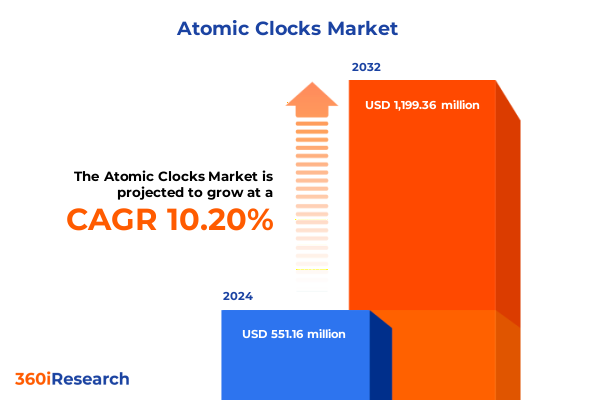

The Atomic Clocks Market size was estimated at USD 603.08 million in 2025 and expected to reach USD 661.85 million in 2026, at a CAGR of 10.31% to reach USD 1,199.36 million by 2032.

Setting the Stage for Revolutionary Advances in Precision Timekeeping through Atomic Clock Technologies Empowering Infrastructure and Scientific Discovery

The field of atomic clocks has entered a transformative era characterized by unprecedented levels of precision, stability, and integration into critical systems worldwide. As the fundamental standard for measuring time, atomic clocks underpin navigation networks, telecommunications synchronization, and advanced scientific research. Recent advancements in quantum technologies and cryogenic cooling have elevated performance metrics beyond traditional benchmarks, enabling next-generation applications in deep-space exploration, high-frequency trading, and resilient national security infrastructures.

Against this backdrop, executives and decision-makers face the dual challenge of navigating technological complexity while capitalizing on emerging market opportunities. This executive summary delivers an authoritative overview of the key drivers and barriers shaping the atomic clock landscape, shedding light on the latest shifts in product design, regulatory influences, and strategic partnerships. By contextualizing industry developments within broader geopolitical and supply chain dynamics, it lays the foundation for informed strategic planning.

In the following sections, we explore transformative shifts in technology, dissect the ripple effects of recent US trade measures, examine detailed segmentation insights spanning type, technology, product, component, application, and end-user categories, and highlight regional and company-level strategies. This introduction sets the stage for a nuanced understanding of how precision timekeeping will evolve over the coming years and how industry leaders can position themselves at the forefront of innovation.

Exploring the Paradigm Shifts Redefining the Atomic Clock Landscape with Quantum Innovations and Miniaturization Fueling New Applications in Science and Industry

Over the past decade, the atomic clock domain has witnessed a series of transformative paradigm shifts that have redefined both the technology itself and its broader applications. Breakthroughs in quantum clock architectures, leveraging optical transitions and entangled ion systems, have propelled frequency stability to levels previously unattainable with cesium or rubidium standards. These quantum-enabled devices are now moving out of specialized laboratories into modular platforms capable of supporting satellite navigation and secure communications.

Meanwhile, significant strides in miniaturization have given rise to chip-scale atomic clocks that offer compelling size, weight, and power advantages without compromising on precision. Portable atomic timekeepers now fit within handheld devices, enabling rapid field deployment for defense and aerospace missions. At the same time, cryogenically cooled masers and double resonance systems continue to dominate scenarios demanding the utmost performance, from deep-space network synchronization to high-energy physics experiments.

Concurrently, cross-industry integration has accelerated. Telecommunication networks are increasingly embedding high-performance atomic references to achieve sub-nanosecond synchronization across global data centers, while financial markets explore direct timing feeds for eliminating latency arbitrage. Furthermore, collaborative research initiatives between national metrology institutes and private enterprises are forging standardized platforms, streamlining certification processes, and catalyzing the commercialization of next-gen atomic clocks.

Assessing the Ripple Effects of 2025 United States Tariff Measures on Atomic Clock Supply Chains and Strategic Sourcing Decisions across High-Precision Timekeeping Components

In 2025, the United States enacted a series of tariff adjustments that have exerted a cascading impact across atomic clock supply chains and strategic procurement practices. By imposing elevated duties on select oscillators, precision quartz crystals, and high-performance resonators imported from key manufacturing hubs, procurement costs for integrated and standalone atomic clock systems have risen appreciably. This realignment has spurred a shift toward domestic sourcing of core components, incentivizing material suppliers to establish local production lines and secure alternative raw-material partnerships.

As a result, clock manufacturers are adapting their sourcing strategies to mitigate exposure to tariff volatility. Some firms have accelerated the vertical integration of quartz crystal fabrication, while others have diversified their supplier base to include emerging producers in allied markets. In addition, these trade measures have intensified engagement with policymakers to secure tariff exemptions for critical research equipment, particularly for applications in scientific research and space exploration.

Despite short-term cost headwinds, several organizations are leveraging the tariffs as an impetus to optimize their value chains. Investments in automation and advanced metrology have lowered dependency on imported high-cost components, fostering greater resilience. Looking ahead, strategic alliances between component manufacturers and integrators are becoming a focal point for ensuring continuity of supply and maintaining competitive positioning in the high-precision timekeeping arena.

Unveiling Core Market Segmentation Insights by Type Technology Product Component Application and End-User Driving Tailored Strategies in Precision Timekeeping

A nuanced understanding of market segmentation reveals critical pathways for tailored strategies in the atomic clock ecosystem. By type, cesium atomic clocks remain the benchmark for long-term stability in national timing laboratories, whereas hydrogen maser clocks excel in generating ultra-low phase noise for spaceborne and ground station synchronization. Rubidium atomic clocks, prized for their compact form factor, have rapidly become the default choice for portable and embedded timing modules in defense and telecommunications.

Turning to emergent technologies, cryogenically cooled atomic clocks preserve performance under extreme conditions, making them invaluable for deep-space missions and high-resolution spectroscopy. Double resonance clocks offer a mature compromise between cost and performance, supporting mainstream terrestrial applications. Meanwhile, quantum clocks are steadily transitioning from experimental prototypes to certified platforms, promising orders-of-magnitude improvements in accuracy and paving the way for redefining the international second.

Product configurations further delineate market approaches. Integrated solutions bundle timing references with synchronization controllers tailored for network operators, whereas portable units facilitate rapid deployment in field-testing and mobile platforms. Standalone systems, equipped with modular interfaces, continue to serve metrology laboratories and research institutions demanding highest-precision references. Component analysis highlights oscillators at the heart of every clock system, complemented by mid-range quartz crystals prized for stability, and resonators that span robust ceramic variants to ultra-precise silicon designs.

Application segmentation underscores the indispensable role of atomic clocks in GPS infrastructure, scientific research endeavors from particle physics to astronomy, and telecommunications frameworks requiring synchronous data transmission. End-user profiles range from aerospace and aviation, with distinct demands for aircraft navigation and spacecraft control, to automotive sectors where autonomous vehicle guidance and infotainment platforms rely on accurate timekeeping. Consumer electronics incorporate atomic timing into computing devices and wearable sensors, while healthcare applications extend to precision medical imaging and telemedicine networks. Research and laboratory environments, spanning both astronomy and physics, invoke the highest stability clocks, and telecommunication providers rely on onboard references to support mobile network base stations and satellite communication payloads.

This comprehensive research report categorizes the Atomic Clocks market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Technology

- Product

- Component

- Application

- End-User

Highlighting Key Regional Dynamics Shaping the Global Adoption of Atomic Clocks across the Americas EMEA and Asia-Pacific Reflecting Diverse Technological Priorities

Regional dynamics exert a profound influence on the adoption and evolution of atomic clock technologies, shaped by varying investment priorities and regulatory frameworks. In the Americas, government initiatives aimed at securing national critical infrastructure have accelerated funding for domestic clock manufacturing and research collaborations. Defense agencies and space agencies in North America continue to be principal investors, driving demand for both high-stability laboratory systems and ruggedized portable units designed for expeditionary operations.

Across Europe, the Middle East, and Africa, the integration of atomic clocks within continental navigation architectures emphasizes cross-border standardization and interoperability. The European GNSS component’s ongoing modernization program has prioritized next-generation clocks to enhance resilience against signal interference. Middle Eastern nations are channeling investment into telecommunications synchronization as part of 5G rollouts, and African research institutions are collaborating on astronomical observatories requiring precision timing references.

In Asia-Pacific, aggressive expansion of telecommunications networks, coupled with civil aerospace advancements, has heightened the region’s appetite for portable and integrated timing solutions. China’s space program and satellite navigation systems have catalyzed indigenous development of hydrogen maser and quantum clock prototypes, while Japan’s metrology institutes continue to refine optical lattice clock standards. Southeast Asian nations are increasingly integrating chip-scale atomic clocks into edge-computing nodes and IoT infrastructures, reflecting a broader shift toward decentralized timekeeping architectures.

This comprehensive research report examines key regions that drive the evolution of the Atomic Clocks market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Strategic Moves and Collaborative Innovations from Leading Players Shaping the Competitive Landscape of Atomic Clock Development and Commercialization Worldwide

The competitive landscape of the atomic clock sector features a mix of established precision timing specialists and innovative newcomers pushing the boundaries of quantum performance. Leading component manufacturers have expanded their portfolios through strategic partnerships, acquiring niche technology firms that deepen expertise in cryogenic systems and resonator design. Meanwhile, integrators are forging alliances with telecommunications giants to embed high-performance timing references directly within network core equipment.

Several organizations have prioritized R&D that bridges laboratory breakthroughs with commercially viable products, exemplified by the rollout of portable quantum clock prototypes optimized for field calibration. Collaboration between national metrology centers and private commercial vendors has yielded standardized certification protocols, reducing time-to-market for advanced atomic clocks. At the same time, a growing number of technology companies are establishing joint ventures in key manufacturing regions to localize production and navigate evolving trade policies.

To maintain differentiation, market leaders are investing in digital services that complement hardware offerings, such as cloud-based time dissemination platforms and remote diagnostics dashboards. These value-added services enable real-time performance monitoring and predictive maintenance, enhancing operational reliability for critical infrastructure operators. Collectively, these strategic initiatives are reshaping the competitive equilibrium, driving both consolidation and diversification within the high-precision timekeeping arena.

This comprehensive research report delivers an in-depth overview of the principal market players in the Atomic Clocks market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AccuBeat Ltd.

- Adtran Networks SE

- AOSense, Inc.

- Bel-Art by SP Scienceware

- Brandywine Communications

- Excelitas Technologies Corp.

- Frequency Electronics, Inc.

- IQD Frequency Products Ltd.

- Leonardo S.p.A.

- Meinberg Funkuhren GmbH & Co KG.

- Microchip Technology Inc.

- Optm, Inc.

- Safran S.A.

- Shanghai Astronomical Observatory

- Stanford Research Systems, Inc.

- Teledyne Technologies Incorporated

- Thermo Fisher Scientific Inc.

- TimeTech GmbH

- Trimble Inc.

- VREMYA-CH JSC

- Zurich Instruments AG

Delivering Actionable Strategic Recommendations for Industry Leaders to Harness Emerging Advances in Atomic Clock Technology and Navigate Complex Regulatory Environments

Industry leaders must adopt a multi-pronged approach to capitalize on emerging opportunities and mitigate evolving risks within the atomic clock domain. First, prioritizing investment in quantum clock research and development will establish long-term differentiation, enabling groundbreaking applications in defense, space exploration, and scientific discovery. By forging partnerships with leading academic institutions and national laboratories, organizations can accelerate technology maturation and shorten the path to certification.

Second, supply chain resilience should be fortified by diversifying component sources and pursuing vertical integration where feasible. Engaging with alternative suppliers of oscillators, quartz crystals, and innovative resonator materials can reduce exposure to tariff fluctuations and geopolitical disruptions. Concurrently, securing strategic alliances with manufacturing hubs in allied regions will ensure continuity of supply while supporting local economic development.

Third, to meet the stringent demands of telecommunications and automotive applications, developing integrated solutions that combine timing references with advanced control electronics is imperative. Such modular platforms should offer seamless interoperability with existing network infrastructure and onboard vehicle systems, delivering sub-nanosecond synchronization with minimal footprint.

Finally, engaging proactively with regulatory bodies and standards organizations is essential to shape favorable policy frameworks. By participating in international working groups and certification consortia, companies can influence the evolution of timing regulations, ensuring that emerging quantum and chip-scale clocks are accommodated within calibration and interoperability norms.

Detailing the Robust Research Methodology Combining Primary Expert Engagement and Comprehensive Secondary Analysis Underpinning Insights into the Atomic Clock Market

This report synthesizes insights derived from a rigorous research methodology that blends primary expert engagements with exhaustive secondary data analysis. The primary phase encompassed in-depth interviews with chief technical officers, lead engineers, and procurement executives across core market segments, ensuring firsthand perspectives on technology adoption, supply chain dynamics, and strategic imperatives. Each interview was structured to validate trends identified in desk research and uncover emerging challenges faced by end users in aerospace, telecommunications, and scientific research domains.

The secondary research leveraged peer-reviewed journals, patent filings, regulatory whitepapers, and industry conference proceedings to map the technological evolution of atomic clocks. Supplementary data sources included component datasheets, standards body publications, and manufacturer technical briefs. This triangulation of perspectives enabled a holistic understanding of both theoretical advancements and commercial viability.

Analytical frameworks applied throughout the study included technology readiness assessments, supply chain risk matrices, and regional policy impact analyses. Quality control protocols involved cross-validation of data points through multiple independent sources and peer review by subject matter experts. Together, these methodological pillars underpin the credibility of the report’s findings and recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Atomic Clocks market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Atomic Clocks Market, by Type

- Atomic Clocks Market, by Technology

- Atomic Clocks Market, by Product

- Atomic Clocks Market, by Component

- Atomic Clocks Market, by Application

- Atomic Clocks Market, by End-User

- Atomic Clocks Market, by Region

- Atomic Clocks Market, by Group

- Atomic Clocks Market, by Country

- United States Atomic Clocks Market

- China Atomic Clocks Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Summarizing Key Takeaways and Forward-Looking Perspectives on the Evolution of Atomic Clock Technologies and Their Strategic Implications for Stakeholders

In conclusion, atomic clock technology stands at the cusp of a new era defined by quantum-enhanced performance, unprecedented miniaturization, and deep cross-industry integration. The transformative shifts highlighted in this executive summary underscore the critical importance of strategic agility, supply chain resilience, and collaborative innovation. With evolving regulatory landscapes and geopolitical considerations influencing component sourcing and trade, organizations must adopt proactive measures to secure their positions at the forefront of precision timekeeping.

By leveraging detailed segmentation insights, understanding regional nuances, and evaluating competitor strategies, stakeholders can make informed decisions that align with both immediate operational needs and long-term strategic objectives. The actionable recommendations presented herein provide a clear roadmap for industry leaders to navigate this complex landscape, harnessing emerging technologies and policy developments to drive sustainable growth.

As the demand for ultra-precise timekeeping continues to rise across applications ranging from deep-space navigation to next-generation telecommunications, the stakes for innovation and strategic foresight have never been higher. This report equips decision-makers with the necessary understanding and tools to capitalize on emerging opportunities and chart a course toward the future of atomic clock excellence.

Partner with Ketan Rohom to Acquire Comprehensive Atomic Clock Market Insights and Empower Your Strategic Decision-Making with In-Depth Analysis and Expert Guidance

Elevate your organization’s competitive edge by securing the comprehensive insights provided in this in-depth report. Ketan Rohom, Associate Director of Sales & Marketing, is ready to guide you through tailored solutions that address the complex challenges and opportunities in precision timekeeping. Engage directly to uncover detailed analyses across technological innovations, tariff impacts, segmentation deep dives, regional dynamics, and strategic recommendations. Take decisive action today to leverage these expert perspectives and accelerate your roadmap for integrating cutting-edge atomic clock solutions into critical applications. Reach out now to transform your strategic planning with unparalleled market intelligence.

- How big is the Atomic Clocks Market?

- What is the Atomic Clocks Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?