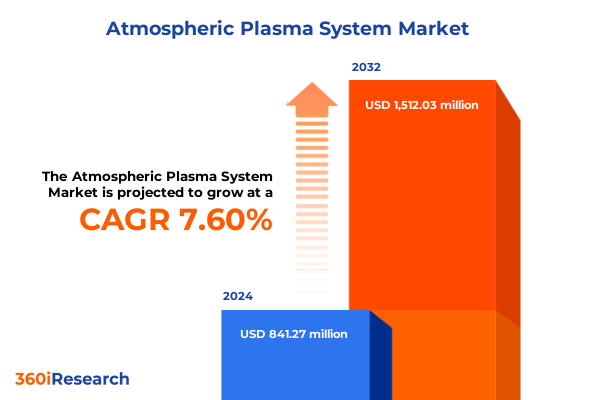

The Atmospheric Plasma System Market size was estimated at USD 901.00 million in 2025 and expected to reach USD 966.69 million in 2026, at a CAGR of 7.67% to reach USD 1,512.03 million by 2032.

Unlocking the Transformative Potential of Atmospheric Plasma Systems to Drive Next-Generation Surface Treatment and Material Enhancement Across Industries

Atmospheric plasma systems have emerged as a pivotal technology for surface treatment applications across diverse sectors, enabling precise, non-chemical modification and activation of materials. Leveraging high-energy ionized gases at atmospheric pressure, these systems deliver streamlined workflows for coating preparation, etching, cleaning, and sterilization without introducing thermal damage or hazardous byproducts. As manufacturing and research environments demand ever-greater efficiency, sustainability, and product performance, atmospheric plasma technology offers a compelling alternative to traditional chemical processes, reducing environmental footprint while improving adhesion and surface energy characteristics.

Over the past decade, advances in dielectric barrier discharge, plasma jet, and corona treatments have expanded the addressable applications, from automotive component cleaning to precision semiconductor wafer etching. These technological refinements have been bolstered by integration with digital control systems and inline production platforms, positioning atmospheric plasma as a versatile solution for both batch and continuous processing operations. Consequently, decision-makers are prioritizing plasma system adoption within their surface treatment arsenals to meet stringent regulatory standards and meet escalating quality requirements.

Navigating Disruptive Technological Breakthroughs and Sustainability Imperatives That Are Reshaping the Atmospheric Plasma System Landscape

The atmospheric plasma market landscape is undergoing disruptive transformation driven by technological breakthroughs and mounting sustainability imperatives. Emerging direct plasma and remote plasma systems are enabling low-temperature surface treatments for sensitive biomedical devices, while microplasma innovations support scaled-down applications in electronics manufacturing. Concurrently, advancements in dielectric barrier discharge units afford unprecedented control over ionization density and energy distribution, which elevates treatment uniformity on complex geometries and high-value substrates.

Sustainability considerations are equally reshaping industry priorities, with companies phasing out solvent-based surface modification methods in favor of chemical-free plasma cleaning solutions that curb waste streams and reduce life-cycle environmental impact. This shift aligns with global regulatory pressures to limit volatile organic compound emissions and adhere to evolving standards for chemical usage, reinforcing atmospheric plasma systems as an eco-friendly alternative.

Additionally, the trend toward digitalization is weaving advanced IoT and AI-driven controls into plasma system architectures. Plug-and-play connectivity, remote performance monitoring, and predictive maintenance algorithms are elevating uptime and process consistency, while outcome-based service models are enhancing total cost of ownership projections. In this way, the confluence of innovation, environmental responsibility, and digital integration is redefining the competitive contours of the atmospheric plasma sector.

Assessing the Compounding Effects of 2025 United States Tariffs on Atmospheric Plasma Systems and Associated Supply Chains

A pivotal challenge confronting atmospheric plasma system users in 2025 stems from the U.S. administration’s imposition of broad-based tariffs on key raw materials and industrial imports. Effective March 12, 2025, a 25% duty on imported steel and aluminum articles, along with derivative products, has directly escalated input costs for equipment manufacturers and system integrators. Moreover, components such as precision nozzles, power supplies, and connection hardware, often sourced internationally, have seen cost increases that ripple through capital expenditure budgets.

Research institutions and lab facilities have felt the effects sharply, with 25% tariffs on scientific equipment imports from Canada, Mexico, and China driving up pricing for plasma generators, power modules, and specialized consumables. As these surcharges feed into procurement cycles, U.S. laboratories face sticker shock and retrenchment in investment plans-particularly as research funding remains constrained.

Industrial manufacturers reliant on plasma-based surface treatments are also grappling with higher operational expenditures. The added import duties on essential machine parts, including motors and electronics, have prompted firms to consider nearshoring strategies or supplier diversification to mitigate margin compression. Recent analyses indicate that over half of manufacturing CFOs are actively exploring supply chain reconfiguration to offset tariff-induced cost pressures.

In response, leading equipment providers are escalating investments in domestic production facilities. For instance, ABB has allocated $120 million to expand local output of low-voltage systems in Tennessee and Mississippi, aiming to source over 90% of U.S. sales regionally and insulate customers from future tariff volatility. These strategic shifts reflect a concerted effort to stabilize supply chains and preserve competitive pricing in an unpredictable trade environment.

Unveiling Segmentation Insights Across Products, Components, Technologies, Materials, Operations, Applications, Verticals, Deployment Modes, and End Users

Market segmentation offers a lens through which to discern nuanced demand drivers and tailor value propositions across diverse operational contexts. From a product perspective, the equipment category bifurcates into custom plasma equipment and industrial-scale systems, each addressing unique throughput and performance requirements. Within custom offerings, dedicated equipment solutions deliver specialized functionality, while modular systems provide scalability and ease of integration, complemented by portable units designed for on-site plasma cleaning services.

Component-level segmentation highlights the significance of plasma arc machines in heavy-duty material processing, plasma generators as the heart of energy delivery, and plasma jet systems for precision surface activation tasks. These core elements interplay with technological typologies-ranging from corona treatments optimized for coating preparation to dielectric barrier discharge configurations that enable nonthermal plasma generation. Direct plasma systems tackle open-air applications, low-pressure variants serve controlled-environment requirements, and emerging microplasma and remote plasma modules open new frontiers in biomedical and microelectronics workflows.

Material processed also dictates system configuration, from high-energy metal and composite etching to ceramic treatments that demand stringent thermal management. Plastic substrates, particularly polyester and polyethylene, benefit from corona and barrier discharge approaches to enhance adhesion properties. Operational modes further delineate market segments, with batch processing remaining vital for specialty manufacturers and continuous processing lines increasingly favored by high-volume producers seeking consistent throughput.

Application-centric analysis underscores the versatility of plasma technology across biomedical device coating and sterilization, material etching for electronics fabrication, plasma cleaning for aerospace components, and surface treatment in automotive paint shops. Industry verticals such as automotive and electronics & semiconductors deploy circuit board etching and wafer cleaning capabilities, while healthcare companies utilize device coating and sterilization services. Packaging firms leverage barrier improvement and label adhesion solutions, and textile producers adopt fabric treatment and functional coating to meet performance benchmarks. Deployment choices between in-line integration and standalone systems reflect operational preferences and facility constraints, closing the loop on customer-specific end-user requirements spanning academic institutes, manufacturing plants, corporate research sections, and dedicated laboratories.

This comprehensive research report categorizes the Atmospheric Plasma System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Component

- Technology Type

- Material Processed

- Operational Mode

- Application

- Industry Verticals

- Deployment Type

- End User

Analyzing Regional Dynamics and Growth Drivers in the Americas, EMEA, and Asia-Pacific Atmospheric Plasma Markets

Regional market dynamics for atmospheric plasma systems reveal distinct growth vectors across the Americas, Europe, Middle East & Africa (EMEA), and Asia-Pacific landscapes. In the Americas, robust industrial bases in North America drive demand for advanced surface treatment equipment, supported by significant R&D expenditure in semiconductor fabrication and medical device manufacturing. Latin American economies are beginning to invest in automation and clean manufacturing, creating nascent opportunities for plasma system integrators.

EMEA’s market trajectory is guided by stringent environmental regulations and sustainability mandates, which have elevated the adoption of nonchemical surface modification technologies. Europe’s automotive and aerospace sectors, in particular, rely on plasma cleaning and activation methods to meet exacting specification standards, while the Middle East is channeling capital toward expanding manufacturing capabilities under diversification initiatives.

The Asia-Pacific region commands the largest share of global atmospheric plasma deployments, propelled by rapid industrialization, government incentives for high-tech manufacturing, and an expanding electronics ecosystem. Emerging markets in Southeast Asia and India are prioritizing automation investments and cleaner production methods, aligning with regional sustainability agendas and rising consumer expectations. Consequently, Asia-Pacific’s momentum is set to reshape the competitive contours of the atmospheric plasma landscape.

This comprehensive research report examines key regions that drive the evolution of the Atmospheric Plasma System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Innovators and Strategic Moves by Key Players Shaping the Atmospheric Plasma Systems Competitive Landscape

The competitive landscape in atmospheric plasma systems is characterized by a blend of established multinationals and innovative niche suppliers that continuously push the envelope in system design and service delivery. Nordson Corporation has emerged as a prominent player with its robust portfolio of plasma treatment units tailored for electronics, automotive, and medical device applications. The company’s customer-centric solutions and global service network underscore its leadership in advanced surface activation technologies.

German-based Plasmatreat GmbH distinguishes itself through a focus on sustainability and eco-friendly processes, leveraging atmospheric plasma sources to replace solvent-based cleaning in critical manufacturing workflows. Its modular platform approach facilitates rapid customization and scalability. Likewise, Tantec A/S has built a reputation for developing tailored corona and plasma systems, supported by strong R&D investments and strategic partnerships with global OEMs.

Enercon Industries Corporation is recognized for its advanced plasma generators and power supplies that enhance adhesion properties across metal and plastic substrates, with a commitment to local assembly and aftermarket support. Emerging competitors such as Surfx Technologies and Plasma Etch are carving out specialized niches in precision cleaning and etching solutions, while companies like AcXys Technologies and Henniker Plasma focus on compact, high-throughput microplasma configurations. This dynamic mix of incumbents and challengers fosters continual innovation and ensures that end-users have access to a wide spectrum of system capabilities and service models.

This comprehensive research report delivers an in-depth overview of the principal market players in the Atmospheric Plasma System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3DT LLC

- AcXys Technologies

- Adtec Plasma Technology Co., Ltd.

- Air Water Engineering Inc.

- Atmospheric Plasma Solutions, Inc.

- Aurion Anlagentechnik GmbH

- bdtronic GmbH by MAX Automation

- Diener electronic GmbH + Co. KG

- Enercon Industries Corporation

- Ferrarini & Benelli Srl

- FUJI Corporation

- Henniker Scientific Ltd by Judges Scientific PLC

- Impedans Ltd.

- Inspiraz Technology

- ME.RO S.P.A.

- Muegge GmbH

- Plasma Etch, Inc

- Plasmalex SAS

- Plasmatreat GmbH

- PVA TePla AG

- Relyon Plasma GmbH by TDK Electronics AG

- Rycobel NV

- SirenOpt

- Softal corona & plasma GmbH

- Surfx Technologies, LLC

- Tantec A/S

- Thierry Corporation

- TIGRES GmbH

- Tri-Star Technologies by Carlisle Companies Incorporated

- Ulbrich Group

- Ushio Inc.

Actionable Strategic Recommendations for Industry Leaders to Capitalize on Emerging Atmospheric Plasma System Trends and Market Opportunities

To navigate evolving market dynamics and capitalize on growth opportunities, industry leaders must adopt a multifaceted strategy. First, diversifying supply chains by expanding domestic production footprints can mitigate tariff-related cost pressures and ensure supply continuity. Investing in local manufacturing hubs and forging strategic alliances with regional suppliers will buffer against geopolitical volatility.

Second, embracing digital transformation through IoT-enabled controls and predictive maintenance platforms can elevate system reliability and reduce operational downtime. Integrating remote monitoring solutions and data analytics tools will enable service providers to offer performance-based contracts, aligning incentives and enhancing customer value.

Third, prioritizing sustainability in both product development and service offerings will resonate with regulatory imperatives and customer expectations. Developing chemical-free plasma treatments and quantifying life-cycle environmental benefits are critical for securing adoption in sectors with stringent emissions and waste management standards.

Finally, cultivating collaborative R&D programs with end-users and academic institutions can accelerate innovation cycles and unlock new applications in emerging fields such as advanced biomedical sterilization and microelectronics. This co-innovation approach ensures that technology roadmaps remain aligned with market needs and fosters deeper customer engagement.

Detailing the Comprehensive Research Methodology Employed to Deliver Rigorous Insights into Atmospheric Plasma System Market Dynamics

This research employs a rigorous, multi-stage methodology to ensure accurate and comprehensive insights. Secondary research involved extensive review of industry publications, technical journals, trade association reports, and government trade notices to map technology trends and policy impacts. Financial disclosures and press releases from leading equipment manufacturers provided data on strategic investments, product launches, and capacity expansions.

Primary research encompassed in-depth interviews with key stakeholders, including R&D leads, plant engineers, procurement managers, and independent consultants across target end-user segments. These expert discussions validated assumptions, refined segmentation frameworks, and surfaced emerging use cases. Quantitative surveys with manufacturing and laboratory end users supplemented qualitative insights, capturing decision-making criteria, purchasing timelines, and total cost of ownership considerations.

All findings were triangulated through cross-verification between secondary data, primary input, and macroeconomic indicators to ensure consistency and reliability. Final data modeling adhered to established analytical best practices, encompassing sensitivity analysis to account for policy scenarios and supply chain disruptions. This structured approach underpins the robustness of the conclusions and recommendations presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Atmospheric Plasma System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Atmospheric Plasma System Market, by Product Type

- Atmospheric Plasma System Market, by Component

- Atmospheric Plasma System Market, by Technology Type

- Atmospheric Plasma System Market, by Material Processed

- Atmospheric Plasma System Market, by Operational Mode

- Atmospheric Plasma System Market, by Application

- Atmospheric Plasma System Market, by Industry Verticals

- Atmospheric Plasma System Market, by Deployment Type

- Atmospheric Plasma System Market, by End User

- Atmospheric Plasma System Market, by Region

- Atmospheric Plasma System Market, by Group

- Atmospheric Plasma System Market, by Country

- United States Atmospheric Plasma System Market

- China Atmospheric Plasma System Market

- Competitive Landscape

- List of Figures [Total: 21]

- List of Tables [Total: 2703 ]

Synthesis and Concluding Perspectives on the Future Trajectory of Atmospheric Plasma Systems in Industrial and Research Applications

In summary, atmospheric plasma systems stand at the nexus of innovation, sustainability, and operational efficiency, offering transformative surface treatment capabilities across a spectrum of industries. The convergence of advanced plasma technologies, digital integration, and eco-friendly modalities is redefining best practices for material activation, cleaning, and coating preparation.

While U.S. tariff measures in 2025 have introduced cost and supply chain complexities, proactive mitigation strategies such as local manufacturing expansion and diversified sourcing are emerging to preserve competitive positioning. Simultaneously, segmentation-driven insights reveal tailored growth pathways-from high-volume automotive lines to precision biomedical cleaning-underscoring the importance of customized solutions.

As regional markets evolve, with North America emphasizing R&D, EMEA enforcing sustainability mandates, and Asia-Pacific leading on scale, industry leaders must adapt with agile strategies that align product roadmaps, service models, and partnership ecosystems. Collaborative innovation, underpinned by rigorous market intelligence, will be the catalyst for capturing new applications and driving value in this dynamic landscape.

Engage with Associate Director Ketan Rohom to Secure Your Customized Atmospheric Plasma Systems Market Research Report Today

Are you ready to leverage comprehensive market insights and drive strategic advantage with authoritative data and expert analysis on atmospheric plasma systems? Reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to discuss how this tailored report can address your specific business objectives and innovation goals. Engage now to secure your competitive edge with in-depth coverage of industry trends, segmentation dynamics, and actionable recommendations-all in one robust resource designed to inform decisive investment and operational strategies.

- How big is the Atmospheric Plasma System Market?

- What is the Atmospheric Plasma System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?