipate consumer needs and respond in real time.

Collectively, these transformative shifts underscore a redefinition of athleisure not as a transient trend but as an enduring ecosystem where co-creation, ethics, and technology converge to deliver multifunctional, emotionally engaging, and future-ready offerings.

Analyzing the Far-Reaching Consequences of Recent United States Tariff Policies on Athleisure Supply Chains and Global Sourcing Strategies

The imposition of new and expanded tariffs by the United States in 2025 has substantially altered the cost calculus for athleisure supply chains, tracing back to the lingering effects of Section 301 duties and novel reciprocal levies targeting low-value imports. Initially introduced as a measure to address perceived unfair trade practices, Section 301 tariffs on Chinese apparel and textiles elevated duties by up to 25 percent, triggering a wave of supplier diversification to Vietnam, Bangladesh, and India to preserve margins. However, continued escalation through reciprocal measures in early 2025 imposed rates up to 145 percent on Chinese shipments and revocation of the de minimis exemption for parcels under US$800, striking at the heart of ultra-fast fashion business models reliant on high-frequency, low-value logistics.

In May of 2025, U.S. import data revealed that apparel imports from China plunged to their lowest levels in over two decades, driven by punitive duties reaching as high as 145 percent and prompting a 30 percent drop in sourcing volumes compared to the prior year. Retailers have responded by accelerating nearshoring strategies in Mexico and Central America, while also seeking alternative Asian hubs like Vietnam, which saw import growth above 29 percent. Yet, this rapid reorientation has strained manufacturing capacity, elevated lead times, and disrupted product development timelines as brands contend with fragmented supplier ecosystems.

Industry associations have voiced grave concerns, warning that these tariffs threaten to inflate consumer prices, erode domestic production competitiveness, and imperil the 3.5 million U.S. jobs supported by the apparel sector. The American Apparel & Footwear Association cautioned that the blanket nature of reciprocal duties fails to recognize the complex interdependencies of Western Hemisphere supply chains, undermining investments made over three decades under regional free trade agreements. Conversely, proponents argue that tariffs could catalyze onshore capacity growth if coupled with targeted incentives and workforce development programs, though the near-term pain remains considerable.

As brands navigate this volatile trade environment, multifaceted risk mitigation strategies are essential, including dual-sourcing arrangements, tariff engineering to classify products under favorable codes, and investment in advanced manufacturing technologies that reduce yield losses. Ultimately, the 2025 tariff regime underscores the critical importance of supply chain agility, regulatory intelligence, and strategic trade planning in safeguarding athleisure competitiveness.

Illuminating Critical Segmentation Dynamics in the Athleisure Market Based on Product Categories, Demographics, Channels, and End User Profiles

Segmentation insights reveal that product categories in athleisure encompass a diverse mix of accessories, apparel, and footwear. Accessories span from functional bags designed with luggage compartments for gym gear to performance-oriented hats that wick moisture, headbands engineered for secure fit during high-intensity workouts, and technical socks that optimize circulation and cushioning. In the apparel realm, active underwear integrates seamless construction for layered comfort, bottoms range from compression tights to joggers refined for streetwear appeal, outerwear offers breathable windbreakers and waterproof shells, while tops include versatile tanks and high-support sports bras. Footwear brands curate a spectrum from casual shoes that evoke lifestyle aesthetics to specialized running shoes with carbon-infused plates, and training shoes optimized for lateral movement and stability.

Age group segmentation highlights distinct usage patterns and value perceptions. Adult consumers prioritize premium performance features, fabric innovation, and brand heritage, whereas teenagers gravitate toward trend-driven designs, bold aesthetics, and social media collaborations. Kids demand durability, ease of movement, and playful colorways that balance functionality with youthful appeal, while seniors seek adaptive fits, slip-resistant soles, and seamless closures that support wellness routines with comfort and safety.

Distribution channels play a pivotal role in market reach and consumer engagement. Offline environments range from department stores showcasing integrated lifestyle segments to specialty stores that curate fitness-centric lines and sporting goods stores serving as hubs for performance gear and expert advice. Online platforms, including company-owned websites, leverage immersive digital showrooms, and third-party e-commerce sites amplify discovery through influencer endorsements and targeted advertising, driving accessibility and convenience across geographies.

End users fall into men’s, women’s, and unisex categories, each demanding nuanced design considerations for fit, form, and styling. Men’s collections often emphasize structured silhouettes and neutral palettes, women’s lines balance performance with sculpting seams and color range, and unisex products focus on inclusive sizing, versatile cuts, and gender-neutral aesthetics that resonate with a broad demographic swath.

This comprehensive research report categorizes the Athleisure market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Age Group

- Distribution Channel

- End User

Examining Regional Divergences and Growth Trajectories across Americas, Europe Middle East and Africa, and the Asia Pacific Athleisure Markets

Regional analysis underscores a differentiated landscape across the Americas, Europe Middle East and Africa, and Asia Pacific. In the Americas, the United States remains a powerhouse in athleisure consumption, fueled by high per-capita spending on wellness and digital retail innovation that enhances personalization and omnichannel integration. Canada and Latin American markets display burgeoning demand driven by rising fitness participation and aspirational consumption, despite logistical challenges across diverse urban and rural geographies.

Across Europe Middle East and Africa, Western Europe exhibits mature retail ecosystems with established department stores and boutique fitness concepts, while Eastern Europe demonstrates accelerated growth as local brands seek to capture shifting consumer preferences toward active lifestyles. The Middle East enjoys rapid expansion through hybrid mall-and-digital strategies that cater to youth demographics, and Africa presents untapped potential with expanding urbanization, increasing disposable income, and a growing middle class prioritizing health and self-expression.

In Asia Pacific, China’s vast manufacturing capabilities continue to underpin global supply chains even as domestic consumption surges for premium athleisure brands, driven by rising fitness culture, social media influence, and government promotion of public health initiatives. India and Southeast Asia follow suit with rapidly evolving retail infrastructures, while Japan and South Korea set style benchmarks by fusing streetwear sensibilities with technical innovation.

Despite common themes of digitalization and sustainability, each region displays unique consumer expectations, regulatory landscapes, and competitive dynamics. Effective regional strategies require deep cultural insights, localized product offerings, and tailored channel partnerships to capitalize on both established markets and high-growth opportunities.

This comprehensive research report examines key regions that drive the evolution of the Athleisure market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Dissecting Leading Athleisure Brands and Innovators Shaping the Competitive Landscape through Unique Positioning and Strategic Partnerships

In the competitive arena of athleisure, leading companies leverage distinctive strengths to maintain momentum. Nike commands the market with its Move to Zero initiative, targeting zero waste and carbon neutrality by 2025, while embedding performance-driven design in its signature product lines. The brand’s investment in circular solutions, energy-efficient logistics centers, and sustainable material development underscores a dual focus on innovation and environmental stewardship.

Adidas has similarly prioritized sustainability by committing that nine out of ten products will be classified as sustainable by 2025, advancing initiatives such as Primeblue and Primegreen to incorporate recycled ocean plastics and bio-based materials. Through partnerships like Parley for the Oceans and aggressive greenhouse gas reduction targets, the company aims to reshape industry norms around material sourcing and product lifecycle impact.

Lululemon continues to expand its lifestyle footprint, having successfully translated its dominant women's yoga apparel heritage into broader casual wear and men’s offerings, with a strategic goal to double its men’s business by 2026. The company’s digital-first ecosystem, including community-driven studio classes and digital fitness services, fortifies brand loyalty and diversifies revenue streams.

Under Armour faces headwinds due to its restructuring plan and supply chain recalibrations but remains an innovator in performance gear, exploring new material technologies and athletic collaborations. Puma differentiates through design-driven collaborations and early adoption of biodegradable Biofabric initiatives, while challenger brands like Alo and Vuori carve niche positions by marrying streetwear aesthetics with premium fabrications. Across the board, strategic partnerships, digital ecosystem development, and sustainability commitments define the blueprint for competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Athleisure market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- adidas AG

- Alo Yoga Inc.

- ASICS Corporation

- Athleta, Inc.

- Columbia Sportswear Company

- Decathlon S.A.

- Fabletics LLC

- Gymshark Ltd

- Halara Inc.

- Li‑Ning Company Limited

- Lorna Jane Holdings Pty Ltd

- Lululemon Athletica, Inc.

- New Balance Athletics, Inc.

- Nike, Inc.

- Outdoor Voices, Inc.

- Patagonia, Inc.

- Puma SE

- Reebok International Ltd

- Sweaty Betty Ltd

- The Gap, Inc.

- The North Face

- Under Armour, Inc.

- VF Corporation

- Vuori Clothing, Inc.

Delivering Strategic and Actionable Recommendations to Elevate Brand Relevance, Optimize Supply Chains, and Strengthen Consumer Engagement in Athleisure

Industry leaders seeking to excel in the evolving athleisure space must prioritize integrated sustainability strategies that encompass materials, manufacturing, and circularity. By setting ambitious targets for recycled content, waste diversion, and carbon reduction, brands can fortify their environmental credentials while nurturing consumer trust and loyalty. Collaboration across the value chain-spanning suppliers, research institutions, and industry coalitions-will be indispensable for scaling eco-innovations in stretch fabrics and biodegradable materials.

To capitalize on personalization and digital engagement trends, executives should invest in advanced data analytics and AI-driven design tools that enable real-time customization and predictive demand planning. Embedding smart textiles with biometric sensors opens new service models that blend product ownership and subscription-based digital offerings, enhancing consumer value and generating recurring revenue streams. Likewise, omnichannel strategies that integrate e-commerce platforms with experiential retail and localized pop-ups can deepen brand immersion and drive conversion across segments.

Supply chain resilience remains paramount amid shifting trade policies and geopolitical uncertainties. Leaders should adopt dual-sourcing frameworks and tariff engineering techniques while exploring nearshoring options to optimize lead times and cost structures. Additionally, pilot programs in advanced manufacturing-such as automated knitting and on-demand production-can reduce inventory risk and support agile product development.

Finally, unlocking growth in emerging demographics and regions requires culturally nuanced marketing and localized product assortments. Establishing regional innovation hubs, fostering community partnerships, and deploying flexible channel models will empower brands to anticipate evolving consumer needs and position themselves as authentic champions of active, wellness-oriented lifestyles.

Outlining Robust Research Methodology Combining Qualitative Interviews, Secondary Data Analysis, and Market Validation for Comprehensive Athleisure Insights

This research report is built upon a robust methodology combining primary qualitative interviews, extensive secondary data analysis, and rigorous market validation. In-depth interviews were conducted with senior executives, product designers, supply chain specialists, and retail strategists across leading brands and manufacturing hubs, ensuring firsthand perspectives on emerging technologies, policy impacts, and consumer preferences. These dialogues provided nuanced context that informed trend identification and strategic imperatives.

Secondary research encompassed a comprehensive review of industry publications, regulatory filings, trade association reports, and academic studies to collate historic and current data on market dynamics, tariff developments, and sustainability initiatives. This process included sourcing information from credible outlets such as Reuters, The Guardian, Vogue Business, and official corporate sustainability reports to ensure factual accuracy and the latest insights.

Quantitative analysis leveraged proprietary data models and industry databases to detect patterns in consumer behavior, channel performance metrics, and regional growth differentials. Statistical triangulation techniques were applied to cross-validate findings from multiple sources and enhance the reliability of strategic conclusions. In parallel, sensitivity analyses examined the potential impact of key variables-such as tariff fluctuations and material cost shifts-on supply chain viability and product profitability.

Finally, all insights and recommendations underwent stakeholder validation sessions, in which preliminary findings were presented to industry thought leaders for feedback. This iterative process refined the report’s strategic guidance, ensuring practical relevance and actionable outcomes for decision-makers navigating the dynamic athleisure landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Athleisure market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Athleisure Market, by Product Type

- Athleisure Market, by Age Group

- Athleisure Market, by Distribution Channel

- Athleisure Market, by End User

- Athleisure Market, by Region

- Athleisure Market, by Group

- Athleisure Market, by Country

- United States Athleisure Market

- China Athleisure Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Synthesizing Key Findings and Insights to Provide a Cohesive Perspective on the Future Trajectory of the Athleisure Market Landscape

The athleisure sector stands at a crossroads where innovation, consumer empowerment, and global trade dynamics intersect to shape future trajectories. As brands navigate the imperative of sustainability, the demand for eco-friendly materials and circular solutions will intensify, driving collaboration and investment across supply chains. Simultaneously, the digitalization of product design, customization, and retail channels promises to redefine brand-consumer relationships, offering unprecedented personalization and community-driven engagement.

Against the backdrop of elevated tariff regimes and shifting geopolitical landscapes, supply chain resilience and agility have become non-negotiable priorities. Companies that master dual-sourcing strategies, tariff classification optimization, and nearshoring initiatives will secure operational continuity and cost efficiency, even as trade policies evolve unpredictably.

Looking ahead, the ability to deliver multifunctional garments that seamlessly integrate performance, comfort, and style will determine competitive differentiation. Athleisure’s future is anchored in the fusion of smart textiles, data-driven experiences, and sustainable considerations, empowering consumers to express individuality while aligning with broader wellness and environmental aspirations.

By synthesizing strategic recommendations, segmentation insights, regional assessments, and company benchmarks, this report provides a cohesive framework for navigating the complex athleisure ecosystem. Stakeholders equipped with these insights will be poised to capture emerging opportunities, mitigate risks, and shape the next chapter of this dynamic market.

Connect with the Associate Director of Sales and Marketing to Secure Your Comprehensive Athleisure Market Research Report and Drive Informed Decision Making

To secure the in-depth insights and strategic foresight detailed throughout this executive summary, readers are invited to engage directly with Ketan Rohom, Associate Director of Sales and Marketing, to discuss your organization’s specific requirements and obtain access to the complete athleisure market research report. Ketan can guide you through tailored purchasing options, provide clarity on additional data modules, and ensure you have the most up-to-date information to drive market-leading decisions. Reach out to initiate a conversation and take the first step toward empowering your team with actionable intelligence that will shape the future trajectory of your athleisure strategy

- How big is the Athleisure Market?

- What is the Athleisure Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?