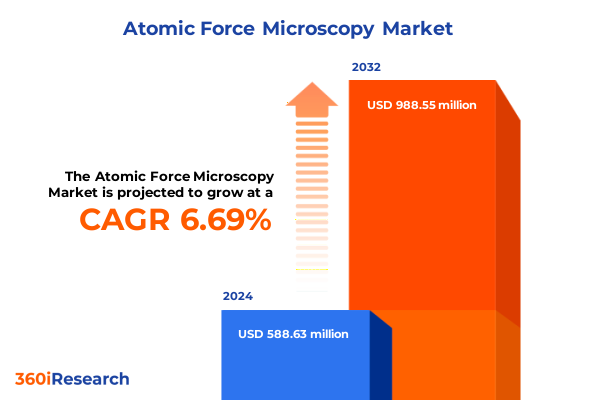

The Atomic Force Microscopy Market size was estimated at USD 529.51 million in 2025 and expected to reach USD 563.71 million in 2026, at a CAGR of 6.66% to reach USD 832.00 million by 2032.

How Atomic Force Microscopy Is Shaping Nanoscopic Insights and Driving Industrial and Research Innovations Across Multiple Disciplines

The atomic force microscope, first brought to fruition by Gerd Binnig, Calvin Quate, and Christoph Gerber in 1986, revolutionized the way scientists interact with matter at the nanometer scale. This pioneering instrument built on the principles of the scanning tunneling microscope by replacing electron tunneling with a flexible cantilever and stylus that could detect forces as small as a single nanonewton. At its core, the AFM uses the minute deflections of the cantilever-recorded via laser beam reflection-to generate three-dimensional topographical maps of surfaces, enabling unprecedented exploration of conductive and insulating materials alike.

Unveiling the Transformative Technological, Commercial, and Operational Shifts Redefining the Atomic Force Microscopy Market Landscape

Over the past decade, atomic force microscopy has undergone a series of transformative technological and operational shifts that are redefining its role across research and industry. High-speed AFM breakthroughs have enabled real-time visualization of molecular dynamics, while artificial intelligence–based scan controllers have minimized tip wear and optimized sample safety, delivering up to fourfold improvements in scan consistency compared to traditional PID control methods. Moreover, machine learning frameworks now streamline data analytics, reducing manual postprocessing by automating feature recognition, pattern classification, and material identification, thereby accelerating time-to-insight and expanding AFM applications in biosciences and nanotechnology. Automation platforms integrating robotic sample handlers and advanced software workflows are further elevating throughput, enabling routine AFM measurements on live cells and complex molecular mixtures with clinical relevance, while interactive user interfaces lower the barrier for multiuser facilities. Consequently, AFM is transitioning from a specialist tool toward an integral component of high-volume industrial quality control and core academic research workflows.

Assessing the Cumulative Impact of United States Tariff Policies on Atomic Force Microscopy Supply Chains and Research Operations in 2025

In 2025, new U.S. tariff policies have created both headwinds and strategic inflection points for AFM manufacturers, distributors, and end users. A universal 10 percent tariff on most imported goods was implemented in early April, followed by country-specific levies that amplify costs for laboratory instrumentation. Imports from China now face an effective duty burden exceeding 145 percent on scientific equipment categories, while non-USMCA goods from Canada and Mexico are subject to a 25 percent tariff on lab-related hardware alongside additional duties, intensifying cost pressures. These measures have prompted U.S. research institutions to file for duty-free entry of critical AFM components under Section 301 exclusions and to reevaluate sourcing strategies, with many labs collaborating with domestic distributors to mitigate supply chain disruptions. From a strategic standpoint, firms are accelerating investments in U.S. manufacturing of cantilevers, scanners, and force sensors, while industry associations lobby for revised trade carve-outs to preserve access to cutting-edge AFM technologies, reflecting the cumulative impediments and adaptive responses shaping AFM operations in the current trade environment.

Unlocking Market Depth Through Comprehensive Segmentation Across Offerings, Operational Modes, Application Domains, and End-User Needs in Atomic Force Microscopy

An in-depth segmentation framework illuminates how diverse AFM offerings and formats cater to distinct market demands. In the hardware domain, the core instrument portfolio extends beyond the atomic force microscope itself to encompass precision force sensors and versatile scanning probes, complemented by software modules that span analytical workflows and image-processing capabilities. Service offerings, ranging from preventative maintenance and consulting engagements to specialized testing and analysis protocols, ensure sustained instrument uptime and data quality. Mode of operation plays a pivotal role, as contact, non-contact, and tapping modes each optimize tip-sample interactions for varying sample stiffness, resolution requirements, and force sensitivity thresholds. The dichotomy between industrial-grade platforms-engineered for robustness and automation-and research-grade systems-designed for maximal resolution and experimental flexibility-further underscores end-user priorities. AFM applications traverse biology and life sciences research, materials science investigations, nanotechnology development, and semiconductor process control, generating a tapestry of use cases. End users include academic and government research institutions seeking novel insights, aerospace and automotive manufacturers employing nanoscale metrology to refine composite materials, chemical and pharmaceutical companies characterizing formulation surfaces, and semiconductor and electronics firms conducting defect analysis and lithography calibration. Finally, sales channels split between offline, where high-touch pre-sales consultation and installation services are critical, and online platforms that facilitate streamlined procurement of probes, software upgrades, and consumables.

This comprehensive research report categorizes the Atomic Force Microscopy market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Mode of Operation

- Grade

- Application

- End-User

- Sales Channel

Evaluating Regional Dynamics and Growth Drivers Across the Americas, EMEA, and Asia-Pacific to Inform Strategic Atomic Force Microscopy Investments

The Americas region remains a cornerstone of AFM innovation and adoption, accounting for over 37 percent of global market share in 2023 and driven by a concentration of leading research universities and national laboratories backed by robust federal funding initiatives. Key players such as Bruker, Park Systems, and WITec anchor this landscape, while agencies like the National Science Foundation and the National Institutes of Health fuel breakthroughs in life sciences and materials research that rely on AFM technologies. In Europe, Middle East, and Africa (EMEA), strong collaboration between industry and academic consortia under Horizon Europe, coupled with specialized research hubs like Germany’s Fraunhofer institutes, supports the integration of AFM into quality control, regulatory compliance, and advanced manufacturing processes-particularly in automotive and clean energy sectors. Asia-Pacific is emerging as the fastest-growing regional market, with China, Japan, South Korea, and India collectively fueling nearly 29 percent of AFM demand in 2023; strategic government investments in semiconductor fabrication, renewable energy research, and biotechnology have bolstered domestic instrument production and adoption of nanoscale metrology tools across both academic research centers and industrial R&D facilities.

This comprehensive research report examines key regions that drive the evolution of the Atomic Force Microscopy market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Partnerships Driving Competitive Advantages in the Global Atomic Force Microscopy Ecosystem

Leading AFM suppliers are advancing the frontier of nanoscale characterization through strategic product launches and digital solutions. In December 2024, Bruker unveiled its Dimension Nexus platform, featuring a compact footprint, upgradable NanoScope 6 controller, and PeakForce Tapping modes, which collectively enhance throughput for multiuser facilities while preserving measurement fidelity on large samples. Park Systems has fortified its position in semiconductor metrology with the NX-Wafer automated AFM, offering sub-angstrom height accuracy, automated defect review, and live monitoring capabilities that integrate seamlessly into wafer fabrication lines. Oxford Instruments Asylum Research continues to broaden application horizons with its Jupiter XR large-sample AFM, now equipped with AR Maps offline analysis software, and its video-rate Vero VRS1250 AFM featuring Quadrature Phase Differential Interferometry for real-time nanoscale imaging, underscoring the importance of both hardware innovation and software-driven data analytics in competitive differentiation. These developments illustrate how leading players leverage technological leadership, cross-sector partnerships, and award-winning product design to capture market share and address evolving end-user requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Atomic Force Microscopy market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bruker Corporation

- Park Systems Corporation

- Oxford Instruments plc

- Horiba, Ltd.

- Hitachi High-Technologies

- Keysight Technologies Inc.

- Attocube Systems AG

- RHK Technology

- Nanomagnetics Instruments Limited

- Nanosurf AG

- A.P.E. Research

- NT-MDT Spectrum Instruments

- AFMWorkshop, LLC

- CSInstruments

- DME Scanning Probe Microscopes

- Molecular Vista, Inc.

- Nanonics Imaging Ltd.

- Veeco Instruments Inc.

Actionable Strategies to Optimize Technological Adoption, Supply Chain Resilience, and Collaborative Research Initiatives in the Atomic Force Microscopy Industry

Industry leaders should prioritize integration of artificial intelligence and automation to optimize AFM workflows, thereby reducing manual intervention and accelerating data throughput. Strengthening supply chain resilience through diversification of component sourcing and localized manufacturing can mitigate the impact of unpredictable tariff regimes, while active engagement in trade-policy discussions will help secure favorable duty-relief provisions. Investing in modular, upgradeable instrumentation architectures enables rapid adaptation to emerging imaging modes and force-sensing capabilities, supporting both research-intensive and high-throughput industrial applications. Collaboration with academic and regulatory institutions to develop standardized best practices in AFM measurement will enhance cross-platform interoperability and reproducibility. Lastly, fostering talent development through targeted training programs and remote instrumentation platforms will cultivate the specialized skill sets necessary to fully exploit AFM’s expanding functionality.

Detailing Rigorous Research Approaches Combining Primary Interviews, Secondary Data Analysis, and Expert Validation in Atomic Force Microscopy Market Study

This analysis synthesizes insights derived from a multi-faceted research approach combining primary and secondary methodologies. Extensive interviews were conducted with senior executives, R&D leaders, and application scientists from leading AFM vendors and end-user organizations to capture nuanced perspectives on product roadmaps, operational challenges, and emerging use cases. Concurrently, a comprehensive review of company press releases, patent filings, and peer-reviewed literature provided quantitative and qualitative context for technological trends and market entry strategies. Secondary data were augmented by analysis of tariff notifications, duty-free exclusion requests, and trade-policy filings to assess regulatory influences on supply chains. Rigorous cross-validation and triangulation techniques ensured data integrity, with expert committee reviews facilitating iterative refinement of segmentation frameworks and competitive positioning assessments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Atomic Force Microscopy market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Atomic Force Microscopy Market, by Offering

- Atomic Force Microscopy Market, by Mode of Operation

- Atomic Force Microscopy Market, by Grade

- Atomic Force Microscopy Market, by Application

- Atomic Force Microscopy Market, by End-User

- Atomic Force Microscopy Market, by Sales Channel

- Atomic Force Microscopy Market, by Region

- Atomic Force Microscopy Market, by Group

- Atomic Force Microscopy Market, by Country

- United States Atomic Force Microscopy Market

- China Atomic Force Microscopy Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Synthesizing Insightful Findings and Anticipating Future Technological and Commercial Trajectories in the Atomic Force Microscopy Sector

The atomic force microscopy landscape continues to evolve rapidly, underpinned by advances in high-speed scanning, artificial intelligence, and integrated software ecosystems. Amidst the interplay of technical innovation, shifting trade policies, and dynamic regional growth patterns, stakeholders must remain agile, investing in flexible instrument architectures and strategic partnerships. The convergence of biological, materials, and semiconductor applications underscores AFM’s centrality across the scientific and industrial spectrum. As market leaders refine their competitive strategies and emerging players introduce novel capabilities, the ability to anticipate regulatory developments and harness cross-disciplinary synergies will determine long-term success in this high-precision domain.

Contact Associate Director Ketan Rohom Today to Unlock Comprehensive Atomic Force Microscopy Market Research Insights for Strategic Decision-Making

For decision-makers seeking in-depth insights and strategic guidance on the evolving atomic force microscopy ecosystem, partnering with Ketan Rohom, Associate Director of Sales & Marketing, will ensure you have tailored access to the comprehensive AFM market research report. Ketan draws on extensive experience in translating technical analysis into practical strategies, offering personalized demos and consultation sessions that align with your organization’s objectives and investment priorities. Reach out today to unlock the full breadth of detailed company profiles, segmentation deep dives, regional outlooks, and actionable roadmaps designed to support informed decision-making, competitive positioning, and innovation acceleration in atomic force microscopy.

- How big is the Atomic Force Microscopy Market?

- What is the Atomic Force Microscopy Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?